*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

What is a SFR?

Last updated: October 15, 2025

If you're new to real estate investing, you've probably come across enough acronyms to make your head spin! One of the most common ones is SFR.

So, what is a SFR? Simply put, SFR stands for "Single Family Rental." It's a type of investment property that's designed for renting out to tenants, typically families or small households, and it encompasses a range of residential structures from one to four units. This makes it an accessible entry point for beginners looking to build wealth through real estate.

As a real estate investing platform well-versed in educating beginners about single family rentals, we'll be sure to cover all the basics to help you build a solid foundation to build up your real estate investing expertise. We'll cover what an SFR really means, the different types included under this umbrella, why it's a smart choice for new investors, how to get started, financing options, management tips, potential risks, and more. By the end of this article, you'll know a lot about SFRs and be able to decide if SFR investing is right for you.

Understanding the Basics of SFR

At its core, a Single Family Rental (SFR) refers to residential properties that are rented out to tenants rather than occupied by the owner. The term "single family" might conjure images of a standalone house with a white picket fence, but in the investing world, it's a broader definition. According to industry standards, SFRs include properties with 1 to 4 units. This classification is important because it affects everything from financing to tax implications.

Why the 1-4 unit cutoff? In the United States, properties with up to four units are often treated similarly to single-family homes for lending purposes. For example, conventional mortgages like those backed by Fannie Mae or Freddie Mac can be used for properties with up to 4 units, making them more accessible for beginners than larger multifamily buildings, which require commercial loans and higher down payments.

SFRs are part of the broader rental market, which has seen significant growth. As of 2025, with housing affordability challenges persisting, more people are renting longer, boosting demand for quality rental homes. Investing in SFRs allows you to generate passive income through rent, benefit from property appreciation, and enjoy tax advantages like depreciation deductions.

But SFR isn't just about buying any house and renting it out. It's a strategic approach to real estate investing that focuses on properties appealing to long-term tenants. These properties often provide stability because families tend to stay longer than in apartments, reducing turnover costs.

Types of SFR Properties

Now, let's get into the specifics of what qualifies as an SFR. As mentioned, it includes 1-4 unit properties. Here's a breakdown of the common types, each with its own pros and cons for investors.

Detached Single Family Home

This is the quintessential SFR: a standalone house on its own lot, not attached to any other structures. Think of a suburban home with a yard, garage, and plenty of privacy. These are popular with families who want space for kids and pets. As an investor, they're straightforward to manage since there's only one unit, but maintenance like lawn care falls on you or the tenant (someone's got to take care of it and that person will be designated in the lease agreement).

Townhome

Townhomes are attached homes sharing walls with neighbors, often in a row and therefore commonly referred to as "row homes". Each unit has its own entrance and might include a small yard or patio. They're like a hybrid between a house and a condo. For investors, townhomes can be more affordable to purchase in urban areas and attract young professionals or small families. However, homeowners' associations (HOAs) might impose fees and rules.

Condo (Condominium)

A condo is a unit within a larger building or complex where you own the interior space, but common areas like hallways, pools, and gyms are shared. Condos are great for low-maintenance investing since the HOA handles exterior upkeep. They're ideal for renters in cities who prioritize amenities over yard space. Watch out for high HOA fees, though, which can eat into profits.

Duplex

A duplex is a single building divided into two separate units, often side-by-side or one above the other. This steps into small multifamily territory, allowing you to rent both units for double the income potential. Beginners love duplexes because you can live in one unit (house hacking) while renting the other to cover your mortgage.

Triplex

A triplex is similar to a duplex but with three units. These could be in a single structure or attached. Triplexes offer even more cash flow diversification—one vacancy doesn't hurt as much. They're still classified as residential for financing, but management involves more tenants.

Quadplex (or Fourplex)

The quadplex is the upper end of SFRs, with four units in one building. This maximizes rental income on a single property while keeping it under the residential loan threshold. Quadplexes are excellent for scaling your portfolio quickly but require stronger management skills.

Each type has unique appeal depending on your market. In suburban areas, detached homes might dominate, while urban investors lean toward condos or multiplexes for higher density.

Benefits of Investing in SFRs

Why choose SFRs over other real estate investments like commercial properties or large apartments? For beginners, the benefits are compelling.

First, accessibility. You don't need millions to start. Many SFRs can be bought with conventional mortgages requiring as little as 3-5% down if you plan to live in one unit. This low barrier contrasts with multifamily properties over four units, which often demand 20-25% down.

Second, steady cash flow. Rents from SFRs are typically higher per unit than apartments because tenants value the privacy and space. Families often sign longer leases, reducing vacancy rates. In 2025, with remote work persisting, demand for spacious rentals remains strong.

Third, appreciation potential. SFRs in growing areas can increase in value over time. Unlike stocks, you control improvements—like updating kitchens—to boost worth.

Fourth, tax advantages. You can deduct mortgage interest, property taxes, insurance, and depreciation. Plus, strategies like 1031 exchanges allow deferring capital gains taxes when selling.

Fifth, diversification. Even within SFRs, mixing types (e.g., a duplex and a condo) spreads risk. If one market softens, others might thrive.

Finally, control. As the owner, you decide on rents, tenants, and upgrades, unlike REITs where you're passive.

Of course, these benefits shine brightest with good due diligence. Always analyze cap rates (net income divided by property value) and cash-on-cash returns.

How to Get Started with SFR Investing

Ready to jump in? Here's a beginner-friendly roadmap.

Educate Yourself: Read books like "The Book on Rental Property Investing" by Brandon Turner or join online communities like BiggerPockets. Understand key metrics: Cash-On-Cash-Return, ROI, NOI (net operating income), and DTI (debt-to-income ratio).

Assess Your Finances: Check your credit score (aim for 620+), save for down payment and reserves (6 months' expenses), and get pre-approved for a loan.

Choose a Market: Look for areas with job growth, low crime, and strong schools. Tools like Zillow or Redfin provide rental data. Consider emerging markets like the Sun Belt for appreciation.

Find Properties: Use MLS listings, real estate agents specializing in investments, or platforms like Roofstock for turnkey rentals. Drive for dollars—scout neighborhoods for "For Sale" signs.

Analyze Deals: Run the numbers. Calculate potential rent minus expenses (mortgage, taxes, insurance, maintenance—budget 1% of property value annually for repairs). Aim for the 1% rule: monthly rent at least 1% of purchase price.

Make an Offer: Work with an agent to negotiate. Include inspections to uncover issues.

Close and Rent: After closing, market the property on sites like Zillow Rental Manager. Screen tenants thoroughly—check credit, references, and income (3x rent).

Start small, perhaps with a duplex for house hacking, to learn without overwhelming risk.

Financing Your SFR Investment

Financing is key for leverage. Options include:

Conventional Loans: For 1-4 units, with 15-30 year terms. Rates as of 2025 hover around 6-7%.

FHA Loans: Great for first-timers, requiring 3.5% down, but with mortgage insurance.

VA Loans: 0% down payment for veterans. These loans are assumable so if you are not a veteran, you may still be able to structure a purchase where you assume the seller's VA loan...

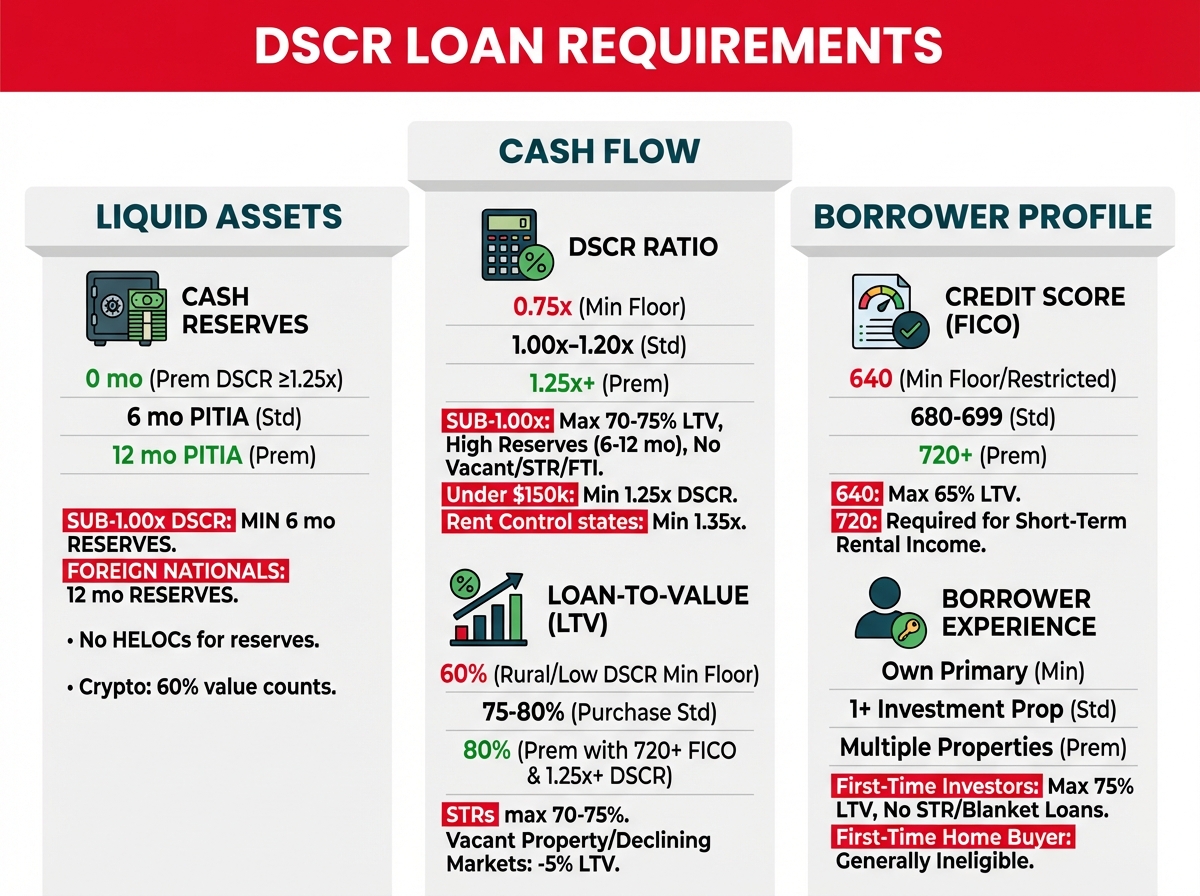

DSCR Loans: 30 year fixed or adjustable rate mortgages designed for rental property investors. No income or employment verification -- these loans are based on your credit score, liquidity and the cash flow of the property.

Hard Money Loans: Short-term, interest-only loans for properties that need to be rehabbed. Also known as a Fix and Flip loan.

HELOCs: Use equity from your primary home to purchase and/or rehab an investment property.

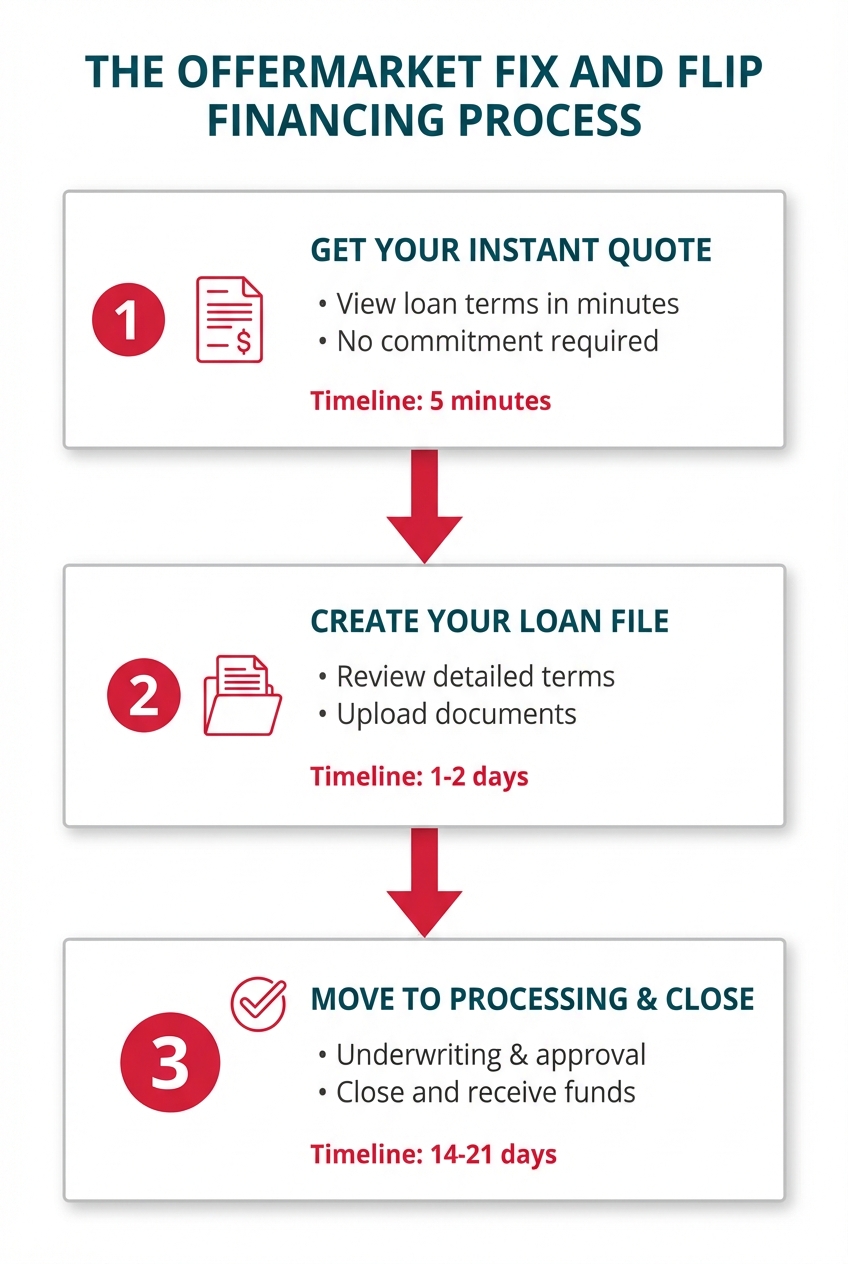

Shop the most competitive capital providers in one place and speak with an SFR financing expert with OfferMarket. If you're looking to finance multiple properties, particularly those with values below $100,000, consider a portfolio loan.

Managing Your SFR

Once owned, management ensures success. Options: self-manage for control (use apps like TenantCloud) or hire property managers (8-10% of rent). Key tasks: tenant screening, rent collection, maintenance requests, and evictions if needed. Build a team—contractors, lawyers, accountants.

Risks and Challenges

No investment is risk-free. SFRs face vacancy, bad tenants, market downturns, and unexpected repairs (e.g., roof replacement costing $10k). Rising interest rates can squeeze profits. Mitigate with insurance, emergency funds, and diversification.

In volatile economies, like post-2020 shifts, focus on resilient markets.

Conclusion

SFR investing offers a proven path to financial freedom for beginners. By understanding what an SFR is—from detached homes to quadplexes—you're equipped to start. Remember, success comes from education, smart analysis, and patience. Consult professionals and take that first step. Your future portfolio awaits!

Access, Finance and Insure SFRs with OfferMarket

OfferMarket is a real estate investing platform focused on serving rental property investors, small builders and flippers. We focus exclusively on 1-4 unit residential properties in non-rural markets.

We hope you will accept our invitation to join us and over 20,000 registered members.

Membership is entirely free and comes with the following benefits:

🏚️ Off market properties 💰 Private lending ☂️ Landlord insurance rate shopping 💡 Market insights

Our mission is to help you build wealth through real estate and we look forward to contributing to your success!