*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

2nd Mortgage: Everything You Need to Know in 2026

What is a Second Mortgage? A Complete Guide for Landlords and Real Estate Investors

Looking to tap into your property's equity to fund your next investment? A second mortgage could be the key to unlocking that capital without selling your assets. Whether you're eyeing a new rental property, planning major renovations, or implementing the BRRRR strategy, understanding second mortgages is essential for growing your real estate portfolio.

In this comprehensive guide, we'll break down everything you need to know about second mortgages—from how they work to when they make sense for your investment strategy. Let's dive in.

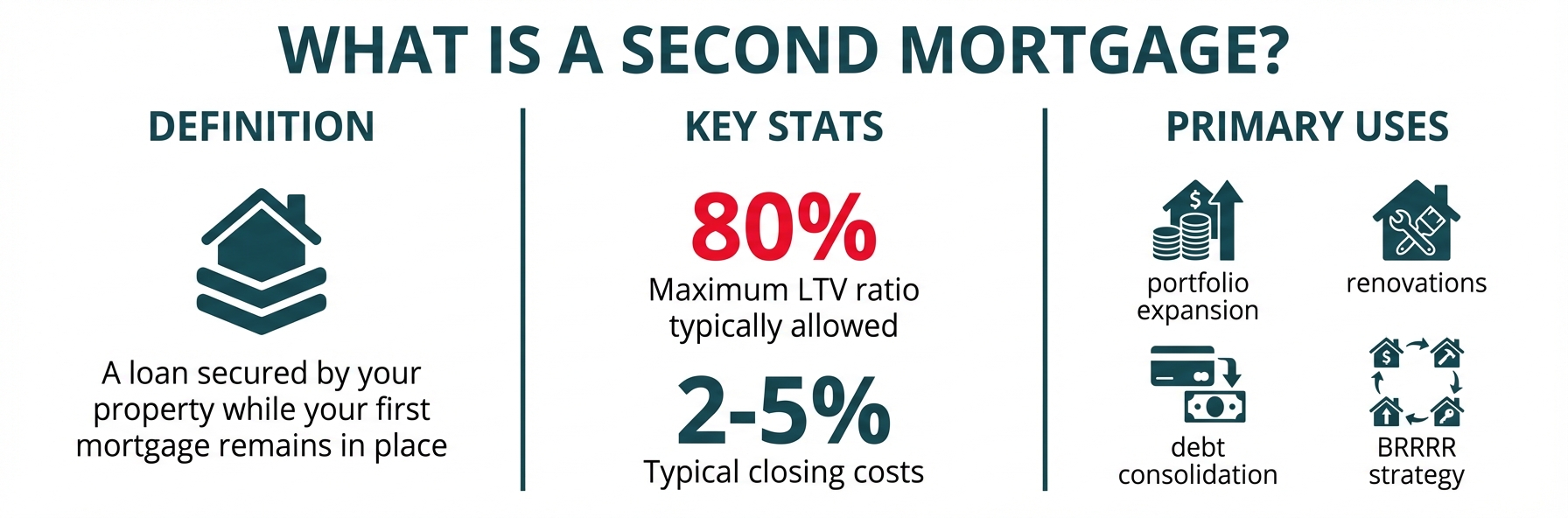

What is a Second Mortgage?

A second mortgage, also known as a junior lien, is a loan you take out using your house as collateral while you still have another loan secured by your house (your primary mortgage). Unlike your primary mortgage which was used to purchase your home, a second mortgage allows you to tap into the equity you've built up in your property.

According to the Consumer Financial Protection Bureau (CFPB), "A second mortgage or junior-lien is a loan you take out using your house as collateral while you still have another loan secured by your house."

Here's the key thing to understand: a second mortgage sits behind your first mortgage in line. If a foreclosure happens, the primary mortgage lender gets paid first from the home sale proceeds, and the second mortgage lender receives whatever's left over.

You'll typically encounter two types of second mortgages:

Home Equity Loans (HELOANs): These give you a lump sum upfront that you pay back over a set term with a fixed interest rate. Nice and predictable.

Home Equity Lines of Credit (HELOCs): Think of these like a credit card secured by your home. You get access to a revolving credit line you can draw from as needed during a specified period.

For savvy real estate investors, second mortgages can be powerful tools. They can fund home improvements, consolidate debt, cover education costs, or—here's where it gets exciting—provide capital for purchasing additional properties or renovating existing ones to boost rental income.

How much can you borrow? That depends on your home equity—the difference between your home's current market value and what you still owe on your primary mortgage.

How Does a Second Mortgage Work?

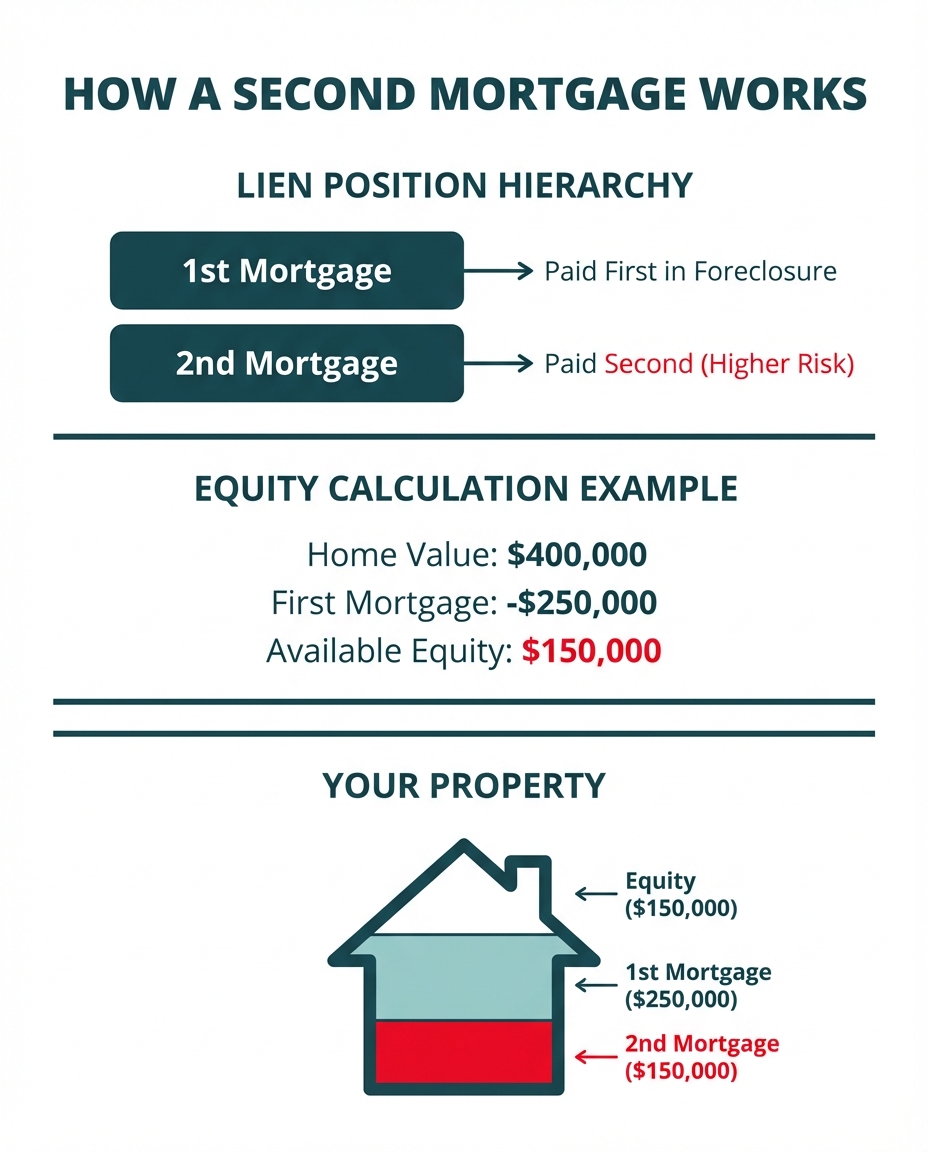

A second mortgage operates as an additional loan taken out against your property while your primary mortgage remains in place. Unlike your first mortgage which has priority claim on your property, a second mortgage holds a subordinate position in what's known as "lien position."

Lien Position and Priority

Here's the deal: when you take out a second mortgage, it becomes the second lien on your property. What does this mean for you? If things go south and your home ends up in foreclosure, the primary mortgage lender gets paid first from the sale proceeds. The second mortgage lender only receives payment if there's money left over. This added risk for second mortgage lenders is exactly why these loans typically come with higher interest rates.

Home Equity as Collateral

Your home equity is the engine that powers a second mortgage—it's simply the difference between your home's current market value and what you still owe on your primary mortgage. This equity becomes your collateral, giving the lender the security they need to approve your loan.

Let's break it down: if your home is worth $400,000 and you owe $250,000 on your primary mortgage, you're sitting on $150,000 in equity that could potentially be tapped through a second mortgage.

Loan-to-Value Considerations

Lenders take a close look at your loan-to-value (LTV) ratio when you apply for a second mortgage. To calculate your LTV, simply divide your total mortgage debt (both first and second mortgages combined) by your home's appraised value.

Most lenders want to see an LTV ratio of 80% or less for second mortgages, though some may stretch higher based on your credit profile and overall financial picture. According to data from the Federal Housing Finance Agency, "The average loan size of closed-end second mortgages is nearly half of the average loan size of home equity lines of credit (HELOCs)" FHFA.

Interest Rates and Costs

Expect to pay more for a second mortgage compared to your primary loan. Recent data shows that "rates for second homes typically run 0.25% to 0.50% higher than primary home loans, and you'll usually face stricter eligibility requirements" [Experian](https://www. experian.com/blogs/ask-experian/second-home-mortgage-rates/). This rate premium reflects the increased risk associated with second-position loans. Keep in mind that investor oriented loans that don't require W2 documentation will run at an even higher interest rate premium of 1%-2%.

Repayment Structures

Second mortgages come in two main forms with different repayment structures:

Home Equity Loans (HELOANs): Think of these as your straightforward option. You get a lump sum upfront with a fixed interest rate and predictable monthly payments over a set term, typically 5-30 years. No surprises here.

Home Equity Lines of Credit (HELOCs): These work more like a credit card for your home equity. You get a revolving credit line to tap into as needed during a draw period (usually 10 years), then shift into repayment mode.

Closing Process

The closing process for a second mortgage mirrors what you experienced with your primary mortgage:

- Property appraisal to nail down current market value

- Credit and income verification

- Title search to confirm property ownership and existing liens

- Closing costs (plan for 2-5% of the loan amount)

- Signing final loan documents

Once you close, your funds either arrive as a lump sum (HELOAN) or become available as a credit line (HELOC). Either way, you're putting your home's equity to work while continuing to build ownership through your primary mortgage payments.

Home Equity Loans (HELOANs): The Lump Sum Option

A Home Equity Loan (HELOAN) delivers a one-time lump sum payment based on your property's equity. For landlords and real estate investors eyeing specific projects, this financing option offers some compelling advantages worth understanding.

Structure and Terms

HELOANs come with a fixed interest rate—your rate stays locked in for the entire loan term. Based on current market data, home equity loan rates typically fall between 5.49% and 10.75%, with averages varying by term length:

- 10-year home equity loans average around 8.10%

- 15-year home equity loans have slightly different rates

[The Wall Street Journal](https://www. wsj.com/buyside/personal-finance/mortgage/home-equity-loan-rates) reports that rates can vary significantly based on your credit profile, loan-to-value ratio, and lender policies.

Predictable Payment Schedule

Here's something you'll love about a HELOAN: your monthly payment stays the same, month after month. Unlike variable-rate products that keep you guessing, you'll know exactly what you owe for the entire loan term—whether that's 5 years or 30. This kind of predictability is gold for landlords and investors who need to forecast cash flows and plan their budgets with confidence.

Strategic Uses for Real Estate Investors

So where does a HELOAN really shine for landlords and real estate investors? Let's break it down:

Property Renovations and Improvements: Got a major renovation project with a clear budget? The lump sum format is perfect for kitchen remodels, bathroom upgrades, or roof replacements—the kind of improvements that justify higher rents.

Portfolio Expansion: Ready to snag another investment property? A HELOAN can cover your down payment and help you grow your portfolio, especially when you've already got your eye on a specific deal.

Capital-Intensive Repairs: When your rental needs big repairs that blow past your normal maintenance budget, a HELOAN delivers the funds you need without throwing off your regular cash flow.

Debt Consolidation: Rolling higher-interest debts from your investment properties into one fixed payment can boost your cash flow and potentially save you money on interest.

According to BMO, fixed-rate home equity loans can start as low as 8.74% APR for qualified borrowers—potentially more affordable than other financing routes for major investments.

Advantages for Long-Term Planning

If you're a real estate investor who values stability and predictability, the fixed nature of HELOANs offers some real advantages:

- Protection from interest rate spikes when markets get choppy

- Simpler budgeting and financial planning for property improvements

- Potential tax benefits on interest paid for property improvements (always check with your tax advisor)

- A clear repayment timeline that fits your investment strategy

Using the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat)? A HELOAN can fund your rehabilitation phase, and that fixed payment structure lets you calculate exactly when your property will start generating positive cash flow.

Understanding HELOCs: A Flexible Second Mortgage Option

A Home Equity Line of Credit (HELOC) is a smart financing tool that gives you revolving credit backed by your home equity. Think of it as a credit card secured by your property. Unlike a HELOAN, which hands you a lump sum upfront, a HELOC lets you tap into funds as you need them.

Draw Period vs. Repayment Period

HELOCs work in two phases, and understanding both is key to using this tool effectively:

Draw Period: This is your access window, typically lasting 5-10 years. During this time, you can borrow up to your approved limit, pay it back, and borrow again. Most lenders only ask for interest payments here, but you can chip away at the principal too if you choose.

"The HELOC draw period is usually 10 years, where you can withdraw funds up to your limit," according to Citizens Bank.

Repayment Period: Once the draw period ends, you shift into repayment mode for the next 10-20 years. The borrowing window closes, and now you're paying back both principal and interest.

"All HELOCs have a 'draw period' (typically 10-15 years) and a 'repayment period' (typically up to 20 years)," notes Credit Union of Southern California.

Variable Interest Rates and Payment Structure

Here's something important to know: most HELOCs come with variable interest rates tied to benchmarks like the prime rate. Your payments can shift as rates move up or down. The upside? HELOCs often start with lower rates than fixed-rate options.

During the draw period, you're typically only covering interest on what you've borrowed. When repayment kicks in, expect your payments to jump as you start tackling the principal.

Benefits for Landlords and Real Estate Investors

HELOCs can be a powerful tool for landlords ready to expand their portfolios:

Flexible Access to Capital: Draw funds only when you need them for property acquisitions or renovations, and you'll only pay interest on what you actually use.

Cash Flow Management: Keep more money in your pocket during the draw period with interest-only payments, freeing up cash for other investment opportunities.

Renovation Funding: Tap into funds for property improvements that boost rental income and property values—it's that simple.

Emergency Reserves: Have a safety net ready for unexpected property repairs without tying up large amounts of cash.

Portfolio Expansion: Put the equity in your existing properties to work by using it for down payments on new investments, helping you grow your portfolio faster.

For landlords using the BRRRR strategy (Buy, Rehabilitate, Rent, Refinance, Repeat), a HELOC can be your go-to funding source for property acquisitions and renovations before you refinance into a permanent mortgage.

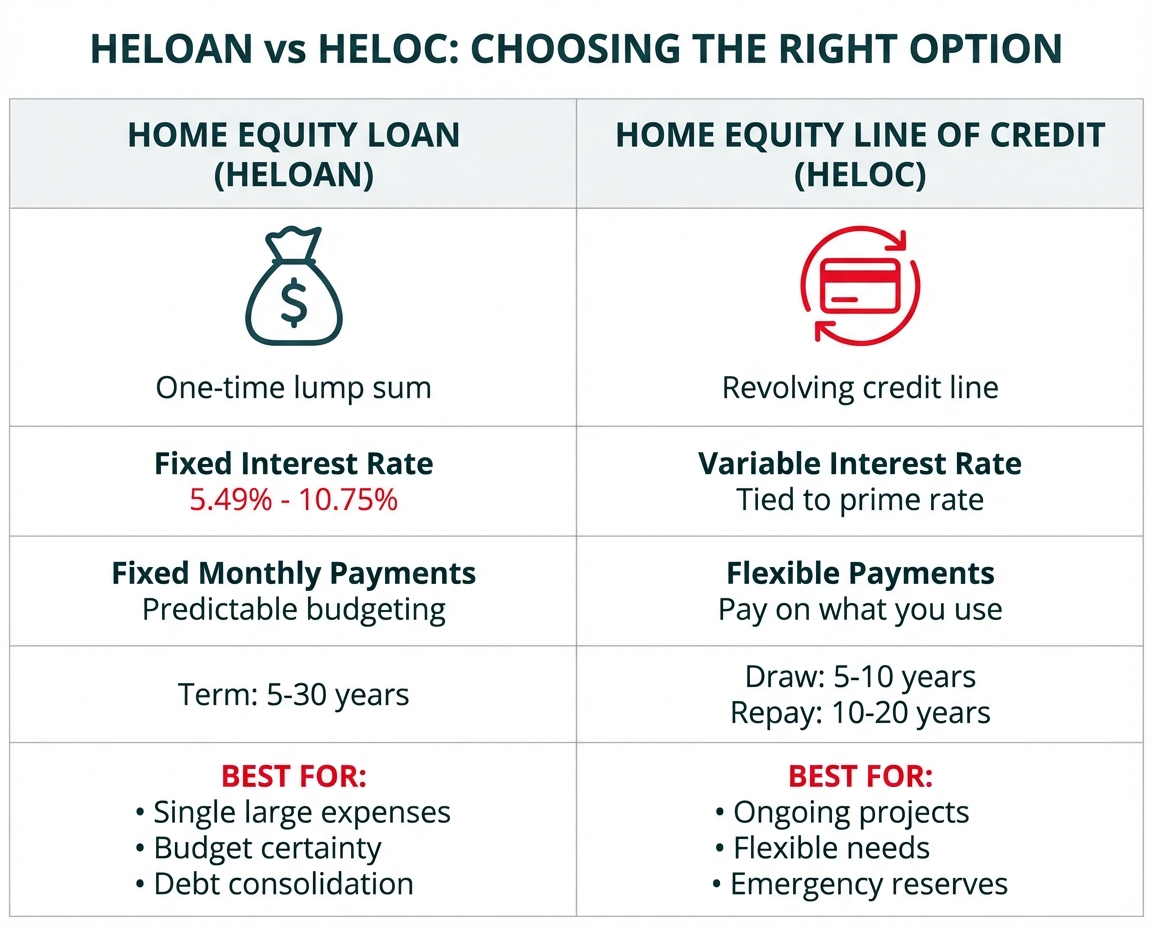

Types of Second Mortgages: HELOANs vs. HELOCs

When you're looking at second mortgage options, you'll find two main products: Home Equity Loans (HELOANs) and Home Equity Lines of Credit (HELOCs). Knowing the differences between these two can help you choose the right fit for your real estate investment goals.

Side-by-Side Comparison

| Feature | Home Equity Loan (HELOAN) | Home Equity Line of Credit (HELOC) |

|---|---|---|

| Disbursement | One-time lump sum | Revolving line of credit with draw period |

| Interest Rate | Fixed | Usually variable, tied to prime rate |

| Payment Structure | Fixed monthly payments | Variable payments based on amount borrowed |

| Term Length | Typically 5-30 years | 5-10 year draw period + 10-20 year repayment period |

| Best For | One-time expenses | Ongoing or unpredictable expenses |

Key Differences in Structure

A Home Equity Loan gives you a one-time lump sum with a fixed interest rate and predictable monthly payments for the life of the loan. This structure makes it similar to your primary mortgage but in second position.

In contrast, a HELOC functions more like a credit card secured by your property. As Competitive Mortgage. explains, "The biggest difference between a home equity loan and a HELOC is that a HELOC provides a revolving line of credit, instead of a one-time pay out". With a HELOC, you draw funds when you need them during the draw period (typically 5-10 years), and you only pay interest on what you've actually used.

Interest Rate Considerations

HELOANs typically come with fixed interest rates, giving you predictable monthly payments. This is a real advantage when rates are climbing—your costs stay locked in for the entire loan term.

HELOCs usually carry variable interest rates tied to the prime rate, so your payments can shift over time. You might enjoy lower rates at the start, but keep in mind this adds some uncertainty to your long-term budget planning.

Best Uses for Each Product

According to financial experts at WSJ Buyside, the right choice comes down to your specific goals and situation:

HELOANs are ideal for: Property renovations with a clear price tag, paying off high-interest debt, or making a single big purchase like another investment property.

HELOCs work better for: Ongoing renovation projects, building an emergency fund for your rental properties, or keeping capital ready for future investment opportunities.

"A HELOC makes sense when you need flexibility or anticipate multiple expenses over time," notes financial experts.

Suitability for Real Estate Investors

For landlords and real estate investors, the choice often comes down to your investment strategy:

Choose a HELOAN if you're tackling a specific renovation project with a defined budget to upgrade a rental property.

Opt for a HELOC if you want ready access to funds for unexpected property repairs, quick-close opportunities on new properties, or if you're implementing a BRRRR (Buy, Rehab, Rent, Refinance, Repeat) strategy where timing and flexibility matter.

Real estate investors on forums like Reddit frequently recommend: "Absolutely get the HELOC. It doesn't hurt you at all having a line of credit unless you're using the money". This gives you the freedom to move fast when the right investment opportunity lands in your lap.

Knowing these differences puts you in the driver's seat to choose the second mortgage product that fits your financial goals and investment game plan.

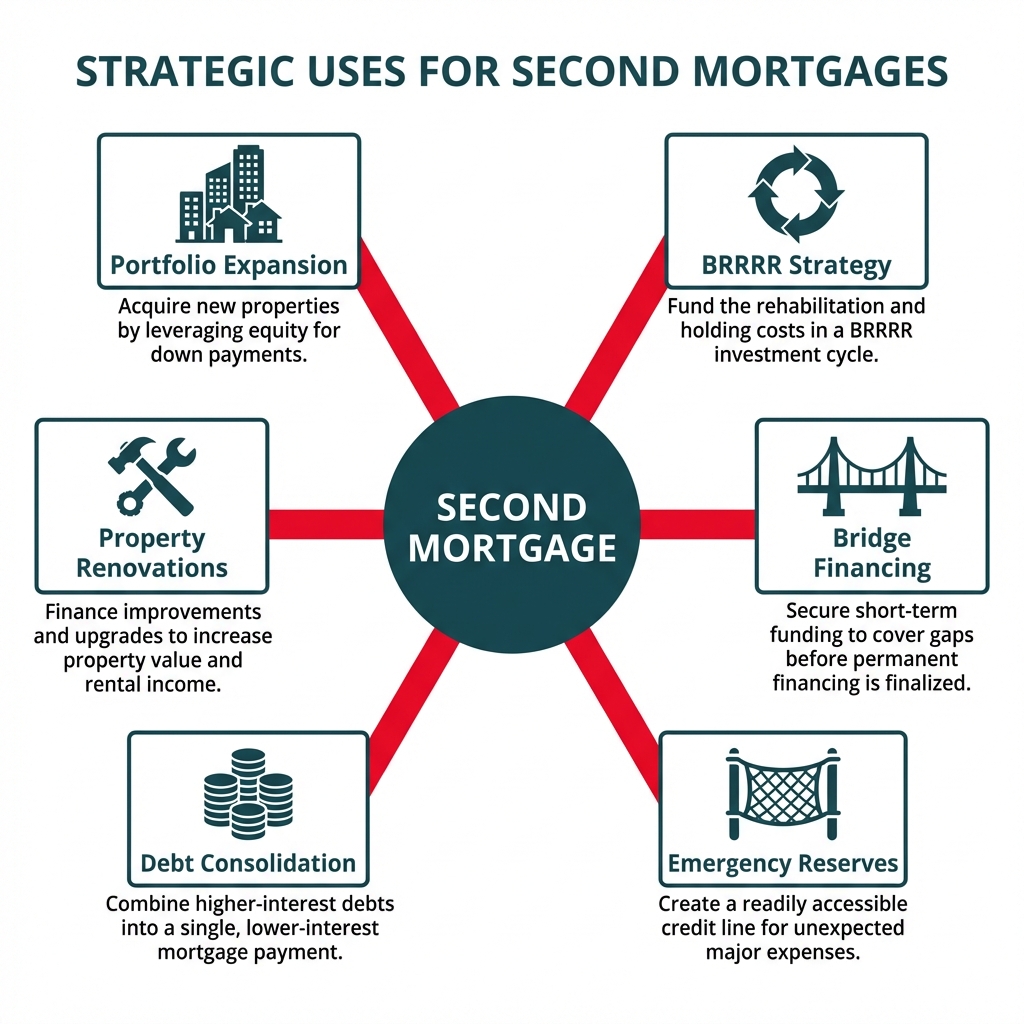

When Should You Consider a Second Mortgage?

Second mortgages can be game-changers for real estate investors and landlords ready to expand their portfolios or upgrade existing properties. Knowing when to tap into this financing option can be the key to moving from standing still to strategic growth.

Funding Additional Property Acquisitions

One of the top reasons investors look at second mortgages is to unlock capital for new property purchases. When you've built solid equity in a property you already own, a second mortgage can give you the down payment you need for your next investment.

This strategy really shines when you spot a time-sensitive deal but don't have cash on hand. Instead of watching a great opportunity slip away, a second mortgage lets you put your existing assets to work and jump on promising deals. However keep in mind that not all real estate investor lenders allow 2nd mortgage proceeds as the source of down payment funds for your next acquisition. From our experience, you should always ask your lender up front if the current product's guidelines allow for 2nd mortgage proceeds to be used for funding the down payment for the current deal.

If your lender understands the exact sources of funds for your acquisition early in the loan origination process, they may be able to put you in the correct product with guidelines that do allow 2nd mortgage proceeds to be used for funding the downpayment thus avoiding to have to do some right before closing, extending timelines and causing unnecessary stress.

Renovating Properties to Increase Value and Rents

Property upgrades are another smart way to put second mortgage funds to work. By improving your existing properties, you can:

- Create better living spaces for your tenants

- Command higher rental rates

- Boost your property's overall value

- Tackle maintenance issues before they turn into expensive headaches

According to our research, strategic renovations are a cornerstone of successful real estate investing, especially when you're using approaches like the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat), where smart improvements directly translate to higher valuations and stronger cash flow.

BRRRR Strategy Implementation

Second mortgages can be a smart tool in your BRRRR investment playbook, especially when you're navigating those in-between phases. Most BRRRR strategies wrap up with a cash-out refinance on your primary mortgage, but a second mortgage can step in to bridge the gap when timing matters.

Per OfferMarket's detailed guide on BRRRR strategy "With the BRRRR Method, you use a cash-out refinance on your investment property to purchase another distressed property to flip and rent out." That said, a second mortgage can give you the capital you need to get the ball rolling, particularly when the right opportunity comes a long and you need additional liquidity.

Bridge Financing Between Deals

Let's face it—real estate investing doesn't always follow a neat timeline. Your capital might be locked up in one project when the next great opportunity knocks. That's where a second mortgage shines as bridge financing, giving you the cash flow to keep your investment momentum going strong.

This strategy lets you grow your portfolio without waiting to complete the full BRRRR cycle on every single property before jumping on your next deal.

Consolidating Higher-Interest Debt

If you're carrying high-interest debt from property improvements or acquisitions—think credit cards or personal loans—a second mortgage typically offers much better rates. Rolling that expensive debt into a lower-interest second mortgage can boost your monthly cash flow and cut down on total interest paid.

Using a second mortgage strategically for debt consolidation helps you strengthen your financial foundation while keeping your valuable real estate assets right where they belong—in your portfolio.

Before pulling the trigger on a second mortgage for any of these strategies, make sure the math works in your favor. Your expected investment returns should clearly outpace the costs of the second mortgage, including interest, closing costs, and any potential risks along the way.

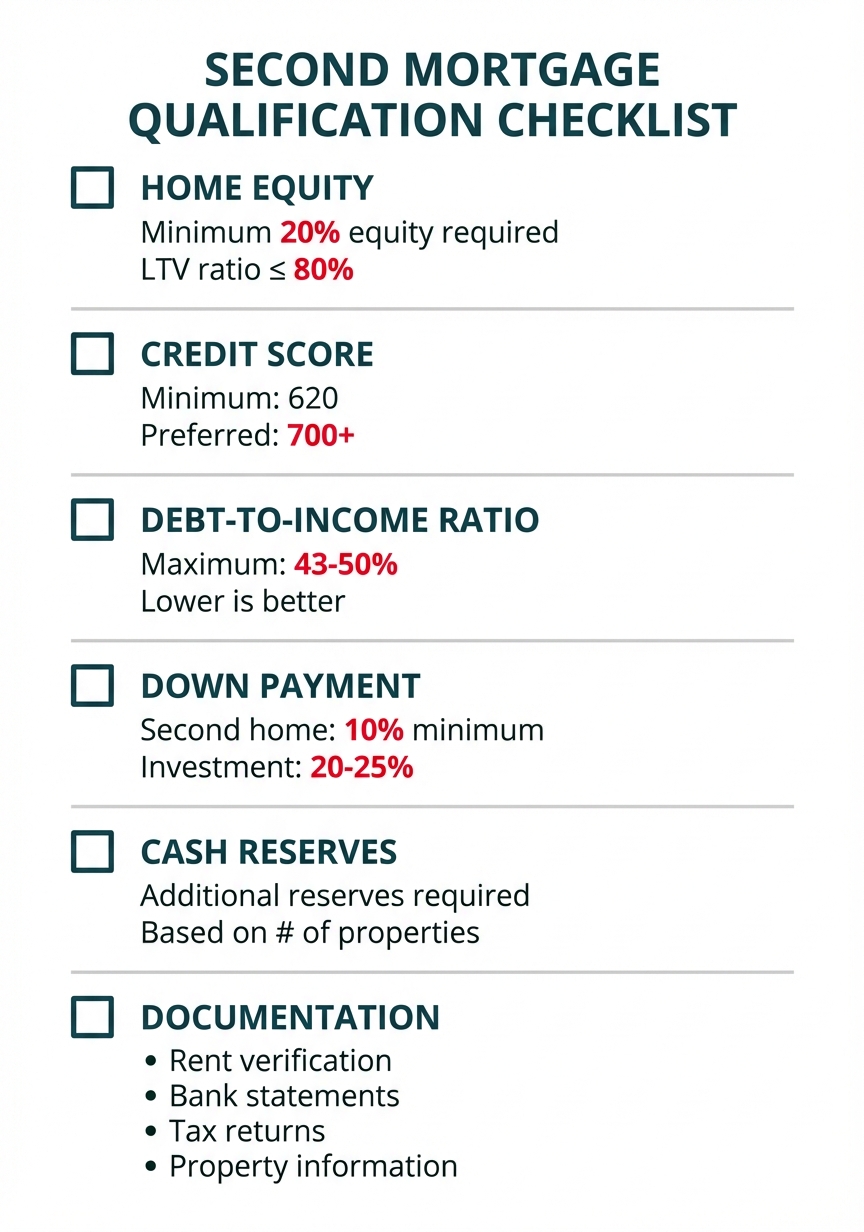

How to Qualify for a Second Mortgage

Getting approved for a second mortgage means showing lenders you're ready to take on this new financial commitment. Whether you're a landlord ready to grow your investment portfolio or a homeowner planning some upgrades, let's walk through exactly what you'll need to qualify.

Equity Requirements

Here's the deal: lenders want to see that you've built up solid equity in your primary home before they'll greenlight a second mortgage. The magic number? At least 20% equity, which translates to a loan-to-value (LTV) ratio of 80% or less. Think of this equity as your financial cushion—it gives lenders confidence that their investment is protected.

According to SmartAsset, "You will likely need at least 20% equity in your primary residence" to qualify for a second mortgage for investment purposes .

Credit Score Thresholds

Your credit score matters—a lot. While you might find lenders willing to work with scores as low as 620, here's a pro tip: the higher your score, the better your rates and approval odds.

APMortgage notes that "Lenders may consider applicants with a score of 620 or higher, though a score above 700 is preferable when qualifying for a second home mortgage" .

Debt-to-Income Ratio Considerations

Lenders want to make sure you can comfortably handle another mortgage payment. The rule of thumb? Keep your total monthly debt payments—including both mortgages—at or below 43-50% of your gross monthly income.

As discussed on Reddit's Real Estate Advice forum, "Is that number [total monthly debt payments] less than 50% of your gross monthly income? If it's more than 50% you may have a hard time qualifying for a second home loan" [](https://www. reddit.com/r/RealEstateAdvice/comments/1exoxkj/how_much_do_you_actually_have_to_make_to_be/).

Down Payment Requirements

Here's the deal with second mortgages: they typically require higher down payments than your primary residence. For conventional loans, plan on putting at least 10% down for a second home, and potentially more for investment properties.

According to Chase, "To buy a second home, you may need a minimum down payment higher than you'd pay for a primary residence, depending on the lender's requirements" .

Reserve Requirements

Lenders want to know you've got a financial cushion if things get tight. For second homes and investment properties, you'll need additional reserves based on how many financed properties you already own.

Fannie Mae's Selling Guide states that "Additional reserve requirements apply to second home and investment properties based on the number of financed properties the borrower will have".

Documentation Needed

Get ready to gather your paperwork. Here's what you'll need for real estate investor oriented 2nd mortgages on their investment properties:

- Bank statements

- Asset verification

- Property information

- Existing mortgage details

- Rental income documentation

Investor vs. Owner-Occupant Requirements

If you're buying as an investor rather than an owner-occupant, expect tougher requirements. Here's what investors typically face:

- Higher down payment requirements (20-25%)

- Higher interest rates

- More stringent credit score thresholds

- Lower maximum LTV ratios

- Additional reserve requirements

At OfferMarket, we specialize in second mortgage solutions built specifically for landlords and investors like you. We offer competitive rates and terms designed for real estate investment, plus a streamlined application process that helps you qualify without the usual headaches.

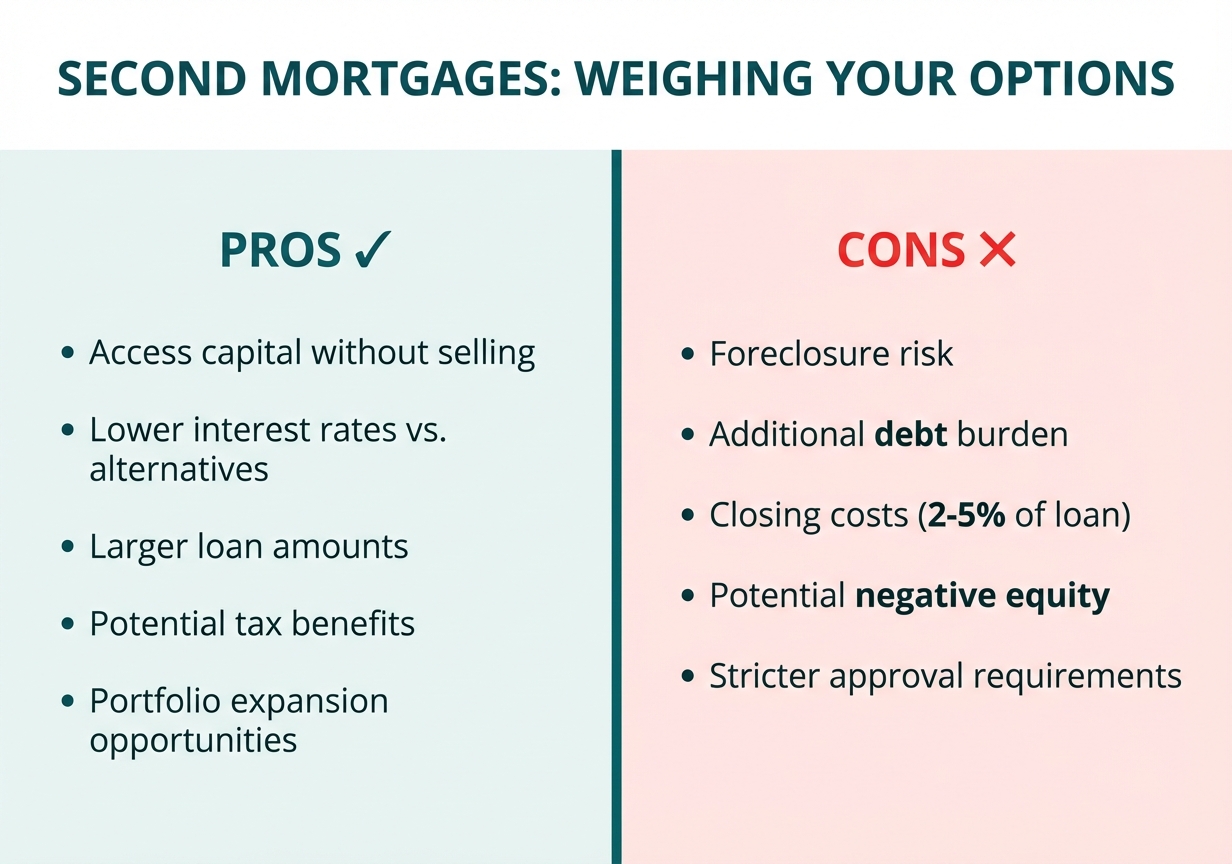

Pros and Cons of a Second Mortgage

Pros of a Second Mortgage

Access to Capital Without Selling Properties: Here's the deal—a second mortgage lets you unlock the equity you've built up without having to part ways with your property. For landlords and real estate investors like you, this means you can keep your portfolio intact while still putting that hard-earned equity to work.

Lower Interest Rates: Good news for your bottom line: second mortgages typically come with much lower interest rates than unsecured loans, credit cards, or personal loans. Why? Because your property backs the loan, which means less risk for the lender—and better rates for you.

Larger Loan Amounts: Since second mortgages are tied to your home equity, you're often looking at access to bigger sums than other financing options can offer. Depending on how much equity you've built, we're talking tens or even hundreds of thousands of dollars to fuel your next move.

Potential Tax Benefits: Here's something worth noting: in certain cases, the interest you pay on a second mortgage may be tax-deductible. The IRS says mortgage interest on a second residence you use personally can be deductible if it meets the same requirements as your primary home . And for rental properties? That second mortgage interest is typically fully deductible as a business expense. (Pro tip: always check with a tax professional for guidance tailored to your specific situation.)

Portfolio Expansion: For investors ready to grow, a second mortgage can be your launchpad. Use that capital to snag additional properties or upgrade your current ones to boost rental income and build long-term wealth.

Cons of a Second Mortgage

Risk of Foreclosure: Here's the reality check—your home is on the line. If payments slip through the cracks, foreclosure becomes a real possibility, and you could lose the roof over your head.

Additional Debt Burden: A second mortgage means more debt on your plate. Your monthly obligations grow, and if your income takes a hit, your finances could feel the squeeze.

Closing Costs and Fees: Just like your first mortgage, expect closing costs—application fees, appraisal fees, title searches, and possibly points. Budget for 2-5% of your loan amount to cover these expenses.

Potential for Negative Equity: Markets shift. If property values drop, you might find yourself owing more than your home is worth—what we call being "underwater" on your mortgage.

Approval Challenges: Getting approved isn't always straightforward. Lenders typically want to see stronger credit scores and healthier debt-to-income ratios than they required for your first mortgage.

Before moving forward with a second mortgage, take time to measure these pros and cons against your financial goals. The benefits can be game-changing for the right investor, but go in with your eyes wide open to the risks.

Cons of a Second Mortgage: Understanding the Risks

Second mortgages can unlock powerful financial opportunities, but let's be straight with you—there are real drawbacks you need to weigh before signing on the dotted line:

Increased Foreclosure Risk

Here's what's at stake: your home backs both your primary and second mortgage. Default on either one, and foreclosure enters the picture. Unlike unsecured debt, this puts your primary residence directly in the crosshairs.

Additional Debt Burden

More debt means more responsibility. A second mortgage adds to your monthly obligations, which can tighten your budget and potentially affect your credit score. This commitment stays with you regardless of what happens to your income down the road.

Closing Costs and Fees

Second mortgages typically involve substantial closing costs, ranging from 2% to 5% of the loan amount according to industry data. For example, on a $100,000 second mortgage, you might pay between $2,000 and $5,000 in upfront fees.

According to Zillow, "Closing costs can cost 3-6% of the loan amount" for second mortgages, which can significantly reduce the net proceeds you receive from the loan .

Here's what you're typically looking at:

- Appraisal fees

- Origination fees

- Credit report fees

- Title search costs

- Documentation preparation fees

Potential for Negative Equity

Here's something to keep on your radar: if property values drop after you secure a second mortgage, you could end up underwater—owing more than your home is actually worth. This scenario can box you in, making it tough to sell without bringing extra cash to the closing table.

Impact on Cash Flow

That extra monthly payment chips away at your available cash flow. For landlords and investors like you, this could squeeze your ability to handle surprise repairs or jump on the next great deal when it comes along.

Prepayment Penalties

Watch out for prepayment penalties in some second mortgage products. These fees kick in if you pay off the loan ahead of schedule, potentially making it expensive to refinance or sell within the first few years.

The bottom line? Weigh these drawbacks against the benefits carefully. Take time to explore whether other financing routes might be a better fit for your goals and comfort level with risk.

Second Mortgage vs. Other Financing Options

You've got choices when it comes to accessing your home equity or funding your next investment property. Let's break down how second mortgages stack up against the alternatives so you can make the smartest move for your situation.

Second Mortgage vs. Cash-Out Refinance

A second mortgage adds an additional loan to your existing mortgage, while a cash-out refinance replaces your current mortgage entirely with a new, larger loan.

Cash-Out Refinance Benefits:

- Typically offers lower interest rates than second mortgages

- Single monthly payment instead of two separate ones

- Potential to improve your loan terms (rate, term, loan type)

Second Mortgage Advantages:

- Keeps your existing first mortgage intact (a big win if you locked in a low rate)

- Often comes with lower closing costs than a full refinance

- Generally faster approval and funding process

According to Better.com, "Cash-out refinance [allows you to] replace your current mortgage with a larger loan. Receive the difference in cash while potentially securing better terms." This option makes more sense when interest rates are favorable compared to your existing mortgage (Better.com).

Second Mortgage vs. Personal Loans

Personal Loans:

- Unsecured (no collateral required)

- Fixed repayment terms, typically 2-7 years

- Higher interest rates than mortgage products

- Smaller loan amounts (usually up to $50,000)

When to Choose Personal Loans:

- For smaller funding needs

- When you want to keep your home off the table as collateral

- When you need funds quickly with minimal paperwork

Second Mortgage vs. Credit Cards

Credit Cards:

- Highest interest rates (often 15-25% APR)

- Flexible revolving credit

- No collateral required

- Quick access to funds

When to Choose Credit Cards:

- For very short-term financing needs

- When you can pay off the balance quickly

- For smaller expenses or emergencies

Second Mortgage vs. Hard Money Loans

Hard Money Loans:

- Secured by real estate

- Higher interest rates (typically 8-15%)

- Shorter terms (usually 1-3 years)

- Based primarily on property value rather than borrower creditworthiness

- Faster approval process

When to Choose Hard Money Loans:

- For short-term real estate investments

- When traditional financing isn't an option

- For fix-and-flip projects with quick turnaround

Second Mortgage vs. Private Lending

Private Lending:

- Flexible terms you work out directly with your lender

- Interest rates that vary based on your relationship and the deal's risk profile

- A more relaxed qualification process

- Often faster access to your funds

When to Choose Private Lending:

- You've got investors in your network ready to partner

- Your deal doesn't check the boxes for traditional lenders

- You've built relationships that open doors to financing

Making the Right Choice

Finding your best financing fit comes down to a few key factors:

- The equity you've built up

- Where your credit score and debt-to-income ratio stand

- How today's rates stack up against your current mortgage

- Your timeline for accessing and paying back the money

- Tax considerations (always worth a chat with your tax pro)

Here's the bottom line for real estate investors: Freedom Mortgage puts it well—"A second mortgage and a refinance are two different loan options that allow you to access the equity in your home" for investment purposes. Your decision really hinges on one question: do you want to keep your current mortgage terms intact, or start fresh with new ones? (Freedom Mortgage).

A conversation with a financial advisor can help you figure out which path best supports your investment strategy and long-term goals.

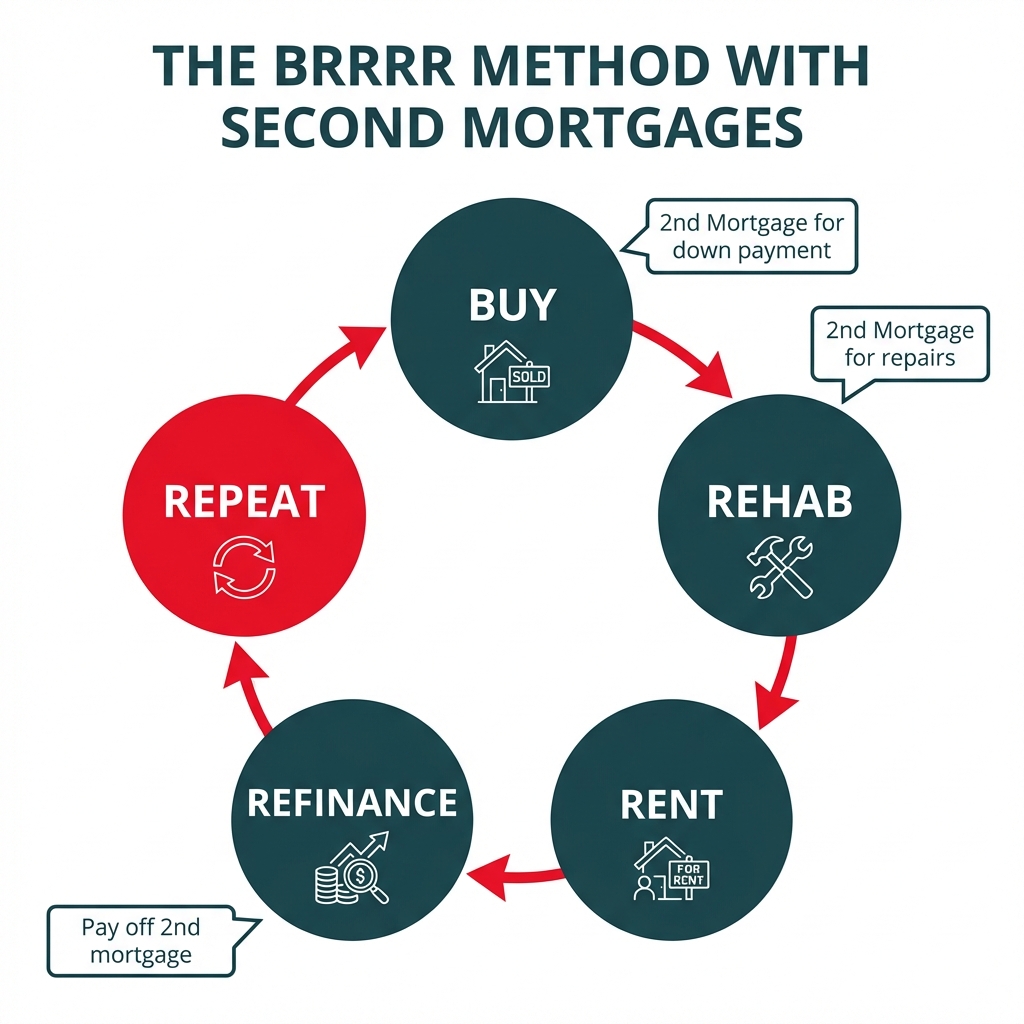

Second Mortgages and the BRRRR Method: A Strategic Approach

The BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) has become a go-to strategy for investors who want to grow their portfolios smartly and efficiently. Second mortgages can be a powerful tool in this approach, especially when you're in the buying and fixing-up stages.

Leveraging Second Mortgages for Rehab Funds

Need capital for your rehab project? A second mortgage lets you tap into the equity you've already built in your existing properties to fund improvements on your new acquisitions. As [Gatsby Investment](https://www. gatsbyinvestment.com/education-center/brrrr-method-real-estate-investors) explains, "This allows you to retain ownership of your first property while gaining the funds to acquire a second property".

Maintaining Liquidity During the Renovation Phase

Here's the thing about the BRRRR method—keeping enough cash on hand during renovations can be tricky. A second mortgage gives you the liquidity to cover renovation costs, carrying costs, and those surprise expenses that always seem to pop up during rehab projects. This approach keeps your cash reserves intact, so you're not left financially stretched when you need flexibility most.

Timing Considerations

When you're using a second mortgage as part of your BRRRR strategy, timing matters—a lot. Your goal? Complete the rehab phase efficiently to keep interest payments on that second mortgage as low as possible. The faster you move to the "rent" phase, the sooner you'll have cash flow coming in to help cover both your primary and secondary mortgage payments.

Exit Strategies and Refinancing Plans

The refinance stage of BRRRR is where everything comes together. You'll typically replace both your primary and second mortgages with a new loan based on your property's improved value. As Kiavi explains, "It replaces the original mortgage with a new loan that includes the remaining balance plus the equity borrowed" . Done right, this lets you recover your initial investment and second mortgage funds—giving you capital to go after your next property.

Case Example: Successful BRRRR With Second Mortgage

Let's walk through a real scenario. Say you own a property worth $300,000 with $150,000 left on the mortgage. You take out a second mortgage for $75,000 (bringing your total LTV to 75%) and use it to purchase and rehab a distressed property for $250,000. After $50,000 in renovations, the property appraises at $350,000. You rent it out, then refinance at 75% LTV—that's $262,500, enough to pay off the purchase loan and most renovation costs. Now you've got two cash-flowing properties and you're ready to find your next deal, potentially using the same second mortgage strategy all over again.

When executed properly, using a second mortgage to fund BRRRR investments can accelerate portfolio growth. That said, keep in mind that this approach increases leverage and financial risk. Make sure you maintain healthy debt-to-income ratios and have backup plans ready if market conditions shift or renovation costs run higher than expected.

How to Qualify for a Second Mortgage

Qualifying for a second mortgage means meeting several key criteria that lenders use to evaluate your application. Requirements vary between lenders, but understanding these fundamentals will help you walk into the application process prepared and confident.

Sufficient Home Equity

The foundation of any second mortgage is having adequate equity in your home. Most lenders require:

- At least 15-20% equity remaining after taking out the second mortgage

- Combined loan-to-value ratio (CLTV) typically below 80-85%

- Recent home appraisal to confirm current value

Want to build more equity? Consider making extra payments toward your principal balance or completing strategic home improvements that boost your property's value.

Credit Score Requirements

Second mortgage lenders generally look for:

- Minimum credit scores of 680 for standard loans

- Scores of 720+ for the best interest rates

- Clean credit history with no late payments

According to Experian, you can improve your credit score by "paying down existing debt, increasing your income, consolidating or refinancing debt and avoiding taking on new debt" in preparation for applying for a second mortgage (Experian).

Debt-to-Income Ratio Management

Your debt-to-income ratio (DTI) plays a big role when qualifying for a second mortgage:

- Most lenders cap DTI at 43-50% for second mortgages

- Front-end ratio (housing expenses only) should be below 28%

- Back-end ratio (all monthly debt payments) should be below 36-43%

Freedom Mortgage notes that you can reduce your DTI by "paying off high-interest debt" first, which can make a real difference in your qualification prospects ([Freedom Mortgage](https://www. freedommortgage.com/learning-center/articles/how-do-I-figure-out-my-debt-to-income-ratio)).

Property Requirements

The property backing your second mortgage must check these boxes:

- Primary residence, second home, or investment property (with varying qualification requirements)

- Good condition confirmed by appraisal

- No title issues or liens

- Appropriate insurance coverage

Documentation Needed

Gather these documents ahead of time to keep your application moving smoothly:

- Bank statements (2-3 months)

- Current mortgage statement

- Homeowners insurance proof

- Property tax records

- Photo identification

When you understand these requirements upfront and come prepared, you're setting yourself up for success. Keep in mind that each lender has their own criteria, so it pays to compare options and find the best fit for your situation.

How to Apply for a Second Mortgage with OfferMarket

Applying for a second mortgage doesn't have to be complicated. At OfferMarket, we've built a streamlined process that gets you from application to funding faster than traditional lenders—no weeks of waiting just to get a quote. You can get an instant quote in 1 minute or less without signing up.

Step-by-Step Application Guide

Get an Instant Quote: Our quoter takes less than 1 minute. Just answer a few basic questions about your property, desired loan amount, and financial situation.

Submit Required Documentation: Once you have your quote in hand, you'll provide:

- Property information (current mortgage statements)

- Identity verification

- Bank statements

- Credit report and background authorization

- Appraisal authorization

Property Valuation: Most second mortgages require a property appraisal to determine current market value.

Underwriting Process: OfferMarket reviews your application and documentation to make a lending decision.

Closing: Sign final paperwork and receive your funds.

Timeline Expectations

Traditional lenders often take 2-8 weeks to process a home equity loan application. At OfferMarket, we've built our systems to move faster. Industry data shows "the average time to get a home equity loan is 39 days" Yahoo Finance, but our streamlined approach can cut that waiting period down considerably. We aim to close within 15 business days.

Here's what a typical timeline looks like:

- Application and initial approval: 1 days

- Property appraisal: 5 days

- Final underwriting: 6 days

- Closing: 2 days

OfferMarket's Competitive Advantages

Here's why savvy investors choose OfferMarket over traditional lenders:

- Instant Quotes: Get your personalized rate quote in under a minute without affecting your credit score

- Transparent Process: You'll know exactly where things stand at every step

- Competitive Rates: Our real estate financing focus means better terms for you

- Streamlined Documentation: Our user-friendly portal makes uploading documents simple and secure

- Specialized Expertise: We understand what landlords and investors actually need—because that's all we do

"Getting a home equity loan can take anywhere from two weeks to two months, depending on your preparation of documents" Credit Union of Southern California. Our technology and focused approach help you move faster without cutting corners on evaluation.

Ready to get started? Head to OfferMarket's loan page and complete our 1-minute quoter to see your personalized rate right away.

Frequently Asked Questions About Second Mortgages

Second mortgages can feel like a maze, but they don't have to be. Whether you're a seasoned investor or just getting started, let's break down the most common questions so you can move forward with confidence.

Can I Get a Second Mortgage to Buy Another House?

It depends on the guidelines of the lending product that you will be using. Ask your lender early in the process if the proceeds from a 2nd mortgage are ok to use for the funding of your new acquisition. ! A second mortgage lets you tap into the equity you've already built in a property you own—even an investment property—to fund your next purchase. According to DDA Mortgage, "A second mortgage for an investment property is a loan taken against the equity in a property you already own, specifically one that is not your primary residence." Think of it as putting your hard-earned equity to work, helping you grow your portfolio without selling off assets or draining your savings.

How Difficult Is It to Get Approved for a Second Mortgage?

Here's the straight talk—approval depends on a few key factors:

- Equity requirements: Most lenders want you to keep at least 15-20% equity in your property after the loan

- Credit score: You'll typically need a score of 680 or higher—a bit more than what's required for a primary mortgage

- Debt-to-income ratio: Lenders want to see that you can comfortably handle another monthly payment

- Property type: Investment properties often come with tighter requirements than your primary home

Newfi Lending puts it this way: "Lenders typically look for a credit score of at least 620, though higher scores may qualify for better rates. Your debt-to-income ratio should generally be below 43%, and you'll need sufficient equity in your home—usually at least 15-20%."

What Are the Typical Closing Timelines for a Second Mortgage?

Good news—second mortgages usually close faster than primary ones:

- HELOC or HELOAN: Expect about 2-4 weeks from application to funding

- Documentation review: Generally lighter than what you went through for your first mortgage

- Appraisal requirements: These may be streamlined, especially if you've had a recent appraisal

What Factors Affect Second Mortgage Interest Rates?

Second mortgage interest rates are influenced by:

- Loan type: HELOCs typically start with lower variable rates while HELOANs offer fixed rates that are initially higher

- Credit profile: A stronger credit score puts you in the driver's seat for better rates

- Loan-to-value ratio: Lower LTVs generally unlock more competitive rates

- Property type: Investment properties usually carry higher rates than primary residences

- Market conditions: The broader interest rate environment impacts all mortgage products

Are There Loan Amount Limitations for Second Mortgages?

Second mortgage amounts are primarily limited by:

- Available equity: Most lenders cap combined loan-to-value ratios at 80-90%

- Debt-to-income considerations: Your ability to comfortably handle payments on the total debt

- Property value: Higher-valued properties can support larger second mortgages

- Lender-specific policies: Some lenders set minimum and maximum loan amounts

Getting clear on these common questions helps you navigate the second mortgage landscape with confidence and determine if this financing option fits your investment strategy.

Conclusion: Is a Second Mortgage Right for You?

Deciding whether to pursue a second mortgage comes down to your financial situation, investment goals, and comfort with risk. This financing tool can be a game-changer for real estate investors and landlords, but it's not the right fit for everyone.

Decision Framework

When evaluating if a second mortgage makes sense for you, weigh these key factors:

Equity Position: Have you built up enough equity in your property? Most lenders want to see at least 15-20% equity remaining after the second mortgage.

Cash Flow Analysis: Will your investment returns outpace the cost of the second mortgage? Run the numbers on the complete picture, including interest rates, closing costs, and potential tax implications.

Risk Assessment: Can your finances handle the increased debt obligation, even if you face rental vacancies or property values take a dip?

Long-term Strategy: Does accessing this equity align with your broader real estate investment strategy?

Financial Considerations

Here's the deal: second mortgages typically come with higher interest rates than primary mortgages. That's because lenders are taking on more risk. As Fortune Builders puts it, "In addition to stricter underwriting, second mortgages typically carry a higher rate of interest. Some investors will find the added costs well worth the price" when the capital is deployed strategically.

Before you move forward, crunch these numbers:

- Total monthly payment obligations

- Cash flow impacts

- Expected ROI on the funds you'll access

- Your debt-to-income ratio after taking on additional debt

Investment Goals Alignment

A second mortgage works best when it directly fuels your investment goals:

- Portfolio Expansion: Tapping equity to cover down payments on additional properties

- Value-Add Improvements: Funding renovations that will meaningfully boost property value or rental income

- Consolidating Higher-Interest Debt: Swapping out pricier financing for a potentially tax-advantaged option

Smart Asset points out that lenders typically look for "a solid credit score, a low debt-to-income ratio and sufficient equity in your current home before approving a second mortgage" for investment purposes. Meeting these benchmarks shows you can handle the additional financial responsibility while working toward your investment goals.

Alternative Approaches

Before you commit to a second mortgage, explore these other paths:

- Cash-out refinance of your primary mortgage

- Private lending or partnership arrangements

- Saving and investing from rental income

- Portfolio loans that cover multiple properties

Each option comes with its own pros and cons when it comes to timing, costs, and flexibility.

Next Steps

If you've determined a second mortgage aligns with your investment strategy:

- Review your credit profile and address any issues that might affect approval

- Calculate your available equity and borrowing capacity

- Compare different second mortgage products (HELOC vs. HELOAN)

- Consult with a tax professional regarding potential tax implications

- Get quotes from multiple lenders to ensure competitive terms

Take Action Today

Ready to put your equity to work and expand your real estate portfolio? At OfferMarket, we offer competitive rates and flexible terms built specifically for landlords and investors like you. Our straightforward process gives you instant quotes—no login required—so you can move forward with confidence.

Get your instant quote from OfferMarket now → and start turning your equity into your next smart investment move.