*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Guaranteed Home Equity Loans with Bad Credit

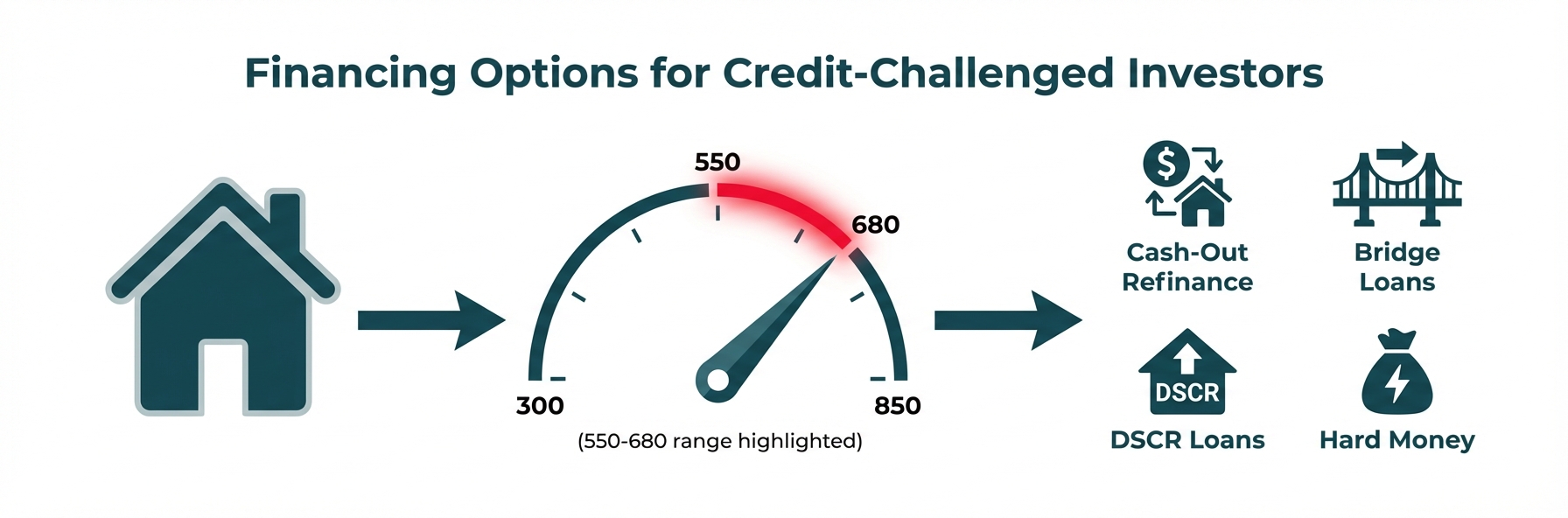

If you're a landlord or real estate investor with less-than-perfect credit, you've probably heard promises of "guaranteed home equity loans" and wondered if they're too good to be true. The reality? While truly guaranteed approval doesn't exist, you absolutely have viable financing options—even with credit challenges.

This guide breaks down your real options for tapping into property equity when traditional lenders might turn you away. We'll explore everything from cash-out refinancing to DSCR loans, hard money lending, and specialized programs designed for investors navigating credit challenges.

What Does "Guaranteed" Mean in Home Equity Loans?

When you spot ads for "guaranteed home equity loans with bad credit," let's break down what this marketing speak really means. Here's the straight talk: truly guaranteed loan approval doesn't exist, especially when you're working through credit challenges.

The Myth of Guaranteed Approval

No matter what some questionable lenders might promise, no reputable lender can guarantee you'll get approved without first looking at your finances. A recent Bankrate survey found that 64% of loan applicants with credit scores under 670 got turned down—that's more than double the rejection rate for folks with top-tier credit. Bottom line? Approvals are never a sure thing.

Personal Guaranty vs. Guaranteed Approval

Here's what lenders typically mean when they use the word "guarantee"—and it's not what you might think:

Personal Guaranty: This is your legal commitment to repay the loan. You're putting yourself on the hook, meaning if things go south, the lender can come after your personal assets beyond just the property.

Guaranteed Approval: This is marketing fluff suggesting anyone can qualify no matter their financial picture. Don't fall for it.

Realistic Expectations for Bad Credit Borrowers

Working with bad credit? Let's set some honest expectations. Equifax data reported by AmeriSave shows that only 4.6% of Home Equity Lines of Credit (HELOCs) issued in December 2024 went to borrowers with subprime scores below 620.

But here's the good news: you still have options. Lenders look at the full picture:

- Your current credit score

- Equity available in your property

- Debt-to-income ratio

- Payment history on existing debts

- The property's value and condition

Understanding the Underwriting Process

Every legitimate lender follows an underwriting process to assess risk. This includes:

- Credit check: Reviewing your credit report and score

- Property appraisal: Determining the current market value

- Title search: Ensuring there are no liens or ownership issues

Here's the deal: instead of chasing "guaranteed" loans that often come with predatory terms, your best bet is finding lenders who specialize in working with credit-challenged borrowers and offer transparent terms. These specialized lenders look at your complete financial picture—not just your credit score—giving you realistic options tailored to your specific situation.

Understanding Home Equity Loans and Their Requirements

Home equity loans (HELOANs) and Home Equity Lines of Credit (HELOCs) let you tap into the equity you've built in your property. For landlords and investors, these can be powerful tools in your financing toolkit. That said, they do come with specific eligibility criteria that can pose challenges if your credit isn't spotless.

What Are Home Equity Loans and HELOCs?

Think of a home equity loan as a lump sum you receive upfront, then pay back over a fixed term at a fixed interest rate. It sits as a second lien on your property, behind your primary mortgage. A HELOC works differently—more like a credit card where you draw funds as needed during a draw period, typically with variable interest rates.

![Task: Create a comparison infographic that clearly distinguishes between home equity loans and HELOCs, showing their key characteristics side-by-side.

Visual Structure: A two-column comparison layout with a central dividing line, showing Home Equity Loan characteristics on the left and HELOC characteristics on the right, with icons and bullet points for each feature.

ASCII Layout Reference:

```

+-------------------------------------------------------------------+

| HOME EQUITY LOAN vs HELOC |

+-------------------------------------------------------------------+

| HOME EQUITY LOAN | HELOC |

| [Stack of Money Icon] | [Credit Card Icon] |

| | |

| • Lump Sum Payment | • Draw as Needed |

| • Fixed Interest Rate | • Variable Interest Rate |

| • Fixed Payment Schedule | • Flexible Payments |

| • Second Lien Position | • Second Lien Position |

| • 15-30 Year Terms | • 10-20 Year Terms |

| | |

| Credit Score: 620+ | Credit Score: 680+ |

+-------------------------------------------------------------------+

```

Image Section Breakdown:

- Header section: Title](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771442932872_m68cel.jpg?alt=media&token=d3b290e8-c51a-412a-9998-58b32d63a9d0)

Credit Score Requirements

When it comes to home equity products, lenders tend to be pickier about credit scores than with some other financing options:

Standard Requirements: Most lenders want to see a FICO score of at least 680 for a home equity loan, though you'll unlock better rates and terms with scores of 720 or higher. According to Experian, many lenders look for a FICO Score of at least 680 for HELOCs.

HELOC Requirements: HELOCs often come with slightly higher credit thresholds, with some lenders preferring scores of 700 or above. Freedom Mortgage notes that while borrowers likely need a FICO Score of at least 680 to qualify for a HELOC, some lenders may prefer a credit score of 720 or more.

How Bad Credit Impacts Eligibility

Here's the reality: if your credit score falls below 680, you'll face some hurdles when applying for traditional home equity products:

- Higher interest rates and less favorable terms

- Lower loan-to-value (LTV) ratios, meaning you can borrow less of your equity

- Potential need for a co-signer

For landlords eyeing DSCR (Debt Service Coverage Ratio) second liens, lenders typically require credit scores of 680 or higher, making these products tougher to access with bad credit.

Traditional Products vs. Alternative Financing

When traditional home equity loans aren't within reach due to credit challenges, don't worry—you've got options:

Cash-Out Refinance: Instead of adding a second loan, you replace your entire mortgage with a new, larger loan and pocket the difference in cash. Some non-prime programs specifically serve borrowers with lower credit scores.

Fix & Flip/Bridge Loans: These short-term financing solutions often come with more flexible credit requirements, sometimes accepting scores as low as 680, but most programs need 680+, though expect higher interest rates and fees.

Home Equity Investments (HEIs): These newer products let you sell a portion of your equity without taking on additional debt, and some providers work with credit scores as low as 500-620.

Private Lending: Some landlords and investors turn to private lenders who may focus less on credit scores and more on the property's value and potential.

Knowing these options puts you in the driver's seat—especially if you're a landlord or investor with credit challenges who needs to tap into property equity for portfolio growth or financial stability.

Cash-Out Refinance: A Viable Option for Bad Credit Borrowers

For property owners with less-than-perfect credit, a cash-out refinance often provides the most accessible path to tap into home equity. Unlike traditional home equity loans that typically require credit scores of 680 or higher, cash-out refinancing opens doors for borrowers who've hit a few credit bumps along the way.

How Cash-Out Refinancing Works

Here's the deal: a cash-out refinance swaps your current mortgage for a new, larger loan. You pocket the difference between what you owe now and your new loan amount as cash. This is different from a home equity loan, which stacks a second lien on top of your existing mortgage.

Let's break it down with a real example. Say your home is worth $300,000 and you still owe $150,000 on your mortgage—that means you're sitting on $150,000 in equity. With a cash-out refinance, you could take out a new $200,000 loan, pay off that $150,000 balance, and walk away with $50,000 in your pocket (after closing costs, of course).

Non-Prime and Expanded Prime Programs

Most traditional lenders want to see credit scores of 680 or higher for conventional cash-out refinancing. But here's the good news: the lending world has expanded to include programs designed specifically for borrowers facing credit challenges:

Non-Prime Programs: These are built for borrowers dealing with recent credit setbacks or FICO scores under 620. Yes, you'll pay higher interest rates than prime borrowers, but you'll gain access to equity that would otherwise be locked away.

Expanded Prime Programs: Think of these as the middle ground—more flexible than conventional loans but not quite as forgiving as non-prime options. They're perfect if you're just shy of traditional qualification standards.

According to Freedom Mortgage, "Freedom Mortgage can often accept a credit score as low as 550 for FHA cash out refinances and doesn't set a minimum score requirement for FHA streamline refinances".

Credit Score Minimums and Seasoning Requirements

Here's what you need to know about credit score requirements by loan type:

- FHA Cash-Out Refinance: Scores as low as 580 to qualify, though most lenders prefer 600+

- VA Cash-Out Refinance: Typically looking for scores around 580-620

- Conventional Cash-Out Refinance: Generally requires 620+

- Non-QM/Non-Prime: May work with scores as low as 500 if you have strong compensating factors

![Task: Create a data visualization chart showing credit score requirements and waiting periods (seasoning) after major credit events for different types of cash-out refinance loans.

Visual Structure: A combination chart with a bar graph showing minimum credit scores for different loan types on the left, and a timeline infographic on the right showing seasoning periods after bankruptcy, foreclosure, and short sale.

ASCII Layout Reference:

```

+------------------------------------------------------------------------+

| CREDIT REQUIREMENTS & SEASONING PERIODS |

+------------------------------------------------------------------------+

| CREDIT SCORES BY LOAN TYPE | WAITING PERIODS AFTER CREDIT EVENTS |

| | |

| FHA [====] 580 | BANKRUPTCY: |

| VA [=====] 600 | Non-Prime: 1-2 years |

| Conv. [=======] 620 | Conventional: 4 years |

| Non-QM [==] 500 | |

| | FORECLOSURE: |

| 300 400 500 600 700 | Non-Prime: 1-3 years |

| | Conventional: 7 years |

| | |

| | SHORT SALE: |

| | Non-Prime: 1-2 years |

| | Conventional: 4 years |

+------------------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771450545667_4p44lp.jpg?alt=media&token=42dbec98-3128-4f7a-9563-f34e634df2ff)

Had a major credit event? Here's how long you'll typically need to wait:

Bankruptcy:

- Chapter 7: 1-2 years with non-prime lenders (compared to 4 years for conventional)

- Chapter 13: You might qualify while still in repayment with non-prime lenders

Foreclosure: 1-3 years with non-prime lenders (versus 7 years for conventional)

Short Sale/Deed-in-Lieu: 1-2 years with non-prime lenders (versus 4 years for conventional)

According to Bankrate, "there are still some refinancing options for people with credit scores below 620".

Pros and Cons Versus Traditional Home Equity Loans

Pros of Cash-Out Refinance for Bad Credit Borrowers:

- More accessible with lower credit scores

- Potentially lower interest rates (single loan vs. second lien)

- Longer repayment terms (typically 15-30 years)

- Possible tax deductions on interest (consult a tax professional)

Cons of Cash-Out Refinance for Bad Credit Borrowers:

- Higher interest rates than prime borrowers receive

- Resets the term of your entire mortgage

- Higher closing costs than home equity loans (typically 2-5% of loan amount)

- Risk of foreclosure if payments cannot be maintained

Here's the bottom line: if you're a landlord or real estate investor working with less-than-perfect credit, cash-out refinancing could be your smartest move for tapping into your property's equity—especially when traditional home equity loans aren't an option due to stricter credit requirements.

Fix & Flip and Bridge Loans: Short-Term Solutions for Credit-Challenged Investors

Don't let credit challenges stop your investment journey. While traditional home equity loans might not be in the cards right now, specialized short-term financing like fix & flip loans and bridge loans could be exactly what you need. These products are built specifically for investment properties and typically offer more breathing room on credit requirements than conventional financing.

What Are Fix & Flip and Bridge Loans?

Think of fix & flip loans as your renovation toolkit—short-term financing that helps you buy distressed properties, make improvements, and sell for profit. Bridge loans work similarly, helping you "bridge" the gap between buying your next property and selling your current one, or providing temporary funding until you secure long-term financing.

Credit Requirements Are More Flexible

Here's some good news: unlike traditional lenders who want to see stellar credit, fix & flip lenders tend to focus on the deal itself rather than your credit history. According to recent industry data, most hard money lenders require minimum credit scores ranging from 680-700 for fix & flip loans, though some may go lower depending on other factors.

"A national hard money lender will want a minimum credit score of at least 680. Depending on the project, some lenders will look at the project's potential rather than your credit score," according to Credit Suite.

Some specialized lenders even advertise "no credit score required" programs, though these typically come with higher interest rates and stricter terms regarding the property itself.

What You Can Expect: Terms and Requirements

Fix & flip and bridge loans generally feature:

- Short loan terms: Usually 6-24 months

- Higher interest rates: Typically 7-15%, depending on your credit profile

- Points at closing: 1-5 points (each point equals 1% of the loan amount)

- Loan-to-Value (LTV) ratios: 65-75% of the purchase price or after-repair value

- Experience requirements: Some lenders prefer borrowers with previous flipping experience

If your FICO score falls below 680, here's what you should prepare for:

- Higher down payments (30-35% versus the standard 25%)

- Interest reserves (several months of payments held in escrow)

- More detailed exit strategies

- Stronger proof of rehab experience

Good News: The Property Matters More Than Your Credit

Here's where things get exciting for investors working on their credit. These loans focus primarily on the property's potential, not just your credit history. As noted by LendEDU, "Many lenders use your personal credit score to determine your interest rate and loan terms, but the property itself serves as the primary collateral."

When lenders review your application, they're looking closely at:

- The property's current value

- The estimated after-repair value (ARV)

- The feasibility of your renovation budget

- The local real estate market conditions

- Your exit strategy (sale or refinance)

Liquidity Requirements

Even with bad credit, you'll need to show, you can handle the project financially. Most lenders want to see that you have access to funds covering at least 25% of the rehab budget plus closing costs, with a minimum of $15,000-$25,000 in reserves.

Who These Loans Work Best For

Fix & flip and bridge loans are a great fit for:

- Investors with credit dings but solid real estate experience

- Those who can bring larger down payments to the table

- Investors with a track record of successful property flips

- Borrowers who need to move fast (closings often happen in 1-3 weeks)

- Those who've spotted high-potential properties in strong markets

Yes, these loans cost more than traditional financing. But here's the thing—they give credit-challenged investors a real opportunity to tap into property equity and keep growing their real estate portfolios, even with past credit bumps in the road.

DSCR Loans: An Alternative Financing Option for Bad Credit Borrowers

Debt Service Coverage Ratio (DSCR) loans offer a smart financing alternative for real estate investors dealing with credit challenges. Here's the key difference: while traditional mortgages zero in on your personal income and credit history, DSCR loans focus on whether the property itself can generate enough income.

How DSCR Loans Work

With DSCR loans, it's all about the property's income potential—not your personal finances. The debt service coverage ratio is simply the property's monthly rental income divided by its monthly debt obligations (think mortgage payment, taxes, insurance, and HOA fees). Lenders typically want to see a DSCR of at least 1.0, which means the property brings in enough to cover all its costs.

![Task: Create an educational infographic explaining the DSCR (Debt Service Coverage Ratio) calculation and what different DSCR values mean for loan qualification.

Visual Structure: A three-section vertical infographic showing the DSCR formula at top, a visual calculation example in the middle, and a color-coded scale showing DSCR ranges and their meanings at bottom.

ASCII Layout Reference:

```

+------------------------------------------------------------------+

| UNDERSTANDING DSCR LOANS |

+------------------------------------------------------------------+

| |

| THE FORMULA: |

| |

| Annual Rental Income |

| DSCR = ───────────────────────── |

| Annual Debt Obligations |

| |

+------------------------------------------------------------------+

| EXAMPLE CALCULATION: |

| |

| Annual Rental Income: $36,000 |

| Annual Debt Payments: $30,000 |

| |

| $36,000 ÷ $30,000 = 1.2 DSCR |

| |

+------------------------------------------------------------------+

| WHAT DSCR MEANS FOR YOUR LOAN: |

| |

| [RED] 0.75-0.99 | Limited Options, Higher Rates |

| [YELLOW] 1.0-1.19 | Acceptable, Standard Terms |

| [GREEN] 1.2+ | Strong Position, Best Terms |

| |

+------------------------------------------------------------------+

```

Image Section Breakdown:

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771445050224_anh1ho.jpg?alt=media&token=02124a79-cbd0-46b7-8e70-efb654a740da)

Why DSCR Loans May Work for Borrowers with Credit Issues

DSCR loans can open doors for investors with credit challenges because:

Property-focused underwriting: The spotlight is on how the investment property performs, not on your personal credit history.

No income verification: Most DSCR programs don't require personal income documentation or debt-to-income ratio calculations.

Flexible credit requirements: While conventional loans typically require scores of 700+, some DSCR programs accept credit scores as low as 680.

Typical DSCR Loan Requirements

Requirements vary by lender, but here's what you can generally expect from most DSCR programs:

Credit score: Minimum requirements are at 680, with better terms available for higher scores.

Down payment: Most DSCR lenders require 20-35% of the property value, with higher requirements for borrowers with lower credit scores.

DSCR calculation: Lenders typically require a minimum DSCR between 0.75 and 1.2, depending on their risk tolerance.

Property type: Must be an investment property (non-owner occupied).

According to OfferMarket, "Most DSCR lenders require a minimum down payment of 20%, with some requiring 25%–30% for borrowers with lower credit scores or weaker property" performance metrics.

The Importance of Rental Income and DSCR

Here's the bottom line: your property's rental income is what makes or breaks your DSCR loan qualification. Lenders will look at:

- Market rents: Most lenders use market rent surveys or comparable properties to determine expected rental income.

- Vacancy rates: Lenders typically factor in a vacancy rate of 5-10% when calculating potential income.

- Debt coverage: The higher your DSCR, the more confident lenders feel about your property's ability to cover its obligations—which can mean better rates and terms for you.

Good news if your credit isn't perfect: some specialized lenders offer programs with credit scores as low as 680, with loan-to-value ratios up to 85%. This makes these loans accessible even if you've faced credit challenges.

The takeaway? For investors working through credit issues, DSCR loans open doors to building your real estate portfolio when traditional financing isn't an option. It's all about the investment's performance—not your past credit history.

Alternative Financing: Private and Hard Money Lending for Bad Credit Borrowers

When traditional lenders say no because of credit hiccups, private and hard money lenders can step in as solid alternatives for real estate investors and landlords. These lending options look at what your property is worth rather than your credit history, opening doors even when your FICO score needs some work.

What Are Hard Money Loans?

Hard money loans are short-term financing tools backed by real estate and funded by private investors or companies instead of banks. While conventional loans put your creditworthiness under a microscope, hard money lenders care most about the property you're putting up as collateral.

"Traditional mortgages offer much lower rates and longer terms for owner-occupied properties — even for those with bad credit or low income," notes LendingTree. But here's the good news: for investors facing credit challenges, hard money creates a path forward when conventional options aren't available.

Why Hard Money Lenders Are More Flexible on Credit

Hard money lenders can partner with borrowers who have poor credit because they play by different rules:

- Asset-based lending: They zero in on property value instead of your credit report

- Higher interest rates and fees: This balances out the extra risk of working with credit-challenged borrowers

- Lower loan-to-value ratios: Usually 65-75% of property value, which builds in a safety margin

According to OfferMarket, "Understanding Hard Money Loans For Bad Credit... focuses on the borrower's credit score, making them accessible to those with poor credit." North Coast Financial confirms that "While a low credit score may result in a higher interest rate or more stringent terms, it is often possible to secure a hard money loan even with a less than ideal credit score. "

Typical Terms and Costs of Hard Money Loans

Let's break down what you can expect when exploring hard money financing:

Terms:

- Loan duration: Typically 6-36 months

- Funding speed: Often 1-2 weeks versus months for conventional loans

- Loan-to-value (LTV): Usually 65-75% of property value

- Minimum credit scores: Can be as low as 680

Costs:

- Interest rates: Typically 9-15% (significantly higher than conventional mortgages)

- Points: 2-5 points (each point equals 1% of the loan amount)

- Origination fees: 1-3% of loan amount

- Potential prepayment penalties

Pros and Cons of Hard Money Loans

Advantages:

- Accessible even when your credit isn't perfect

- Quick approval and funding when timing matters

- Flexible terms and underwriting criteria

- Lenders focus on the property's potential, not just your credit history

- Build relationships with lenders for smoother future deals

Disadvantages:

- Higher interest rates (9-15% compared to 6-7% for conventional mortgages)

- Upfront fees add up through points and origination costs

- Shorter repayment windows to work within

- Lower loan-to-value ratios mean you'll need more skin in the game

- Foreclosure risk if your investment doesn't pan out as planned

Here's the bottom line: hard money loans shine as short-term tools for fix-and-flip projects, bridge financing, or locking down a property fast while you arrange permanent funding. They open doors for credit-challenged investors, but those higher costs make them a poor fit for buy-and-hold strategies.

Understanding the Cost of Financing Options for Investors with Bad Credit

When your credit isn't stellar, knowing exactly what financing will cost you is essential for protecting your profits. Let's walk through the expenses tied to different financing options and how they affect your investment returns.

Interest Rates: The Primary Cost Factor

Interest rates for home equity products vary significantly based on credit score. According to Experian, while prime borrowers might access rates around 5-7%, those with credit scores below 700 can expect to pay 2-4% higher rates on comparable products.

If you're working with less-than-perfect credit, here's the landscape you're navigating:

- Traditional Home Equity Loans: Tough to qualify with scores below 640

- Cash-Out Refinance: Doable with scores as low as 680, though you'll pay 2-5% more than prime borrowers

- Fix & Flip/Bridge Loans: Open to you with scores of 680+, but expect rates in the 9-14% range based on your specific situation

Points and Origination Fees

Here's something important to understand: lenders use points (each point equals 1% of your loan amount) to balance out the risk when working with credit-challenged borrowers:

- Prime Borrowers: 0.5-1 points

- Credit-Challenged Borrowers: 2-4 points

Let's put that in real numbers. On a $200,000 loan, you could be looking at up to $8,000 more in upfront costs.

Additional Fees to Plan For

When you're building your budget, make sure you account for these potential extras:

- Higher insurance requirements: Your lender may ask for more comprehensive coverage

- Larger reserves: Expect to hold 6-12 months of payments in escrow

- Processing fees: Typically $500-1,500 depending on your deal's complexity

- Appraisal costs: $400-700 for standard properties, more for unique or complex ones

- Prepayment penalties: These show up more often with non-prime loans

What This Actually Looks Like: A Side-by-Side Comparison

Let's break down the numbers for an investor pulling $100,000 from a $400,000 property:

![Task: Create a detailed cost comparison infographic showing the total financial impact of good credit versus bad credit on a $100,000 home equity loan over 15 years.

Visual Structure: A side-by-side comparison layout with two scenarios, showing upfront costs at top and total costs over time visualized as stacked bar charts below, with key metrics highlighted in callout boxes.

ASCII Layout Reference:

```

+------------------------------------------------------------------------+

| COST COMPARISON: GOOD CREDIT VS BAD CREDIT |

| $100,000 Loan on $400,000 Property |

+------------------------------------------------------------------------+

| GOOD CREDIT (700+) | BAD CREDIT (620) |

| ------------------------- | ------------------------- |

| Interest Rate: 7.5% | Interest Rate: 10.5% |

| Points: 1 ($1,000) | Points: 2 ($2,000) |

| Fees: $5,000 | Fees: $7,000 |

| ------------------------- | ------------------------- |

| Upfront Costs: $6,000 | Upfront Costs: $9,000 |

| | |

| Monthly Payment: $699 | Monthly Payment: $911 |

| | |

| [====== BAR ======] | [========= BAR =========] |

| Total Cost: $130,820 | Total Cost: $171,980 |

| | |

+------------------------------------------------------------------------+

| DIFFERENCE: $41,160 MORE WITH BAD CREDIT |

+------------------------------------------------------------------------+

```

Image Section Breakdown:

- Header section:

* Main title](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771451198331_le29uj.jpg?alt=media&token=d80fa66f-601e-4d35-a5ee-57c32710954d)

Scenario 1: Good Credit (700+)

- Home Equity Loan: 7.5% interest, 1 point, $5,000 in fees

- Monthly payment: $699

- Total cost over 15 years: $130,820

Scenario 2: Bad Credit (680)

- Non-Prime Cash-Out Refinance: 10.5% interest, 2 points, $7,000 in fees

- Monthly payment: $911

- Total cost over 15 years: $171,980

That's a $41,160 difference in your pocket—money that could fund your next deal or boost your overall returns.

ROI Considerations for Investors

When you're looking at financing options with higher costs due to bad credit, here's what you need to think about:

- Calculate your all-in yield: If you're borrowing at 10% for a property returning 12% cash-on-cash, your margin is tight

- Factor in appreciation: Even with higher financing costs, market appreciation might make the investment worthwhile

- Consider the renovation uplift: For fix-and-flip loans, will the property's increased value after improvements cover those higher loan costs?

According to Bankrate, you should aim for at least a 5% spread between financing costs and expected returns to give yourself a cushion for market fluctuations and unexpected expenses.

Evaluating if the Loan Makes Financial Sense

Before you move forward with higher-cost financing, run through this checklist:

- Calculate your debt service coverage ratio (DSCR): Your property's income should exceed debt payments by at least 25% (1.25 DSCR)

- Stress-test your investment: Can it handle 10% higher expenses or 10% lower income?

- Consider opportunity cost: Would it make more sense to improve your credit first and lock in better terms later?

- Evaluate exit strategies: Make sure you have multiple ways to exit the investment if market conditions shift

Here's the bottom line: the best financing rates aren't always available to credit-challenged investors, but that doesn't mean profitable deals are off the table. The key is knowing your true costs and making sure your investment returns can comfortably exceed them.

How to Improve Your Credit to Qualify for Better Loan Terms

If you're a landlord or real estate investor dealing with bad credit, improving your score can open doors to better loan options and terms. There's no magic fix, but smart, strategic moves can strengthen your credit profile over time.

Short-Term Credit Improvement Strategies (1-3 months)

Pay down revolving credit balances: Want a quick win? Lower your credit utilization ratio—that's the percentage of available credit you're currently using. This is one of the fastest ways to give your score a lift.

"Paying down balances, fixing errors, and making on-time payments can boost your score quickly," according to Tucson Federal Credit Union.

Check for and dispute errors on your credit reports: Pull your credit reports from all three bureaus (Experian, Equifax, and TransUnion) and look for mistakes. Getting errors removed can give your score an immediate bump.

Avoid applying for new credit: Every hard inquiry can ding your score temporarily, so hold off on new credit applications while you're gearing up for a mortgage or equity loan.

Long-Term Credit Building Strategies (6-12+ months)

Establish consistent on-time payment history: Here's the deal—payment history makes up roughly 35% of your credit score. That's a big chunk you can control.

Bankrate notes:

"One of the most important ways to improve your credit is to keep all your accounts in good standing. Missing a payment can lower your credit score".

Diversify your credit mix: Lenders want to see you can juggle different types of credit like a pro. A solid mix typically includes revolving accounts (credit cards) and installment loans.

Address collections and negative items: Got collections or charge-offs dragging you down? Here's your game plan:

- Negotiate "pay for delete" arrangements with creditors

- Set up payment plans for outstanding debts

- Request goodwill adjustments for isolated late payments

Maintain low balances on credit cards: Once you've improved your utilization ratio, keep those balances low—aim for under 30% of your available credit.

Special Considerations for Mortgage and Home Equity Loans

Prioritize mortgage and housing payments: If you're a real estate investor eyeing additional financing, your mortgage payment history on existing properties matters—a lot. Lenders look at this closely.

Seasoning periods after major credit events: Know that most lenders require "seasoning periods" after major credit setbacks:

- Chapter 7 Bankruptcy: Typically 7 years

- Chapter 13 Bankruptcy: Often 7 years after discharge

- Foreclosure: Usually 7 years

- Short Sale: Commonly 7 years

Monitoring Progress

Keep tabs on your credit journey with free monitoring services, or invest in paid subscriptions for deeper insights. Many offer mortgage-specific score simulators—handy tools that show you how different moves might impact your score.

The bottom line? Building credit takes time and consistency. While some borrowers may see improvements within months, meaningful changes typically require at least 6-12 months of responsible credit management.

Success Stories: Overcoming Bad Credit in Real Estate Investing

Here's the good news: plenty of real estate investors have faced credit hurdles and still managed to secure financing and build thriving portfolios. These stories prove that bad credit isn't a dead end—it's just a detour on your real estate investment journey.

From Bankruptcy to Property Owner

Consider this inspiring example: a couple who went through bankruptcy after their business failed. With everything guaranteed under their personal names, their credit scores took a serious hit. But they didn't give up. They rebuilt and eventually purchased a home by:

- Partnering with lenders who evaluated more than just credit scores

- Showing consistent income after their bankruptcy

- Offering larger down payments to reduce lender concerns

Their experience demonstrates that even after a major setback like bankruptcy, homeownership and real estate investing are absolutely achievable with the right strategy and determination.

What Successful Investors Want You to Know

Investors who've pushed past credit challenges keep coming back to these winning strategies:

- Be upfront about your credit situation with lenders and potential partners

- Zero in on solid property fundamentals instead of chasing "no credit check" shortcuts

- Start with smaller deals and prove yourself before scaling up to bigger investments

- Connect with lenders who specialize in credit-challenged borrowers and truly get real estate investment economics

- Keep your current payment history spotless to show you're dependable

- Explore seller financing where the property owner becomes your lender

These real-world wins prove that bad credit creates speed bumps, not roadblocks. With creativity, grit, and smart planning, you can find your path to financing.

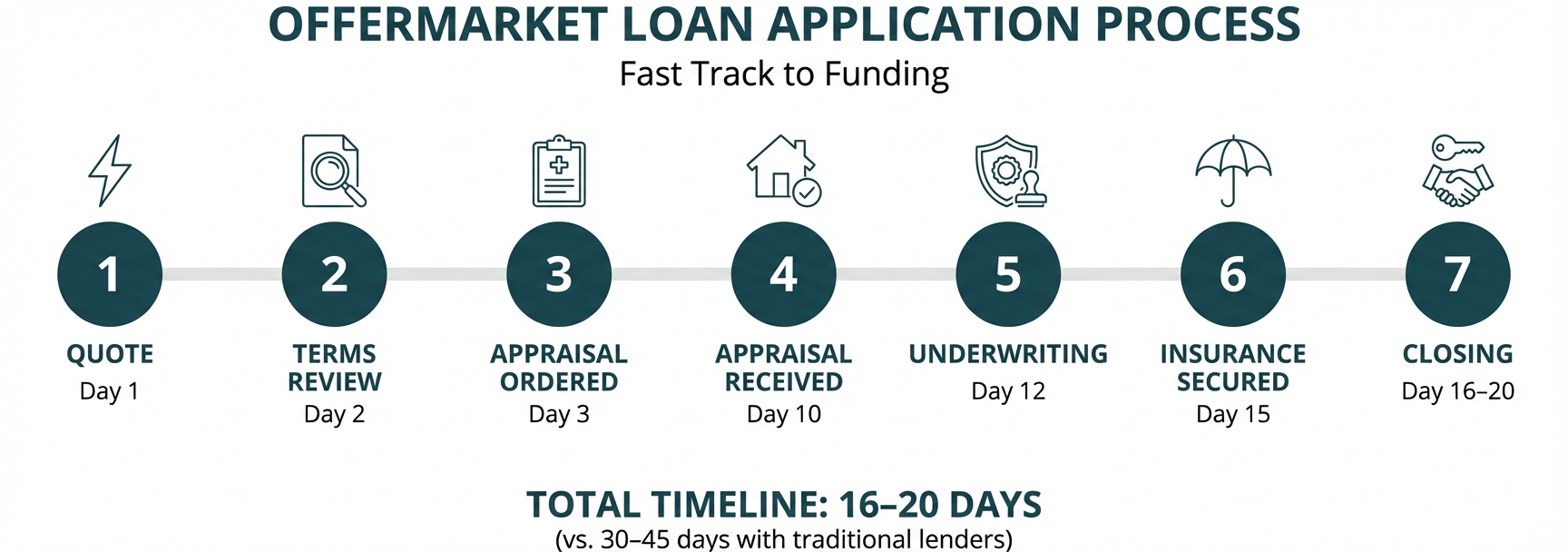

Streamlined Application and Approval Process

We've designed our loan application process to be straightforward, even when your schedule is packed:

- Instant Quote: Submit your online loan application

- Preliminary Assessment: We'll quickly review your situation and identify the loan options that make sense for you.

- Documentation: No guesswork here. We'll tell you exactly what paperwork you need to gather.

- Underwriting: We move straight to the property valuation (often using streamlined appraisals or BPOs)

- Loan Approval: Get decisions in days, not weeks—much faster than traditional banks.

- Closing: We keep things moving so you can close quickly and get on with your investment.

Transparency is baked into every step. You'll know exactly what you're signing up for—all terms, costs, and requirements—before you commit to anything.

When you work with OfferMarket, you're not just getting financing. You're getting a partner who's invested in your success. Credit challenges? We've helped investors work through them. Our goal is simple: help you build and grow your real estate portfolio. Your wins are our wins, and that's a partnership that goes well beyond a single deal.

FAQs About Home Equity Loans and Financing Options

Can I get a home equity loan with bad credit?

It depends, most investor focused programs have absolute cut offs at 680. While investor focused lending programs don't care about W2s, employment income or tax return information, credit score maintenance is an absolute requirements for any borrower seeking to get funding for growing their real estate portfolios.

What are the alternatives to home equity loans for bad credit borrowers?

If your credit score is standing in the way of a traditional home equity loan, you've still got options:

- Cash-out refinance through non-prime lenders

- Fix-and-flip or bridge loans (some accept scores as low as 680)

- Credit unions or local banks with more flexible lending criteria

- Government-backed loan programs

- Bringing on a co-signer with stronger credit

How long does it take to get approved for a loan?

The approval timeline varies by lender and loan type. Home equity loans may take 1-3 weeks from application to funding. Bridge loans and fix-and-flip financing can sometimes close in as little as 7-14 days. The process includes application submission, documentation review, property appraisal, underwriting, and closing.

What documentation will I need to apply?

Be prepared to provide:

- Property information (deed, tax assessments)

- Mortgage statements

- Insurance documentation

- Credit history explanation for recent negative events

How much can I borrow against my home's equity?

According to the Federal Trade Commission, "Many lenders prefer that you borrow no more than 70-80 percent of the equity in your home". This is calculated as your home's current value minus your remaining mortgage balance. With bad credit, lenders may restrict this further to 70% or less of your available equity.