*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Can You Get an Equity Loan with Poor Credit? A Guide for Real Estate Investors

If you're a landlord or real estate investor with less-than-perfect credit, you might be wondering whether you can still tap into your property's equity. The short answer is yes—but it comes with challenges. Understanding your options and taking strategic steps to improve your credit can make a huge difference in the terms you'll receive.

![**Task:** Create an infographic that explains the credit score ranges and their impact on equity loan approval for real estate investors.

**Visual Structure:** A horizontal tiered diagram showing four distinct credit score ranges, with each tier displaying the score range, approval likelihood, and typical interest rate impact. Use a gradient effect from red (poor) to deep teal (excellent).

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| CREDIT SCORES & EQUITY LOAN APPROVAL |

+----------------------------------------------------------+

| [RED ZONE] [YELLOW] [LIGHT TEAL] [DEEP TEAL] |

| Below 680 680-699 700-719 720+ |

| |

| Difficult Higher Rates Improved Best Rates |

| Approval Expected Terms & Terms |

| |

| 7.5%+ 7.0-7.5% 6.5-7.0% 6.0-6.5% |

| Interest Interest Interest Interest |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770498998587_v0zf9m.jpg?alt=media&token=42ea32b0-89a7-42e2-a830-976ae48b391f)

Understanding Equity Loans and Credit Requirements for Real Estate Investors

Equity loans are a smart way for landlords and real estate investors to tap into the value they've built in their properties. These loans—including Home Equity Loans (HELOANs) and Home Equity Lines of Credit (HELOCs)—let you access cash without selling your assets, giving you capital to grow your portfolio, tackle renovations, or jump on new investment opportunities.

If you're a real estate investor, equity loans can be a game-changer for the popular BRRR (Buy, Renovate, Rent, Refinance) strategy, helping you acquire more properties or upgrade the ones you already own. That said, getting approved for these loans gets trickier if your credit isn't in great shape.

In the lending for real estate investors world, "poor credit" generally means a FICO score below 680, though this can vary depending on the lender and loan type. When it comes to investment properties, expect tougher credit requirements than you'd face for a primary residence. Most lenders set 680 as the minimum for investment property equity loans, and you'll need a score of 720 or higher to lock in the best rates.

As Freedom Credit Union points out, "A minimum credit score of 620 is usually required to qualify for a home equity loan, although a score of 680 or higher is preferred". For investment properties, though, the bar is higher. HomeLife Mortgage notes that "The best investment property mortgage rates are reserved for borrower's high credit scores (720 and above), large down payments, or low loan-to-value ratios" .

These credit thresholds exist for good reason—they reflect how lenders assess risk. Real estate investors carry more risk than primary homeowners because investment properties are more likely to face foreclosure when finances get tight. Consequently, lenders protect themselves by requiring stronger credit profiles from investor borrowers.

Understanding the Impact of Credit Scores on Equity Loans

Your credit score plays a major role when lenders review your equity loan application. This three-digit number determines whether you qualify and directly affects the interest rate and terms you'll be offered.

Credit Score Requirements for Equity Loans

Most lenders look for a minimum credit score of 680 to approve a home equity loan or HELOC. The good news? Better scores unlock better opportunities:

- 680-699: You'll likely qualify, but expect higher interest rates

- 700-719: You're in a stronger position for improved rates and terms

- 720 and above: This is where you access the most competitive rates and favorable loan terms

- 740+: You're in the driver's seat with premium rates and maximum borrowing potential

According to Experian, "Minimum credit score requirements vary by lender, but most want to see a credit score above 680, and some may require a score of 720 or higher" for the best HELOC rates .

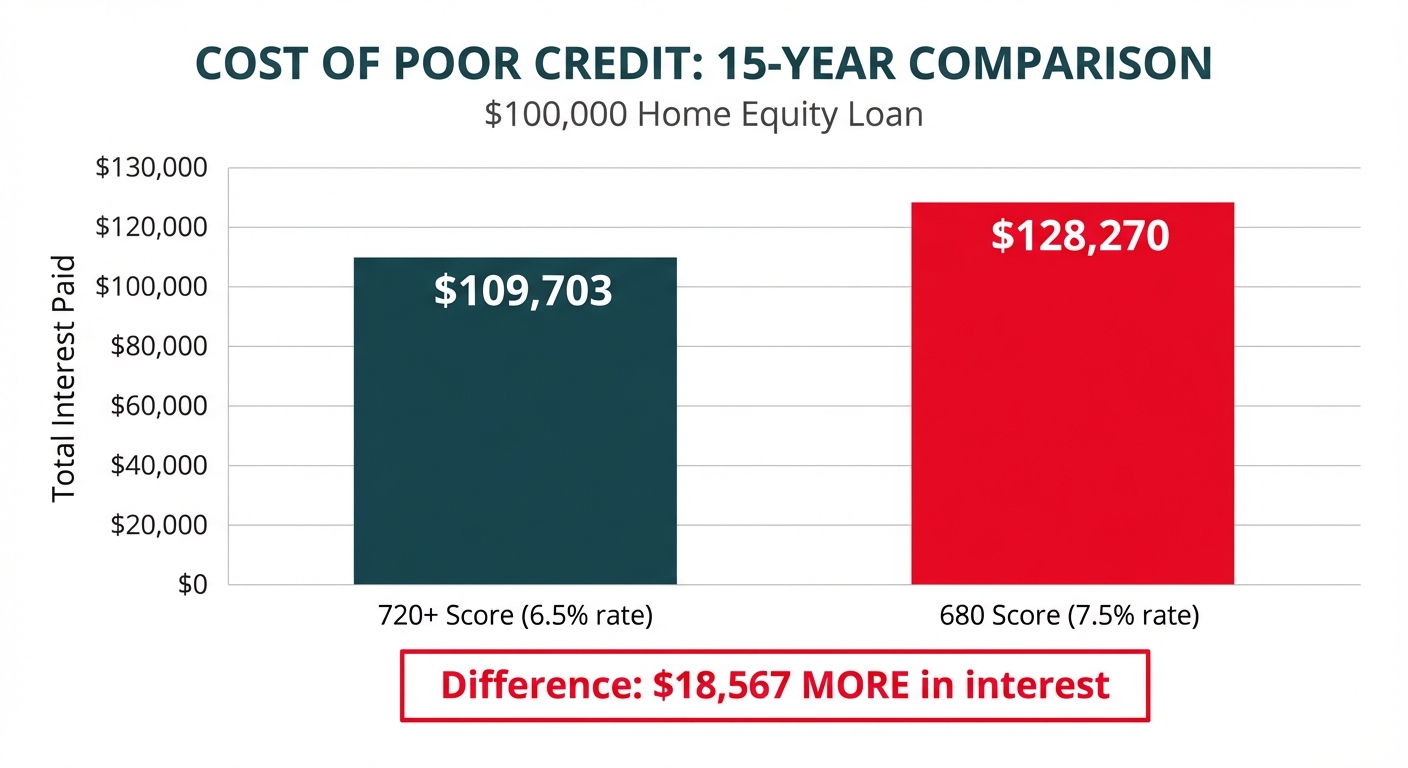

The Cost of Poor Credit Over Time

The gap between a "good" and "excellent" credit score might look small on paper, but the real-world impact on your wallet can be significant. A modest rate difference adds up fast over the life of your loan.

Let's break it down with a $100,000 home equity loan over 15 years:

- With a 720+ credit score: 6.5% interest rate = $109,703 in total interest

- With a 680 credit score: 7.5% interest rate = $128,270 in total interest

That's $18,567 extra out of your pocket—money you could have put toward your next investment property or used to pay down principal faster.

Why Lenders Care About Your Credit Score

Lenders see your credit score as a snapshot of how you handle financial responsibility. A higher score tells them:

- Consistent payment history: You've shown you can make payments on time, every time

- Responsible credit utilization: You're not maxing out your available credit

- Long-term financial stability: You've kept accounts in good standing over the years

- Risk management: You've proven you can handle different types of credit responsibly

As noted by Amerisave, "A score of 680 or higher typically qualifies you for better interest rates and more favorable loan terms; Scores above 740 can unlock the lowest available" rates for home equity loans.

Here's the bottom line for real estate investors and landlords: strong credit is your ticket to growth. You'll likely tap into financing multiple times as you build your portfolio. Each investment property is a major financial move, and the loan terms you qualify for based on your credit score can make or break your cash flow and overall returns.

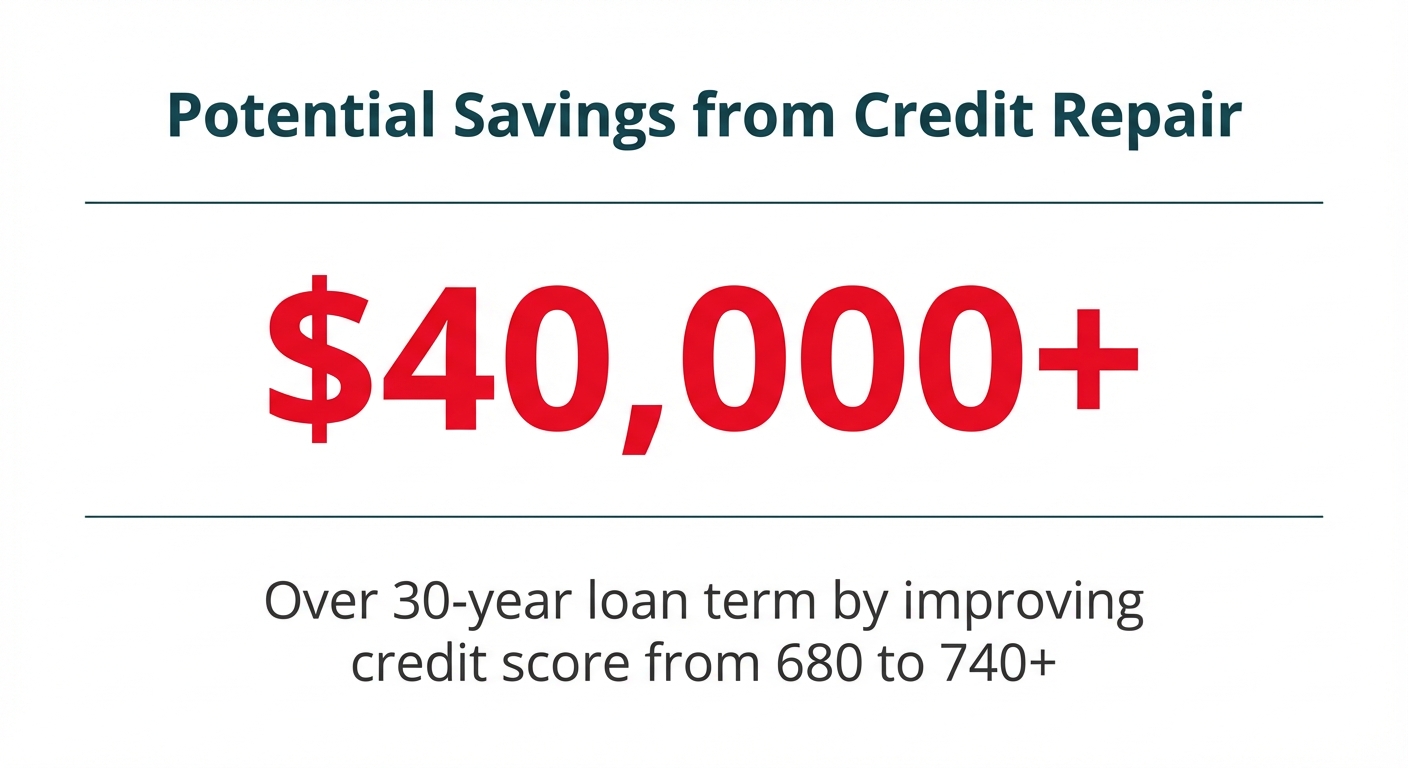

The Financial Impact of Credit Repair Before Applying for Equity Loans

We get it—when you're ready to apply for an equity loan, waiting feels counterproductive. But here's the smart play: taking time to repair your credit first can put serious money back in your pocket. The short-term patience pays off in long-term gains.

The True Cost of Poor Credit on Equity Loans

The gap between getting a loan at 680 versus 740+ credit? It's bigger than you might think. Bankrate's 2025 analysis confirms that while a 680 score can get you approved, lenders save their best rates for borrowers hitting 740 or above .

Let's break it down with real numbers: On a $250,000 equity loan over 30 years, just a 0.5% higher interest rate from lower credit can cost you tens of thousands of dollars over the life of that loan.

The Math Behind Credit Score Improvement

Let's break down the real numbers using OfferMarket's DSCR loan calculator—because seeing the actual impact makes all the difference:

- A borrower with a 680 credit score might receive an interest rate of 7.5% on a $250,000 loan

- The same borrower with a 740 credit score might qualify for a 6.75% rate

- This 0.75% difference results in savings of approximately $111 per month

- Over a 30-year loan term, this amounts to over $40,000 in saved interest

Short-Term Patience vs. Long-Term Financial Impact

Here's the thing: spending 6-12 months on credit repair might feel like hitting pause on your investment goals. But let's put it in perspective. You're planning to hold investment properties for years, maybe decades. That temporary delay? It's just 1-2% of your total investment timeline. But the savings? They'll benefit you for 100% of your loan term.

Beyond Interest Rates: Additional Benefits of Better Credit

A stronger credit score does more than lower your interest rate. It opens doors across the board:

- Lower or waived origination fees

- More flexible loan terms and conditions

- Higher approval amounts

- Reduced or eliminated PMI requirements

- Greater negotiating power with lenders

For investors focused on building long-term wealth, prioritizing credit repair before major borrowing is one of the smartest moves you can make. The return on your time spent improving your credit score will likely outperform many of your actual property investments.

Steps to Improve Your Credit Score for Equity Loan Approval

Ready to boost your credit score and unlock better equity loan options? While many lenders look for a minimum score of 680, shooting for 720+ puts you in position for the best rates and terms. Here's your action plan:

![**Task:** Create a step-by-step infographic showing the six key actions to improve credit scores for equity loan approval, presented as a vertical timeline with icons and clear action items.

**Visual Structure:** A vertical flowchart with six connected steps, each containing an icon, title, and brief description. Steps flow from top to bottom with connecting lines in deep teal.

**ASCII Layout Reference:**

```

+-----------------------------------------------+

| 6 STEPS TO IMPROVE YOUR CREDIT SCORE |

+-----------------------------------------------+

| |

| [1] Check Reports & Scores |

| └─ Review all 3 bureaus for errors |

| ↓ |

| [2] Prioritize On-Time Payments |

| └─ Set up automatic payments |

| ↓ |

| [3] Reduce Credit Utilization |

| └─ Keep balances under 30% |

| ↓ |

| [4] Dispute Report Errors |

| └─ Submit formal disputes |

| ↓ |

| [5] Avoid New Credit Applications |

| └─ Minimize hard inquiries |

| ↓ |

| [6] Diversify Credit Mix |

| └─ Balance revolving & installment |

| |

+-----------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770497737903_k7cx6j.jpg?alt=media&token=09ecb448-206d-48f1-ad5d-76a7c915fac0)

Check Your Credit Reports and Scores

First things first—you need to know exactly where you stand:

- Request free copies of your credit reports from all three major bureaus (Experian, Equifax, and TransUnion)

- Review reports carefully for errors, discrepancies, or fraudulent activity

- Note your current FICO scores to establish a baseline for improvement

As Equifax points out, checking your credit reports and scores should be step one in any improvement plan. It gives you a clear roadmap for where to focus your efforts.

Prioritize On-Time Payments

Payment history makes up roughly 35% of your credit score—that's the biggest slice of the pie:

- Set up automatic payments for all recurring bills

- Create calendar reminders for due dates

- Consider paying bills twice monthly if cash flow allows

- Address any delinquent accounts immediately

Reduce Credit Utilization Ratio

Your credit utilization ratio (the amount of available credit you're using) carries serious weight with lenders:

- Aim to keep utilization below 30% of available credit

- For optimal results, maintain utilization between 10-20%

- Pay down revolving balances strategically

- Consider making multiple payments throughout the month

A Reddit thread in r/RealEstate suggests: "Leave a balance less than 15% -20% of the total amount available to you. Do not pay it off completely. Instead set up auto payments."

Dispute Errors on Your Credit Report

Mistakes happen, and they can drag your score down unfairly:

- Draft formal dispute letters for each credit bureau

- Include supporting documentation

- Follow up after 30 days if no response

- Consider working with a credit repair specialist for complex issues

Avoid New Credit Applications

Each hard inquiry can temporarily ding your score:

- Refrain from applying for new credit cards or loans

- If shopping for rates, complete applications within a 14-30 day window

- Remove yourself from pre-approval marketing lists

Diversify Your Credit Mix

Lenders want to see you can handle different types of credit responsibly:

- Maintain a healthy mix of revolving accounts (credit cards) and installment loans

- Consider a credit-builder loan if your credit history is limited

- Keep older accounts open to preserve credit history length

Timeline Expectations for Credit Repair

Let's set realistic expectations for your credit improvement journey:

- 30-60 days: Correction of reporting errors, reduction in utilization

- 3-6 months: Improvement from consistent on-time payments, debt reduction

- 6-12 months: Substantial improvement from sustained positive habits

- 12+ months: Time needed to address serious derogatory marks like bankruptcies or foreclosures

Here's the good news: while you're building your credit, you can still research investment opportunities and sharpen your real estate strategy. That way, you'll be ready to move when your score hits that loan approval threshold.

Understanding the FICO Scoring Model for Real Estate Lending

If you're a landlord or real estate investor looking for equity loans, knowing how your FICO credit score works is a game-changer. With this knowledge in your back pocket, you can take smart steps to boost your creditworthiness and improve your chances of getting approved—even if your credit isn't where you'd like it to be right now.

The Five Components of Your FICO Score

Your FICO score breaks down into five key pieces, and each one carries a different weight in your overall number:

![**Task:** Create a pie chart infographic showing the five components of a FICO credit score with their respective percentages, using the specified brand colors.

**Visual Structure:** A circular pie chart with five segments, each labeled with the component name and percentage. Include a legend on the right side with detailed descriptions of each component.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| FICO SCORE COMPONENTS |

+----------------------------------------------------------+

| |

| [PIE CHART] LEGEND |

| ■ Payment History 35% |

| 35% Payment ■ Amounts Owed 30% |

| 30% Amounts ■ Length of History 15% |

| 15% Length ■ New Credit 10% |

| 10% New ■ Credit Mix 10% |

| 10% Mix |

| |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770497786778_ki7t5h.jpg?alt=media&token=84060e08-2a1f-4400-adb0-1ed78c819589)

Payment History (35%): This is the big one. Lenders want proof that you pay your bills on time, every time. Late payments, accounts in collections, and bankruptcies can really hurt you here.

Amounts Owed (30%): Think of this as your credit utilization—how much of your available credit you're actually using. When your balances are high compared to your limits, lenders may see that as a red flag.

Length of Credit History (15%): This looks at how long you've had your credit accounts open. The longer your track record, the better your score tends to be.

New Credit (10%): Opening several new accounts or having multiple credit inquiries in a short time can make lenders nervous about your risk level.

Credit Mix (10%): A healthy variety of credit types—credit cards, installment loans, mortgages—shows lenders you can handle different kinds of debt responsibly.

What Matters Most for Real Estate Lending

When it comes to equity loans and mortgages, lenders zero in on specific parts of your credit profile:

Payment History: Mortgage lenders look at this one closely because it's the best indicator of whether you'll pay back your loan. Even one missed mortgage payment can make it harder to secure real estate financing down the road.

Debt-to-Income Ratio: This isn't part of your FICO score directly, but lenders pay close attention to how much of your monthly income goes toward paying off debts. Even with a solid credit score, a high DTI ratio could take you out of the running.

Credit Utilization: Carrying high balances on credit cards or existing loans signals financial stress to lenders. This makes them think twice before approving additional credit for your real estate ventures.

Stable Credit History: When it comes to real estate lending, lenders want to see a well-established credit track record. A longer history with some bumps often beats a short history with perfect payments.

Most conventional mortgage lenders rely on FICO Score 8 or the newer FICO Score 10 models, though some use versions specifically designed for mortgage lending. Here's the breakdown: scores above 720 unlock the best rates, while scores below 680 mean higher interest rates or possible denial.

For real estate investors pursuing equity loans with less-than-perfect credit, knowing these components helps you pinpoint exactly where to focus your improvement efforts. This knowledge puts you in the driver's seat for loan approval and better rates.

Alternative Financing Options During Credit Repair

Here's the good news: you don't have to pause your real estate investment plans while building up your credit. Several alternative financing paths can keep you moving forward until your credit qualifies for traditional equity loans.

Hard Money Loans

Hard money loans are short-term financing from private lenders who care more about your property's value than your credit score. Here's what to expect:

- Higher interest rates (8-15%)

- Shorter terms (6-24 months)

- Lower credit requirements

- Quick approval processes

According to Benworth Capital, "Hard money loans are a viable alternative for real estate financing, especially if your credit score is less than stellar. These loans are asset-based, meaning they're secured by the property itself rather than your creditworthiness."

Creative Financing Structures

Here's the good news: several creative financing approaches can open doors for investors facing credit challenges:

Seller Financing: Work directly with the property seller to finance your purchase, cutting traditional lenders out of the equation entirely.

Subject-To Financing: Step into the seller's existing mortgage payments while the loan stays in their name.

Lease Options: Lock in your right to purchase a property after leasing it for a set period.

Crowdfunding: Team up with other investors through real estate crowdfunding platforms that often have more flexible credit requirements.

Partnership Approaches

The right partners can unlock capital access while you work on rebuilding your credit:

Joint Ventures: Team up with investors who bring strong credit and capital to the table but may need your time or expertise.

Real Estate Investment Groups: Get involved with local investment clubs where you can build relationships with potential funding partners.

Private Equity Partnerships: Reach out to private equity firms that focus on real estate investments.

As noted by Loan Guys, "Crowdfunding allows you to pool funds with other investors through online platforms, often with lower barriers to entry than traditional financing."

Keep in mind that these alternative options typically cost more than traditional financing, making them better suited as stepping stones while you strengthen your credit profile. Use this time to not only tap into real estate opportunities but also to build a track record of responsible financial management that will help you qualify for better loan terms down the road.

Researching BRRRR While Improving Your Credit

For real estate investors working on credit repair, the waiting period doesn't have to be wasted time. Now is the ideal time to learn about the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method—a proven strategy for building a rental portfolio that you can put into action once your credit score is in better shape.

Understanding the BRRRR Method

The BRRRR method is a step-by-step approach to real estate investing that helps you grow wealth through rental properties while recycling your capital:

- Buy - Find undervalued, distressed properties with solid potential for appreciation

- Rehab - Fix up the property to boost its value and appeal to renters

- Rent - Secure quality tenants who provide steady monthly income

- Refinance - Once the property is stabilized, refinance to pull out your initial investment

- Repeat - Take that capital and start the process over with a new property

The BRRRR method is a real estate strategy that involves flipping properties, renting them out and using equity you've built to refinance your loan for better terms. This approach lets you potentially recover your initial investment while keeping ownership of cash-flowing assets .

Preparing for BRRRR While Improving Credit

While you're working on credit repair, here are the key skills you can start building right now:

Market Research: Dig into local real estate markets to spot neighborhoods with growth potential and strong rental demand.

Building a Network: Start connecting with real estate agents, contractors, property managers, and fellow investors who focus on investment properties.

Financial Analysis: Get comfortable analyzing deals using metrics like the 70% rule, cash-on-cash return, and cap rates to spot profitable opportunities.

Renovation Knowledge: Study renovation costs and processes so you can accurately estimate rehab budgets for future projects.

Landlord Education: Learn landlord-tenant laws, proper screening procedures, and effective property management techniques.

Successful BRRRR strategy requires following each step in the proper sequence. The BRRRR method only works if each step is followed in the proper order.

Aligning Credit Improvement with BRRRR Timeline

Here's the good news: the time you spend researching BRRRR while repairing your credit can work in your favor. These timelines often sync up nicely:

- Months 1-3: Kick off your credit repair journey while diving into BRRRR basics and getting to know your local market

- Months 4-6: Keep building that credit score while expanding your investor network and sharpening your deal analysis skills

- Months 7-9: As your credit climbs, start scouting potential properties and connecting with lenders who understand your goals

- Months 10-12: With stronger credit in hand, you're ready to tackle your first BRRRR deal armed with real knowledge

Here's the bottom line: traditional lenders typically want to see scores of 680+ for investment properties. But don't view this waiting period as lost time—it's your foundation for real estate success. Once you hit that sweet spot of 720+, you'll have both the credit profile and the expertise to execute BRRRR like a pro.

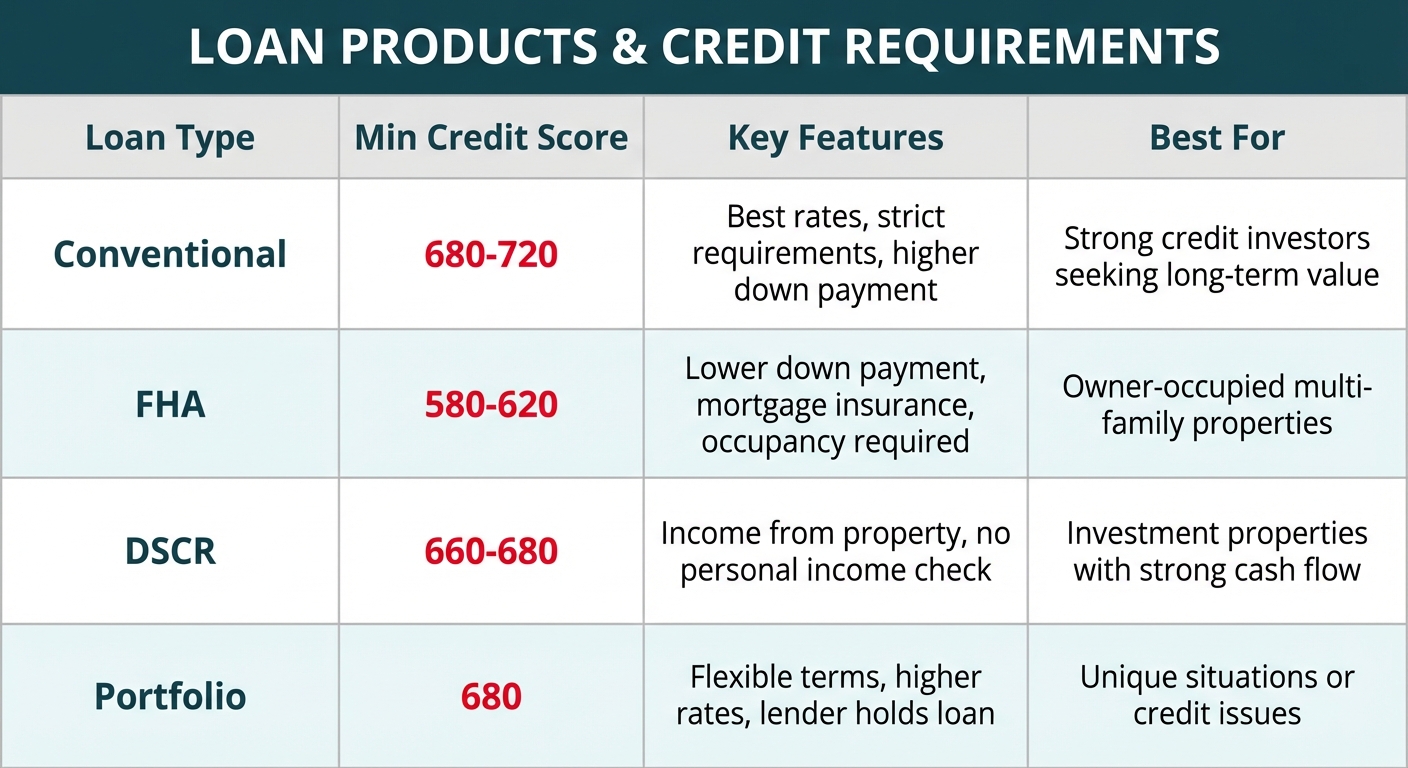

Navigating Loan Products and Their Credit Requirements

If your credit isn't where you want it to be, understanding your loan options is a game-changer. Each loan type has different credit score requirements, and knowing these details helps you map out a smart financing strategy.

Conventional Loans

Conventional loans set the bar higher, typically requiring credit scores of 680 or above. Want the best rates and terms? Aim for 720+. These loans follow Fannie Mae and Freddie Mac guidelines and reward strong credit with competitive interest rates.

FHA Loans

FHA loans are designed mainly for owner-occupied properties, but here's a useful tip: they can work for small multi-family properties if you plan to live in one of the units. These loans have more flexible credit requirements, with minimums as low as 580 for a 3.5% down payment. Keep in mind, though, that mortgage insurance premiums will add to your overall costs.

DSCR Loans for Investment Properties

Here's where things get interesting for investors. Debt Service Coverage Ratio (DSCR) loans are built specifically for investment properties. The big difference? Approval is based primarily on what the property can earn, not your personal income. That's a game-changer for many investors.

So what credit score do you need? Most DSCR loan programs look for a minimum of 660-680. Some lenders will work with scores as low as 620, but you'll need some strong compensating factors:

- Credit scores between 620-659 typically mean a maximum LTV (Loan-to-Value) of 65-70%, higher interest rates, and larger reserve requirements

- Scores of 680+ open the door to better terms, including higher LTV ratios and lower rates

- Plan on a down payment of 20-25% of the property value

OfferMarket's DSCR requirements puts it this way: "Program minimums vary; most products have a minimum FICO score of 680 but stronger credit score always results in a lower rate."

Portfolio Loans

Portfolio loans offer another path worth exploring. Since lenders keep these loans on their own books instead of selling them, they have more wiggle room with requirements. You might qualify with a credit score as low as 600, but expect higher interest rates and fees—that's how lenders balance the added risk.

Hard Money Loans

If your credit has taken a serious hit (below 600), hard money loans might be your best immediate option. These short-term loans care more about the property's value than your credit score. The trade-off? Higher interest rates (often 10-15%) and shorter terms (1-3 years). Think of them as a bridge, not a destination.

According to OfferMarket's DSCR loan page, "A minimum credit score of 680 is standard, though some lenders may require higher scores for better terms. " This highlights the importance of shopping around, as requirements can vary significantly between lenders.

Knowing these requirements helps you realistically assess which loan products might work for your current credit situation—and gives you clear targets if you're working to improve your score.

The Real Cost of Poor Credit: Breaking Down the Numbers

Here's the truth: the difference between a "fair" credit score and a "good" or "excellent" score can mean thousands of dollars over the life of your loan. Let's look at what different credit tiers actually cost you on a $200,000 equity loan.

Credit Score Tiers and Their Financial Impact

Lenders typically group credit scores into tiers that determine your interest rates and loan terms:

- Below 680: Tough to get approved, and if you do, expect the highest rates

- 680-739: Some restrictions apply, rates are higher than ideal

- 740+: You're in the sweet spot for the best rates and terms

Here's what the numbers actually look like on a $200,000 equity loan:

| Credit Score | Approximate Interest Rate | Monthly Payment (30-year term) | Total Interest Paid |

|---|---|---|---|

| 740+ | 6.25% | $1,231 | $243,360 |

| 680-739 | 6.75% | $1,297 | $266,920 |

| Below 680 | 7.50%+ (if approved) | $1,398+ | $303,280+ |

Let that sink in: with a 680 credit score, you're looking at roughly $66 more per month and $23,560 more in interest over your loan term compared to someone with a 740+ score. Drop below 680, and those costs climb even higher—assuming you can get approved in the first place.

The Opportunity Cost of Proceeding with Poor Credit

The direct costs are just part of the picture. There's also a real opportunity cost to moving forward with poor credit:

Limited access to equity: Lenders typically cap how much equity you can tap into when your credit score is lower. Borrowers with scores below 680 often face "substantially reduced equity access" compared to those with stronger credit [Source](https://www. midflorida.com/resources/insights-and-blogs/insights/mortgage/home-equity/how-much-equity-do-you-need-for-a-heloc).

Higher DTI requirements: A lower credit score often means lenders want to see a lower debt-to-income ratio, which can limit how much you're able to borrow.

Investment opportunity losses: Every extra dollar you pay in interest is a dollar that could be working for you—whether that's funding your next property or upgrading your current holdings.

Here's the bottom line: most financial experts recommend waiting 6-12 months to boost your credit score before applying for a significant equity loan. The savings can add up to tens of thousands of dollars. For real estate investors focused on maximizing ROI, improving your credit before taking on new debt is simply smart business.

As lending experts point out, "A score of 680 or higher typically qualifies you for better interest rates and more favorable loan terms; Scores above 740 can unlock the lowest available [ates".

For you as an investor, these differences in borrowing costs have a direct impact on your bottom line and your ability to grow your portfolio efficiently.

Maintaining Credit While Scaling Your Real Estate Portfolio

If you're a real estate investor working to secure equity loans while navigating credit challenges, keeping your credit score healthy is non-negotiable. This becomes even more important as you grow, since each new property affects your debt-to-income ratio and overall creditworthiness.

Balancing Growth with Credit Health

Growing your real estate portfolio takes smart financial planning to protect your credit score along the way. As BlueprintTitle explains, "Another common way to scale a real estate investment portfolio is the BRRRR method, which stands for buy, rehab, rent, refinance, and repeat." When done right, this approach lets you recycle your capital while keeping the impact on your credit score to a minimum [](https://blueprinttitle. com/financing-strategies-to-scale-your-single-family-rental-portfolio/).

When you're ready to grow, keep these credit-smart strategies in your back pocket:

- Staggered acquisitions: Give your credit score breathing room by spacing out property purchases between applications

- Strategic financing timing: Plan your loan applications carefully to avoid stacking up hard inquiries

- Debt-to-income management: Make sure each new property brings in positive cash flow to balance out the additional debt

Building Business Credit While Protecting Personal Credit

Here's the deal: as your portfolio expands, separating business credit from personal credit becomes a game-changer. Here's why it matters:

- Entity protection: Setting up an LLC or corporation puts a wall between your personal and business finances

- Increased borrowing capacity: Business credit lines give you extra firepower beyond personal limits

- Reduced personal credit impact: Many business loans won't show up on your personal credit report

Ready to get started? Here's your action plan:

- Get an EIN (Employer Identification Number)

- Open dedicated business bank accounts and credit cards

- Set up vendor credit accounts with your suppliers

- Partner with lenders who report to business credit bureaus

Credit Reporting Tools That Work for Landlords

As a landlord, you've got some unique ways to boost your credit profile:

Rental Payment Reporting Look into services that report your tenants' on-time rent payments to credit bureaus. This shows lenders you know how to manage properties and generate reliable income.

Portfolio Performance Documentation Keep solid records of:

- Property cash flow statements

- Tenant payment histories

- Maintenance and improvement investments

- Appreciation documentation

The Straight Up Chicago Investor puts it well: successful scaling means "maintaining a sound financial base with good credit" as the foundation for your growth journey.

By putting these strategies into action, you'll keep your credit in great shape while growing your real estate portfolio. The result? Better eligibility for equity loans—even if your credit isn't perfect right now.

Preparing for Future Financing While Repairing Credit

Here's the good news: you don't have to wait until your credit is perfect to start preparing for your next investment. While you're building up that score, you can sharpen your market research skills and get familiar with your loan options. That way, when your credit hits the sweet spot, you're ready to move fast.

OfferMarket's platform gives you the tools you need during this preparation phase:

Market Analysis Tools: Browse property listings and dig into market data to spot promising investment opportunities. As Stanford's real estate industry research guide points out, "Financial data platforms that provide access to pricing data on global equities and futures are essential for informed investment decisions" [^1].

Instant Loan Quotes: Not quite ready to apply? No problem. Getting sample quotes now helps you understand current rates and terms. You'll know exactly what to aim for as you work toward that 720+ score for the best rates.

Educational Resources: OfferMarket has guides on the BRRRR loans (Buy, Rehab, Rent, Refinance, Repeat loans) and other proven products and strategies you can study while boosting your credit.

Property Valuation Tools: Like platforms such as HouseCanary, OfferMarket offers valuation tools that help you analyze potential deals and understand the equity potential in properties [^2].

Here's the bottom line: by using these resources now, you're building a solid investment strategy while repairing your credit. This two-pronged approach means you're not just improving your score—you're also becoming a smarter, more prepared investor. When you're ready to secure financing, you'll be positioned for success.

[^1]: Stanford University Libraries - Real Estate Industry Research Guide [^2]: Acme Real Estate - Market Analysis Tools

Strategic Timing for Equity Loan Applications

When it comes to equity loans, timing matters—especially if you've been working hard to boost your credit score. A little strategic planning can make a real difference in your approval chances and the loan terms you land.

Waiting Period After Credit Improvements

You've put in the work to improve your credit. Now, give it time to shine. Lenders want to see consistent positive habits, not just a quick fix.

"It's generally best to wait six months between credit card applications. That will prevent hard inquiries from making a significant negative impact on your [credit score]," according to Experian, one of the major credit bureaus .

If you're a real estate investor bouncing back from credit challenges, here's what to expect:

- After bankruptcy: 2-4 years depending on the loan program

- After foreclosure: 3-7 years for conventional loans

- After credit score improvements: At least 6 months of stability

Optimizing Credit Inquiries

Ready to apply? Be smart about how you shop around—your credit score will thank you:

"Complete all mortgage applications within a 14-day window to count as a single inquiry [and] avoid applying for other credit during your mortgage application process," advises Mortgage Solutions.

This "rate shopping" window is your friend. It lets you compare offers from different lenders without racking up multiple hard inquiries on your report.

Market Timing Considerations

Your personal credit timeline isn't the only factor. Keep an eye on broader market conditions too:

- Interest rate environment: Apply during stable or decreasing rate periods when possible

- Seasonal considerations: Some lenders are more actively seeking new business at certain times

- Property market conditions: Align your equity loan with favorable property valuation periods

For investors with borderline credit scores (around 680-700), patience can really pay off. Waiting for both credit improvement and favorable market conditions often results in significantly better loan terms over the life of the loan. Here's the bottom line: the difference between a 680 and 720+ credit score can mean tens of thousands of dollars in interest savings on a substantial equity loan.

One important detail to keep in mind: most lenders require credit documents to be dated within 60-90 days of closing. So timing your credit repair efforts with your application window is key to getting the best possible results.

How to Apply for an Equity Loan with OfferMarket

Applying for an equity loan with poor credit might feel overwhelming, but we've built our process at OfferMarket to be as simple and straightforward as possible. Here's your roadmap to navigating the application and approval process:

Quick Online Quote System

Our online quote system takes just one minute to complete, giving you preliminary loan terms without a lengthy application. This streamlined approach helps you:

- Understand potential loan options without a hard credit pull

- Compare different loan scenarios quickly

- Get immediate feedback on whether your situation might qualify

Not quite ready to apply? No problem. Submitting a practice deal can give you valuable insights into the lending process and help you prepare for when your credit score improves.

Human Review Process

Here's what makes OfferMarket different: our commitment to personalized service. Within one business day of submitting your online quote:

- A seasoned loan specialist reviews your submission

- They analyze your property details, credit situation, and investment goals

- You receive a follow-up call to discuss tailored options that fit your specific circumstances

This personal approach means you're getting real expertise applied to your unique situation—not just automated responses.

Benefits of Having Deal Details in the System

By submitting your deal information to OfferMarket's system early:

- Less back-and-forth: All relevant information is already captured upfront

- Faster processing: When you're ready to move, the groundwork is already laid

- Smarter recommendations: The more complete your information, the better guidance you'll receive

As industry experts note, "With streamlined mortgage processing, [lenders] can enhance transparency, foster trust, and expedite the path to securing financing" (Blooma). OfferMarket builds on this philosophy by creating an efficient system that works for you at every stage of your credit journey.

Even if your credit score isn't quite where it needs to be today, connecting with OfferMarket early puts you ahead of the game. Their team can guide you on credit improvement strategies while watching for opportunities that match your evolving financial profile.

Creating Your Credit Improvement Plan for Real Estate Success

Building a strategic credit improvement plan is key for real estate investors who want access to better financing options. This isn't about quick fixes—it's about taking a comprehensive approach that positions you for long-term success in real estate investing.

![**Task:** Create a timeline infographic showing the credit improvement journey for real estate investors, with milestones and expected outcomes at each stage.

**Visual Structure:** A horizontal timeline with four major milestone markers, each showing time period, actions to take, and expected credit score improvements. Use a road/path metaphor with progression from left to right.

**ASCII Layout Reference:**

```

+-------------------------------------------------------------------------+

| CREDIT IMPROVEMENT TIMELINE |

| Path to Investment-Ready Credit |

+-------------------------------------------------------------------------+

| |

| START ──→ [30-60 Days] ──→ [3-6 Months] ──→ [6-12 Months] ──→ READY |

| Quick Wins Building Significant 720+ |

| +10-20 pts Momentum Progress Score |

| +30-50 pts +50-100 pts |

| |

+-------------------------------------------------------------------------+

```

**Image Section Breakdown:**

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770498928055_qgdz9a.jpg?alt=media&token=09a3d27e-481d-4ba3-87dc-498fb0e78907)

Assessing Your Starting Point

Start by pulling your credit reports from all three major bureaus (Experian, Equifax, and TransUnion). Review these reports carefully for:

- Errors or discrepancies that need to be disputed

- Outstanding balances that need attention

- Payment history issues that are dragging down your score

- Overall credit utilization ratio

Setting Realistic Timeline Expectations

Here's the truth: credit improvement takes time, especially when you're aiming for investment-grade scores. Here's what to expect:

- 3-6 months: You'll see modest gains from fixing errors, lowering utilization, and building a solid payment track record

- 6-12 months: More meaningful progress as negative marks fade and your positive habits start paying off

- 12-24 months: The typical window needed to climb into excellent credit territory (720+) if you're starting from a challenging position

Bottom line: if there's anyone who needs strong credit, it's real estate investors. Building that foundation takes both patience and a smart game plan (Spark Rental).

Creating Milestone-Based Goals

Break your credit journey into bite-sized wins:

- First 30 days: Dispute all errors, automate your payments, get utilization under 30%

- 90-day mark: Lock in three straight months of on-time payments, evaluate your credit mix

- 6-month mark: Consider strategic new credit applications to diversify your profile

- 12-month mark: Connect with a lending pro to assess your investment readiness

Leveraging OfferMarket's Resources During Your Credit Journey

Put this time to work for you:

- Research and Education: Dive into OfferMarket's learning resources to understand different loan products and what it takes to qualify

- Practice Scenarios: Test-drive investment scenarios using OfferMarket's DSCR calculator tool to see how your credit tier impacts your terms

- Professional Guidance: After you submit an example deal into our OfferMarket's instant loan quote you can book a call with an OfferMarket specialist to map out a personalized plan for your credit situation

- Market Research: Use OfferMarket's property listings to research markets and identify potential future investment opportunities

Here's something every investor should know: according to the National Association of Realtors, "Credit scores play a big role in determining whether you'll qualify for a loan." Understanding how to systematically improve yours is a game-changer for your investment journey (NAR).

Here's the good news: by creating a structured plan with clear milestones, you can strengthen your credit profile while building your real estate knowledge at the same time. That way, when your credit is ready to go, you'll have the confidence and expertise to make smart investment moves.