*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

How Long Does It Take to Get a HELOC? A Real Estate Investor's Guide to Timeline and Better Alternatives

If you're a real estate investor or landlord eyeing a HELOC to fund your next deal, here's what you need to know: the timeline matters—and so does choosing the right financing tool for your investment strategy.

![Task: Create a professional timeline infographic showing the HELOC process stages from application to funding, with time ranges for each phase.

Visual Structure: Horizontal timeline with 6 major milestones connected by a flowing line, with time ranges displayed beneath each milestone. Use icons above each milestone to represent the stage.

ASCII Layout Reference:

```

[Application Icon] [Documents Icon] [Appraisal Icon] [Underwriting Icon] [Approval Icon] [Funding Icon]

| | | | | |

●─────────────────●─────────────────●─────────────────●──────────────────●─────────────────●

| | | | | |

1-3 days 1-2 weeks 3-10 days 1-2 weeks 3-5 days 3-7 days

APPLICATION → DOCUMENTATION → APPRAISAL → UNDERWRITING → APPROVAL → FUNDING

Total Timeline: 2-6 Weeks (Standard) | Investment Properties: 4-6 Weeks

```

Image Section Breakdown:

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770847531845_nal9xv.jpg?alt=media&token=c8c38593-ace6-4c1d-b7ba-a44e2e42c08b)

How Long Does It Take to Get a HELOC?

- Typical timeline: HELOCs generally take between 1 to 3 weeks from application to funding, with some lenders able to close in as few as 7-14 days under ideal conditions

- Process overview: The HELOC approval process includes application, documentation review, property appraisal, underwriting, and closing

- For real estate investors: HELOCs on investment properties typically take longer and have stricter requirements than those on primary residences

- Key factors affecting timeline: Credit score, property type, lender efficiency, documentation readiness, and property appraisal scheduling

- Preparation matters: Having financial documents ready and responding quickly to lender requests can significantly reduce closing time

- Investment property considerations: Lenders typically require higher credit scores (700-720 minimum) for investment properties versus primary residences (680)

- Alternative for investors: Fixed-rate HELOANs often provide more predictable terms and may be better suited for real estate investment strategies than variable-rate HELOCs

HELOCs can move faster than many financing options, but here's the real question: does this product fit your investment game plan? The variable rates that come with HELOCs can add uncertainty to your numbers. Fixed-rate alternatives like HELOANs might give you the stability you need—we'll break that down later in this guide.

According to LendingTree, while the standard HELOC timeline spans 2-6 weeks, the fastest lenders in the market can complete the process in just 5-7 days under optimal circumstances. For investment properties, though, expect to land on the longer end of that range—additional underwriting requirements come with the territory.

How Long Does It Take to Get a HELOC?

Let's be real: getting a Home Equity Line of Credit (HELOC) won't happen overnight. But knowing what to expect timeline-wise puts you in the driver's seat as you map out your next investment move. Here's what you need to know about HELOC processing times:

- Standard timeline: Most lenders take between 2-4 weeks to process a HELOC from application to funding, with traditional banks typically requiring 3-4 weeks minimum

- Fastest scenarios: Some online lenders can complete the process in as little as 7 days under ideal circumstances with perfect documentation

- Longest scenarios: Complex investment properties or incomplete applications can extend timelines to 6-8 weeks

- Key factors affecting speed: Property type, documentation readiness, lender efficiency, appraisal scheduling, and underwriting backlog

- Real estate investor consideration: HELOCs on investment properties typically take 4-6 weeks, longer than primary residence HELOCs

Let's break this down. Getting a HELOC involves several stages: submitting your application, gathering and reviewing documents, scheduling a property appraisal, going through underwriting, and finally closing. At each step, you have the power to speed things up—or watch delays pile up—depending on how prepared you are and how efficiently your lender operates.

According to Chase, "The traditional HELOC process usually takes 2-6 weeks from application to funding, depending on the lender and your financial profile" source. The good news? Some investment-focused lenders offer faster turnarounds for qualified investors who come to the table with their paperwork in order.

Here's the reality for real estate investors: expect the shorter end of that timeline. "Most lenders can close an investment property HELOC in 1-3 weeks" Why the faster? Investment property lending usually involved experienced real estate investors that can fulfill application process more rapidly.

Knowing this timeline puts you in the driver's seat, especially when you're eyeing a time-sensitive deal. In the following sections, we'll walk through each step of the process and share proven strategies to get your HELOC approved faster.

Required Documentation and Qualification for HELOC on Investment Properties

Getting a Home Equity Line of Credit (HELOC) on an investment property means jumping through a few more hoops than you would for your primary residence. Don't worry—we'll walk you through it. This initial phase typically takes 1-3 business days as lenders review your financial picture and property portfolio.

Documentation Requirements

Investment property HELOC applications require solid documentation because lenders see these as higher-risk loans. Here's what you'll want to gather:

- Soft pull credit score: To see investors credit profile

- Bank statements: Usually the past 2-3 months

- Mortgage statements for the target property

- Rental income verification: Lease agreements and payment history for the investment property

- Proof of insurance on the investment property, which the team at OfferMarket will help you get

According to PenFed Credit Union, "Other documents may include retirement award letters, various benefit statements, or 1099 forms. You may also need to provide mortgage statements of all properties you own" .

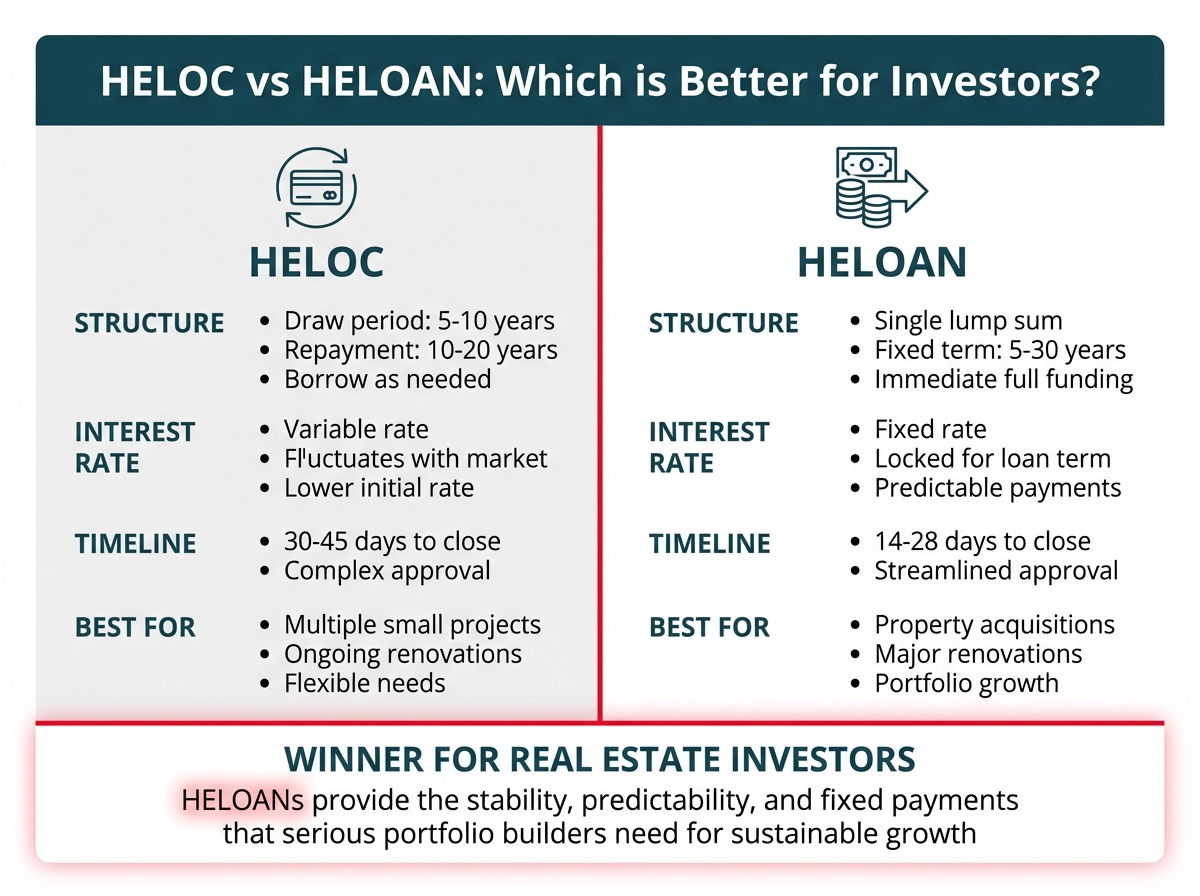

Investment Properties vs. Primary Residences: Key Differences

Here's the reality: lenders hold investment property HELOCs to a higher standard. Understanding these differences helps you prepare:

"Lenders want reserves for at least six months of payments on rental property HELOCs. Primary residences often skip this requirement completely," notes Better.

Initial Qualification Process

- Pre-qualification: Submit basic financial information for preliminary approval

- Application submission: Complete formal application with all required documentation

- Credit check: Lenders will pull your credit report. Most experienced lenders go for soft pull to keep borrowers credit score in check

- Income verification: Validation of all income sources, including rental income

- Preliminary property assessment: Initial evaluation of the investment property's value

Here's the deal: the qualification phase lays the groundwork for everything that follows. Smart investors who arrive with their documentation ready and organized typically breeze through this stage in 1 day. Missing paperwork? That's where delays creep in and timelines stretch.

The Appraisal Process for HELOCs on Investment Properties

Let's be real—the appraisal phase is often where your HELOC timeline hits a speed bump. Investment properties face extra scrutiny from lenders, and that takes time.

How Appraisals Work for Investment Properties

When it comes to investment property appraisals for HELOCs, lenders dig deeper than they would for your primary residence. They're looking at the full picture: market value, income potential, and how well the property holds up as a rental. Your appraiser will examine comparable sales nearby, review your rental income history, and assess the property's overall condition.

Here's something important to know: lenders almost always require boots-on-the-ground appraisals for investment properties. Those automated valuations or desktop appraisals that work for primary homes? They typically won't cut it here. Why? Investment properties carry more risk, and lenders want eyes on their collateral.

Typical Wait Times for Appraisals

Plan ahead—the appraisal process can add meaningful time to your HELOC journey:

- Scheduling delay: 3-7 business days to schedule an appraiser

- Property inspection: 1-2 hours on-site

- Report preparation: 2-5 business days

- Lender review: 1-3 business days

According to Better, "A HELOC application can take anywhere from five days to six weeks. Traditional banks typically take two to four weeks to approve a HELOC, while online lenders may be able to close in as little as a week." This extended timeline is often due to appraisal scheduling constraints and processing time.

Common Appraisal Challenges for Investors

When it comes to investment property appraisals, you'll want to be aware of these hurdles:

- Limited comparable sales: Finding similar investment properties that have recently sold in your area isn't always easy

- Tenant occupancy issues: Working around tenant schedules to get the appraiser inside can slow things down

- Deferred maintenance concerns: If your property has condition issues, expect them to affect your valuation

- Income verification complexity: Appraisers need to confirm your rental income numbers check out

- Neighborhood factors: Rental properties in certain locations get extra scrutiny for location-specific risks

HELOC Underwriting Process for Landlords and Real Estate Investors

If you're looking to tap into your investment property's equity with a HELOC, here's what you need to know: the underwriting process works differently than it does for your primary residence. As a real estate investor or landlord, you'll face a more thorough evaluation—but understanding what lenders look for can help you prepare and move through the process with confidence.

Investment Property Underwriting Criteria

Lenders hold investment properties to higher standards when evaluating HELOC applications. Here's what you can expect:

- Higher credit score requirements (usually 680+ versus 620+ for primary residences)

- Lower loan-to-value (LTV) ratios, often capped at 70-75% compared to 80-85% for primary homes

- More extensive documentation of rental income history and property performance

- Bank statements

- Insurance coverage

- Reserves

Debt-Service Coverage Ratio Considerations

Your debt-service coverage ratio (DSCR) plays a major role in investment property HELOC approvals. Here's the breakdown:

- Most lenders want to see a DSCR of at least 1.1—meaning your property brings in 10% more income than its debt obligations

- The calculation factors in all property expenses, including potential HELOC payments at fully-drawn amounts

- If you own multiple leveraged properties, expect even higher DSCR requirements

- Some lenders will look at your global DSCR across your entire real estate portfolio

The good news? Strong DSCR numbers often mean faster underwriting because you're demonstrating lower risk to the lender.

Typical Timeline for HELOC Underwriting

For investment properties, expect the underwriting process to take a bit less time than it would for your primary residence:

- Initial application review: 1-2 business days

- Document collection and verification: 2-3 business days

- Investment property appraisal: 3-10 business days

- Final underwriting decision: 2-3 business days

Here's the good news: if you've got your financial documents organized and your portfolio is performing well, you could see approval in as little as 7-14 days. On the flip side, if you're working with a complex investment setup or a larger portfolio, plan for 3-4 weeks while lenders do their homework.

Understanding the HELOC Closing Process

You've got the green light on your investment property HELOC—now it's time to cross the finish line. The closing process locks in your access to funds and sets the terms of your credit line. Knowing what to expect here helps you plan your next investment moves with confidence.

Required Closing Documents

Here's what you'll need to have ready at closing:

- Loan agreement: Spells out all terms, conditions, and repayment obligations

- Truth in Lending disclosure: Breaks down costs, APR, and payment details

- Deed of trust or mortgage: Puts up your property as collateral

- Right of rescission notice: Gives you a 3-day window to back out (for primary residences)

- Signature cards: Gives you the keys to access your credit line

Keep in mind that investment property HELOCs often require less paperwork then you'd see with a primary residence—think rental income verification and property management documentation but not W-2, tax documents or pay stubs.

The Closing Meeting

You'll typically wrap things up at a title company, attorney's office, or your lender's location. For investors with multiple properties, some lenders offer remote closing options. The meeting itself usually takes 1-2 hours, during which you'll:

- Review all loan documents

- Sign the credit agreement and security instruments

- Receive information about accessing your funds

- Pay any closing costs (if not rolled into the loan)

![Task: Create an infographic illustrating the top 5 common challenges that delay HELOC approvals for real estate investors, with icons and brief explanations.

Visual Structure: Vertical layout with five distinct challenge sections, each containing an icon, challenge title, and brief description. Use a numbered format (1-5) with visual progression.

ASCII Layout Reference:

```

┌─────────────────────────────────────────────────────────────┐

│ TOP 5 CHALLENGES DELAYING HELOC APPROVALS FOR INVESTORS │

├─────────────────────────────────────────────────────────────┤

│ │

│ 1 [Document Icon] DOCUMENTATION COMPLEXITY │

│ Multiple properties require extensive rental income │

│ verification and property management agreements │

│ │

├─────────────────────────────────────────────────────────────┤

│ │

│ 2 [Portfolio Icon] MULTIPLE PROPERTY COMPLICATIONS │

│ Cross-collateralization concerns and portfolio-wide │

│ debt analysis extend underwriting timelines │

│ │

├─────────────────────────────────────────────────────────────┤

│ │

│ 3 [Calculator Icon] DEBT-TO-INCOME CHALLENGES │

│ Multiple mortgages increase DTI ratio even when │

│ properties are profitable and cash-flowing │

│ │

├─────────────────────────────────────────────────────────────┤

│ │

│ 4 [Home Icon] APPRAISAL DISCREPANCIES │

│ Investment property condition and market volatility │

│ lead to more conservative valuations │

│ │

├─────────────────────────────────────────────────────────────┤

│ │

│ 5 [Warning Icon] LENDER HESITANCY │

│ Many lenders have stricter policies or don't offer │

│ HELOCs for investment properties at all │

│ │

└─────────────────────────────────────────────────────────────┘

```

Image Section Breakdown:

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770846837538_bffv29.jpg?alt=media&token=a3727a15-6fda-4686-86bd-63039f817a68)

Documentation Complexities for Investment Properties

Here's the reality: lenders want to see paperwork from investors. We're talking rental income verification some cases property management agreements. Missing even one piece of this puzzle is one of the top reasons HELOCs get delayed.

"One of the most common reasons for denial is a borrower's lack of sufficient equity and second most common is credit score," mortgage specialists point out. This hits investors especially hard when your income flows from multiple properties with varying cash flows.

Multiple Property Complications

Own several properties? Expect extra scrutiny from lenders:

- Cross-collateralization concerns: Multiple mortgaged properties make lenders nervous about a domino effect if financial trouble hits

- Portfolio debt analysis: They're looking at your entire real estate picture, not just the one property you're borrowing against

- Complex underwriting: Investment properties need specialized review that simply takes longer than standard residential assessments because more documents needs to be verified across larger number of properties.

Credit History and Debt-to-Income Challenges

Most of the time, investor focused lenders are not concerned with the size or cross collaterization of your portfolio and instead concerned with economics of the exact deal at hand.

If the current investments property has enough built up equity, your credit score is good and tenants are in place, there should not be any major reason your HELOC won't be closed in a speedy manner.

Appraisal Discrepancies and Property Condition Issues

Investment properties face stricter appraisal standards:

- Rental property condition: Wear and tear from tenants may reduce appraised value

- Neighborhood investment concentration: Areas with high investor ownership may face additional scrutiny

- Market volatility concerns: Lenders may apply larger valuation haircuts to investment properties in fluctuating markets

As CBS News reports, "Your property doesn't meet underwriting guidelines. Your financials may be solid, but your property itself can still lead to a denial."

Lender Hesitancy with Investment Properties

Here's the reality: many lenders have stricter policies for investment property HELOCs, and some won't offer them at all. As one real estate investing discussion on Reddit puts it, "The reason mortgages have lower interest rates than regular loans is because if you cannot pay the loan, the bank takes the house." That security equation shifts with investment properties—lenders know owners may be more willing to walk away when times get tough.

These investor-specific hurdles are exactly why many savvy real estate professionals turn to specialized investment property financing solutions instead of traditional HELOCs when growing their portfolios, such as HELOANs for 2nd position loans.

Tips for Landlords to Expedite Each Step for Getting a HELOC

If you're a real estate investor or landlord looking to tap into your property equity quickly, here's the good news: preparation and organization can make all the difference. While the standard timeline runs 1-3 weeks, these strategic moves can help you cut that waiting time significantly.

Preparation Strategies

First step is to research lenders that provide access to investor specific HELOCs and get several quotes. This will allow you to get a sense of current pricing and requirements from multiple providers. This process will help you discover gaps in your own understanding of the process and better prepare you to close quickly when the perfect deal comes along. Some wide things to do as you submit your quote request are:

- Check and improve your credit score: Pull your credit report from free credit check sites, look for errors, and address anything that could slow things down. Lenders typically look for scores above 700 for the best rates and fastest approvals.

- Calculate your equity position: Figure out your current loan-to-value (LTV) ratio. Most lenders want you to keep at least 15-20% equity after the HELOC, so knowing this number upfront helps you set realistic expectations.

- Research lender requirements: Different lenders have different documentation needs and approval timelines. According to MortgageResearch.com, "online lenders typically process applications faster than traditional banks, with some offering approvals in as little as 5-7 days" compared to the standard 30+ days.

Pre-qualifying Documentation

Getting your paperwork organized will shave days or even weeks off the process:

- Property documentation: Pull together your deed information, property tax statements, insurance declarations, and any HOA documentation.

- Financial records: Recent bank statements, investment account statements, and documentation of other income sources.

- Current mortgage information: Include statements for all existing loans on the property.

Working with Experienced Lenders

The lender you choose makes a real difference in your timeline:

- Select lenders specializing in investment properties: Not all HELOC providers understand what real estate investors need. Those with experience in investment property financing can move your application through faster.

- Consider digital-first lenders: Online lenders like Figure and Rate can give you conditional approvals within minutes and funding in as few as 5 days for qualified borrowers, according to LendingTree's research on [fastest HELOC closings](https://www. lendingtree.com/home/home-equity/the-fastest-way-to-tap-your-home-equity/).

Leveraging Existing Banking Relationships

Here's a smart move: use the relationships you've already built.

- Apply with your existing mortgage lender: They've got your information and property details on file, which means less paperwork and faster processing for you.

- Use banks where you have established accounts: Being a loyal customer pays off—you'll often get priority service and may even snag relationship discounts.

- Consider credit unions: Don't overlook these gems. Credit unions frequently offer competitive rates plus personalized attention that can help push your approval through faster.

Organization Tips

A little organization goes a long way in keeping your timeline on track:

- Create a dedicated email folder: Keep all your HELOC communications in one spot so nothing slips through the cracks.

- Respond to lender requests immediately: Here's the truth—every day you wait to send requested documents is another day added to your timeline.

- Set up electronic document signing: Skip the snail mail and close faster with e-signatures.

- Track your application status proactively: Don't sit back and wait. Check in regularly and stay in touch with your loan officer.

Put these strategies to work, and you could cut your HELOC timeline from the typical 30+ days down to just 5-10 days with the right lender. That means faster access to capital when that perfect property hits the market.

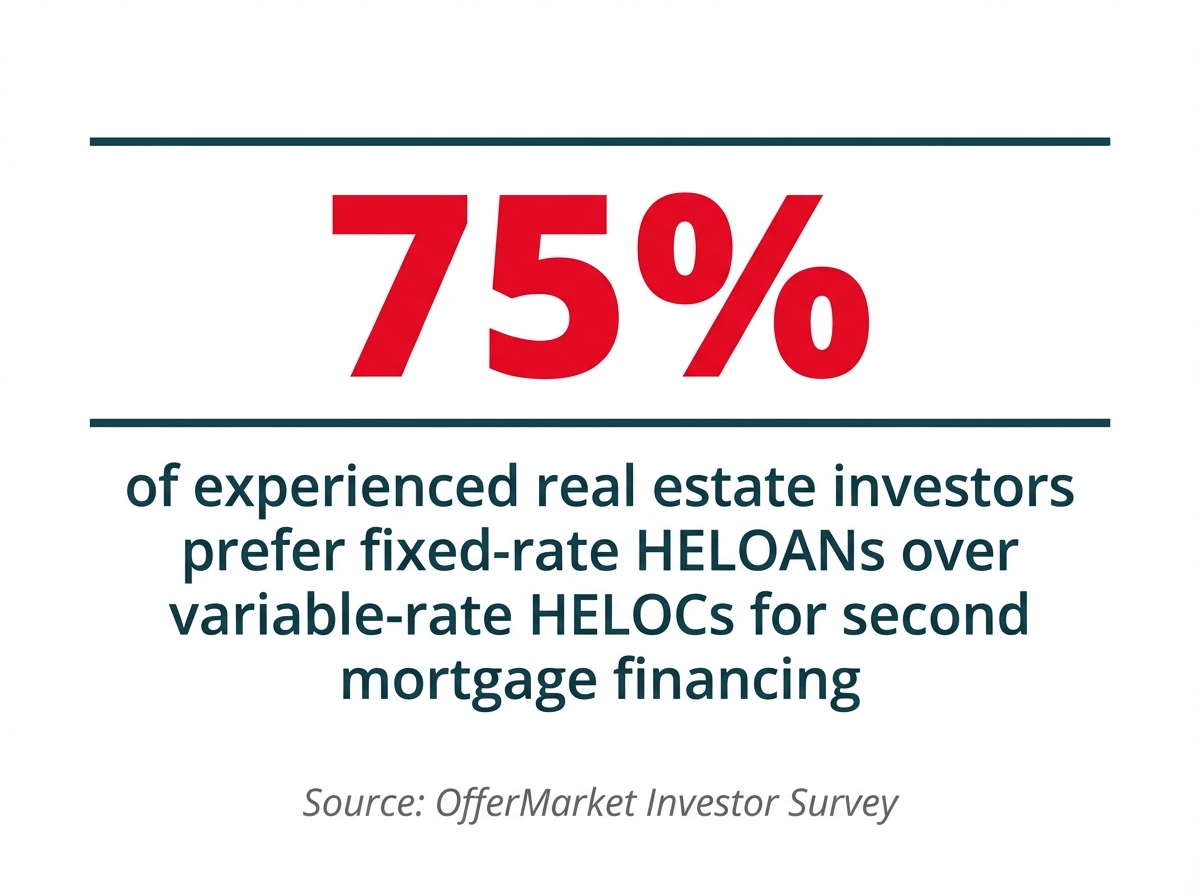

HELOCs vs HELOANs: Which is Better for Real Estate Investors?

Choosing the right financing tool can make a real difference in how quickly you grow your portfolio and how healthy your cash flow stays. Both Home Equity Lines of Credit (HELOCs) and Home Equity Loans (HELOANs) let you tap into your property's equity, but they work differently—and understanding those differences helps you pick the right one for your investment strategy.

Processing Timeline Differences

When a great investment opportunity pops up, timing matters. Let's look at how these two options compare. HELOCs typically involve a more complex approval process due to their revolving nature, often taking 10-35 days from application to funding. HELOANs, on the other hand, usually close faster—typically within 1-3 weeks—because lenders make a single underwriting decision for a fixed amount.

As noted by OfferMarket, "Unlike a HELOC, which provides a lump sum, a HELOC allows you to borrow against your home equity as needed, up to a predetermined credit limit." This flexibility comes with additional processing requirements that can extend closing timelines for investors with time-sensitive acquisition opportunities.

Structural Advantages for Portfolio Growth

The core structural difference between these products matters a lot when you're building your real estate portfolio:

- HELOCs: Come with a draw period (typically 5-10 years) followed by a repayment period (typically 10-20 years). This two-phase setup may not match up well with how long you plan to hold your investment properties.

- HELOANs: Give you the full loan amount upfront with a steady repayment schedule from day one. This makes planning your cash flow much simpler.

According to Strato Lending Group, "HELOC Timeline: Draw Period → Repayment Period," with the draw period typically lasting 5-10 years followed by a repayment period of 10-20 years. This extended timeline structure can create misalignment with typical investment property acquisition and disposition strategies.

Predictability Benefits for Investment Planning

If you've been investing in real estate for a while, you know that predictability is gold when growing your portfolio. Here's where HELOANs really shine:

- Fixed payment amounts: You can map out cash flow projections across all your properties with confidence

- Consistent interest rates: You're protected from market swings that could eat into your rental profits

- Clear amortization schedules: You can calculate ROI on your investment properties with precision

As your portfolio expands, this predictability becomes even more valuable. That's why HELOANs tend to be the smarter choice for investors with a strategic growth plan in mind.

Rate Structure Impact on Long-Term Portfolio Performance

Let's talk about one of the biggest factors that can make or break your investment strategy: interest rates. Here's how these two options stack up:

- HELOCs: Come with variable rates that move with the market, which means your investment property cash flow can become a bit of a guessing game

- HELOANs: Lock in a fixed rate for the entire loan term, giving you the predictability you need to plan your investments with confidence

Here's the thing about HELOCs: those attractive introductory rates can be tempting. But as Guild Mortgage points out, "HELOCs typically have lower initial interest rates than fixed-rate home equity loans. However, over time, if interest rates rise, a HELOC could [become more expensive]." That's a real concern when you're trying to protect your investment property profits in a rising rate environment. Source

If you're serious about building a portfolio that grows steadily over time, the stability of HELOANs often makes more sense than the flexibility of HELOCs—especially as you expand into multiple properties.

HELOCs and Real Estate Investing: Why Experienced Investors Often Choose Alternatives

When it comes to growing your real estate portfolio, you've got options. HELOCs might catch your eye initially, but here's something worth knowing: many experienced investors end up going a different route. At OfferMarket, we've worked with countless real estate investors, and we've seen firsthand why HELOCs aren't always the best fit for investment properties.

Variable Rate Risk for Investment Properties

Here's the challenge with HELOCs that keeps savvy investors up at night: those variable interest rates. Because HELOC rates typically follow the prime rate, your monthly payments can bounce around unpredictably—not exactly ideal when you're trying to run the numbers on your next deal. This variability can significantly impact cash flow calculations for investment properties.

"Using a HELOC to buy a rental property is not a great idea," according to experienced investors. "You will probably have trouble getting a mortgage as you will be leveraged to the hilt, and the interest rate on the HELOC will be higher than a mortgage." Reddit investors have noted these concerns when discussing HELOC usage for real estate acquisitions.

Draw Period Limitations and Repayment Concerns

Here's something many investors overlook: HELOCs come with a draw period (usually 5-10 years) followed by a repayment period. This structure can catch you off guard, especially when the repayment period kicks in and your monthly payments jump significantly. If you're planning for long-term portfolio growth, this repayment timeline might not work in your favor.

There's another hurdle to consider. Lenders typically require more from investment property HELOC borrowers: "Lenders want reserves for at least six months of payments on rental property HELOCs. Primary residences often skip this requirement completely." This extra cash requirement can tie up funds you'd rather put to work elsewhere.

Higher Costs and Risk Factors for Investment Properties

Let's be straightforward about the risks here. "Using your home's equity to invest is always risky and could jeopardize your financial stability," according to FINRA. This concern grows when you're using an investment property as collateral rather than your primary residence.

Here's what you're typically looking at with investment property HELOCs:

- Higher interest rates than primary residence HELOCs

- Additional fees and closing costs

- More stringent qualification requirements

- Lower loan-to-value ratios (typically 75-80% maximum)

Better Alternatives for Portfolio Expansion

Smart investors working with OfferMarket often find better options than HELOCs for growing their portfolios:

HELOANs (Home Equity Loans): Here's the deal—unlike HELOCs, HELOANs come with fixed interest rates and predictable payment schedules. That makes them a smarter fit for long-term investment planning. OfferMarket's HELOAN products give you the stability you need when you're ready to put your equity to work.

DSCR Loans (Debt Service Coverage Ratio): These loans look at what your property earns, not what you earn personally. If you're building a portfolio with multiple properties, this approach can be a game-changer.

Fix and Flip Loans: Got your eye on a fixer-upper? Specialized fix and flip financing is built for shorter project timelines, so the terms actually match your strategy.

Bridge Loans: When you need to move fast, bridge loans deliver funding quicker than HELOCs. "While HELOCs can be useful for small-scale renovations or debt consolidation, they lack the urgency and deal-driven utility" that bridge financing brings to time-sensitive opportunities.

Understanding these options puts you in the driver's seat. You can match the right financing tool to your specific investment strategy. At OfferMarket, we focus on lending solutions built specifically for real estate investors like you—products designed to support long-term portfolio growth without the headaches that can come with traditional HELOCs.

HELOCs and Real Estate Investing: Better Alternatives for Portfolio Growth

If you're looking to grow your real estate portfolio, you've got options beyond HELOCs that might work better for your goals and timeline. Sure, HELOCs offer flexibility—but those variable rates and unpredictable payments? They can throw a wrench in your investment plans.

DSCR Loans: Speed and Investment Property Focus

DSCR loans are built with investment properties in mind. Instead of digging into your personal income, lenders look at whether the property itself can cover the debt. That's a big win for investors focused on cash flow. This makes them particularly attractive for real estate investors with multiple properties.

Key advantages:

- No personal income verification required

- Faster approval process (often 2-3 weeks)

- Based on property performance rather than borrower financials

- Scalable for portfolio growth

Fix and Flip Loans: Quick Funding for Renovation Projects

If you're in the business of buying, renovating, and selling properties, fix and flip loans are designed with you in mind. These short-term financing options get you to the closing table faster than traditional HELOCs.

Timeline benefits:

- Expedited underwriting process

- Closing possible in as little as 7-10 days

- Draw schedules aligned with renovation milestones

- No lengthy home equity verification process

Portfolio Loans: Efficient Scaling for Multiple Properties

Ready to grow your investment portfolio? Portfolio loans let you finance multiple properties under one umbrella, saving you the headache of securing individual HELOCs for each property.

Efficiency factors:

- Single application for multiple properties

- Consolidated closing process

- Typically closes in 3-4 weeks

- Reduced documentation requirements for experienced investors

Cash-Out Refinancing: Fixed Rates and Lump Sum Access

Sitting on significant equity in your current properties? Cash-out refinancing gives you a more predictable path forward compared to HELOCs, often with timeline advantages worth considering.

"Cash-out refinances typically offer fixed rates, providing payment stability, whereas HELOCs usually have variable rates, which can be lower initially but may increase over time," according to Insula Capital Group.

HELOANs: The Superior Second Mortgage Option

Here's a smart alternative many savvy investors prefer: Home Equity Loans (HELOANs). Unlike HELOCs with their variable rates and draw periods, HELOANs lock in a fixed rate, giving you predictable payments that stay the same for the life of your loan.

"HELOCs have fewer closing costs than HELoans, but often carry ongoing fees for account maintenance, inactivity or rate adjustments," as noted by OfferMarket. While HELOCs may save you money upfront, the steady, predictable nature of HELOANs often makes them the smarter choice when you're mapping out your real estate investment strategy.

Here's what we've seen: most experienced real estate investors who work with OfferMarket gravitate toward fixed-rate options like HELOANs over variable-rate HELOCs for their second mortgage needs. Why? Because knowing exactly what you'll pay each month makes it much easier to keep your investment portfolio's cash flow running smoothly.

HELOANs vs HELOCs for Real Estate Investors

When you're ready to put your home equity to work, you've got two main paths: a Home Equity Loan (HELOAN) or a Home Equity Line of Credit (HELOC). Both let you tap into your property's value, but they work quite differently—and the right choice depends on your investment game plan.

Fixed Rate Benefits for Investment Planning

With a HELOAN, you get something powerful: predictability. Your interest rate stays locked in, and your monthly payments remain the same. For investors planning their next acquisition, this consistency is gold—it lets you map out your expenses and cash flow with confidence.

HELOCs work differently. They typically come with variable rates that move with the market. Sure, those lower introductory rates look appealing, but when rates climb unexpectedly, your investment projections can get thrown off course, eating into your rental property margins.

"Unlike a HELOAN, which provides a lump sum, a HELOC allows you to borrow against your home equity as needed, up to a predetermined credit limit," notes OfferMarket's analysis of these financing options for investors OfferMarket.

Lump Sum Advantages for Acquisitions

Here's where HELOANs really shine for investors: you get all your funding at once. That's perfect when you're ready to purchase a property outright, tackle a major renovation, or put down a substantial down payment. This structure aligns perfectly with the decisive capital requirements of real estate transactions.

HELOCs offer flexibility, but they can throw a wrench in your acquisition timeline. As Heritage Federal Credit Union puts it, "A HELOC can provide you with the flexibility, affordability, and access to capital necessary to grow your real estate portfolio" Heritage FCU. The catch? That flexibility comes with uncertainty about future borrowing costs, which can make planning your next investment move a bit trickier.

Portfolio Scaling Considerations

When it comes to growing your portfolio, seasoned investors often reach for HELOANs. Here's why:

- Predictable underwriting: Fixed terms mean smoother, more straightforward approvals

- Simplified accounting: Consistent payments make tracking expenses across multiple properties a breeze

- Reduced refinancing needs: Lock in your rate and forget about scrambling when interest rates climb

- Long-term stability: Steady payments help you build a sustainable, growing portfolio

HELOCs can still work well if you're flipping properties or juggling several smaller projects that need revolving capital. Just keep in mind that variable rates add a layer of risk that many smart portfolio managers prefer to avoid.

Tax Implications for Investors

Good news: both HELOANs and HELOCs can offer tax advantages. The key is how you use the funds. Interest may be tax-deductible when you put the money toward substantial home improvements or investment property purchases—just be sure to follow IRS guidelines.

If you're a high-net-worth investor, smart tax planning is essential. As Mid Penn Bank explains, "A HELOC offers access to capital when needed without triggering capital gains taxes or selling assets in unfavorable market conditions" Mid Penn Bank. This advantage applies to HELOANs as well, though the fixed structure provides clearer forecasting for tax planning purposes.

Professional real estate investors increasingly recognize that while HELOCs offer flexibility, HELOANs provide the stability, predictability, and structured financing that supports sustainable portfolio growth—particularly in volatile interest rate environments.

Real-World HELOC Timelines for Real Estate Investors

Every investor's HELOC journey looks a little different. Your timeline will depend on your financial picture, property portfolio, and which lender you choose. Let's walk through some real-world scenarios so you know what to expect.

Example Timelines from Actual Investor Experiences

Fast-Track Success: 2-3 Weeks Here's an inspiring example: A landlord couple used a HELOC to grow their real estate portfolio quickly. After building solid equity in their primary residence, they secured a HELOC in just under three weeks and used those funds to purchase their first rental property in cash. That quick turnaround meant they could make competitive all-cash offers—a real edge in a hot market. The result? They've since grown to five rental properties generating roughly $28,000 annually in passive income .

Typical Timeline: 4-6 Weeks Most real estate investors find their HELOC approval takes 4-6 weeks from application to funding. Here's how that typically breaks down:

- Initial application and document gathering (1 week)

- Lender review and requests for additional documentation (1-2 weeks)

- Property appraisal scheduling and completion (1-2 weeks)

- Final approval and closing preparations (1 week)

Delayed Scenarios: 8+ Weeks Sometimes things take longer—8 weeks or more. This usually happens when:

- Your property has unusual characteristics requiring specialized appraisals

- Title issues pop up that need resolution

- You have complex income structures requiring extra verification

- You apply during a lender's busy season

Best and Worst-Case Scenarios

Best-Case Scenario: If you've got excellent credit (740+), a low debt-to-income ratio (under 36%), substantial equity (50%+), all your documents ready to go, and you choose a lender with a streamlined process, you could see HELOC funding in as little as 2 weeks.

Worst-Case Scenario: On the flip side, some investors have seen their timelines stretch to 3+ months or longer. Here's what typically causes those delays:

- Properties in rural areas where comparable sales are hard to find

- Lender staffing shortages or internal bottlenecks

- Missing paperwork that triggers multiple back-and-forth requests

- Title issues that need legal resolution

What Seasoned Investors Have Learned

Real estate investors on communities like BiggerPockets have shared some hard-won wisdom from their HELOC experiences:

Timing Matters: Investors who secured HELOCs right before market downturns learned a tough lesson—when property values dropped, their available credit shrank or vanished exactly when they needed it most .

Preparation Pays Off: Investors who gathered all their documents before applying consistently reported faster approvals.

Relationship Banking Helps: Having an existing relationship with your lender can mean faster processing and better service.

Communication Is Key: Staying in regular contact with your lender (without overdoing it) keeps your application moving and prevents it from getting stuck.

Smart Strategies for Working with HELOC Timelines

Savvy real estate investors have fine-tuned their approach to work with these timeline realities:

Apply Early: Start your HELOC application 2-3 months before you actually need the funds.

Maintain Contingencies: Have a backup financing plan ready in case your HELOC doesn't close in time for a deal you're eyeing.

Consider Alternative Products: For investment properties, products designed specifically for real estate investors (like fixed-rate HELOANs) often offer more predictable timelines and better terms than traditional HELOCs.

Staged Acquisition Strategy: Smart investors often develop a staged acquisition strategy—using the HELOC for initial property acquisition, then refinancing with long-term financing once the property is stabilized. This approach lets you replenish your HELOC and stay ready for the next opportunity.

Understanding these real-world timelines helps you set proper expectations and build an effective strategy for using HELOCs as part of your real estate investment toolkit.

How OfferMarket Accelerates the Loan Process for Real Estate Investors

If you're a real estate investor looking for financing that actually works the way you do, OfferMarket delivers real advantages over traditional HELOC providers. Our specialized approach to investor lending creates a streamlined experience that can significantly cut closing timelines and reduce complexity.

Portfolio-Focused Underwriting

Here's the difference: traditional lenders focus primarily on your personal finances. At OfferMarket, our underwriting process is built specifically for real estate investors. We get that investment properties operate differently from primary residences, and our evaluation criteria reflect that reality. By focusing on portfolio performance metrics and investment potential—not just personal income—we can often approve deals that traditional lenders might pass on.

This investor-first approach means we process applications more efficiently. We're not trying to squeeze your investment scenario into a residential lending framework that wasn't designed for it. As industry experts note, "Private lenders can step in to provide the additional funds needed to complete a deal, helping investors move forward without delay" when traditional financing creates bottlenecks (RCN Capital).

Integrated Ecosystem for Investors

What really sets OfferMarket apart is our integrated ecosystem built specifically for real estate investors. Beyond lending, we provide:

- Free insurance review to ensure you have optimal coverage at competitive rates

- Property listing marketplace designed for investment properties

- Portfolio analysis tools to help you evaluate potential acquisitions

This integration eliminates the hassle of coordinating multiple service providers—one of the biggest causes of closing delays. As noted by real estate closing experts, "Coordinating busy professionals like lenders, appraisers, and inspectors can create scheduling bottlenecks, pushing back the closing date" (Cipparone Law).

Streamlined Documentation Process

We've cut through the red tape. Our documentation requirements zero in on what actually matters for evaluating investment properties—no more drowning in unnecessary paperwork that bogs down traditional lenders. Our digital platform lets you upload documents securely and track your application status in real time, so you're not stuck in an endless loop of back-and-forth emails.

For real estate investors, this efficiency goes beyond convenience—it's your edge in a competitive market. As market experts point out, "Timeline certainty can transform financing from a constraint into a competitive advantage when you can move quickly and confidently" (Multifamily Loans). With OfferMarket's streamlined process, you can make offers knowing exactly where your financing stands.

While we don't offer HELOCs, our HELOAN products deliver the fixed structure and predictability that savvy real estate investors want when building and scaling their portfolios. By focusing on investor-specific products, we process applications faster and with more certainty than lenders juggling homeowner loans.