*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Where to get Non-Recourse Loans?

When you're building a real estate portfolio, protecting your personal assets while accessing the capital you need becomes a top priority. Non-recourse loans offer a powerful solution—a financing structure that limits your liability to the collateral property itself, keeping your other assets safe if things don't go as planned.

This comprehensive guide breaks down everything you need to know about non-recourse loans: how they work, when they make sense for your investment strategy, and how to secure them through OfferMarket's streamlined platform.

Types of Non-Recourse Loans Available at OfferMarket

Non-recourse loans are a powerful tool for real estate investors who want to grow their portfolios without putting everything on the line. At OfferMarket, we've built several non-recourse loan products designed to fit different investment strategies and goals.

Portfolio Rental Loans

Portfolio rental non-recourse loans are built for investors juggling multiple rental properties. Before you dive in, here's what you need to know:

Minimum Portfolio Requirements: There are 2 tiers, the 2-10 sized portfolio and 10+. With a 2 properties portfolio with up to 10 maximum, minimum value of $72,000 per property and minimum loan amount is $50,000 per property is necessary to qualify. Note on Valuation, if 25% or more of the properties in the portfolio have values less than $100,000, the maximum Loan-to-Value (LTV) is capped at 70%. If your portfolio is 10+ properties and up to 25 properties, those loans typically have higher minimum asset value requirements (e.g., $100,000 per property).

Bad-Boy Carve-Outs: These loans are non-recourse, but there's a catch. Certain actions can make you personally liable. Watch out for these triggers:

- Fraud or material misrepresentation

- Misapplication of funds (including rental income)

- Voluntary bankruptcy filing

- Environmental violations

- Transfers of property without lender consent

Pledge of Equity: Expect lenders to ask you to pledge your ownership interest in the property-holding entity (the LLC or corporation) as extra security. This pledge of equity serves as a secondary layer of protection for the lender while maintaining the non-recourse nature of the loan.

Higher Interest Rates: Non-recourse portfolio loans typically carry interest rates 0.5% to 1.5% higher than comparable recourse loans, reflecting the additional risk assumed by the lender.

Get started here by getting an instant quote.

DSCR Loans (Debt Service Coverage Ratio)

DSCR loans offer another solid path to non-recourse financing, and they're especially useful for:

Exception Route: Most DSCR loans start out as recourse, but here's the good news—investors with strong property performance can often negotiate non-recourse terms. Here's what you'll typically need:

- DSCR ratios of 1.25 or higher

- Lower loan-to-value ratios (often below 70%)

- Strong borrower credit profiles (680+ credit scores)

IRA LLC Borrowers: If you're a self-directed IRA investor, these loans are a game-changer. IRS regulations require you to use non-recourse financing, and as OfferMarket's DSCR loan program notes, "some lenders may work with lower scores if you demonstrate strong property cash flow." This opens doors for IRA investors across different credit profiles.

At OfferMarket, we put our deep lending expertise to work for you. We help investors navigate these requirements and secure non-recourse financing that fits their investment goals while keeping personal liability to a minimum. Our team knows how to structure these loans so you can grow your portfolio while staying protected.

Get started here by getting an instant quote.

OfferMarket's Integrated Advantage

Here's what makes OfferMarket different—we look at the whole picture of your investment journey:

Extensive Capital Provider Network: We work with numerous capital providers who specialize in non-recourse financing, so we can find you the right fit with competitive terms.

Property Listing Integration: Here's something you won't find with standalone lenders, OfferMarket brings together loan options and property listings in one place. That means you can find your next investment opportunity and secure financing without jumping between platforms.

Insurance Solutions: We've got you covered—literally. Our specialized insurance products are built specifically for non-recourse borrowers, meeting the unique coverage requirements that lenders typically require for these loan types.

According to industry research, "Non-recourse lending differs from others in that we don't require any personal guarantees". At OfferMarket, we use this distinction to help you grow your real estate portfolio while keeping your personal assets protected.

We know the ins and outs of non-recourse lending requirements. That expertise allows us to help you secure favorable terms—even if you've hit roadblocks trying to get this specialized financing through traditional channels.

What Are Non-Recourse Loans?

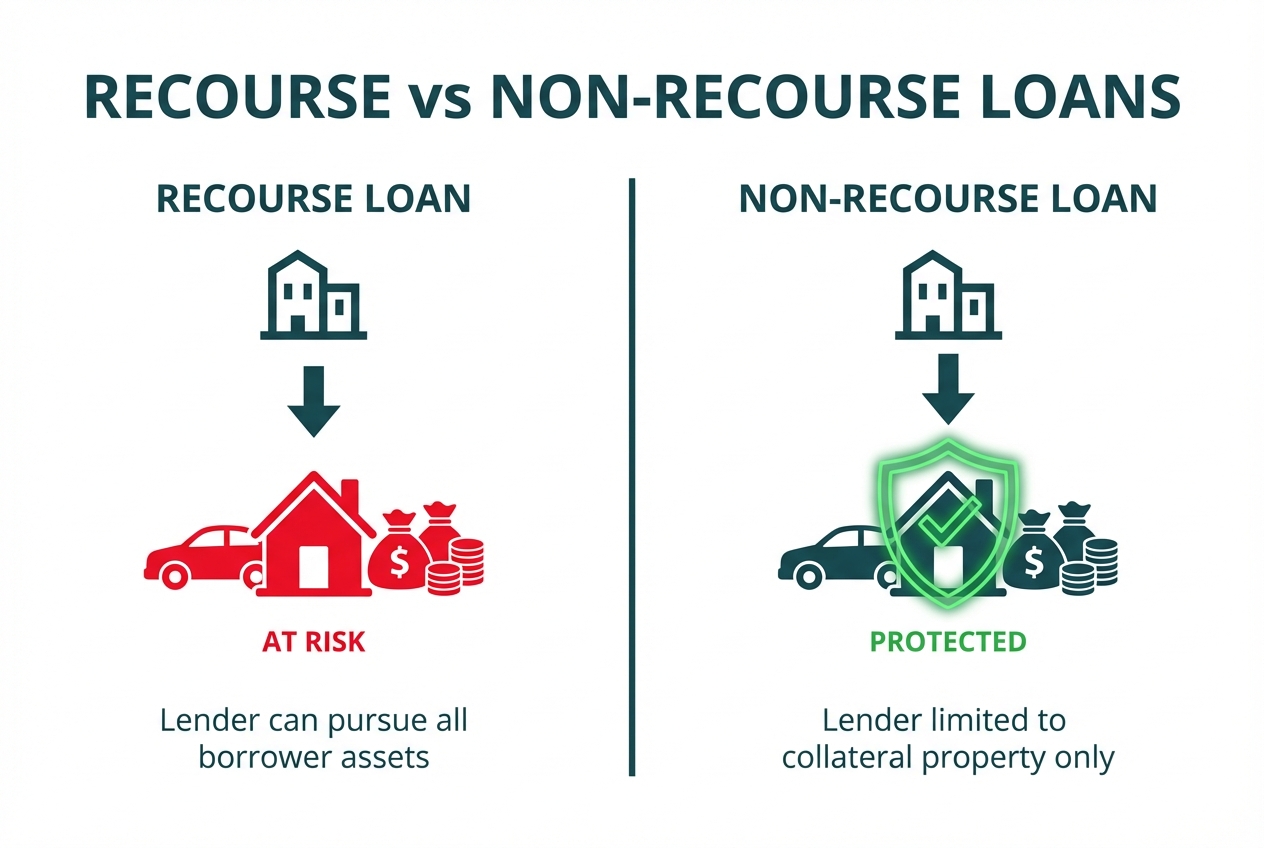

A non-recourse loan is a type of secured financing where the lender's ability to collect on a defaulted loan is limited exclusively to the collateral securing that loan. If you default on a non-recourse loan, the lender can seize and sell the property, but they cannot pursue your other assets or income to recover any remaining balance.

This stands in stark contrast to recourse loans, where lenders can pursue your personal assets, garnish wages, or take other legal action to collect the full debt amount beyond just the collateral property.

Understanding Non-Recourse Loans in Real Estate

A non-recourse loan is a specialized financing option where the lender's recovery is strictly limited to the collateral securing the loan if you default. Unlike traditional loans, if you default on a non-recourse loan, the lender cannot come after your personal assets beyond the secured property itself.

Key Characteristics of Non-Recourse Loans

Non-recourse loans give you a significant layer of protection by creating a clear separation between your personal and investment assets. The fundamental principle is straightforward: the property alone serves as security for the debt. As Investopedia explains, "A non-recourse loan is a type of loan where the lender's recovery is limited to the collateral in the event of borrower default, meaning they cannot pursue [the borrower's other assets]" (Investopedia).

How Non-Recourse Loans Differ from Recourse Loans

Understanding the distinction between recourse and non-recourse loans is essential for your investment strategy:

- Recourse loans allow lenders to pursue you personally for any remaining balance after foreclosure and sale of the collateral.

- Non-recourse loans restrict lenders to recovering only the collateral property itself, regardless of any remaining loan balance.

This key difference creates a liability firewall that savvy investors like you seek, particularly when building larger real estate portfolios.

![Task: Create a detailed infographic flowchart showing what happens in default scenarios for both recourse and non-recourse loans, illustrating the step-by-step process and outcomes.

Visual Structure: Two parallel flowcharts side by side, each showing the progression from default to final outcome, with decision points and consequences clearly marked.

ASCII Layout Reference:

```

+----------------------------------------------------------------+

| DEFAULT SCENARIO: WHAT HAPPENS NEXT? |

| |

| RECOURSE LOAN NON-RECOURSE LOAN |

| |

| [Borrower Defaults] [Borrower Defaults] |

| ↓ ↓ |

| [Lender Forecloses] [Lender Forecloses] |

| ↓ ↓ |

| [Property Sold] [Property Sold] |

| ↓ ↓ |

| [Deficiency Remains?] [Deficiency Remains?] |

| ↓YES ↓NO ↓YES ↓NO |

| [Pursue [Case [Case [Case |

| Personal Closed] Closed] Closed] |

| Assets] |

| ↓ |

| [Wage Garnishment] |

| [Asset Seizure] |

| [Legal Action] |

+----------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771383259319_f2cdhf.jpg?alt=media&token=5c69df68-a9bf-464e-b009-169735a667fc)

Collateral Requirements and Loan Structure

Because lenders take on greater risk with non-recourse financing, these loans typically come with:

- Higher down payment requirements - Often 30-40% of the property value

- More stringent property qualification standards - Properties must demonstrate strong income potential

- Higher interest rates - To compensate for the increased risk to lenders

- Stricter borrower qualifications - Including experience requirements for real estate investors

According to The Entrust Group, "A non-recourse loan is a type of debt that is secured only by the asset the loan finances. The lender has no other recourse, or ability to seize other assets" (The Entrust Group). What does this mean for you? Lenders pay extra attention to the quality and value of the property you're putting up as collateral.

Protection of Personal Assets

Here's the big win with non-recourse loans: your personal assets stay protected. Picture this—if your property value tanks below what you owe, you can walk away without being on the hook for the difference. This safety net is a game-changer for:

- Investors with significant personal wealth who want to keep it protected

- Real estate portfolio owners who need to keep risk contained between properties

- Self-directed IRA investors (the IRS actually requires you to use non-recourse financing)

Getting a handle on these basics sets you up to make smart choices about when and how to use non-recourse loans in your investment playbook.

Types of Non-Recourse Loans Available for Real Estate Investors

Non-recourse loans aren't one-size-fits-all. Let's break down the different types so you can find the right fit for your investment goals.

Portfolio Rental Loans

Got multiple rental properties? Portfolio rental loans let you bundle them under one non-recourse loan—a real time-saver for managing your real estate holdings.

Here's what you need to know about portfolio rental loans:

- Loan Amounts: Typically range from $100,000 to $5+ million

- Requirements: Often require a minimum of 2-10 properties in the portfolio, terms change for 10+ portfolios.

- Interest Rates: Generally higher than recourse loans, typically 1-2% above conventional financing

One heads-up: these loans include "bad-boy carve-outs" and often require you to pledge equity as extra security. The higher interest rates reflect the increased risk the lender takes on when they can only go after the property if things go south.

DSCR Loans (Debt Service Coverage Ratio)

DSCR loans focus on whether your property brings in enough income to cover the mortgage payments—that's why they're a go-to choice for income-producing properties.

- Loan Amounts: Generally $100,000 to $5 million for residential DSCR loans

- Terms: Typically 30-year amortization with 5-10 year fixed rate periods

- Qualifying Metric: Your property needs to generate enough income to hit a minimum DSCR (typically 1.25 or higher)

- Interest Rates: Usually 0.5-1.5% higher than conventional financing

Here's something worth knowing: DSCR loans can sometimes be set up as non-recourse loans, especially for larger commercial deals or for investors using IRA LLCs who need non-recourse terms to stay on the right side of IRS rules.

![Task: Create an educational infographic explaining the DSCR (Debt Service Coverage Ratio) calculation with a clear visual example showing how the ratio is calculated and what different ratio values mean for loan qualification.

Visual Structure: Top section with formula, middle section with calculation example using real numbers, bottom section with interpretation scale showing what different DSCR values mean.

ASCII Layout Reference:

```

+----------------------------------------------------------+

| UNDERSTANDING DSCR (Debt Service Coverage) |

| |

| THE FORMULA: |

| +----------------------------------------------------+ |

| | DSCR = Net Operating Income / Debt Service | |

| +----------------------------------------------------+ |

| |

| EXAMPLE CALCULATION: |

| +----------------------------------------------------+ |

| | Annual Rental Income: $60,000 | |

| | Operating Expenses: - $15,000 | |

| | Net Operating Income: $45,000 | |

| | | |

| | Annual Debt Service: $36,000 | |

| | | |

| | DSCR = $45,000 / $36,000 = 1.25 | |

| +----------------------------------------------------+ |

| |

| WHAT YOUR DSCR MEANS: |

| [====|====|====|====|====|====] |

| 0.8 1.0 1.15 1.25 1.35 1.5 |

| [RED][YELLOW][GREEN GRADIENT] |

| |

| < 1.0 = High Risk - Typically Declined |

| 1.0-1.15 = Marginal - May Require Higher Rates |

| 1.25+ = Strong - Preferred by Most Lenders |

| 1.35+ = Excellent - Best Terms Available |

+----------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385282915_ctyv0r.jpg?alt=media&token=33e911cc-7d89-4ecb-a3eb-cfefff4a208a)

Commercial Mortgage-Backed Securities (CMBS) Loans

CMBS loans are the heavy hitters when it comes to non-recourse financing in commercial real estate today.

- Loan Amounts: Typically $2 million and up

- Terms: Usually 5, 7, or 10-year terms with 25-30 year amortization

- Property Types: Office buildings, retail centers, industrial properties, and multifamily complexes

- Interest Rates: Competitive with other commercial financing options

Here's how they work: these loans get bundled together and sold as securities to investors. This setup lets lenders offer non-recourse terms while keeping their risk in check. You'll typically see loan-to-value ratios of 65-75%, and your property needs to show strong, steady cash flow.

Self-Directed IRA Loans

If you're using a self-directed IRA to buy real estate, non-recourse loans aren't just a nice option—the IRS says you have to use them.

- Loan Amounts: Typically $100,000 to $2 million

- Terms: Often 5-10 year terms with 20-30 year amortization

- Down Payment: Usually require 30-40% down payment

- Restrictions: You cannot personally guarantee the loan as the IRA owner

"When you're looking at an IRA loan, understanding your repayment liability is key. Traditional loans are considered recourse debt," explains IRA Resources in their whitepaper on non-recourse loans for real estate investing.

Here's the good news: non-recourse loans keep you on the right side of IRS rules against self-dealing because you can't personally guarantee the loan. This means you can tap into your retirement funds for real estate purchases while keeping those valuable tax advantages intact.

Each loan type brings something different to the table. Your job? Figure out which one matches your investment goals, how much risk you're comfortable with, and the properties you've got your eye on.

DSCR Loans: Non-Recourse Financing for Investment Properties

DSCR (Debt Service Coverage Ratio) loans are a specialized financing tool that can be set up as non-recourse debt when the right conditions are met. These loans evaluate a property's ability to generate sufficient income to cover its debt obligations, making them a smart choice for real estate investors looking to grow their portfolios.

Understanding DSCR Calculations

Here's the deal: the Debt Service Coverage Ratio is simply a way to compare what your property earns versus what you owe. Most lenders want to see a minimum DSCR between 1.2 and 1.5—that means your property brings in at least 20-50% more than your loan payments require. The best part? This ratio is what qualifies you, not your personal income. That's great news if you're self-employed or have income that doesn't fit neatly into traditional lending boxes.

When DSCR Loans Can Be Non-Recourse

Most DSCR loans come with recourse terms, but here's how you can potentially secure non-recourse options:

Strong Property Performance: Got a property that's crushing it with cash flow (think DSCR of 1.25 or higher)? You may be in a good position to negotiate non-recourse terms.

Self-Directed IRA Investments: If your self-directed IRA LLC is doing the borrowing, non-recourse isn't just nice—it's required. The IRS doesn't allow personal guarantees on IRA investments, plain and simple.

Higher Equity Requirements: Willing to put more skin in the game? Lenders often offer non-recourse terms when you bring a larger down payment to the table (usually 30-40% or more).

Premium Pricing: Sometimes it comes down to trade-offs. Higher interest rates and origination fees can open the door to non-recourse provisions.

Benefits for IRA LLC Borrowers

If you're investing through a self-directed IRA, non-recourse DSCR loans are your friend. Here's why:

- They keep you on the right side of IRS rules by avoiding prohibited personal guarantees

- They let your retirement account tap into real estate leverage without triggering prohibited transactions

- They help you grow your retirement wealth through real estate while keeping your personal assets protected

- They create a clean line between your retirement investments and personal finances

At OfferMarket, we're here to help you navigate the ins and outs of non-recourse DSCR loans. Whether you're an IRA investor or simply want to build wealth through real estate with the right legal protections in place, we've got your back.

Benefits of Non-Recourse Loans for Real Estate Investors

Non-recourse loans can be a game-changer for real estate investors who want to grow their portfolios while keeping their personal assets protected. Let's break down why these loans deserve a spot on your radar.

![Task: Create a visually striking infographic highlighting the four key benefits of non-recourse loans for real estate investors using icons and concise explanations.

Visual Structure: Four-quadrant layout with a central title, each quadrant containing an icon, benefit heading, and brief description.

ASCII Layout Reference:

```

+----------------------------------------------------------+

| |

| KEY BENEFITS OF NON-RECOURSE LOANS |

| |

| +---------------------+ +------------------------+ |

| | [SHIELD ICON] | | [GROWTH CHART ICON] | |

| | Limited Personal | | Strategic Portfolio | |

| | Liability | | Scaling | |

| | | | | |

| | Your personal | | Grow faster without | |

| | assets stay | | personal debt-to- | |

| | protected | | income limits | |

| +---------------------+ +------------------------+ |

| |

| +---------------------+ +------------------------+ |

| | [IRA ICON] | | [ESTATE PLAN ICON] | |

| | Self-Directed | | Tax & Estate | |

| | IRA Compatible | | Planning Benefits | |

| | | | | |

| | Required for IRA | | Clean asset | |

| | real estate | | separation for | |

| | investments | | wealth transfer | |

| +---------------------+ +------------------------+ |

| |

+----------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385181085_wpavl4.jpg?alt=media&token=edabbfef-f6a2-4e18-97ef-3269c36713e6)

Limited Personal Liability

Here's the big win with non-recourse financing: your personal assets stay off the table. With traditional recourse loans, lenders can come after your savings, other properties, or personal belongings if the property doesn't cover what you owe. Non-recourse loans? The lender can only look to the property itself for repayment.

"In the event of a default, the only recourse that the lender has is against the individual subject property that's used as collateral for the loan," explains Trust Company Equity Trust in their guide to self-directed IRA non-recourse loans. "The lender cannot pursue the borrower's personal assets to satisfy any deficiency."

Think of it as building a protective wall between your investment properties and everything else you've worked hard to accumulate. That peace of mind can help you move forward with confidence.

Strategic Portfolio Scaling

Ready to grow? Non-recourse financing can help you build your portfolio faster because you're not bumping up against personal debt-to-income limits. Lenders focus on how the property performs, not your personal paycheck, which opens doors to bigger opportunities.

According to commercial lending experts, "Non-recourse loans can enable an investor to borrow more. This is because the debt isn't tied to the borrower's income or total assets, which means they may be able to qualify for a larger loan than they would with recourse financing."

Here's what this means for your investment strategy:

- Pursue multiple acquisition opportunities simultaneously

- Maintain liquidity for additional investments

- Leverage property performance rather than personal financial statements

- Create separation between different investment properties

Self-Directed IRA Compatibility

If you're investing with retirement funds, here's something important to know: non-recourse loans are the only financing option allowed for self-directed IRA real estate investments. IRS regulations don't allow personal guarantees on loans within these accounts, so non-recourse financing becomes your go-to option.

"A non-recourse loan is a specific type of loan that allows you to use your IRA funds to purchase real estate investments," notes My IRA Lender. "With this loan, the property purchased is used as collateral and the lender cannot come after other assets in your IRA or personal assets if you default on the loan."

Tax and Estate Planning Considerations

Non-recourse loans can work in your favor when it comes to estate planning. They create a clean line between your assets and liabilities, which can make passing wealth to your heirs more straightforward and may even offer some tax advantages depending on your situation.

Here's another benefit worth knowing: the asset protection that comes with non-recourse financing means that if things go south and a property ends up underwater, you can walk away without putting your broader financial picture or estate plans at risk. Of course, this should always be a last resort, and you'll want proper legal guidance before making that call.

When you use non-recourse loans strategically, you're building a portfolio that can handle market ups and downs while keeping your personal wealth and retirement savings protected.

Bad-Boy Carve-Outs: Understanding the Fine Print of Non-Recourse Loans

Non-recourse loans appeal to real estate investors because your liability stops at the collateral property. But here's what you need to know: these loans come with exceptions called "bad-boy carve-outs" that can put you on the hook personally. Let's break down these provisions so you know exactly what you're signing up for.

What Are Bad-Boy Carve-Outs?

Bad-boy carve-outs are specific conditions written into your non-recourse loan agreement. If you violate them, your loan flips from non-recourse to recourse—meaning you become personally liable. Lenders include these provisions to protect themselves from borrower misconduct or actions that could hurt the property's value.

According to the Commercial Real Estate Finance industry, "Non-recourse carve-outs—also called 'bad boy carve-outs'—are specific borrower actions that can trigger personal liability under a non-recourse loan. These acts range from fraud and voluntary bankruptcy to more operational issues like failing to pay taxes or refusing property inspections."

![Task: Create a comprehensive infographic listing and explaining the most common bad-boy carve-out provisions that can trigger personal liability in non-recourse loans, using warning symbols and clear categorization.

Visual Structure: Header with warning symbol, followed by two columns of carve-out categories with icons and descriptions, and a bottom call-out box emphasizing the consequences.

ASCII Layout Reference:

```

+------------------------------------------------------------+

| [WARNING ICON] BAD-BOY CARVE-OUTS: KNOW THE TRIGGERS |

| |

| Actions That Convert Non-Recourse to Full Recourse: |

| |

| INTENTIONAL ACTS | OPERATIONAL FAILURES |

| +----------------------+ | +------------------------+ |

| | [FRAUD ICON] | | | [TAX ICON] | |

| | Fraud & | | | Tax & Insurance | |

| | Misrepresentation | | | Defaults | |

| +----------------------+ | +------------------------+ |

| | [BANKRUPTCY ICON] | | | [TRANSFER ICON] | |

| | Voluntary | | | Unauthorized | |

| | Bankruptcy | | | Transfers | |

| +----------------------+ | +------------------------+ |

| | [WASTE ICON] | | | [ENVIRONMENT ICON] | |

| | Property Waste & | | | Environmental | |

| | Mismanagement | | | Violations | |

| +----------------------+ | +------------------------+ |

| | [MONEY ICON] | | | [BLOCK ICON] | |

| | Misappropriation | | | Interference with | |

| | of Funds | | | Lender Rights | |

| +----------------------+ | +------------------------+ |

| |

| +------------------------------------------------------+ |

| | CONSEQUENCE: Violation of these provisions converts | |

| | your loan to FULL RECOURSE - putting ALL personal | |

| | assets at risk, not just the property. | |

| +------------------------------------------------------+ |

+------------------------------------------------------------+

```

Image Section Breakdown:

- Header: Warning triangle icon in Vivid Red,](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385198194_iu2b8y.jpg?alt=media&token=76a75595-c77f-440a-a992-4f35dfcbf2e7)

Common Carve-Out Provisions

Here are the bad-boy carve-out provisions you'll encounter most often:

- Fraud and Misrepresentation: Providing false information during the loan application process or in ongoing financial reporting

- Voluntary Bankruptcy Filings: Intentionally declaring bankruptcy to avoid loan obligations

- Waste and Property Mismanagement: Allowing the property to deteriorate or removing fixtures that reduce property value

- Unauthorized Transfers: Transferring the property or ownership interests without lender approval

- Tax and Insurance Defaults: Failing to pay property taxes or maintain required insurance coverage

- Environmental Issues: Violations of environmental regulations or allowing hazardous materials on the property

- Misappropriation of Funds: Using property income for purposes other than property expenses and debt service

- Interference with Lender's Rights: Preventing property inspections or hindering the lender's security interest

What Triggers Personal Liability?

Here's what you need to know: not all carve-out violations carry the same weight. Some violations trigger full-recourse liability, meaning you become personally responsible for the entire loan balance. Others may only create liability for the actual damages the lender suffers.

"Bad boy acts usually also include acts of fraud, misrepresentations by the borrower in its interactions with the lender, or the borrower's misappropriation of insurance or condemnation proceeds," notes a legal analysis from Alston & Bird LLP.

Negotiating Carve-Out Provisions

If you've been in the real estate game for a while, you know that bad-boy carve-outs aren't set in stone. Here's what you can push back on:

- Capping liability to actual damages instead of the entire loan balance

- Adding materiality thresholds for certain violations

- Building in cure periods for accidental or technical slip-ups

- Tightening up the definition of "waste"

- Making sure only intentional actions (not honest mistakes) trigger full recourse

OfferMarket's Approach to Bad-Boy Carve-Outs

At OfferMarket, we're in your corner when it comes to understanding bad-boy carve-outs. Here's how we help:

- We break down all carve-out provisions in plain English

- We guide you on what's negotiable based on your profile and property type

- We make sure you know exactly what to do (and not do) to keep your non-recourse protection intact

- We structure loans with fair carve-out terms that work for everyone

Getting a handle on bad-boy carve-outs is key to enjoying the perks of non-recourse financing while keeping your personal assets protected.

Self-Directed IRAs and Non-Recourse Loans: IRS Requirements

Thinking about buying real estate through a Self-Directed IRA (SDIRA)? You'll need to know the IRS rules around non-recourse loans. The IRS has clear guidelines on how these deals must be set up to keep your retirement account's tax benefits intact.

Why Non-Recourse Loans Are Mandatory for SDIRAs

Here's the deal: the IRS requires that any loan your self-directed IRA takes out must be non-recourse. This comes straight from Internal Revenue Code 4975, which says you can't personally guarantee a loan for your IRA. As Trust Company of America puts it, "Under the guidelines of Internal Revenue Code 4975, you cannot sign a personal guarantee of a loan that your IRA is taking on. You're considered a disqualified person"

Avoiding Prohibited Transactions

Here's the deal: using a non-recourse loan keeps you on the right side of IRS rules and protects your entire IRA from disqualification. The IRS doesn't mess around when it comes to prohibited transactions, so keep these guidelines front and center:

- You can't personally guarantee the loan—hands off!

- The loan goes to your IRA, not to you as an individual

- Every dollar of income and expense must flow through the IRA

- No enjoying that property yourself until you hit retirement age

As Advanta IRA explains, "Non-recourse loans for a self-directed IRA are used and required by the IRS when your IRA seeks conventional financing to invest"

Documentation and Structural Requirements

Ready to get your non-recourse loan set up properly? Here's your checklist of what you'll need to gather:

- Proof of property income

- Official property appraisal

- Purchase contract

- IRA asset statement showing you've got enough for the down payment

LLC Considerations for SDIRA Real Estate Investments

Thinking about holding your SDIRA real estate through an LLC? Smart move for many investors. Here's what you need to know when pairing this structure with non-recourse financing:

- Your SDIRA must be the sole owner of the LLC—no exceptions

- The loan stays non-recourse, even when the LLC is the borrower

- Your LLC operating agreement needs careful drafting to stay IRS-compliant

- All loan paperwork must list the LLC as borrower with your IRA as sole member

This setup can give you extra liability protection and make property management easier. Just make sure everything is structured correctly to keep the IRS happy.

Disadvantages of Non-Recourse Loans

Non-recourse loans give you solid protection as a borrower, but they're not without their trade-offs. Let's walk through the key disadvantages you'll want to weigh before making your decision:

![Task: Create a balanced comparison chart showing the trade-offs of non-recourse loans, with advantages on one side and disadvantages on the other, using a scale/balance visual metaphor.

Visual Structure: Balance scale design with advantages on left side and disadvantages on right side, showing the trade-offs investors must consider.

ASCII Layout Reference:

```

+------------------------------------------------------------+

| NON-RECOURSE LOANS: WEIGHING THE TRADE-OFFS |

| |

| [BALANCE SCALE ICON] |

| |

| ADVANTAGES | DISADVANTAGES |

| +--------------------+ | +-------------------------+ |

| | [SHIELD] | | | [PERCENTAGE UP] | |

| | Limited Personal | | | Higher Interest | |

| | Liability | | | Rates (+0.5-1.5%) | |

| +--------------------+ | +-------------------------+ |

| | [PORTFOLIO] | | | [MAGNIFYING GLASS] | |

| | Portfolio | | | Stricter | |

| | Flexibility | | | Underwriting | |

| +--------------------+ | +-------------------------+ |

| | [IRA] | | | [MONEY DOWN] | |

| | IRA Compatible | | | Larger Down | |

| | | | | Payment (30-40%) | |

| +--------------------+ | +-------------------------+ |

| | [ESTATE] | | | [CHECKLIST] | |

| | Estate Planning | | | More Stringent | |

| | Benefits | | | Requirements | |

| +--------------------+ | +-------------------------+ |

| | | [DOLLAR SIGNS] | |

| | | Additional Fees | |

| | | & Costs | |

| | +-------------------------+ |

+------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385198619_bwwt3i.jpg?alt=media&token=801c83dd-8459-4c61-815d-89ba1246793a)

Higher Interest Rates

Here's the reality: non-recourse loans cost more in interest than recourse loans. Why? Because lenders are taking on more risk when they can only go after the property if things go south.

A Federal Reserve study from December 2021 found that recourse loans run about 52 basis points (0.52%) cheaper than comparable non-recourse options. On a $1 million investment property, that difference adds up to thousands of extra dollars in interest each year.

Stricter Underwriting Standards

Lenders get pickier with non-recourse applications. Expect them to look for:

- Higher credit scores (often 700+)

- More extensive documentation of assets and income

- Stronger property performance history

- Greater scrutiny of the borrower's investment experience

Larger Down Payment Requirements

You'll need deeper pockets upfront with non-recourse financing. While recourse loans might let you borrow up to 80-85% of the property value, non-recourse loans typically max out at 65-75% LTV (Corporate Finance Institute). That means more of your own money on the line from day one.

Property Condition Requirements

Since the property is the lender's only safety net, they'll scrutinize it closely. Be prepared for:

- Professional property inspections

- Higher property quality standards

- More comprehensive maintenance records

- Stricter location and market requirements

Additional Fees and Costs

The protection you get from non-recourse financing comes with a bigger price tag across the board:

- Higher origination fees

- More expensive due diligence requirements

- Costlier insurance requirements

- Higher reserve requirements

- More expensive legal documentation

The bottom line? Non-recourse loans aren't the right fit for every investor or every property. The decision to pursue non-recourse financing should be part of a broader investment strategy that weighs these costs against the benefit of limiting personal liability.

Smart Ways to Use Non-Recourse Loans in Your Real Estate Portfolio

Non-recourse loans give you more than just a way to finance your next property. When you use them wisely, these loans become a key tool in building a smarter, more resilient investment approach.

Diversify Your Portfolio with Confidence

Non-recourse loans open doors to diversification by letting you acquire more properties without putting everything you own on the line. Because each property carries its own liability, you can spread your investments across different markets, property types, and asset classes with greater peace of mind.

According to Marion Street Capital, "Non-recourse loans are prevalent in commercial property financing, where the property itself serves as collateral," making them especially useful if you want to break into commercial real estate without exposing your personal assets to extra risk.

Keep Your Liabilities in Check

One of the biggest wins with non-recourse loans is how they create protective walls between your investments. This separation of risk means you can:

- Keep potential losses contained to a single property

- Shield your personal assets from business-related liabilities

- Build a more sustainable investment strategy for the long haul

This protection really proves its worth during economic downturns or in unpredictable markets, stopping one troubled property from dragging down your entire portfolio.

Grow Your Holdings Without Growing Your Risk

If you're ready to expand your real estate investments, non-recourse financing gives you a clear path to growth without piling on personal risk at the same rate. This makes them particularly valuable for:

- Landlords expanding rental portfolios

- Investors transitioning from single-family to multi-family properties

- Real estate professionals building commercial property portfolios

As noted by MyIRALender, non-recourse loans can be strategically used "as part of your overall investment strategy" to facilitate growth while maintaining appropriate risk boundaries. Source

Retirement Planning with Real Estate

Here's something many investors don't realize: non-recourse loans are essential for retirement planning when you're using a self-directed IRA to invest in real estate. The IRS actually requires that any loans tied to IRA investments be non-recourse—making these loans your only compliant option for leveraging retirement funds in property investments.

What does this mean for you? You can:

- Put your retirement funds to work purchasing investment properties

- Leverage your existing IRA assets to acquire larger properties

- Build potentially tax-advantaged income streams for your retirement years

Exit Strategy Considerations

When it comes to planning your exit, non-recourse loans give you options. Because the loan is tied to the property—not to you personally—you'll find more flexibility when:

- Selling to buyers who want to assume your existing financing

- Transferring properties to business entities or family members

- Liquidating investments if market conditions shift

Bottom line: if you anticipate ownership changes down the road or simply want to keep your options open, non-recourse loans offer the flexibility smart investors need throughout the investment lifecycle.

Qualifying for Non-Recourse Loans: Requirements and Considerations

Let's be upfront: qualifying for a non-recourse loan takes more effort than conventional financing. Because lenders can only claim the collateral property if you default, they're taking on more risk—which means they'll want to see you meet specific criteria.

![Task: Create a comprehensive checklist-style infographic showing the key qualification requirements for non-recourse loans, organized by category with checkboxes and specific criteria.

Visual Structure: Vertical layout with header, followed by four categorized sections with checkbox items, each containing specific requirements and thresholds.

ASCII Layout Reference:

```

+------------------------------------------------------------+

| NON-RECOURSE LOAN QUALIFICATION REQUIREMENTS |

| |

| PROPERTY REQUIREMENTS |

| [ ] Built after 1940 |

| [ ] Located in United States |

| [ ] Investment property (not primary residence) |

| [ ] Minimum value: $70,000+ |

| [ ] Strong income potential |

| |

| FINANCIAL REQUIREMENTS |

| [ ] Down payment: 30-40% (IRA: 40-50%) |

| [ ] DSCR minimum: 1.25x |

| [ ] Documented rental income history |

| [ ] Pro forma for new acquisitions |

| |

| CREDIT & DOCUMENTATION |

| [ ] Credit score: 660+ (better terms at 700+) |

| [ ] Property appraisal report |

| [ ] Property inspection completed |

| [ ] Environmental assessment (commercial) |

| [ ] Rent rolls and operating statements |

| |

| ENTITY STRUCTURE |

| [ ] LLC or business entity established |

| [ ] Operating agreements prepared |

| [ ] Entity documentation ready |

| [ ] SDIRA: Specialized structure required |

| |

+------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385384624_obwof2.jpg?alt=media&token=8841e0ad-4c00-451a-bf6d-f66e394b5ff1)

Property Requirements

Not every property qualifies for non-recourse financing. Here's what most lenders look for:

- Properties built after 1940

- Real estate located within the United States

- Investment properties only (not primary residences)

- Minimum property values (typically $72,000 or higher)

- Strong income potential from the property

Financial Requirements

Down Payment Expectations

Be prepared to bring significant equity to the table with non-recourse loans:

- Most lenders require 30-40% down payment

- Self-directed IRA non-recourse loans may require 40-50% down

- Commercial non-recourse loans often require lower loan-to-value ratios than conventional loans

"Most non-recourse lenders will require at least 30% equity down; others will want at least 40%. Expect to pay a higher interest rate for a non-recourse loan since the lender is taking more risk."

Income Verification and Debt Service Coverage

For investment properties, here's what you need to know:

- A minimum Debt Service Coverage Ratio (DSCR) of 1.25x is standard

- Your property needs to generate enough income to cover those debt payments

- For existing properties, you'll likely need documented rental income history

- New acquisitions or developments? Have your pro forma statements ready

Credit and Documentation Requirements

Even without personal guarantees, lenders want to see:

- Solid credit scores (aim for 660+ to unlock better terms)

- Property appraisal and inspection reports

- Environmental assessments for commercial properties

- Rent rolls and operating statements for existing rental properties

- A clear business plan for your investment property

Entity Structure Considerations

Getting your entity structure right matters for non-recourse loans:

- LLCs or other business entities are the go-to choice

- Self-directed IRA investors need specialized structures

- Set up your entity before you apply

- Have your operating agreements and entity documentation ready

If you're a self-directed IRA investor, specialized non-recourse loan programs are available. According to NASB, "A minimum loan amount of $175,000 is required to apply" for their IRA non-recourse loan program.

Getting familiar with these qualification requirements puts you ahead of the game when pursuing non-recourse financing. OfferMarket is here to guide you through these requirements and connect you with lenders whose terms align with your investment goals.

How to Apply for a Non-Recourse Loan with OfferMarket

Ready to secure a non-recourse loan? Let's walk through the preparation and application process together. At OfferMarket, we've built a straightforward path to help real estate investors secure financing with confidence. Here's your step-by-step roadmap to navigating the application process:

![Task: Create a visual step-by-step process flowchart showing the six stages of applying for a non-recourse loan with OfferMarket, including estimated timelines and key actions at each stage.

Visual Structure: Vertical flowchart with six numbered stages connected by arrows, each stage containing a title, timeline estimate, and key actions.

ASCII Layout Reference:

```

+------------------------------------------------------------+

| YOUR NON-RECOURSE LOAN APPLICATION JOURNEY |

| |

| [1] INSTANT QUOTE REQUEST |

| Timeline: 24-48 hours |

| • Submit property details |

| • Receive preliminary terms |

| ↓ |

| [2] DOCUMENTATION PREPARATION |

| Timeline: 3-5 days |

| • Gather property documents |

| • Compile entity documentation |

| • Prepare financial statements |

| ↓ |

| [3] CREATE LOAN FILE |

| Timeline: 1-2 days |

| • Official file setup |

| • Document organization |

| • Loan specialist assignment |

| ↓ |

| [4] UNDERWRITING PROCESS |

| Timeline: 1-3 weeks |

| • Property assessment |

| • Entity structure review |

| • Risk analysis |

| ↓ |

| [5] CONDITIONAL APPROVAL |

| Timeline: 5-15 business days |

| • Review approval terms |

| • Address outstanding conditions |

| • Final verification |

| ↓ |

| [6] CLOSING PROCESS |

| Timeline: 5-10 days |

| • Sign closing documents |

| • Coordinate with IRA custodian (if applicable) |

| • Fund loan and complete transaction |

| |

| TOTAL ESTIMATED TIMELINE: 4-8 WEEKS |

+------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771385643127_gqsq69.jpg?alt=media&token=90a976ec-d03f-40cd-bfc0-9641bd8b3604)

Step 1: Submit an Instant Quote Request

Your non-recourse loan journey kicks off with our instant quote system. This quick assessment helps us understand your financing needs and get you preliminary terms fast:

- Head over to the OfferMarket loan portal

- Fill in the basic property and investment details

- Get your preliminary loan terms, usually within 24-48 hours

Step 2: Create Your Loan File

Once your documentation is in, we'll set up your official loan file. Think of this as your application's home base:

- Your preliminary terms live here

- All your submitted documents get organized and reviewed

- You'll be paired with a dedicated loan specialist who knows your file inside and out

Step 3: Documentation Gathering

Got your preliminary terms and ready to move forward? Great. Now it's time to gather your paperwork. Non-recourse loans do require more documentation than traditional financing, but don't worry—we'll walk you through it:

- Property documentation (purchase agreement, current lease agreements, property tax statements)

- Entity documentation (LLC operating agreement, articles of organization)

- Financial statements (rent rolls, property income/expense reports)

- For self-directed IRA loans: IRA custodian documentation and verification of funds

Pro tip: Getting these documents together early can speed up your approval significantly.

Step 4: Underwriting Process

Now comes the deep dive. During underwriting, we take a thorough look at your application:

- Property assessment (including valuation and income verification)

- Entity structure review

- Risk analysis tailored to non-recourse terms

- Evaluation of "bad-boy" carve-out provisions

Keep in mind that approval timelines for non-recourse loans can vary depending on the complexity of your deal. While some lenders may process applications within 1-2 days, others may take several weeks, particularly for complex scenarios [Source: https://www.skylacu.com/learning-guidance/time-it-take-to-get-mortgage-approved].

Step 5: Conditional Approval

Once underwriting wraps up successfully, you'll receive conditional approval:

- Review your conditional approval terms carefully

- Address any outstanding conditions (additional documentation, clarifications)

- Complete final verification of all application details

From conditional approval to closing, you're typically looking at 5 to 15 business days. The speed depends on how quickly you submit required documents and whether the underwriter spots any additional concerns [Source: https://www.realpha.com/blog/conditional-approval-heres-everything-you-need-to-know].

Step 6: Closing Process

You're in the home stretch! Here's what the final stage looks like:

- Review and sign your closing documents

- Coordinate with your IRA custodian (if applicable)

- Complete any final verifications

- Fund the loan and seal the deal

At OfferMarket, we've built our process to move faster than many traditional lenders. Because we understand both the lending side and the property side of real estate investing, we can spot potential roadblocks early and clear them before they slow you down.

Ready to get started? Submit an instant quote today to create your loan file and take the first step with confidence.

Real-World Examples of Non-Recourse Loans in Action

Non-recourse loans have helped countless investors grow their portfolios while keeping their personal assets safe. Let's look at how real investors have put non-recourse financing to work.

Portfolio Growth Through Non-Recourse Financing

Seasoned real estate investors frequently turn to non-recourse loans to scale up fast—without putting their personal wealth on the line. Take Brookfield Corporation as an example. They've mastered the art of using non-recourse debt strategically in their real estate deals. This approach lets them grow their holdings while keeping a clear wall between corporate investments and personal assets—essentially creating a safety net that supports bold growth without reckless risk.

Brookfield's strategy shows exactly how big players use non-recourse financing to go after major acquisitions that would simply be too risky with traditional recourse loans.

Self-Directed IRA Investment Success Stories

Non-recourse loans are a game-changer for self-directed IRA investors who can't provide personal guarantees due to IRS rules. Here's a real-world example that shows exactly how this works.

An Advanta IRA client found a solid rental property listed at $100,000 but only had $40,000 sitting in their retirement account. Instead of walking away from the deal, they got smart about it—securing a non-recourse loan for the remaining $60,000, with just the property backing the loan. Here's what that move accomplished:

- They grabbed an income-producing asset worth more than double their available cash

- They stayed completely within IRS guidelines for their self-directed IRA

- Every dollar of rental income went straight back into their retirement account

According to Advanta IRA's case study, the property grew in value over time while kicking off steady rental income—giving this investor's retirement portfolio a serious boost without ever risking personal assets.

How OfferMarket Structures Optimal Non-Recourse Loans

At OfferMarket, we walk clients through non-recourse financing every day—and we've gotten pretty good at it. Take this recent win: a landlord wanted to grow from 3 properties to 10 without taking on more personal liability. Here's how we made it happen:

- We reviewed their current portfolio and mapped out their investment goals

- We built a portfolio non-recourse loan with terms that made sense

- We matched them with properties on our marketplace that hit their DSCR targets

- We connected them with our insurance partners to lock in the right coverage

Using OfferMarket's all-in-one approach—loans, listings, and insurance under one roof—this investor tripled their portfolio in just six months while keeping the liability protection that non-recourse financing provides.

We also helped another client secure non-recourse financing through their self-directed IRA LLC, guiding them through the IRS requirements and bad-boy carve-out provisions every step of the way. The result was a compliant, protected investment that continues to build their retirement wealth through real estate.

These real-world examples show that with the right expertise and financing structure, non-recourse loans can be powerful tools for portfolio expansion, retirement planning, and risk management in real estate investing.

Frequently Asked Questions About Non-Recourse Loans

What qualifications are required for a non-recourse loan?

Non-recourse loans come with stricter qualification requirements than traditional financing. Here's what lenders typically look for:

- Strong property cash flow (typically a DSCR of 1.25 or higher, but OfferMarket's cut off is 1.1 to allow more properties to work)

- Higher down payments (usually 25-35%)

- Good credit history (though less emphasis on personal credit)

- Property in good condition with solid income potential

- Commercial property experience (for larger investments)

Here's the key thing to understand: since lenders can only go after the collateral property if you default, they're laser-focused on the property's value and income-generating capability rather than your personal finances.

What are "bad-boy carve-outs" in non-recourse loans?

Bad-boy carve-outs are exceptions to the non-recourse nature of the loan that protect lenders from borrower misconduct. These carve-outs convert the loan to full recourse if you commit certain acts:

- Fraud or intentional misrepresentation

- Gross negligence or willful misconduct

- Improper use of insurance proceeds

- Unauthorized transfers of the property

- Waste or intentional damage to the property

- Misappropriation of funds or security deposits

As noted by Talimar Financial, "Non-recourse loans are more likely to be offered when [these conditions are avoided]," making it essential for you to understand these provisions before signing loan documents.

How do non-recourse loans work with Self-Directed IRAs?

Self-Directed IRAs must use non-recourse loans when financing real estate due to IRS regulations. Here's what you need to know:

- The loan must be made to the IRA, not to you personally

- You can't provide a personal guarantee as the IRA owner

- The property you're purchasing is the only collateral allowed

- UBIT (Unrelated Business Income Tax) may apply to income from debt-financed property

- Plan on putting 30-40% down from your IRA funds

"A non-recourse loan essentially states, in the event of a default, the only recourse that the lender has is against the individual subject property that's used as collateral for the loan," explains Equity Trust Company.

Are there prepayment penalties with non-recourse loans?

Yes, most non-recourse loans do include prepayment penalties. Here are the common types you'll encounter:

- Yield Maintenance: A calculation that ensures the lender receives their expected return

- Step-Down Penalties: Penalties that decrease over time (e.g., 5% in year 1, 4% in year 2)

- Defeasance: Swapping out the property collateral with government securities

- Lockout Periods: Windows where prepayment simply isn't an option

Because lenders take on more risk with non-recourse financing, these penalties tend to be steeper than what you'd see with recourse loans.

What entity requirements exist for non-recourse loans?

Non-recourse loans typically require you to set up specific legal structures:

- Single Purpose Entity (SPE): An LLC or corporation created solely to hold the financed property

- Single Asset Entity (SAE): An entity that owns only the specific property being financed

- Bankruptcy Remote Entity: A structure designed to shield the asset if related entities face bankruptcy

For SDIRA investments, remember that the loan goes to the IRA itself or to an LLC owned by the IRA—never directly to you as the IRA owner.

What are typical loan terms for non-recourse financing?

Here's what you can expect with non-recourse loans:

- Interest Rates: 0.5-1.5% higher than comparable recourse loans

- Loan-to-Value (LTV): 60-75% (meaning you'll need 25-40% down)

- Amortization: 25-30 years is standard

- Loan Term: 5-10 years with a balloon payment at the end

- Debt Service Coverage Ratio: You'll need at least 1.25x

- Fees: Expect higher origination and processing costs

The bottom line? Lenders take on more risk with non-recourse loans, so they offset that with tighter requirements and slightly higher rates. It's a trade-off worth understanding as you weigh your options.

Can I refinance a non-recourse loan?

Absolutely—and it can be a smart move when the timing is right. Here's what to keep in mind:

- Check for prepayment penalties on your current loan

- Compare today's interest rates to what you're paying now

- Consider whether your property's stronger performance could unlock better terms

- Look at opportunities to increase leverage if your property value has grown

- Explore ways to pull out equity while keeping your non-recourse protection

Refinancing tends to make the most sense when rates have dropped meaningfully or your property is performing significantly better than when you first secured financing.