*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

HELOAN vs HELOC, how can Real Estate Investors use them.

HELOAN vs HELOC, how can Real Estate Investors use them.

If you're a real estate investor or landlord looking to tap into your existing equity to grow your portfolio, you've got two solid options to consider: Home Equity Loans (HELOANs) and Home Equity Lines of Credit (HELOCs). Knowing how these two products differ is key to making smart investment moves that support your long-term wealth-building goals.

Both HELOANs and HELOCs let you access the equity you've built in your properties, but they work quite differently in practice. With a HELOAN, you get a fixed lump sum upfront, along with consistent monthly payments and a locked-in interest rate. This predictable structure is a favorite among investors tackling major acquisitions or renovations. Why? Because in real estate investing, knowing exactly what your payments will be makes cash flow planning a whole lot easier.

![**Task:** Create a professional infographic comparing HELOAN and HELOC at a glance, designed for real estate investors to quickly understand the fundamental differences between these two financing products.

**Visual Structure:** A side-by-side comparison infographic split vertically down the middle, with HELOAN on the left and HELOC on the right. The header spans the full width, and six comparison rows beneath show key differentiating factors.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| HELOAN vs HELOC: Quick Comparison |

+---------------------------+------------------------------+

| HELOAN | HELOC |

+---------------------------+------------------------------+

| [Icon: Stack of money] | [Icon: Credit card] |

| Lump Sum | Revolving Credit |

+---------------------------+------------------------------+

| [Icon: Lock] | [Icon: Graph trending up] |

| Fixed Interest Rate | Variable Interest Rate |

+---------------------------+------------------------------+

| [Icon: Calendar] | [Icon: Flexible arrows] |

| Fixed Monthly Payment | Variable Payment |

+---------------------------+------------------------------+

| [Icon: Single arrow] | [Icon: Circular arrows] |

| One-Time Disbursement | Multiple Draws |

+---------------------------+------------------------------+

| [Icon: Target] | [Icon: Question mark] |

| High Predictability | Lower Predictability |

+---------------------------+------------------------------+

| [Icon: Building] | [Icon: Wrench] |

| Best for: Large purchases | Best for: Ongoing projects |

+---------------------------+------------------------------+

```

**Image Section Breakdown:**

1. **Header Section:** Full-width banner in Deep Teal (#1b444a) background with white text reading](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770746591342_1toldv.jpg?alt=media&token=4e3518f2-c130-4dab-9dd8-0a9820121752)

HELOCs, on the other hand, give you flexibility through revolving credit with variable rates—but that flexibility can add some uncertainty to your investment planning. Recent data shows both products remain popular, with usage patterns reflecting different investor needs and market conditions. According to the Mortgage Bankers Association, HELOC commitment volume averaged $1.8 billion per company in 2023, with slight fluctuation from previous years, showing these products still have a strong place in the market.

In this guide, we'll walk you through:

- How HELOANs and HELOCs are structured and how they work

- Key differences in terms, rates, and accessibility

- Smart strategies for using each to expand your real estate portfolio

- How to figure out which option fits your investment approach

- Risk factors and considerations specific to investment properties

At OfferMarket, we specialize in real estate financing solutions, offering HELOANs built specifically for landlords and property investors like you. Our approach combines competitive rates with streamlined processes designed specifically for real estate investors like you who want to grow their portfolios through smart leverage.

What is a HELOAN?

A Home Equity Loan (HELOAN) is a straightforward financing tool that lets you tap into the equity you've built in your property. Think of it as borrowing against your own success. You get a one-time lump sum at a fixed rate, then pay it back over a set period—typically 5 to 30 years. No surprises, no guesswork.

How HELOANs Work

When you take out a HELOAN, you're adding a second mortgage to your property. The amount you can borrow depends on your equity—that's simply the gap between what your property is worth today and what you still owe on your primary mortgage.

Here's what makes HELOANs a solid choice for investors:

Fixed Interest Rate: Your rate stays the same from day one to final payment. No market fluctuations to worry about. As of February 2026, the national average home equity loan interest rate is 7.90%, according to Bankrate's latest survey.

Lump Sum Disbursement: You get all your funds at closing. That means you're ready to move on your next investment opportunity right away.

Fixed Repayment Terms: Same payment every month, covering both principal and interest. Easy to budget, easy to plan around.

Loan-to-Value Ratios for Investors

Here's where the numbers matter. Most lenders set the combined loan-to-value (CLTV) ratio—your primary mortgage plus your HELOAN divided by your property's value—at 80-85%. But if you've built a strong portfolio and have excellent credit, you might qualify for up to 90%.

For investment properties, expect lenders to be a bit more cautious. They typically cap LTV ratios at 75-80% to manage their risk—and honestly, that's not a bad thing for you either.

Qualification Requirements for Real Estate Investors

When you apply for a HELOAN, lenders will look at several key factors to determine your eligibility:

- Credit Score: You'll typically need a minimum FICO score of 660-680, though scores above 740 will help you lock in the best rates.

- Debt-to-Income Ratio (DTI): Most lenders want to see a DTI of 43% or lower, including all your property-related debts.

- Property Type and Condition: Your investment property needs to be in good shape and meet lender guidelines.

- Equity Position: Plan on having at least 15-20% equity in the property.

- Rental Income History: Lenders like to see a solid track record of stable rental income.

- Cash Reserves: Be prepared to show you have enough cash on hand to cover 6-12 months of mortgage payments.

Repayment Structure

Here's the good news about HELOANs: they come with an amortized repayment structure. That means each payment chips away at both principal and interest, and you'll have the loan fully paid off by the end of your term. The result? Predictable monthly payments you can confidently build into your cash flow projections.

Let's put some real numbers to it: on a $100,000 HELOAN with a 10-year term at 8.10% interest, you're looking at fixed monthly payments of approximately $1,213 from start to finish.

Timeline for Funding

From application to closing, expect the HELOAN approval and funding process to take about 2-6 weeks. Several factors influence this timeline:

- Property appraisal scheduling and completion

- Title search and verification

- Underwriting review

- Document preparation and verification

Keep this timeline in mind when mapping out your investment strategy. Good news for the tech-savvy: some digital-first lenders can speed things up, potentially getting you to closing in as little as 2-3 weeks.

For real estate investors like you, HELOANs offer predictable costs and structured repayment schedules that work hand-in-hand with long-term investment strategies—especially when you're eyeing a single major acquisition or a renovation project with a clear budget in mind.

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by your property's equity. Unlike a HELOAN, which provides a lump sum, a HELOC allows you to borrow against your home equity as needed, up to a predetermined credit limit. This flexibility makes it a smart choice for real estate investors who need funding on their own timeline.

How HELOCs Work

Think of a HELOC like a credit card, but with your home's equity backing it up. Here's how it breaks down:

- Revolving Credit Line: Borrow what you need, pay it back, and borrow again—all within your approved limit

- Variable Interest Rates: Most HELOCs have variable rates tied to the Prime Rate, so your payments may shift over time

- Interest-Only Payments: During the draw period, you often have the option to pay just the interest

According to Bankrate, the national average HELOC interest rate sits at 7.31% as of February 2026, though rates can range from 5.49% to over 10% depending on your credit profile and lender.

Draw Period vs. Repayment Period

A HELOC comes with two key phases you should understand:

Draw Period: This is your access window—typically 5-10 years—where you tap into funds as needed. During this phase, you may only need to cover interest payments on what you've borrowed.

Repayment Period: Once the draw period ends, you enter 10-20 years of repayment. No more borrowing—now it's time to pay down both principal and interest.

![**Task:** Create a timeline infographic illustrating the two distinct phases of a HELOC: the Draw Period and the Repayment Period, showing how payments change over time.

**Visual Structure:** A horizontal timeline with two distinct sections showing the progression from Draw Period to Repayment Period, with visual indicators for payment types and amounts at different stages.

**ASCII Layout Reference:**

```

+------------------------------------------------------------------------+

| HELOC Timeline: Draw vs Repayment |

+------------------------------------------------------------------------+

| |

| DRAW PERIOD (Years 1-10) | REPAYMENT PERIOD (Years 11-30)|

| -----------------------------------|----------------------------------|

| [Access funds as needed] | [No more borrowing] |

| | |

| Payment Type: | Payment Type: |

| Interest Only | Principal + Interest |

| (Optional) | (Required) |

| | |

| Example Monthly Payment: | Example Monthly Payment: |

| $300-450 | $800-1,200 |

| [Small bar graph] | [Large bar graph] |

| | |

| ↓ Borrow ↑ Repay ↓ Borrow | ↓ Balance decreases |

+------------------------------------------------------------------------+

```

**Image Section Breakdown:**

1. **Header Section:**

- Title:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770747212104_01bgb5.jpg?alt=media&token=47beb256-25b9-4d76-a4c2-6ad1e0101f4d)

Credit Limits for Real Estate Investors

Here's where it gets exciting for investors. Lenders typically let you borrow up to 80-85% of your home's value minus your existing mortgage balance. If you've built significant equity, you could qualify for limits of $500,000 or more—giving you serious firepower for your next investment move.

Interest Calculation and Payments

HELOC interest rates are typically variable and tied to the Prime Rate with a margin added by the lender. According to Forbes Advisor, current HELOC APRs average around 7.70%, though this can vary significantly based on your credit profile and property value.

To put this in perspective, the interest-only monthly payment on a fully drawn $50,000 HELOC might range from $375 to $450 depending on the current rate environment.

Usage Restrictions

HELOCs give you flexibility, but lenders do set some ground rules:

- Some lenders require minimum draws (e.g., $10,000 initially)

- Certain lenders may restrict using funds for business purposes or investments

- Most lenders prohibit using HELOC funds for illegal activities or day trading

If you're a real estate investor, here's a smart move: confirm that your intended use—whether it's property acquisition, renovations, or something else—aligns with your lender's policies before you sign on the dotted line.

Key Differences Between HELOANs and HELOCs

Choosing between a HELOAN and a HELOC? Let's break down the fundamental differences so you can pick the right tool for your investment strategy.

Side-by-Side Comparison

| Feature | Home Equity Loan (HELOAN) | Home Equity Line of Credit (HELOC) |

|---|---|---|

| Funding Structure | Lump sum payment | Revolving line of credit |

| Interest Rate | Fixed rate | Variable rate (typically) |

| Payment Structure | Fixed monthly payments | Variable payments based on amount drawn |

| Disbursement | One-time | Multiple draws during draw period |

| Predictability | High | Lower due to variable rates |

| Flexibility | Limited after closing | High during draw period |

| Best For | One-time large expenses | Ongoing or variable expenses |

| Term Structure | Single term (typically 5-30 years) | Draw period (5-10 years) + repayment period (10-20 years) |

Interest Rate Structures

Here's where HELOANs really shine for investors who value predictability: you get a fixed interest rate that stays the same for the entire loan term. This predictability makes them especially useful for real estate investors who want to accurately forecast expenses and cash flow. When you're crunching numbers on investment properties, knowing exactly what your financing costs will be for the next 10-15 years gives you a real edge.

HELOCs, on the other hand, typically come with variable interest rates tied to an index (usually the prime rate). While they might start with attractive introductory rates, these can climb over time, potentially eating into your investment returns. As TD Bank puts it, "a HELOC is more flexible, while a HELOAN is more predictable"—and that sums up the core tradeoff between these two options.

Payment Flexibility and Structure

HELOANs come with structured, consistent monthly payments covering both principal and interest. This makes budgeting straightforward and helps you manage cash flow across your investment properties with confidence.

HELOCs give you more wiggle room, particularly during the draw period when you may only need to cover interest on what you've actually borrowed. Just keep in mind: this flexibility can lead to payment shock when the repayment period kicks in and principal payments come due.

Fee Structures and Closing Costs

Both products typically involve closing costs, though the amounts can vary quite a bit:

HELOAN closing costs generally run between 2% and 6% of the loan amount, much like a traditional mortgage. Expect origination fees, appraisal fees, title search costs, and other standard closing expenses.

HELOC closing costs may be lower upfront, but watch out for ongoing fees that HELOANs don't carry. As Bankrate explains, "HELOCs have fewer closing costs than HELoans, but often carry ongoing fees for account maintenance, inactivity or rate lock-ins."

For real estate investors, those recurring HELOC fees can add up quickly—especially if you're not tapping into the full credit line on a regular basis.

Tax Implications

Both HELOANs and HELOCs may offer tax advantages when used for qualified property improvements, though tax laws change frequently. For investment properties specifically, interest paid on either product may be deductible as a business expense when used for business purposes like property improvements or acquisitions.

Risk Assessment

HELOANs present lower interest rate risk since the rate is locked in at closing. This makes them particularly attractive in rising rate environments or for long-term investment planning.

HELOCs carry interest rate risk that can significantly impact your investment returns if rates rise substantially during your draw or repayment periods. While they offer flexibility, this comes with less certainty about long-term costs.

For real estate investors focused on predictable returns and stable cash flow management, the fixed structure of a HELOAN often provides a more solid foundation for investment planning, despite the potentially higher initial interest rate compared to introductory HELOC rates.

When to Choose a HELOAN for Real Estate Investing

Home Equity Loans (HELOANs) offer several distinct advantages that make them particularly suitable for real estate investors in specific scenarios. Unlike their more flexible counterparts, HELOANs provide a structured approach to financing that aligns well with planned investment strategies.

Benefits of Fixed Rates for Investment Planning

Here's the thing about HELOANs: that fixed interest rate gives you a rock-solid foundation for mapping out your investment strategy. When you're running the numbers on a rental property or flip, knowing exactly what your financing costs will be throughout the loan term takes a major variable off your plate. This predictability becomes your best friend when projecting cash flow for rental properties—your debt service stays the same no matter what the market throws at you.

Protection Against Market Volatility

In today's uncertain economic environment, HELOANs offer a hedge against interest rate fluctuations that could otherwise derail your investment strategy. As one real estate investment advisor puts it, "The safest and most financially wise strategy for leveraging equity is to use that equity to buy an income-producing hard asset like a rental property". With a HELOAN, you lock in your rate at origination, protecting your investment from future rate increases that could eat into your returns with variable-rate products.

Ideal Scenarios for Using HELOANs in Real Estate Investing

HELOANs work best when you need:

- Property Acquisitions: You know exactly how much capital you need for a down payment on your next investment property

- Major Renovation Projects: You're tackling comprehensive property improvements with a clear, defined budget

- Portfolio Expansion: You're ready to grow strategically and know precisely how much capital you require

- Debt Consolidation: You want to roll higher-interest investment property debts into one lower-rate loan

- Buy-and-Hold Strategies: You're in it for the long haul and want fixed payments that won't creep up over time

![**Task:** Create an infographic showcasing the top 5 ideal scenarios for using HELOANs in real estate investing, with icons and brief descriptions for each use case.

**Visual Structure:** A vertical layout with five distinct sections, each featuring an icon, scenario title, and brief description. The sections are connected by a vertical line representing a strategic investment path.

**ASCII Layout Reference:**

```

+--------------------------------------------------------+

| Top 5 HELOAN Scenarios for Investors |

+--------------------------------------------------------+

| |

| 1. [House Icon] PROPERTY ACQUISITIONS |

| ------------------------------------------------ |

| Fund down payments with predictable financing |

| |

| 2. [Hammer Icon] MAJOR RENOVATIONS |

| ------------------------------------------------ |

| Budget comprehensive improvements with confidence |

| |

| 3. [Growth Icon] PORTFOLIO EXPANSION |

| ------------------------------------------------ |

| Scale strategically with known capital amounts |

| |

| 4. [Merge Icon] DEBT CONSOLIDATION |

| ------------------------------------------------ |

| Simplify multiple high-interest loans |

| |

| 5. [Clock Icon] BUY-AND-HOLD STRATEGY |

| ------------------------------------------------ |

| Lock in fixed payments for long-term stability |

+--------------------------------------------------------+

```

**Image Section Breakdown:**

1. **Header Section:**

- Title:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770753199758_hixpjo.jpg?alt=media&token=64748d9e-43e6-4909-8038-95b87d81862a)

Budgeting Advantages for Property Management

The consistent payment structure of a HELOAN makes tracking expenses across your portfolio simple. You can easily build these fixed costs into your operating budgets, making it easy to pinpoint profitability thresholds for each property. This predictability is especially helpful when you're juggling multiple properties—no more constantly recalculating debt service costs that shift with variable-rate products.

If you're a real estate investor focused on steady growth and reliable returns, the structured nature of HELOANs gives you a solid foundation to reduce financial risk while building your portfolio strategically.

When to Choose a HELOC

For real estate investors, a Home Equity Line of Credit (HELOC) can be a powerful financial tool in situations where flexibility matters more than structure. While HELOANs offer predictability, HELOCs really shine when you need flexible access to your funds.

Managing Multiple Renovation Projects

When you're juggling several property renovations at once, a HELOC lets you draw funds as each project phase demands. This means you're not paying interest on the full loan amount from day one—which is exactly what happens with a HELOAN. Instead, you tap into capital strategically, right when specific renovation milestones call for it.

Emergency Property Repairs

Let's face it—investment properties throw curveballs. Roof leaks, HVAC breakdowns, you name it. A HELOC gives you instant access to repair funds without filling out a new loan application every time something goes wrong. This quick-response capability keeps your tenants happy and stops small headaches from turning into budget-busting nightmares.

Bridge Financing for Property Acquisition

Smart investors often use HELOCs as short-term bridge financing to snag properties fast—before locking in permanent financing. Here's what the data shows: "Using a HELOC is one of the most common ways for new investors to get into property flipping. With a HELOC, you can purchase, rehab, and flip a property without waiting for traditional financing approval".

Leveraging Interest-Only Payment Periods

Here's a powerful feature: most HELOCs come with an initial draw period (typically 5-10 years) where you only pay interest. This keeps your monthly payments low—a real advantage when you're focused on maximizing cash flow during renovations or while filling units. Once rental income starts flowing, you can pay down the HELOC or refinance into something more permanent.

Scaling Your Portfolio Gradually

If you're building your investment portfolio step by step, a HELOC gives you the power to tap into your equity without juggling multiple separate loans. As one BiggerPockets forum member pointed out, "Usually lenders allow you to go up to 70% LTV on investment HELOCs but for primary owned properties you can go up to 90% LTV". This higher LTV on primary residences makes HELOCs especially appealing if you're just getting started on your real estate investing journey.

That said, keep in mind that the variable interest rate structure of HELOCs adds some uncertainty to your investment math. While the flexibility is a real advantage, you'll want to think through whether this uncertainty fits with your overall investment strategy and how much risk you're comfortable taking on.

Many experienced investors we talk to at OfferMarket we see a higher prevalence of HELOANs due to their predictable nature where its easier to match cashflows between assets and this liability.

The Risks of HELOCs for Real Estate Investors

Smart real estate investing means understanding all the angles. The variable nature of HELOCs comes with some real risks that you should weigh carefully before moving forward. Most experienced investors that already are juggling multiple projects try to keep their mental overhead low, so introducing variable components that they need to keep track of when they might have 10 more similar deals to manage in the near future becomes a non starter making them prefer predictable HELOANs.

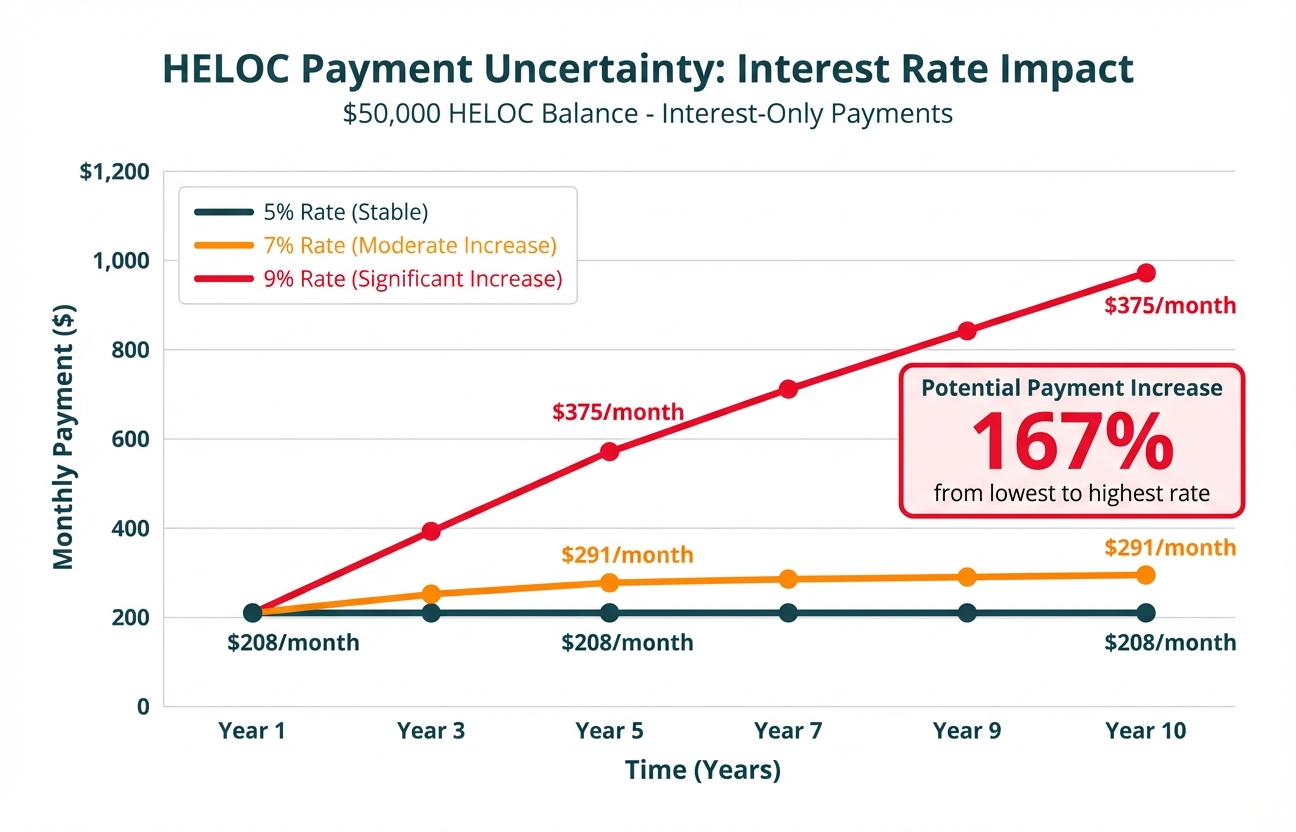

Payment Uncertainty and Cash Flow Challenges

Unlike HELOANs with their steady, predictable payments, HELOCs with variable rates can make cash flow planning tricky. When interest rates climb, your monthly payments go up too, which could throw off your carefully planned investment returns.

Here's a real-world example from Leader Bank: "If you have a $50,000 balance and an interest rate of 5.00%, your monthly interest payment would be $208.33." But if that rate jumps to 7%, you're now looking at $291.67 per month - that's a 40% increase that could really eat into your investment property's bottom line.

Post-Draw Period Payment Shock

Here's something many real estate investors don't plan for: what happens when your HELOC's draw period ends. During the draw period (usually 5-10 years), you might only need to cover interest payments. But once the repayment period kicks in, you're on the hook for both principal and interest, which often means a significant jump in your monthly payment.

Bankrate notes that "Current HELOC borrowers can expect their interest rate and payments to adjust within a month or two after a Fed rate change," creating potential for rapid payment increases that can destabilize investment property cash flows.

Impact on Debt Service Coverage Ratios

Here's something every savvy investor needs to keep on their radar: maintaining healthy debt service coverage ratios (DSCR) is non-negotiable. When your HELOC payments swing unexpectedly, your DSCR can take a hit. That could mean tripping covenant violations with other lenders or hitting roadblocks when you're ready to finance your next deal.

Negative Amortization Risk

Some HELOCs let you make interest-only payments during the draw period—sounds appealing, right? But here's the catch: without disciplined principal repayment, you're looking at negative amortization. Your debt actually grows instead of shrinking, which can put your investment property in a tough spot if market values take a dip.

Rate Caps and Maximum Payment Exposure

Good news: most HELOCs come with lifetime rate caps that put a ceiling on your interest rate. The not-so-good news? Those caps can sit pretty high—sometimes 18% or more. Smart investors run the numbers on their maximum possible payment exposure to make sure their properties stay profitable, even if rates climb to worst-case levels.

Bottom line: if you're building long-term wealth through real estate, the unpredictable nature of HELOC payments is a real consideration. Weigh this risk carefully against the flexibility these products offer.

Leveraging Home Equity with the BRRRR Method

The BRRRR method (Buy, Rehabilitate, Rent, Refinance, Repeat) has become a go-to strategy for investors ready to scale their portfolios without constantly dipping into fresh capital. It's all about working smarter with the equity you've already built.

How BRRRR Works with Home Equity

Here's where things get exciting: the BRRRR method becomes even more powerful when you pair it with home equity financing. Instead of saving up new down payments for each property, savvy investors tap into their existing equity through a HELOAN or HELOC to fund the initial purchase and rehabilitation of distressed properties. Once the property is renovated and rented, you refinance based on the improved value, pulling out most or all of your initial investment to reinvest in the next deal and payoff the HELOAN or HELOC. The most common BRRRR loans are DSCR and Fix and Flip loans, specifically designed for this activity, while 2nd mortgage loans such as HELOANs and HELOCs are often used more seldom and strategically because they create an increased risk of being over-levered for the real estate investor.

"Instead of saving up new down payments for each property, an investor buys a fixer-upper, improves it, rents it out, and then refinance it at the higher post-renovation value," explains AirDNA's analysis of the strategy.

![**Task:** Create a circular flow diagram illustrating the BRRRR method (Buy, Rehabilitate, Rent, Refinance, Repeat) and how home equity financing powers each cycle of this real estate investment strategy.

**Visual Structure:** A circular diagram with five connected stages forming a continuous loop, with a central element showing home equity as the catalyst. Arrows connect each stage in clockwise direction.

**ASCII Layout Reference:**

```

+----------------------------------------------------------------+

| The BRRRR Method Cycle |

| Powered by Home Equity |

+----------------------------------------------------------------+

| |

| [BUY] |

| ↓ |

| [REHABILITATE] |

| ↓ |

| [REPEAT] ← [Center: EQUITY] → [RENT] |

| ↑ ↓ |

| └──────── [REFINANCE] ←──────────┘ |

| |

| Each stage shows: |

| - Icon representing the stage |

| - Stage name |

| - Key action/benefit |

| - Connection arrow to next stage |

+----------------------------------------------------------------+

```

**Image Section Breakdown:**

1. **Header Section:**

- Title:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770747725754_iyfhtq.jpg?alt=media&token=14218cc8-4da9-4af4-ba8c-721a71e3c84f)

Portfolio Scaling with Home Equity

If you've built up equity in your existing properties, both HELOANs and HELOCs can become powerful engines for portfolio growth. The real win here? Capital efficiency—you get to control more properties while keeping more cash in your pocket.

As real estate investment experts put it, "The BRRRR method stands for Buy, Refurbish, Refinance, Rent, Repeat, and is a superior property investment strategy used to maximise capital efficiency". This efficiency is exactly how some investors build impressive portfolios, sometimes scooping up multiple properties in just a few years.

Which Works Better for BRRRR: HELOAN or HELOC?

When you're putting the BRRRR strategy into action:

HELOANs give you predictability with fixed rates and payments—perfect when you've mapped out your acquisition and renovation budget. If you know exactly what you need for a specific project, this is your go-to option.

HELOCs offer flexibility during the rehab phase, letting you draw funds as surprises pop up during renovation. Just keep in mind that variable interest rates can make your investment math a bit trickier and requires focus that even the most seasoned investors we talk to at OfferMarket sometimes dont want to maintain.

Here's the bottom line: for most investors working the BRRRR method, a HELOAN tends to be the smarter choice. Its fixed structure matches up nicely with the predictable returns you're aiming for and helps you maintain steady cash flow from start to finish.

HELOAN and HELOC Qualification Requirements for Real Estate Investors

As a real estate investor, you'll face different qualification standards than primary homeowners when applying for home equity products. Let's break down what you need to know to set yourself up for success.

Credit Score Requirements

When it comes to investment properties, lenders want to see stronger credit scores than they'd require for your primary residence. For a HELOAN on an investment property, most lenders look for a minimum FICO score of 680, though hitting 720 or higher will unlock better rates and terms. HELOCs tend to be a bit more flexible—you might qualify with a 620, but aim for 680+ to access the most competitive rates.

According to Experian data, "borrowers likely need a FICO Score of at least 680 to qualify for a HELOAN, but some lenders may prefer a credit score of 720 or more".

Equity and LTV Considerations

Here's the deal with investment property financing—you'll need more skin in the game than with your primary residence:

- Most lenders want you to keep 20-25% equity in the property

- Maximum LTV ratios for investment properties typically fall between 75-80%

- Some lenders may stretch to 85% LTV for investors with exceptional qualifications

Navy Federal Credit Union notes that "You'll need at least 15–20% home equity to qualify for most HELOCs or home equity loans", though investment properties often come with stricter requirements.

Debt-to-Income (DTI) Requirements

Lenders want to make sure you can handle additional debt, so they'll take a close look at your DTI ratio:

- Maximum DTI for investment property equity products typically falls between 36-43%

- All property-related expenses (mortgage, taxes, insurance, HOA) get factored into the calculation

- Good news: rental income can help offset some expenses, but keep in mind that lenders usually only count 75% of it to account for potential vacancies

Documentation and Verification

Get ready to gather more paperwork than you would for a primary residence:

- Proof of rental income through leases and bank statements

- Property insurance verification

- Track record showing transaction you were involved with

- Business documentation regarding your LLC

Investment Property Restrictions

A few more things to keep on your radar when financing investment properties:

- Property type restrictions (some lenders shy away from multi-unit properties, commercial buildings, mixed use or even condos)

- Occupancy requirements (short, medium and long occupancy vs market or section 8 tenants)

- Geographic limitations (some lenders won't lend in certain markets)

- Portfolio size limitations (some lenders cap how many financed properties you can have)

Getting familiar with these requirements before you apply puts you in the driver's seat. You'll move through the approval process more smoothly and boost your chances of landing favorable terms for your real estate investment financing.

Tax Implications: HELOANs vs HELOCs for Real Estate Investors

When you're weighing a HELOAN against a HELOC, don't overlook the tax angle—it can make a real difference in how much your financing actually costs you in the long run.

Current Tax Deductibility Rules

Here's the deal: whether you can deduct the interest on your HELOAN or HELOC comes down to what you do with the money. The IRS is pretty clear on this—you can only write off that interest if you use the funds to "buy, build, or substantially improve" the property securing the loan.

So, if you're tapping into your equity to snag a new investment property, give your rental a facelift, or make major upgrades to something in your portfolio, you're likely in good shape for a deduction. But if you're using that cash for personal stuff or anything unrelated to improving real estate, the IRS won't let you deduct the interest.

Business Purpose Documentation

Here's where good habits pay off. When you use HELOAN or HELOC funds for your real estate business, you'll want to keep your paperwork tight. That means:

- Keeping detailed records of every transaction

- Writing down the business reason for each expense

- Holding onto receipts for materials, contractor payments, and other costs

- Drawing a clear line between business and personal spending

As financial experts point out, "For a cash-out refinancing, HELOC, or traditional home equity loan, taxes can only be deducted from the non-principal amount if used to 'buy, build, or substantially improve' the property".

Impact of 2017 Tax Law Changes

The Tax Cuts and Jobs Act of 2017 shook things up when it comes to deducting HELOAN and HELOC interest. Before this law came along, you could generally deduct interest on home equity debt no matter what you spent the money on. Now, the deductibility is strictly tied to using the funds for qualified home improvements or investment property purposes.

According to the IRS, "For tax years beginning after December 31, 2017, and before January 1, 2026, the deduction for interest paid on home equity loans and lines of credit is suspended, unless they are used to buy, build, or substantially improve the taxpayer's home that secures the loan".

The key point is "Taxpayer's home that secures the loan". Which means that you won't be able to write off the interest payments if you use the funds to grow your portfolio. If you use the proceeds to buy a new property, IRS disallows the write off.

Comparing Tax Advantages: HELOAN vs HELOC

HELOAN Tax Advantages:

- Fixed interest rates make tax planning straightforward and predictable

- Lump sum distribution simplifies tracking qualified expenses

- Ideal for large, one-time projects where documentation is clear-cut

HELOC Tax Advantages:

- Draw funds when you need them across multiple investment properties

- Works well for phased improvement projects over time

- Gives you control over timing expenses for optimal tax benefits

Record-Keeping Requirements

Smart record-keeping is your best friend when it comes to maximizing tax benefits from either financing option:

- Keep separate accounts for each property

- Track improvement costs property by property

- Save loan statements showing interest paid

- Hold onto proof of how every dollar was spent

- Document the business purpose behind all expenditures

A quick word of advice: partnering with a tax professional who knows real estate investing inside and out is always a smart move. They'll help you stay compliant with current tax laws and squeeze every available deduction from your specific situation.

How to Decide: Factors to Consider When Choosing Between HELOAN and HELOC

Choosing the right home equity product for your real estate investment strategy doesn't have to be complicated. As a real estate investor or landlord, your choice between a HELOAN and HELOC should match your investment goals, comfort with risk, and the specific needs of your projects.

Step-by-Step Evaluation Process

Assess Your Investment Goals

- Long-term wealth building: Building a portfolio of rental properties? The steady, predictable nature of a HELOAN could be your best friend here.

- Short-term flips or renovations: If you're flipping houses or tackling big renovations with costs that shift, a HELOC gives you the flexibility to roll with the punches.

- Portfolio expansion: Think about whether you need funds for one specific purchase or want access to capital for multiple opportunities down the road.

Analyze Your Risk Tolerance

- Interest rate sensitivity: HELOCs have variable rates that can change over time. Here's the key question: Can your investment strategy handle potential rate bumps?

- Payment predictability: HELOANs give you fixed payments you can count on—making your long-term cash flow projections much easier to nail down.

- Leverage comfort: Be honest with yourself about how comfortable you are carrying debt and how it affects your overall investment picture.

Evaluate Market Conditions

- Interest rate environment: When rates are climbing, locking in a fixed rate with a HELOAN can be a smart move.

- Real estate market cycle: Fast-moving markets favor the nimbleness of a HELOC, while steadier markets often pair well with the certainty a HELOAN provides.

Align with Your Property Strategy

- Buy and hold: Fixed-rate HELOANs and long-term rental strategies go hand in hand—you'll love that payment stability.

- Value-add investments: Got properties that need ongoing improvements? A HELOC lets you tap funds as projects come up.

- Mixed portfolio: Take a look at which option best supports your unique blend of properties and investment approaches.

According to a comprehensive guide on real estate equity strategies, "The choice between debt and equity financing depends on your financial situation, risk tolerance, and investment goals. Some investors use a combination of both to maximize returns while minimizing risk".

Timeline and Exit Strategy Considerations

Your timeline matters when picking the right financing tool. Here's how to think about it:

Investment Horizon:

- Short-term projects (1-3 years) might benefit from a HELOC's flexibility and potential interest-only payments during the draw period.

- Long-term investments (5+ years) often align better with a HELOAN's predictable payment structure.

Exit Strategy Implications:

- If you plan to refinance or sell properties within a specific timeframe, consider which product offers the most favorable terms for early repayment.

- For properties you intend to hold indefinitely, the stability of a HELOAN may outweigh the initial flexibility advantages of a HELOC.

Industry experts remind us that "In this season of high interest and economic uncertainty," investors need to carefully weigh "the five essential financing options" to find the right fit for their unique situation.

Here's our best advice: submit an example deal for an instant quote. Real numbers beat theory every time. You'll see exactly how each lending product impacts your specific investment scenario—and that clarity is priceless when making big financial decisions.

When to Choose a HELOAN

Home Equity Loans (HELOANs) shine in specific situations. For landlords and real estate investors like you, the predictable nature of HELOANs delivers the financial stability you need when mapping out your long-term investment game plan.

Property Acquisition Scenario

Let's look at a real-world example. Say you're an experienced investor ready to add another rental property to your portfolio. You've got $300,000 in equity sitting in your primary residence, with a current mortgage of $300,000 on a home worth $600,000. That's serious untapped potential waiting to work for you.

According to recent research, this investor could tap into their home equity to fund a new investment property purchase. By choosing a HELOAN for $150,000 with a fixed interest rate of 5.5% over 15 years, they lock in predictable monthly payments of approximately $1,225.

Here's what this fixed payment structure puts in your corner:

- Accurately calculate cash flow projections for the new property

- Lock in interest rates during a potentially rising rate environment

- Make a substantial down payment on a $500,000 rental property

- Avoid the uncertainty of variable payment amounts

Let's break down the ROI: with the new property generating $3,200 in monthly rental income and approximately $2,400 in expenses (including the HELOAN payment), you're looking at a positive monthly cash flow of $800. Plus, you'll benefit from property appreciation, mortgage principal reduction, and tax advantages—all while knowing exactly what your payment will be each month. It easier to see all the numbers when you use our DSCR calculator to figure out the exact cash flow a property can produce.

Debt Consolidation for Portfolio Optimization

Here's another smart play where a HELOAN works in your favor: consolidating high-interest debt tied to multiple investment properties.

As noted by financial experts, savvy real estate investors often leverage home equity to sharpen their overall investment strategy. Picture an investor with several properties who's juggling various loans at different interest rates:

- Credit card debt from emergency property repairs: $25,000 at 18% APR

- Personal loan for a previous down payment: $35,000 at 12% APR

- Short-term loan for renovation costs: $40,000 at 10% APR

By securing a HELOAN for $100,000 at 6.5% fixed interest, you can:

- Consolidate all high-interest debts into a single, lower-interest loan

- Reduce monthly payment obligations by approximately $850

- Improve overall cash flow across your property portfolio

- Create tax-deductible interest (when used for qualifying investment properties)

- Establish a clear payoff timeline with no surprises

The ROI here is straightforward: you're saving approximately $7,200 annually in interest, boosting your cash flow, and freeing up capital to invest in additional properties or improvements that grow your portfolio's value.

HELOANs are generally the better choice when:

- You need a specific, known amount for a one-time investment

- You prefer payment stability for accurate long-term financial planning

- You want to lock in current interest rates

- You're making a substantial investment requiring a large sum upfront

- You have a clear repayment strategy based on rental income or other steady revenue

For real estate investors focused on building a stable, predictable portfolio with careful cash flow management, the fixed nature of HELOANs often provides the financial foundation needed for sustainable growth.

Why OfferMarket Is Your Smart Choice for HELOANs

As a real estate investor or landlord, you need financing that actually gets how your business works. OfferMarket isn't your typical lender—we've built our HELOAN products specifically with investment property owners like you in mind.

Built for Investors Like You

Most lenders focus on homeowners living in their properties. We focus on you. That means we understand the ins and outs of investment property financing, from higher loan-to-value ratios to flexible underwriting that factors in your rental income and overall portfolio. We speak your language.

What Sets Us Apart

Here's why savvy investors choose OfferMarket:

- Multiple Capital Sources: We connect you with various lending partners, giving you more options and competitive rates

- Investment Property Expertise: Our underwriters truly understand rental property economics

- Faster Processing: Our streamlined approval process respects your time and experience

- Cost-Effective Solutions: Enjoy lower fees and better terms than many traditional banks

As industry experts point out, "Lenders who can seamlessly manage home equity loans will be well-positioned to retain their customers and capture repeat business".

Integrated Investor Services

Here's where OfferMarket really shines for real estate investors. They go beyond just handing you a loan—they're in your corner for the long haul:

- Free Insurance Review: Make sure you're not overpaying for property coverage

- Property Listings: Get your properties in front of buyers when you're ready to sell

Relationship-Based Lending

Most lenders treat you like a transaction. OfferMarket treats you like a partner. Their team gets it—real estate investing is a marathon, not a sprint. They're here to grow with you, not just close a deal and move on.

For investors ready to scale efficiently, specialized lenders like OfferMarket deliver exactly what you need—"the trusted lender in real estate... that helps property investors build and scale their portfolios with ease".

With their deep investor knowledge, tailored products, and full-service approach, OfferMarket stands out as a solid partner for landlords and investors ready to put their home equity to work.

The HELOAN Application Process for Real Estate Investors

Ready to unlock your home equity through a HELOAN? Let's walk through what to expect. While traditional lenders can drag their feet, specialized investor-focused lenders often move faster when you need capital now.

Just submit an instant quote to get started and our online portal and processing team will guide you through the rest of the process.

Timeline Expectations

How long will this take? That depends on who you're working with:

Traditional Banks and Credit Unions:

- Average processing time: 30-45 days

- Appraisal scheduling alone can add 1-2 weeks

According to a recent Mortgage Bankers Association study, "it took an average of 38 days to close on a HELOC in 2024 (7 days longer than the previous year)".

Specialized Lenders:

- Some lenders can close in as little as 14-20 business days

- Digital-first lenders often complete the process in 10-15 days

The Streamlined Process at OfferMarket

Instant Quote System: Pop your basic property and financial details into our online portal, and you'll have a preliminary approval and rate quote in your hands within minutes.

Documentation Submission: Upload your investor documents through our secure portal—no faxing, no mailing, no hassle.

Underwriting: Our team gets real estate investors. We look at your whole portfolio strategy, not just one property at a time.

Appraisal Process: For qualifying properties, we offer desktop and drive-by appraisal options to keep things moving quickly.

Closing: Go digital with your closing, and expect funding in your account within 24-48 hours after you sign.

Approval Criteria for Investors

Here's what we look at when reviewing your application—and it's tailored specifically for investors like you:

- Cash flow from investment properties

- Experience level as an investor

- Property types and locations

Here's the reality: "many lenders still average 30 to 45 days to close a home equity loan". At OfferMarket, we've built our process around real estate investors, and most applications go from submission to funding in under three weeks.

Conclusion: Making the Right Choice for Your Real Estate Investment Strategy

Choosing between a HELOAN and HELOC comes down to your investment strategy, financial goals, and how much risk you're comfortable with. Let's break down what matters most.

Summary of Key Differences

HELOANs give you predictability—fixed rates and structured payments—which makes them a solid choice for one-time investments where you know exactly what you need. HELOCs offer flexibility with revolving credit, but here's the catch: variable rates can make your investment math a moving target.

Here's what the numbers are telling us: HELOANs are gaining serious traction among real estate investors who want predictability in unpredictable times. The Mortgage Bankers Association projects that demand for fixed-rate equity products will climb significantly through 2025 as savvy investors lock in rates ahead of potential market shifts.

Finding Your Best Fit

Buy-and-Hold Investors: A HELOAN is often your sweet spot. Stable financing terms pair naturally with long-term holding strategies and predictable rental income.

Fix-and-Flip Investors: That HELOC flexibility might look tempting, but variable rates can chip away at your profits fast. Smart flippers are increasingly choosing HELOANs to nail down their costs from day one.

Portfolio Builders: Think about securing a HELOAN for each new acquisition. This approach lets you match specific financing to each property as your portfolio grows.

PWC's Emerging Trends in Real Estate report backs this up: investors using fixed-rate equity products like HELOANs typically see steadier portfolio growth than those leaning on variable-rate options.

OfferMarket: Built for Investors Like You

We do things differently here. OfferMarket delivers HELOAN solutions crafted specifically for real estate investors. Here's what that means for you:

- Competitive fixed rates designed to boost your investment returns

- A streamlined application built for investors, not typical homeowners

- Deep expertise in investment property financing scenarios

- Bonus services like insurance reviews and property listing opportunities

- A full network of real estate investment resources at your fingertips