*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

What is ARV and Why is it Important?

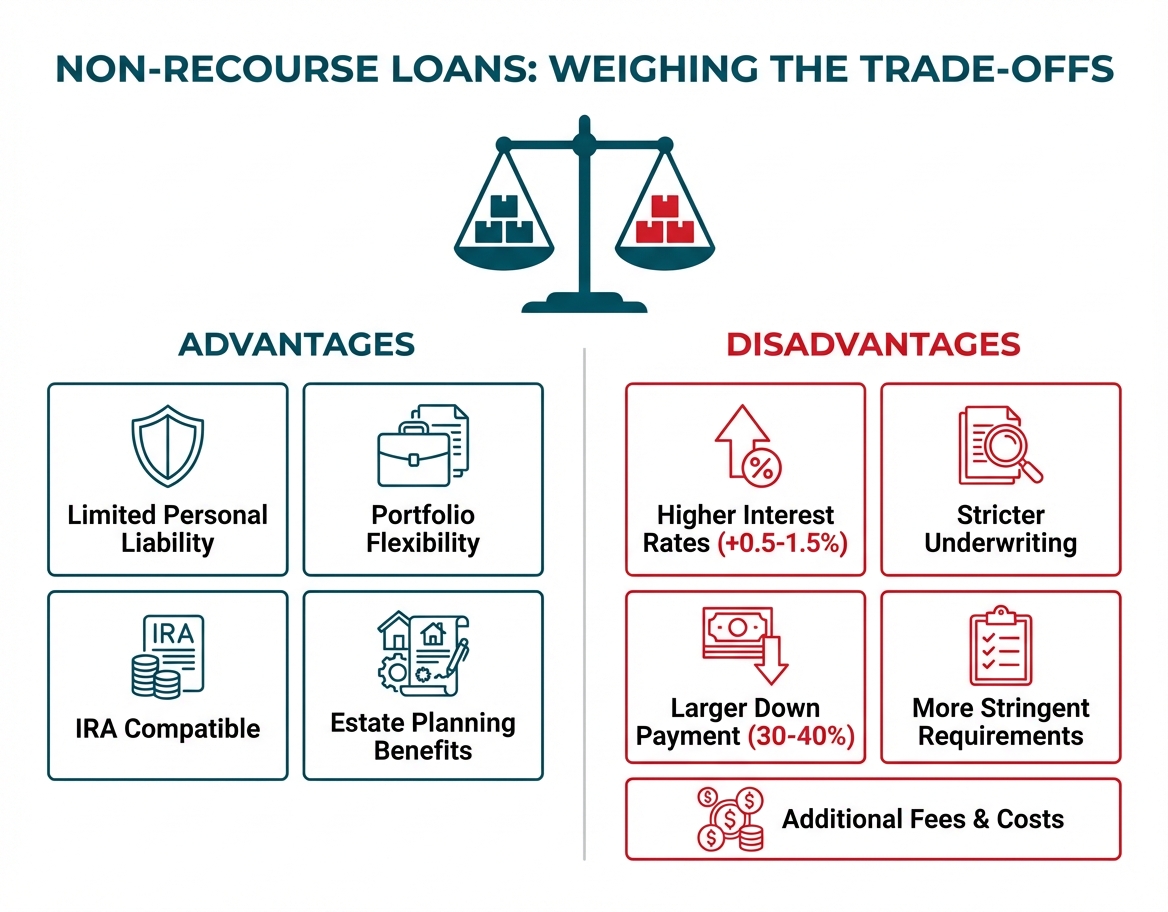

When you're diving into real estate investing—especially fix-and-flip projects or rental property renovations—one number matters more than almost any other: After Repair Value, or ARV. This single metric can make or break your investment decisions, determining whether you walk away with a healthy profit or barely break even.

Think of ARV as your North Star. It guides everything from how much you should pay for a property to how much you should spend on renovations. Get it right, and you're setting yourself up for success. Get it wrong, and you could be leaving money on the table—or worse, losing it.

In this comprehensive guide, we'll walk you through everything you need to know about ARV: what it is, why it matters, how to calculate it accurately, and how to use it to make smarter investment decisions. Whether you're a first-time house flipper or a seasoned investor looking to sharpen your skills, you'll find actionable insights that can boost your bottom line.

What is ARV and Why is it Important?

After Repair Value (ARV) is a key number every real estate investor needs to know. Simply put, it's your best estimate of what a property will be worth on the market once you've completed all your planned renovations and repairs. Getting this number right helps you figure out whether a deal makes sense—and whether you'll walk away with a solid profit.

Definition and Basic Formula

ARV tells you what buyers or renters will pay for your property once it's fully fixed up and market-ready. Here's the basic formula:

*ARV = (Average Price per Sq. Ft. of Renovated Comps}) * (Your Property's Sq. Ft.)*

Now, here's where it gets interesting: the value added by renovations isn't just what you spend on them. It's about how much those improvements actually boost the property's market value. As Rocket Mortgage puts it, "After-repair value is a measure used by real estate investors and house flippers to estimate the future value of a property after renovations".

Why ARV Matters for Investors

ARV is your compass for making smart investment decisions. Here's how it guides you:

Determining Maximum Allowable Offer (MAO)): ARV helps you work backward to figure out the most you should pay for a property while still protecting your profits.

Budgeting for Renovations: When you know your target ARV, you can plan your rehab budget with confidence.

Securing Financing: Lenders look at ARV when deciding how much to offer on fix-and-flip or renovation loans.

Estimating Profit Margins: Compare your ARV to your total investment, and you'll see your potential returns clearly.

Risk Assessment: A solid ARV calculation shows you whether the profit potential is worth the risk.

Difference Between ARV and Current Market Value

Think of current market value as what the property is worth today, as-is. ARV is your vision of what it will be worth tomorrow, after you've worked your magic. This distinction is crucial for investors looking to add value through renovations. According to Janover, "An after-repair value of a property is simply the property's market value after any repairs, renovations, or improvements have taken place".

![**Task:** Create a side-by-side comparison infographic illustrating the difference between Current Market Value and After Repair Value (ARV) with visual representations of property conditions.

**Visual Structure:** Two-panel comparison layout with property illustrations, value indicators, and descriptive text showing the transformation from current state to renovated state.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| CURRENT MARKET VALUE vs AFTER REPAIR VALUE |

+----------------------------------------------------------+

| | |

| +---------------------+ | +---------------------+ |

| | [House Image] | | | [House Image] | |

| | Worn/Outdated | | | Renovated/Modern | |

| +---------------------+ | +---------------------+ |

| | |

| CURRENT MARKET VALUE | AFTER REPAIR VALUE (ARV) |

| | |

| What property is worth | What property will be |

| TODAY, as-is | worth AFTER renovations |

| | |

| • Existing condition | • Completed renovations |

| • No improvements | • Market-ready condition |

| • Lower value | • Maximum value potential |

| | |

| $150,000 | $250,000 |

+---------------------------+------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771432690838_uw5nau.jpg?alt=media&token=b34453de-6c55-404f-a6ef-4cd175238839)

Role in Investment Decisions

ARV is your compass for navigating several smart investment strategies:

Fix-and-Flip: You'll use ARV to figure out if a property can be purchased, renovated, and sold at a profit that makes sense for your goals.

BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat): ARV helps you determine if you can pull out your initial investment through refinancing after renovations.

Value-Add Investing: Commercial property investors use ARV to evaluate potential returns from property improvements.

Wholesaling: Real estate investors use ARV to calculate maximum allowable offer (MAO) to the seller.

Think of ARV as your safety net. It helps you avoid overpaying for properties or sinking too much money into improvements the market won't reward. When you nail down an accurate ARV before purchasing, you're setting yourself up to make confident, data-driven decisions in a competitive market.

Why ARV is Critical for Real Estate Investment Success

After Repair Value (ARV) is the bedrock of nearly every winning real estate investment strategy. As a key valuation metric, ARV empowers you to make informed decisions that directly impact your profits and investment outcomes.

Evaluating Potential ROI

ARV gives you a clear snapshot of a property's potential return on investment before you commit a single dollar. By comparing the projected post-renovation value against your acquisition and renovation costs, you can quickly determine if a property meets your profit targets.

According to [Privy](https://www. privy.pro/investors/why-is-arv-important-for-real-estate-investors/), "The ARV will enable investors to determine if a property is likely to make a return on investment before spending time or money on it". This pre-investment check helps you weed out properties that won't hit your financial targets, so you can zero in on deals with real profit potential.

Determining Maximum Purchase Prices

Here's where ARV really earns its keep: figuring out the most you should pay for a property. Using the popular 70% rule (we'll break this down later), you can calculate your maximum allowable offer (MAO) to make sure you're not overpaying.

Here's the formula:

MAO = (ARV × 0.70) - Total Costs (Rehab + Closing costs (buying and selling) + Holding costs)

This simple calculation builds in your profit margin and gives you a safety cushion against market shifts and those surprise renovation costs we all know too well.

Avoiding Over-Improvements

Here's a trap many new investors fall into: pouring money into upgrades the neighborhood simply won't support. ARV calculations grounded in local comps help you sidestep this expensive mistake by showing you the property's value ceiling.

When you understand your neighborhood comps and local market dynamics, you can shape your renovation plans around what buyers actually want and will pay for. That means no more sinking cash into fancy upgrades you'll never see again at closing.

Setting Realistic Profit Expectations

Here's the bottom line: ARV helps you set realistic profit expectations right from the start. When you accurately estimate both the final value and all your costs, you can project your potential profit margin before you even make an offer.

This clarity empowers you to determine whether a property fits your investment strategy and financial goals. It also gives you a solid benchmark to measure your project's success when it's complete—helping you refine your approach with every deal you close.

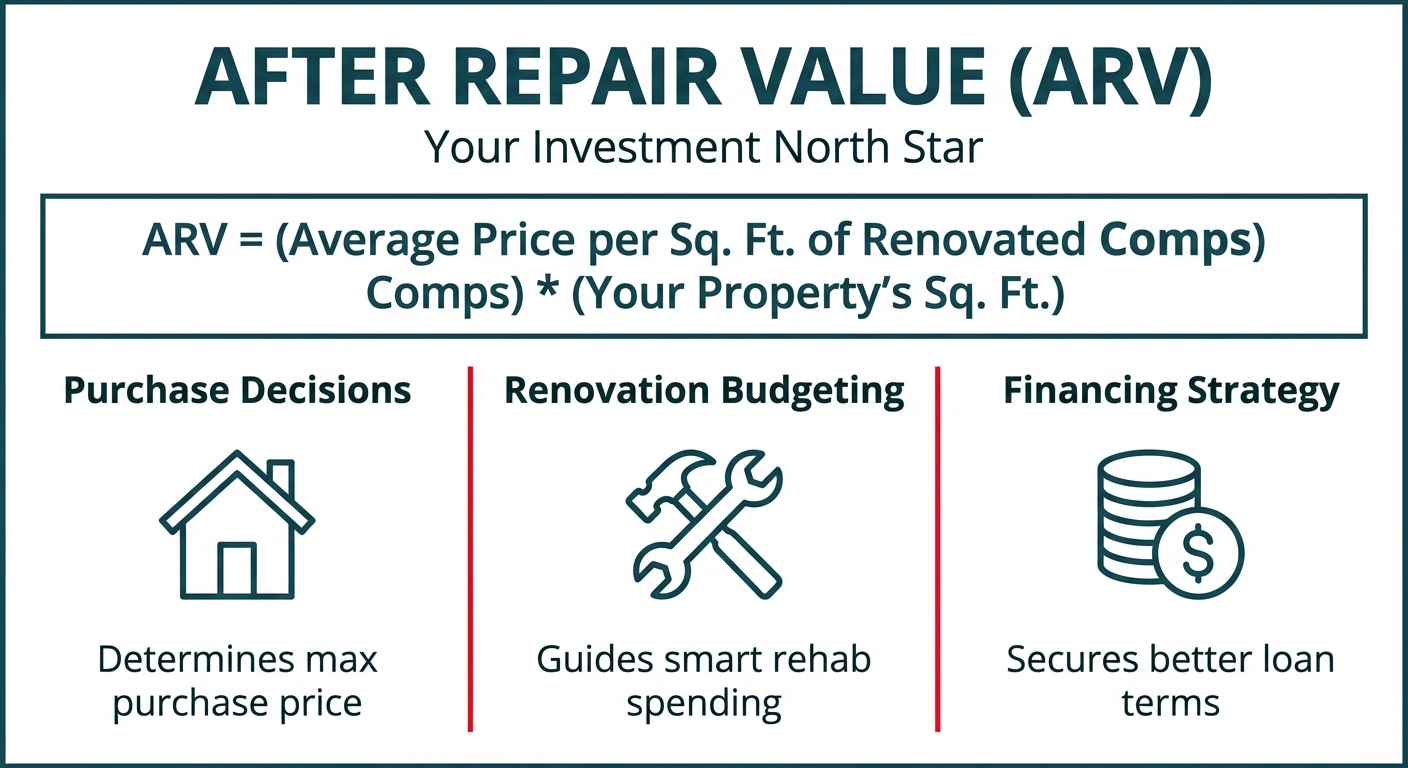

How to calculate the ARV

*ARV = (Average Price per Sq. Ft. of Renovated Comps}) * (Your Property's Sq. Ft.)*

The secret to nailing your ARV? Choosing the right comparable properties and making smart adjustments based on market conditions, property features, and renovation quality.

To calculate ARV, follow this simplified approach:

Search for recently sold homes in the area with similar square footage, layout, year built, and condition (post-renovation).

Step 1: Research Comps

Search for recently sold homes in the area with similar square footage, layout, year built, and condition (post-renovation).

Step 2: Adjust for Differences

If a comparable home has additional features like a finished basement or larger lot, adjust the value of your target property up or down accordingly.

Step 3: Determine Value Per Square Foot

Take the sale price of a comparable home and divide it by its square footage. Multiply this price-per-square-foot by your property’s size to estimate its ARV.

ARV Example

A nearby renovated home sold for $250,000 and is 2,000 SqFt. $250,000 ÷ 2,000 = $125 per SqFt.

If your property is also 2,000 sq. ft., the estimated ARV is $125 × 2,000 = $250,000.

Gathering Comparable Sales Data

Good ARV calculations start with solid comparable sales data ("comps"). Here's what you need to do:

- Find recently sold properties - Stick to sales within the last 3-6 months

- Stay within proximity - Ideally within 0.5-1 mile of your subject property

- Match property characteristics - Similar square footage (within 20%), bedroom/bathroom count, lot size, and property type

- Consider property age - Similar construction era and architectural style

- Examine property condition - Select properties in the condition you expect your property to be in after renovations

As noted by Longhorn Investments, "After repair value, or ARV, refers to the estimated value of a property after it has undergone repairs, renovations, or improvements. " The accuracy of this estimate depends heavily on the quality of your comparable sales analysis.

Adjusting for Property Differences

Here's the thing: no two properties are exactly alike. That means you'll need to make smart adjustments when comparing your subject property to the comps:

- Square footage - Typically valued at $50-150 per square foot depending on the market

- Bedrooms/bathrooms - Often valued at $5,000-20,000 per bedroom/bathroom

- Garage spaces - Approximately $5,000-10,000 per space

- Lot size - Adjustments based on local land values

- Special features - Swimming pools, views, upgraded finishes, etc.

- Condition - Account for differences in renovation quality and completeness

Factoring in Neighborhood Trends

Your ARV doesn't exist in a vacuum. Market conditions and neighborhood trends play a big role in your calculations:

- Appreciation/depreciation rates - Is the neighborhood gaining or losing value?

- Days on market - How quickly are properties selling?

- Price per square foot trends - Are values increasing or decreasing?

- Development activity - New construction or commercial development can influence values

- School district changes - Improvements or declines in school ratings affect property values

- Seasonality - Market fluctuations based on time of year

Using Professional Appraisals

You can absolutely calculate ARV on your own, but professional appraisals offer solid validation for your numbers:

- Pre-renovation appraisals - Can include "subject-to" valuations based on planned improvements

- Appraiser consultations - Many appraisers offer consultation services to investors

- Automated Valuation Models (AVMs) - Digital tools that provide value estimates

- Real estate agent Comparative Market Analysis (CMA) - Less formal than appraisals but useful for validation

Birmingham appraiser Tom Horn breaks it down into three straightforward steps for nailing your ARV:

Use appropriate comparable sales

Make proper adjustments for differences

Consider neighborhood trends and market conditions

This methodical approach helps investors avoid both overly optimistic and unnecessarily conservative valuations.

Keep in mind that ARV is ultimately an estimate, and market conditions can shift during your renovation timeline. Smart investors typically build in a margin of safety to account for unexpected market changes or renovation surprises.

The 70% Rule in ARV Real Estate: Formula, Applications, and Adaptations

The 70% rule is a go-to guideline in real estate investing, especially for house flippers and renovation investors. This straightforward formula helps you figure out the maximum purchase price you should pay for a property to walk away with a healthy profit after renovations.

Understanding the Formula

Here's the deal: the 70% rule says you should pay no more than 70% of a property's after-repair value (ARV) minus your estimated repair costs. Let's break it down:

Maximum Purchase Price = (ARV × 0.70) - Repair Costs

Let's say a property's ARV is $200,000 and it needs $50,000 in repairs:

- Maximum Purchase Price = ($200,000 × 0.70) - $50,000

- Maximum Purchase Price = $140,000 - $50,000

- Maximum Purchase Price = $90,000

That remaining 30% covers your holding costs, selling expenses, and profit margin—making this a powerful tool for quick investment analysis.

![**Task:** Create a detailed infographic breaking down the 70% Rule calculation with a visual pie chart showing where the 30% margin goes and a worked example with specific numbers.

**Visual Structure:** Two-section layout with left side showing the 70% Rule formula and calculation example, right side displaying a pie chart breakdown of the 30% safety margin allocation.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| THE 70% RULE EXPLAINED |

+----------------------------------------------------------+

| | |

| THE FORMULA | WHERE THE 30% GOES |

| | |

| Max Purchase Price = | [PIE CHART] |

| (ARV × 0.70) - Repairs | |

| | Transaction Costs: 10% |

| EXAMPLE: | Holding Costs: 8% |

| ARV: $200,000 | Contingency: 5% |

| Repairs: $50,000 | Your Profit: 7% |

| | |

| Step 1: | TOTAL: 30% |

| $200,000 × 0.70 | |

| = $140,000 | |

| | |

| Step 2: | |

| $140,000 - $50,000 | |

| = $90,000 | |

| | |

| MAX PURCHASE PRICE | |

| $90,000 | |

+---------------------------+------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771434840479_ophbnk.jpg?alt=media&token=98110f66-a0c5-469f-aa60-7e41c914ee1a)

When to Adjust the Percentage

While 70% is your solid starting point, experienced investors know this percentage isn't set in stone. Here's when you might need to flex:

Market Competitiveness: In hot markets with high demand, you might need to work with 75-80% of ARV to stay in the game.

Project Complexity: For properties requiring extensive or specialized renovations, dropping to 65% gives you extra breathing room.

Holding Time: Longer projected holding periods may call for a lower percentage to cover increased carrying costs.

As one seasoned investor puts it, "You know the drill: buy at 70% of a home's after-repair value minus repair costs. For a $200K ARV home with $50K in repairs, that's a $90K max..." However, this same investor has moved beyond rigid adherence to this rule in today's market conditions.

Regional Variations

Here's the thing: the 70% rule doesn't work the same everywhere. Your local market matters a lot:

High-Appreciation Markets: In hot spots like coastal California or New York City, savvy investors often stretch to 75-80%. Why? Strong price growth can justify tighter margins.

Stable Midwestern Markets: In these steady-Eddie markets, the classic 70% rule typically holds up just fine.

Rural or Declining Markets: When properties take longer to sell or values are softening, smart investors tighten up to 60-65%. Better safe than sorry.

As Rocket Mortgage puts it, "Following this rule can help house flippers ensure they're making a profit on their investment." Think of it as your baseline—then adjust based on what's happening in your backyard.

Safety Margin Justification

So where does that 30% actually go? Let's break it down:

- Transaction Costs: Figure 8-10% for real estate commissions, closing costs, and transfer taxes.

- Holding Costs: Budget 5-8% for insurance, property taxes, utilities, and financing while you're renovating.

- Contingency Buffer: Set aside about 5% for those surprises—because there are always surprises.

- Profit Margin: The remaining 10-15% is your paycheck for the time, expertise, and risk you're putting in.

Here's the good news: this built-in cushion is why house flipping works. Industry data shows roughly 88% of flips sell at a profit, with only 12% breaking even or losing money.

Bottom line? The 70% rule gives you a solid starting point for analyzing deals. Use it as your foundation, then fine-tune based on your specific market and project. That's how smart investors build wealth.

Common Pitfalls in ARV Estimation: Avoiding Costly Mistakes

Getting your After Repair Value (ARV) right is one of the most important skills you'll develop as a real estate investor. But here's the thing—even seasoned pros slip up sometimes. Let's walk through the most common mistakes so you can sidestep them and protect your bottom line.

Overestimating Property Value

We get it. You see a property's potential, and excitement takes over. But letting optimism drive your numbers is one of the quickest ways to tank a deal. Overpaying for a property or pouring in more renovation dollars than the market will reward? That's a recipe for disappointment.

"Overestimating the ARV can have negative financial consequences for investors," warns PropertyRadar, pointing out that this often happens when we get emotionally attached or skip the homework.

Here's your game plan: stick with conservative numbers and get a few different perspectives on value. Chat with local agents who really know the neighborhood—their insights are gold.

Underestimating Repair Costs

On the flip side, lowballing your renovation budget can eat your profits alive. What looked like a winner on paper becomes a money pit in reality.

Pine Financial Group puts it well: "Investors often focus on obvious repairs while missing structural issues, code violations, or outdated systems that can significantly increase renovation costs."

Here's how to nail your repair estimates:

- Collect multiple contractor bids

- Build in a 10-15% cushion for surprises

- Invest in thorough inspections upfront

- Break down your scope of work with specific line-item costs

Ignoring Market Trends

Real estate doesn't stand still, and neither should your analysis. Missing shifts in market conditions can throw your ARV way off target. Market shifts during your renovation period can significantly impact your exit strategy and final returns.

Consider factors such as:

- Seasonal market fluctuations

- Interest rate changes affecting buyer purchasing power

- Local economic developments (infrastructure projects)

- Shifts in buyer preferences and design trends

Poor Comparable Property Selection

Here's a common pitfall that trips up even experienced investors: choosing the wrong comparable properties ("comps"). When your comps don't truly match your subject property, your valuation becomes unreliable—and that can cost you.

When selecting comps, make sure they:

- Are within 0.5-1 mile of your subject property (closer in dense urban areas)

- Have similar square footage (within 20%)

- Share similar age, style, and construction quality

- Have sold within the last 3-6 months

- Feature comparable amenities and condition

"Not adjusting comps is a critical mistake. It is well known that you need to add or subtract value based on differences between your property and the comparable sales," notes Pine Financial Group.

Failure to Account for Holding Costs

Here's something that catches many investors off guard: holding costs. While you're focused on purchase price and renovation expenses, those ongoing costs of owning the property can quietly eat into your profits—especially on longer projects.

Key holding costs to include in your ARV calculations:

- Mortgage payments or interest on hard money loans

- Property taxes

- Insurance

- Utilities

- HOA fees (if applicable)

- Property maintenance

- Marketing expenses for resale

By understanding and sidestepping these common ARV estimation mistakes, you'll develop sharper valuations, make smarter investment decisions, and set yourself up for more profitable outcomes in your real estate journey.

![**Task:** Create a warning-style infographic highlighting the five most common ARV estimation mistakes with icons and brief descriptions for each pitfall.

**Visual Structure:** Grid layout with five warning boxes arranged in a cross pattern, each containing an icon, mistake title, and key warning points.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| 5 COSTLY ARV ESTIMATION MISTAKES TO AVOID |

+----------------------------------------------------------+

| |

| +------------------------+ |

| | [!] OVERESTIMATING | |

| | PROPERTY VALUE | |

| | • Emotional decisions | |

| | • Skipping research | |

| +------------------------+ |

| |

| +-------------------+ +-------------------+ |

| | [!] UNDER- | | [!] IGNORING | |

| | ESTIMATING | | MARKET TRENDS | |

| | REPAIR COSTS | | • Seasonal shifts | |

| | • Missing issues | | • Interest rates | |

| | • No contingency | | • Local economy | |

| +-------------------+ +-------------------+ |

| |

| +------------------------+ |

| | [!] POOR COMPARABLE | |

| | PROPERTY SELECTION | |

| | • Wrong location | |

| | • Outdated sales | |

| +------------------------+ |

| |

| +------------------------+ |

| | [!] FORGETTING | |

| | HOLDING COSTS | |

| | • Taxes & insurance | |

| | • Utilities & fees | |

| +------------------------+ |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771434871966_1bsn8i.jpg?alt=media&token=5e7f4095-90ce-440e-8993-8aecb9275bbe)

How ARV Impacts Real Estate Financing

Let's talk about why After Repair Value (ARV) matters so much when it comes to financing your deals. For investors seeking loans for property rehabilitation projects, ARV is a game-changer. Understanding how lenders use ARV in their decision-making process can significantly improve your chances of securing favorable financing terms.

ARLTV Explained

After Repair Loan-to-Value (ARLTV) is a key metric lenders use to determine the maximum loan amount they'll provide based on a property's projected value after renovations. While traditional LTV ratios only look at current value, ARLTV accounts for the value increase you'll create through your planned improvements.

Most fix-and-flip lenders offer between 65-75% of the ARV, which sets the ceiling for your total loan amount. Here's a quick example: if a property's ARV is $600,000 and your lender offers 70% ARLTV, you could secure up to $420,000 to cover both your purchase and renovation costs. This approach helps lenders manage their risk while giving you the capital you need to complete your project successfully.

Typical Lending Parameters

Fix-and-flip lenders look at several key factors when setting your loan terms:

- ARLTV Ratio: Most lenders cap financing at 65-85% of ARV, depending on your experience and project scope

- Loan-to-Cost (LTC): This measures your loan amount against total project costs (purchase price plus renovations)

- Experience Level: If you're new to flipping, expect more conservative terms than veteran investors receive

- Timeline: Most fix-and-flip loans run between 6-12 months

- Speed of Approval: These specialized loans often close in 1-3 weeks—much faster than conventional financing

According to Park Place Finance, investors should look for lenders offering "70-85% LTV based on ARV" for optimal financing terms that balance leverage with manageable risk exposure.

Documentation Requirements

To secure ARV-based financing, lenders typically require comprehensive documentation that supports both the current property value and your projected ARV:

- Purchase Contract: Shows the acquisition cost

- Detailed Scope of Work: Itemized renovation budget and timeline

- Comparable Sales Analysis: Recent sales of similar renovated properties in the area

- Proof of Experience: Portfolio of previous successful projects

- Exit Strategy: Clear plan for property sale or refinance

- Financial Statements: Credit reports, and asset verification

As Capstone Lending points out, "Conduct thorough market research to ensure the property's after-repair value (ARV) justifies the purchase and rehab costs. Your lender will verify these numbers independently".

Appraisal Processes

Getting the ARV right starts with a solid professional appraisal. Here's how appraisers estimate what your property will be worth once the work is done:

- Subject-To Appraisal: This assumes all your planned renovations are complete—essentially a snapshot of the finished product

- Comparable Market Analysis: A look at what similar renovated homes in your neighborhood have sold for recently

- Cost Approach: Adding up replacement costs plus land value, then subtracting depreciation

- Income Approach: For rental properties, this calculates value based on expected rental income

Your lender will bring in an independent appraiser to double-check your ARV estimates. Think of this as a safety net—it keeps everyone honest and helps confirm your project makes financial sense before you dive in.

Lender Risk Mitigation Strategies

Smart lenders don't just hand over funds and hope for the best. Here's how they protect their investment—and yours:

- Conservative ARV Calculations: Using multiple valuation methods to avoid inflated numbers

- Draw Schedules: Releasing renovation funds in stages as work gets completed and inspected

- Experienced Contractor Requirements: Making sure qualified pros handle the heavy lifting

- Regular Inspections: Checking in on construction progress against your approved scope of work

- Market Analysis: Keeping an eye on local real estate trends to spot potential bumps ahead

As RCN Capital explains, "Brokers and lenders need to be well-versed in how ARV is calculated to accurately assess risk and determine the appropriate financing terms".

Getting a handle on these financing details puts you in a stronger position when applying for loans and helps you set realistic goals for your projects. Once you've got ARV-based financing down, you'll be better equipped to put your capital to work and boost your real estate returns.

How ARV Influences DSCR Loans and Rental Property Financing

After Repair Value (ARV) is a key factor in shaping the terms and feasibility of DSCR loans for rental property investors. If you're planning to renovate a property before turning it into a rental, knowing how ARV and DSCR work together is essential for unlocking better financing options and stronger cash flow.

ARV's Impact on DSCR Calculations

The Debt Service Coverage Ratio (DSCR) tells you whether a property's rental income can cover its debt payments. Lenders calculate this by dividing rental income by debt payments. The higher your DSCR, the better your ability to handle debt—most lenders like to see a DSCR of 1.25 or higher to offer you the best loan terms.

Here's where ARV comes in: smart renovations that boost your property's value can also increase what you can charge in rent. That means a better DSCR calculation, which can qualify you for more favorable financing.

As industry experts put it, "Estimated rent helps calculate DSCR, while purchase price and rehab costs help determine LTV or Loan-to-ARV" when you're pulling together your loan documentation.

Refinancing Strategies Using ARV

Savvy real estate investors often use ARV strategically when shifting from fix-and-flip projects to long-term rentals:

Initial Acquisition and Renovation: You purchase a distressed property with short-term financing, then renovate to boost its value.

ARV-Based Refinancing: Once your renovations wrap up, your property's new ARV becomes the foundation for refinancing into a DSCR loan.

Cash-Out Potential: When your ARV climbs well above your purchase and renovation costs, you may qualify for cash-out refinancing—putting your initial investment back in your pocket.

"Once the property is stabilized with tenants and rental income is flowing, investors can transition into a DSCR loan. This refinancing step allows them to pay off the short-term financing used for the renovation phase and establish long-term, stable financing for their rental property."

Cash Flow Projections and ARV

Getting your ARV right is key to projecting future cash flow from your rental properties. When you can confidently predict both the post-renovation value and the rental income bump, you're able to:

- Optimize Renovation Budgets: Put your dollars toward improvements that boost both ARV and rental income

- Forecast DSCR Improvements: See how your renovations will strengthen the property's DSCR

- Plan Long-Term Investment Strategy: Make smart calls about how long to hold and when to exit

A property with a solid DSCR based on post-renovation rental income gives you breathing room and peace of mind. Here's a practical example: a DSCR of 1.67 means your rental income covers debt payments with 67% to spare—a healthy cushion for surprise repairs or vacant months.

Leveraging ARV for Optimal DSCR Loan Terms

Savvy investors use ARV strategically to lock in the best DSCR loan terms:

- Document ARV Thoroughly: Back up your ARV with detailed renovation plans, contractor bids, and solid comps

- Focus on Rent-Boosting Improvements: Zero in on upgrades that attract tenants and justify higher rents

- Timing the Refinance: Complete renovations and establish rental history before applying for DSCR loans

- Maintain Conservative Estimates: While optimism is natural, realistic ARV and rental projections lead to sustainable financing

When you understand how ARV affects DSCR calculations, you're equipped to build strategies that maximize both property value and long-term cash flow potential—ultimately creating stronger returns while keeping financing costs in check.

ARV in Ground-Up Construction Projects

Ground-up construction brings its own set of challenges when calculating After Repair Value (ARV). Here's the thing: you're estimating the value of something that doesn't exist yet. Unlike renovation projects where you have an existing structure to work from, new construction demands a more thorough approach to nailing down your ARV.

Speculative vs. Pre-Sold Projects

The risk profile of ground-up construction looks very different depending on whether you're building on spec or have a buyer lined up:

Pre-sold projects give you a more reliable ARV since you've already locked in a committed buyer at an agreed price. This dramatically reduces risk and often opens the door to more favorable loan terms.

Speculative projects call for more conservative ARV estimates because you're facing market uncertainty. Lenders typically apply stricter loan-to-ARV ratios here, often capping at 65-70% of the projected ARV.

According to Myers Capital Hawaii, "A maximum LTARV of 70% is typical for ground-up construction projects, though this can vary based on project specifics and borrower qualifications." In practical terms, for a property with a projected ARV of $500,000, you'd typically be looking at a maximum loan amount of $350,000.

Construction Cost Variables

When calculating ARV for new construction, you'll need to carefully account for several cost variables:

- Hard costs: Direct construction expenses including materials, labor, and equipment

- Soft costs: Permits, architectural plans, engineering fees, and other non-construction expenses

- Land value: The cost of the land itself, which can significantly impact overall project feasibility

- Contingency reserves: Typically 5-15% of the total budget to account for unexpected expenses

Here's the reality: cost overruns are one of the biggest threats to hitting your projected ARV. Material prices can swing wildly, labor gets tight, weather throws curveballs, and supply chains hiccup. All of these can eat into your final construction costs—and your profit margin right along with them.

Market Absorption Factors

Market absorption—basically, how fast buyers snap up new inventory—plays a direct role in your ARV calculations for ground-up builds. Here's what to keep your eye on:

- Local housing supply: What's the current inventory situation in your target market?

- Comparable new construction: What are similar new builds actually selling for?

- Projected market conditions: Where is demand headed during your construction timeline?

- Seasonal variations: When should you aim to complete your project for the best market timing?

When you're calculating ARV for new construction, don't just look at today's comps. Dig into market trends and absorption rates too. As RCN Capital puts it, "Accurately calculating ARV can help investors determine if a project is financially viable before committing resources." This matters even more for ground-up projects, where you're looking at longer timelines and bigger capital commitments than your typical renovation.

When you account for all these factors in your ARV calculations, you'll have a much clearer picture of whether a ground-up project makes sense—and you'll be in a stronger position to secure the right financing terms.

Tools and Resources for Accurate ARV Calculation

Getting your After Repair Value (ARV) right comes down to having solid data and the right tools in your toolkit. The good news? Today's investors have more resources than ever to sharpen their ARV estimates.

Online Valuation Tools

Here are some go-to platforms that can give you an edge:

Zillow and Redfin offer quick access to sales history and price trends—great starting points for getting a feel for property values

Local MLS (Multiple Listing Service) is still the gold standard for real-time market data, though you'll typically need to partner with a licensed agent to tap into it

DealCheck has become a favorite among investors for ARV analysis, making it easier to size up potential deals quickly

Professional Software Solutions

When you're ready to level up your analysis game, professional software platforms deliver the firepower you need:

Mashvisor puts data-driven property analysis at your fingertips, helping you scout markets and evaluate investment opportunities across the U.S. with confidence

HouseCanary arms investors, lenders, and brokers with powerful analytics to make smarter decisions faster

PropStream gives you deeper comparable property data and owner records—many savvy investors pair it with DealCheck for a more complete picture

Professional Appraisal Services

DIY tools are great, but sometimes you need the human expertise that technology simply can't match:

- Licensed appraisers tap into proprietary data and apply standardized methodologies you won't find elsewhere

- Their reports carry real weight with lenders and help validate your ARV estimates

- Yes, professional appraisals run $300-$600, but they can save you thousands by catching valuation mistakes before they cost you

Contractor Estimates

Getting your repair costs right can make or break your ARV calculation:

- Partner with experienced contractors who truly understand renovation costs in your target market

- Build standardized cost sheets for common repairs so you stay consistent deal after deal

- Cultivate relationships with multiple contractors—comparing estimates helps you verify costs and avoid surprises

Market Analysis Resources

Smart investors look beyond individual properties to understand the bigger picture:

- Local real estate investment associations offer valuable market insights and networking connections

- Government economic data reveals employment trends and population growth that directly affect property values

- Don't overlook neighborhood factors like school ratings, crime statistics, and development plans—they significantly impact your ARV

Master these tools and resources, and you'll develop more accurate ARV estimates that reduce your risk and boost your investment returns. The most successful investors typically use a combination of these resources rather than relying on any single method.

Components of a Comprehensive Scope of Work (SOW)

A solid Scope of Work (SOW) is your blueprint for nailing accurate ARV calculations in any renovation project. Getting this document right from the start sets you up for consistent, profitable outcomes whether you're tackling repairs, full renovations, or new construction.

Cost Estimation Techniques

Getting your cost estimates right is the backbone of a strong SOW. Here's a pro tip: create standardized templates for different types of renovations. This simple step helps you catch those sneaky expenses that can throw off your ARV calculations and eat into your profits. Your templates should cover everything from demo day to the final coat of paint.

According to methodology:

"One of the best ways to make sure you don't miss anything when building your estimate is to start with a template".

Material Selection Considerations

Your material choices directly affect both your renovation budget and your final ARV. Here's what to keep in mind:

- Quality-to-value ratio: Premium materials cost more upfront but can significantly boost your ARV in the right markets

- Market expectations: Study your comps to understand what buyers expect in your target neighborhood

- Durability and maintenance: Think long-term costs if you're planning to hold onto the property

- Supply chain considerations: Plan ahead for material availability and delivery schedules

Labor Cost Factors

Labor usually eats up 30-50% of your renovation budget, so it deserves careful attention in your SOW. When you're crunching labor numbers, keep these factors in mind:

- Regional wage variations: What you pay for labor varies widely depending on location

- Specialist vs. general contractor rates: Specialized work commands premium pricing

- Project timeline impact: Rush jobs often incur higher labor costs

- Seasonality: Construction labor costs may fluctuate based on seasonal demand

Contingency Planning

Here's the truth: not planning for the unexpected is one of the biggest reasons renovation budgets go off the rails. A solid SOW should always include contingency planning for those curveballs that inevitably come your way.

Consider this eye-opening stat: "14% of all rework in construction globally is caused by bad data," and more than half of construction pros run into problems because of poor information management. The takeaway? Thorough planning and documentation in your SOW can save you from expensive do-overs down the road.

Our advice: build in a contingency budget of 10-20% for your renovation projects. Dealing with an older property or one with unknown conditions? Lean toward the higher end. This safety net means unexpected surprises during renovation won't throw your ARV-based investment strategy off course.

How OfferMarket Simplifies ARV-Based Investing

OfferMarket sets itself apart by giving you an all-in-one platform built specifically for ARV-based investing. Instead of bouncing between multiple services and piecing together information, you get everything you need in one place.

Comprehensive ARV Calculation Tools

OfferMarket's platform puts powerful ARV calculation tools right at your fingertips, helping you make decisions backed by solid data. You can accurately estimate after-repair values by analyzing comparable properties, market trends, and renovation costs—all without subscribing to separate analytics services. That means more time focusing on deals and more money staying in your pocket.

Here's something worth noting: AI-powered ARV calculation methods are becoming the industry standard in 2026, delivering greater accuracy and efficiency than traditional approaches HomeSage. OfferMarket taps into these technological advances to give you reliable ARV estimates—the foundation you need for profitable investment decisions.

Seamless Access to ARV-Based Financing

Here's where OfferMarket really shines for investors like you: direct access to financing products built specifically for ARV-based investments. No hoops to jump through. The platform offers:

- Fix and flip loans with competitive ARLTV (After Repair Loan to Value) ratios

- DSCR loans that factor in your post-renovation rental income potential

- Ground-up construction financing based on projected completed value

- Delayed financing options if you initially purchase with cash

What does this mean for you? No more hunting for lenders who actually get ARV concepts or explaining your investment strategy over and over again. OfferMarket's lending partners already speak your language and can quickly evaluate and fund qualifying projects.

Exclusive Property Listing Advantages

OfferMarket's free property listings open the door to off-market opportunities with serious ARV potential. While traditional listing platforms focus on retail-ready properties, OfferMarket zeroes in on investment properties that need some work to reach their full market value.

Here's what you can do on the platform:

- Filter properties based on ARV potential

- Zero in on opportunities in your target markets

- Connect directly with motivated sellers

- List your own properties without paying fees

This direct link between property listings and ARV-focused financing creates a smooth path from finding your next deal to funding it.

Integrated Insurance Solutions

Rounding out the ecosystem, OfferMarket's insurance integration keeps your investment properties protected throughout renovation and beyond. You'll find:

- Renovation insurance that covers properties during the rehab phase

- Landlord insurance for buy-and-hold investors

- Builder's risk policies for ground-up construction

- Flexible coverage options that adapt as properties move from renovation to rental or sale

As LeaseRunner. points out, understanding ARV is key for determining the right insurance coverage, since it reflects your property's true value after improvements are completed.

Real-World Examples of Successful ARV Calculations

Let's get practical. Accurate ARV calculations can be the difference between a winning investment and an expensive lesson. Here are some real scenarios where investors nailed their ARV estimates and reaped the rewards.

Renovation Success Stories

Picture this: an investor spots a rough-around-the-edges property in a neighborhood on the rise. They crunch the numbers, nail down a solid ARV estimate, and map out their renovation plan. Instead of spreading their budget thin on minor cosmetic fixes, they zero in on kitchen and bathroom upgrades—the improvements that buyers actually pay more for. The result? A healthy profit at closing.

Financing Outcomes

Here's something every smart investor knows: lenders look at your ARV when deciding how much to lend you, especially on fix-and-flip loans. Come to the table with a well-researched ARV backed by solid comps, and you're in a stronger position to negotiate better terms and higher loan amounts. That means you can tackle bigger, more profitable projects with confidence.

Profit Realization

The 70-75% rule remains a staple guideline for many successful investors when calculating maximum purchase prices. However, market conditions can necessitate adjustments to this formula. As noted in industry discussions, some markets have become so competitive that investors have had to adjust their calculations to remain competitive while still ensuring profitability.

Lessons Learned

Seasoned real estate investors emphasize several key lessons when it comes to ARV calculations:

Focus on sold comps, not active listings: Actual sale prices give you the real story—asking prices are often just wishful thinking.

Stay local and recent: Your best comparables are properties sold within the last 3-6 months and within a 0.5-1 mile radius of your target property.

Account for market trends: In fast-moving markets, even recent sales may need adjusting to reflect what's happening right now.

Be conservative in estimates: Smart investors always build in a cushion. Renovation costs have a way of creeping up, and markets can shift unexpectedly.

Consider property-specific factors: Features like lot size, view, school district, and unique amenities can make a real difference in your ARV—don't overlook them.

By putting these lessons into practice and staying disciplined with your ARV calculations, you'll be well-positioned to spot profitable deals and sidestep costly missteps on your real estate investment journey.

![**Task:** Create an action-oriented call-to-action infographic showing the five-step process for leveraging ARV with OfferMarket, designed as a roadmap with clear action items.

**Visual Structure:** Horizontal roadmap design with five sequential stops/stations, each containing an action step with specific deliverables and OfferMarket resources.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| YOUR ARV SUCCESS ROADMAP WITH OFFERMARKET |

+----------------------------------------------------------+

| |

| START --> [1] --> [2] --> [3] --> [4] --> [5] --> SUCCESS|

| |

| +--------+ +--------+ +--------+ +--------+ +--------+ |

| |DEVELOP | |APPLY | |ACCESS | |CONSULT | |SECURE | |

| |SYSTEM | |70% RULE| |TOOLS | |EXPERTS | |FUNDING | |

| | | | | | | | | | | |

| |• Build | |• Calc | |• Search| |• Review| |• Choose| |

| |worksheet|• Set max| |listings| |calcs | |loan | |

| |• Track | |purchase| |• Use | |• Get | |type | |

| |comps | |price | |ARV calc| |strategy| |• Apply | |

| |• Document |• Build | |• Find | |help | |• Close | |

| |process | |cushion | |insurance |• Plan | |deal | |

| +--------+ +--------+ +--------+ +--------+ +--------+ |

| |

| READY TO START? Visit OfferMarket.com or Call Today |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771437425778_6cs44a.jpg?alt=media&token=0907dc9a-de4d-4053-b199-4ae76b5469c4)

Follow these steps and use OfferMarket's all-in-one platform to put ARV calculations to work in your investment strategy. You'll reduce your risk and set yourself up for stronger returns on every deal.