*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Home Equity Agreements (HEAs) for Real Estate Investors: A Comprehensive Guide

When you're looking to tap into your property's equity, you might come across Home Equity Agreements (HEAs)—also known as home equity investments or shared equity agreements. These financial products have gained some attention in recent years, but here's the reality: they're rarely used by experienced real estate investors, and for good reason.

In this comprehensive guide, we'll break down everything you need to know about HEAs, including how they work, their costs, and why most savvy landlords and property investors choose alternative financing options like DSCR loans or Fix & Flip loans instead.

What is a Home Equity Agreement (HEA)?

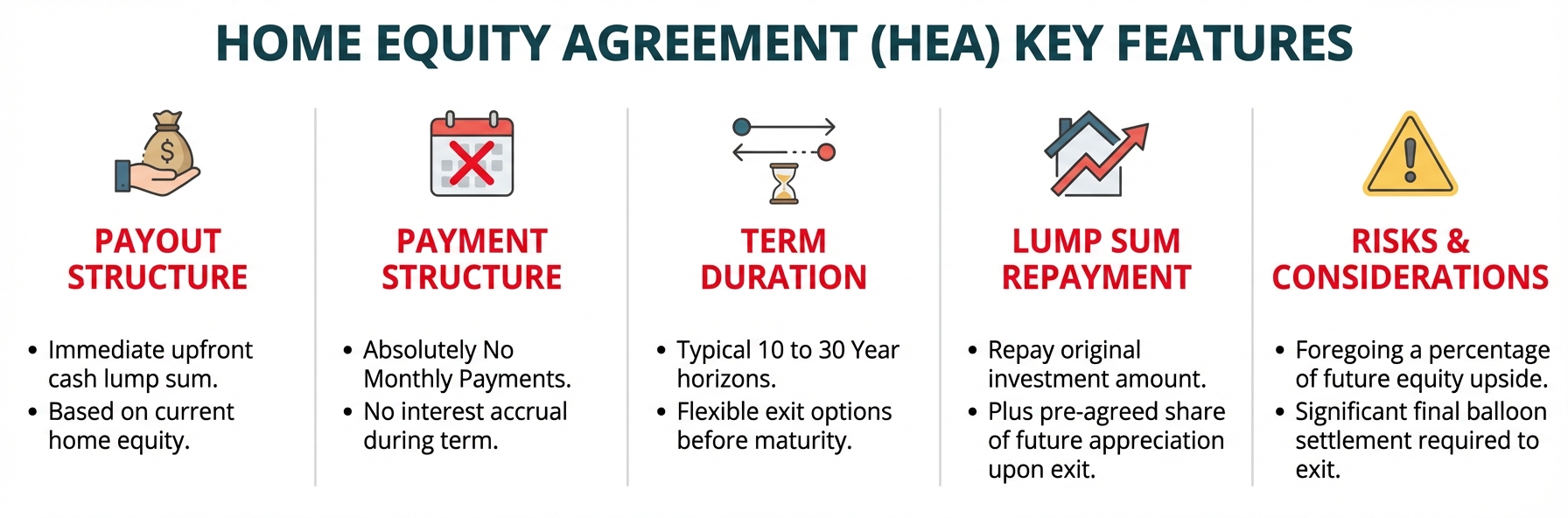

A Home Equity Agreement (HEA) is a financial arrangement where you sell a portion of your home's equity to an investor in exchange for a lump sum of cash upfront. Unlike traditional loans, HEAs don't require monthly payments or charge interest, making them a unique financing option for property owners.

You might also hear HEAs called home equity investments (HEIs) or shared equity agreements. These names reflect their investment-like structure rather than a traditional debt arrangement. Here's the deal: the investor gives you capital today and receives a share of your property's future appreciation when the agreement term ends.

The fundamental structure is straightforward: you get cash now, and in return, you agree to share a percentage of your home's future value with the investor. Repayment happens either when you sell your home or when the agreement term ends—typically anywhere from 10 to 30 years, depending on the provider.

According to the Consumer Financial Protection Bureau, "Home equity contracts are financial agreements in which a homeowner gets an upfront cash payment from a company and, in exchange, must repay a lump sum amount at a later date". This repayment amount is typically calculated based on your home's value at the time of settlement.

For real estate investors, particularly landlords, HEAs offer an alternative way to tap into property equity without adding debt service that could squeeze your cash flow. However, as we'll explore further, this convenience comes with significant trade-offs that make them rarely used among savvy real estate investors.

How Home Equity Agreements (HEAs) Work

Home Equity Agreements (HEAs) represent a unique financing option for real estate investors, and they work quite differently from traditional loans. Here's the key distinction: an HEA isn't a loan at all—it's an investment agreement between you as the property owner and a funding company.

The Basic Mechanics

Here's the deal: an HEA lets you tap into your home equity by sharing a slice of your property's future appreciation with an investor. You get a lump sum of cash upfront—no monthly payments to worry about. In exchange, the funding company gets a percentage of your property's future value when you sell or when the agreement wraps up.

Now, let's look at the real numbers. The Consumer Financial Protection Bureau shares this eye-opening example: a homeowner who receives $50,000 upfront could end up repaying around $68,045 after just three years—even if their property lost value. That's a significant cost to consider before signing on the dotted line.

![Task: Create a detailed step-by-step flow diagram infographic illustrating how a Home Equity Agreement transaction works from initial application through final settlement.

Visual Structure: A vertical flowchart with six sequential steps connected by arrows, showing the complete HEA lifecycle with icons and explanatory text for each stage.

ASCII Layout Reference:

```

+------------------------------------------------------------------+

| HOW HOME EQUITY AGREEMENTS WORK |

+------------------------------------------------------------------+

| |

| [1] PROPERTY APPRAISAL → Property valued at $500,000 |

| [House Icon] |

| ↓ |

| [2] RECEIVE CASH → Get $50,000-$150,000 upfront |

| [Money Icon] (10-30% of home value) |

| ↓ |

| [3] NO MONTHLY PAYMENTS → Live payment-free for term |

| [Calendar Icon] (10-30 years typical) |

| ↓ |

| [4] PROPERTY APPRECIATES → Home value grows over time |

| [Graph Icon] |

| ↓ |

| [5] SETTLEMENT TRIGGER → Sale or term expiration |

| [Clock Icon] |

| ↓ |

| [6] REPAYMENT → Pay initial amount + share of |

| [Calculator Icon] appreciation (20-40% typical) |

| |

+------------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770670949780_1ndz55.jpg?alt=media&token=612c658f-454e-4361-a5d0-94610513ab75)

Valuation and Investment Amount

First things first: a professional appraiser determines your property's current market value. From there, HEA providers typically offer you between 10-30% of your home's value in cash. One important guardrail: most providers require you to keep at least 20% equity in your property after the transaction.

Term Length and Structure

HEA terms usually run between 10-30 years, though you'll find some providers with shorter options. Here's the good news: you stay in the driver's seat. You keep full ownership and control of your property throughout the term, along with the usual responsibilities—maintenance, taxes, and insurance.

One thing to know: as Investopedia points out, the HEA provider places a lien on your home, just like a mortgage lender would. This protects their investment and gives them a legal claim to their share when the agreement concludes.

Repayment Scenarios

When it comes time to settle up, you've got options:

- Property Sale: Sell your property, and the HEA provider receives their agreed-upon percentage of the sale price.

- Buyout: Ready to part ways early? You can buy out the agreement before the term ends, typically based on your current appraised value.

- Term Expiration: If the term ends without a sale, the property owner must repay the investment based on the property's current value, often requiring refinancing or obtaining another loan.

Practical Example for Landlords

Let's walk through a real-world scenario that many real estate investors might face:

Say you own a rental property worth $500,000 with $300,000 in equity. You've got your eye on another investment property but need cash for the down payment. With an HEA, you could receive $100,000 (20% of your home's value) in exchange for 30% of the property's future appreciation.

Fast forward 10 years, and your property value has climbed to $700,000:

- Appreciation: $200,000

- HEA provider's share (30% of appreciation): $60,000

- Total repayment: $160,000 ($100,000 initial investment + $60,000 appreciation share)

Here's the bottom line: while skipping monthly payments sounds appealing, the long-term cost can add up quickly—especially in appreciating markets where investment properties typically shine.

One important note: HEA agreements aren't one-size-fits-all. Some providers include guardrails or caps on the repurchase amount, so make sure you understand exactly what you're signing up for.

The Limited Marketplace for Home Equity Agreements

Home Equity Agreements have been gaining momentum, but here's what you need to know: your options are still fairly limited, especially if you're a real estate investor. Despite market growth, only a handful of major providers are in the game.

Major HEA Providers in the Market

Here are the key players you should know about:

- Unison: One of the pioneers in equity sharing agreements

- Point: Notable for accepting some investment properties

- Hometap: Known for offering larger payouts

- Splitero: Offers more flexible timelines

- Unlock: Provides more flexible terms

- Aspire HEI: A newer entrant backed by Redwood Trust

According to the Consumer Financial Protection Bureau, "As of 2024, the market is dominated by four companies: Unison, Point, Hometap, and others". This limited number of providers creates a challenging environment for investors seeking these financial products.

Why Real Estate Investors Rarely Use HEAs

Here at OfferMarket, we've noticed that investors don't often turn to HEAs. Here's why that makes sense:

Limited Availability for Investment Properties: Most HEA providers zero in on owner-occupied primary residences. As AmeriSave points out, "Most home equity agreement companies focus exclusively on owner-occupied primary residences, but Point is a notable exception".

Restrictive Qualification Criteria: Investment properties typically face tougher requirements and less attractive terms than primary residences.

Cost Inefficiency: If you've got a solid credit score, traditional financing usually delivers better terms and lower costs overall.

Geographic Limitations: Many HEA providers only work in certain states, which can be a roadblock if you own properties in multiple regions.

Future Appreciation Concerns: If you're playing the long game with appreciation, sharing that upside with an HEA provider probably doesn't sit well with you.

When you add it all up, HEAs just don't make the cut for most real estate investors' toolkits—even though they can work well in specific situations. Most landlords and property investors get more bang for their buck with products built for investment properties, like DSCR loans or traditional portfolio financing.

Benefits of HEAs for Real Estate Investors

That said, Home Equity Agreements do bring some real advantages to the table for investors who want to tap into capital while keeping their options open:

No Monthly Payments

Here's a big one: unlike traditional loans, HEAs don't come with monthly payments. That can be a game-changer for your cash flow. This feature is particularly valuable for landlords who want to maximize their monthly rental income without additional debt service obligations.

Improved Cash Flow Management

When you eliminate monthly payments, you free up funds to put toward other investment opportunities, property improvements, or emergency reserves. According to SoFi, "A home equity agreement allows homeowners to access a lump sum of cash without applying for a traditional loan," making it easier to manage cash flow strategically source.

Flexible Use of Funds

The capital you access through an HEA can be used for virtually any purpose, including:

- Purchasing additional investment properties

- Renovating existing properties to increase rental income

- Consolidating higher-interest debts

- Diversifying your investment portfolio beyond real estate

No Impact on Credit Score

Here's something worth knowing: since HEAs are not loans but rather investment agreements, they typically don't appear on credit reports and don't affect debt-to-income ratios. This can be a real advantage if you're looking to preserve your borrowing capacity for other ventures.

Faster Closing Process

HEAs often close more quickly than traditional financing options, with some companies completing the process in as little as two weeks. According to Turner Title, this makes them "ideal for retirees or those with irregular income" who need quick access to capital source.

No Additional Debt

Because HEAs are equity investments rather than loans, they don't add debt to your balance sheet. This can be especially helpful if you're already highly leveraged or want to maintain specific debt-to-equity ratios in your portfolio.

Access to Equity Without Selling

For investors with significant equity in their properties but who want to maintain ownership, HEAs provide a smart way to tap into that value without selling the asset. This allows continued participation in potential property appreciation while accessing immediate capital.

Despite these benefits, it's important to note that in OfferMarket's experience, HEAs are rarely utilized by sophisticated real estate investors due to their high costs and the availability of more cost-effective alternatives like DSCR loans. Most savvy landlords find that DSCR programs offer better long-term value for their investment strategies.

Drawbacks and Risks of HEAs for Real Estate Investors

Home Equity Agreements (HEAs) might look appealing since you won't have monthly payments to worry about, but let's dig into some significant drawbacks you'll want to weigh before signing on the dotted line.

Loss of Appreciation Upside

Here's the big one: you're giving up a slice of your property's future gains. In a strong market, this can really add up. Let's say your property jumps 30% in value over five years—you could end up handing over two or three times what you originally received to the HEA provider. That's money that could have stayed in your pocket.

![Task: Create a comparison chart showing the true cost of an HEA versus a traditional loan over a 10-year period with property appreciation scenarios.

Visual Structure: A dual-axis bar chart comparing total costs between HEA and Traditional Loan across three appreciation scenarios (Low 2%, Moderate 4%, High 6% annual appreciation).

ASCII Layout Reference:

```

+------------------------------------------------------------------+

| HEA vs TRADITIONAL LOAN: 10-YEAR COST COMPARISON |

| ($100,000 Initial Capital) |

+------------------------------------------------------------------+

| |

| Total Cost ($) |

| 200k | [RED BAR] |

| | $179k |

| 175k | [RED BAR] |

| | $148k |

| 150k | [RED BAR] |

| | $120k |

| 125k | [TEAL] [TEAL] [TEAL] |

| | $115k $115k $115k |

| 100k |__________________________________________________________|

| | |

| Low (2%) Moderate (4%) High (6%) |

| Annual Property Appreciation Rate |

| |

| [TEAL BOX] Traditional Loan [RED BOX] Home Equity Agreement |

+------------------------------------------------------------------+

```

Image Section Breakdown:

- Title:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770672638534_7blo1l.jpg?alt=media&token=74855677-1fd3-4929-a363-21866e92954f)

High Effective Costs

The tricky part? You won't know the true cost until the agreement wraps up. As financial experts point out, "The major drawback of a home equity agreement is the unpredictable and potentially high cost of repayment, which is tied to the home's appreciation" (SoFi). For investors who like to plan ahead with predictable numbers, this uncertainty can be a real headache.

Restrictive Terms and Property Requirements

Many HEA providers set strict rules around property upkeep and improvements. Some agreements might limit your renovation options or require you to get approval before making big changes. You may also face restrictions on when you can sell or buy back the agreement (Money).

Prepayment Penalties

Here's something to watch out for: if your investment strategy shifts and you need to exit the HEA early, you could be hit with hefty prepayment penalties. These fees can eat into the financial benefits you thought you were getting from the agreement in the first place.

Designed for Desperate Situations

Let's be real—HEAs are typically marketed to homeowners struggling with poor credit or financial hardships who can't qualify for traditional financing. If you're a professional real estate investor with an established portfolio, HEAs are likely an expensive detour when you could be taking advantage of DSCR loans, portfolio loans, or traditional HELOCs.

Higher Costs Than Traditional Investor Loans

The Consumer Financial Protection Bureau puts it plainly: "Home equity contracts are expensive compared to other home-secured financing options" (CFPB). As a smart landlord or investor, you likely have access to more cost-effective financing that won't require you to give up your future appreciation.

Limited Availability

Even with growing interest in alternative financing, HEAs aren't easy to come by in the investment world. Many investors find it challenging to locate reputable providers who'll work with investment properties instead of just primary residences.

Bottom line: if you're a professional real estate investor focused on building long-term wealth, the drawbacks of HEAs usually outweigh the benefits—especially when better financing options are available for those with solid investment track records.

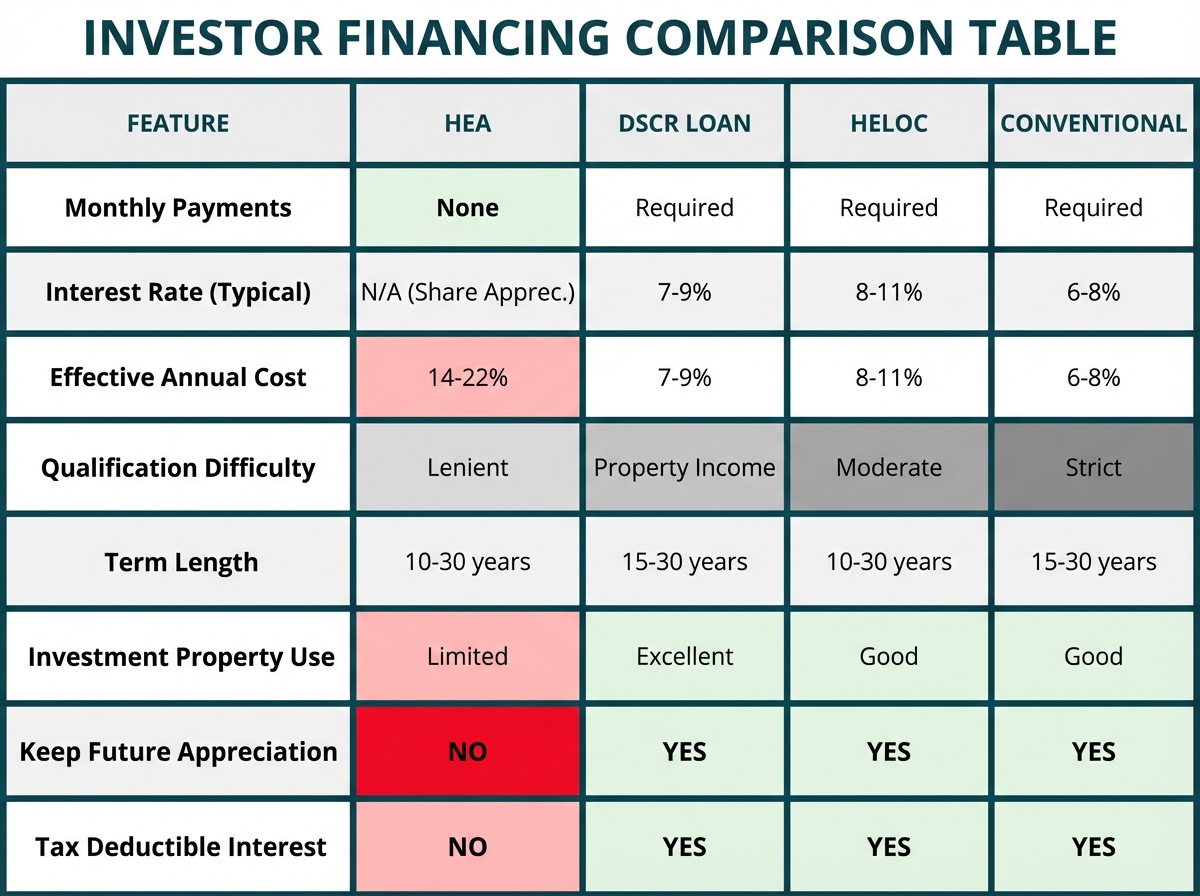

HEAs vs. Other Financing Options for Real Estate Investors

Before you commit to any financing for your investment properties, let's break down how Home Equity Agreements (HEAs) stack up against more traditional investor loan products like DSCR loans, HELOCs, and conventional mortgages.

Monthly Payment Structure

One of the biggest differences between HEAs and other financing options comes down to how payments are structured. HEAs require no monthly payments during the term of the agreement, which can be a real win for your cash flow. On the flip side, DSCR loans, HELOCs, and conventional mortgages all come with regular monthly payments you'll need to budget for.

Here's something worth knowing: according to Figure, "DSCR loans qualify based on the property's income rather than the borrower's personal income, making them ideal for investors with multiple properties or complex income situations." This key difference shapes how you'll manage your monthly cash flow and overall investment strategy.

Qualification Requirements

HEAs put the spotlight on your property's value and equity position rather than your personal financial picture. While credit scores and debt-to-income ratios may still come into play, they're typically less demanding than what you'd face with traditional loans.

DSCR loans work differently—they qualify you based on whether your property can generate enough income to cover the debt. As Treadstone Mortgage points out, "DSCR Loans may offer more flexible cash-out refinance options, which can be a powerful tool for portfolio growth. Meanwhile, Conventional Loans typically have stricter qualification requirements."

Cost Structure and Long-Term Financial Impact

Here's the reality check: HEAs can end up costing you significantly more over time compared to other financing options, particularly in markets where property values are climbing. Since you're giving up a slice of future appreciation, the effective cost could far outpace traditional interest rates if your property value takes off.

For investment properties, DSCR loans often deliver better long-term value. The folks at BiggerPockets forums put it well: "You will get a better rate on a DSCR loan compared to an investment property HELOC. Investment property HELOCs are hard to find but a closed end second might be more available."

Flexibility and Use of Funds

Good news on both fronts: HEAs and DSCR loans give you flexibility in how you put those funds to work, whether that's property improvements, expanding your portfolio, or other business needs. However, DSCR loans typically provide more predictable terms and costs, making them easier to factor into long-term investment strategies.

Why Experienced Investors Often Prefer DSCR Loans

Seasoned real estate investors often gravitate toward DSCR loans over HEAs, and here's why:

- Predictable costs: You know your interest rate and payment schedule from day one

- Retention of appreciation: You keep every dollar of your property's appreciation

- Portfolio scalability: DSCR loans are built for investment properties and work across your entire portfolio

- Industry acceptance: These loans are widely available and well-understood in the investment community

HEAs might look appealing because there are no monthly payments to worry about. But when you crunch the numbers, the long-term cost and the appreciation you're giving up make them a tough sell for investors who understand how equity growth builds real wealth in real estate.

HEAs vs. Fix & Flip Loans: Which is Better for Real Estate Investors?

When you're exploring financing options for your real estate investments, you'll likely find yourself comparing Home Equity Agreements (HEAs) with traditional investment loan products like Fix & Flip loans. Let's break down the key differences so you can make the right choice for your investment strategy.

Purpose and Term Length

Fix & Flip loans are short-term financing tools built specifically for investors who want to buy, renovate, and sell properties quickly for profit. These loans typically run from 6 to 24 months—just enough time to complete your renovations and get the property sold.

HEAs work differently. They're longer-term arrangements where you receive a lump sum today in exchange for a share of your property's future appreciation, with terms usually spanning 10-30 years. This fundamental difference makes each option suitable for very different investment strategies.

Cost Structure and Repayment

Fix & Flip loans require regular monthly payments and come with interest rates that are typically higher than traditional mortgages but lower than HEAs when you look at the total cost of capital. As Multifamily Loans points out, "One of the biggest advantages of using alternative financing like a home equity line of credit to finance a fix-and-flip project is a potentially lower interest rate" compared to equity-sharing arrangements like HEAs.

HEAs don't require monthly payments, which can feel like a win for your cash flow. But here's the trade-off—you're handing over a slice of your property's future appreciation, and in a hot market, that slice can add up fast.

Qualification Requirements

Fix & Flip loans zero in on what really matters: your property's potential value after renovation (the "after repair value" or ARV) and your track record as an investor. Traditional metrics like debt-to-income ratios take a back seat, which opens doors for experienced investors who might not check every box for conventional financing.

HEAs tend to be more forgiving when it comes to credit scores and income verification, making them a solid option if your credit isn't spotless. The catch? You'll need substantial existing equity in your property to qualify.

Suitability for Different Investment Strategies

Fix & Flip loans are built for investors who move with purpose—those with clear exit strategies and projects they plan to wrap up within 6-24 months. LendingOne puts it well: these loans are designed to "match financing options like fix and flip... to your investment strategy," making them a natural fit for short-term renovation projects with defined timelines.

HEAs work better for investors who want to tap into their equity without selling and are comfortable sharing a piece of their property's future growth. However, for savvy real estate investors with solid credit and a clear game plan, Fix & Flip loans typically deliver more cost-effective financing while giving you greater control over your property's future value.

Here's the bottom line: experienced real estate investors generally find that traditional investment loan products like Fix & Flip loans offer better terms, more predictable costs, and stronger long-term profitability than HEAs. That's exactly why HEAs remain a niche product in the real estate investment financing world.

HEAs vs. Other Financing Options for Real Estate Investors

When you're weighing financing options for your investment properties, you need to understand how Home Equity Agreements (HEAs) stack up against more traditional financing vehicles like cash-out refinancing, DSCR loans, and HELOCs.

Monthly Payment Obligations

Here's where HEAs stand out: no monthly payments. Unlike cash-out refinancing or HELOCs, which require regular monthly payments, HEAs defer payment until the end of the agreement term or when you sell the property. For landlords, this can be a game-changer for monthly cash flow.

But let's be real—this benefit comes at a price. While cash-out refinancing typically offers interest rates between 6-8% depending on your credit profile, HEAs often claim a much larger slice of your future equity appreciation—sometimes 30-40% of your property's value increase.

Total Cost Comparison

As a real estate investor, you need to think long-term about costs. Cash-out refinancing generally comes with higher upfront closing costs (typically 2-5% of the loan amount) but gives you predictable expenses through fixed interest rates.

HEAs work differently. Lower initial costs sound appealing, but they can become seriously expensive if your property appreciates well. Let's break it down: say you receive $100,000 through an HEA in exchange for 40% of future appreciation. If your property increases in value by $200,000 over ten years, you'll owe $80,000 on top of the original $100,000—that's effectively an extremely high interest rate.

Tax Implications

Here's some good news for investors considering cash-out refinancing: mortgage interest on rental properties remains tax-deductible as a business expense. HEAs? Not so straightforward. The tax treatment is murkier and generally less favorable—payments to HEA providers typically don't qualify for those same valuable deductions.

Qualification Requirements

Let's break down what you'll need to qualify for each option. HEAs tend to be more lenient, while cash-out refinancing requires:

- Good credit scores (typically 620+)

- Debt-to-income ratios below 43%

- Significant property equity (usually at least 20% remaining after refinancing)

HEAs often approve investors with:

- Lower credit scores

- Higher debt-to-income ratios

- Less concern about income verification

So yes, HEAs might work for investors facing credit hurdles. But here's the reality check: the long-term costs make them a poor choice for investors who can qualify for investor friendly financing.

Timeline for Funding

Need cash fast? HEAs can deliver capital in as little as 2-3 weeks. Cash-out refinancing typically takes 30-45 days. That speed difference matters when you're chasing a time-sensitive deal—but it rarely makes up for the significantly higher costs down the road.

Why Most Savvy Landlords Avoid HEAs

At OfferMarket, we've worked with thousands of real estate investors, and here's what we've noticed: professional landlords rarely use HEAs. Here's why:

- Cost-effectiveness: DSCR loans and cash-out refinancing simply cost less over time for investors with decent credit

- Preservation of appreciation: Smart investors know that property appreciation builds serious wealth—why give away a slice of that upside?

- Availability: DSCR loans and cash-out refinancing are widely accessible, while HEA providers are limited and often focus on distressed homeowners rather than investors

The bottom line? If you're building long-term wealth through real estate, traditional financing options like DSCR loans or cash-out refinancing give you better terms and let you keep your property's full appreciation potential.

How to Qualify for an HEA Loan

Home Equity Agreements (HEAs) come with their own set of qualification requirements—and they look quite different from what you'd expect with traditional real estate investment loans. Let's break down what you need to know before applying.

Property Equity Requirements

Most HEA providers want to see that you've built up solid equity in your property. You'll typically need somewhere between 20-40% equity in your home to get approved. This makes sense—the funding company needs to know you have real skin in the game.

According to The Mortgage Reports, "Most companies require at least 20–40% equity" in the property for HEA qualification purposes. Think of this equity requirement as a safety net that protects both you and the HEA provider.

Property Type Limitations

HEAs tend to be more flexible than traditional mortgages when it comes to property types:

- Single-family homes are the most straightforward to qualify

- 1-4 unit residential properties typically make the cut

- Rental properties? Yes, many HEA providers welcome them

- Vacation homes can work with the right company

As noted by Point, "You're generally eligible for a home equity sharing agreement if you own a 1-4 unit property. Rental properties are eligible" for many HEA programs.

Credit Profile Considerations

If your credit history isn't spotless, you're not automatically out of the running. Investor loans usually demand credit scores of 620 or higher for better rates, but HEAs can open doors for those with lower scores.

Unlock Technologies notes that HEAs can be appropriate for those who "Have below-average credit: With traditional loans or refinancing, you typically need a credit score of 620 to qualify" (Unlock).

Location Restrictions

Not all properties qualify for HEAs based on where they're located:

- Many HEA providers only operate in certain states

- Some neighborhoods or zip codes may be excluded due to market volatility

- Rural properties might face extra scrutiny or restrictions

- HEA companies often prefer high-appreciation markets

Investor Experience Considerations

For real estate investors specifically, some HEA providers may look at:

- Your track record as a property investor

- Portfolio size and performance

- Property management experience

- Future investment plans

Ownership Structure Limitations

How your property is owned can affect eligibility:

- Properties held in irrevocable trusts are typically ineligible

- Properties owned by LLCs may face restrictions

- Properties with multiple owners may require all parties' consent

Hometap specifically notes, "We don't invest in properties in irrevocable trusts or properties held in LLCs," which can be a real roadblock for experienced real estate investors (Hometap).

Why HEAs Target Credit-Challenged Investors

HEAs are often marketed to property owners who struggle to access traditional financing. The no-monthly-payment feature appeals to cash-strapped investors, but here's the trade-off: you're giving up future equity. If you're a real estate investor with solid credit and steady income, traditional investment property loans usually make more financial sense over time.

Understanding the True Cost of HEA Loans for Investors

Home Equity Agreements (HEAs) might look appealing with their no-monthly-payment setup, but as a savvy investor, you'll want to dig into the real costs before signing on. Unlike traditional financing, HEAs come with a layered fee structure that can add up to significantly more expense down the road.

Fee Structure and Effective Interest Rates

HEAs typically charge processing fees between 3-5% of your initial payment amount, which get deducted from your upfront funds. But here's where it gets interesting—the real cost is in the appreciation sharing model. On average, HEA providers take roughly 1.5% to 2% of your property's total future value for every 1% of current value they advance to you.

Let's break down what this actually means for your wallet. When you calculate the effective annual cost, HEAs can run anywhere from 14% to 22% annually in the early years. That's significantly higher than traditional financing options like DSCR loans or HELOCs, which typically offer single-digit interest rates.

According to the Consumer Financial Protection Bureau, the true cost of HEAs becomes clearest when you look at different appreciation scenarios.

Long-Term Cost Implications with Appreciation Scenarios

Let's walk through a real-world example. Say you own an investment property worth $500,000 and receive $50,000 (10% of your property's value) through an HEA. In return, you agree to give the HEA provider 20% of your home's future value when the agreement ends in 10 years.

Here's what happens if your property appreciates at a modest 4% annually:

- Initial property value: $500,000

- Property value after 10 years: approximately $740,000

- Amount owed to HEA provider: $148,000 (20% of $740,000)

- Effective cost: $98,000 ($148,000 - $50,000 initial advance)

- Equivalent to an annual percentage rate of approximately 11.5%

Now, let's see what happens with stronger appreciation. If your property grows at 6% annually:

- Property value after 10 years: approximately $895,000

- Amount owed to HEA provider: $179,000 (20% of $895,000)

- Effective cost: $129,000 ($179,000 - $50,000)

- Equivalent to an annual percentage rate of approximately 13.8%

A market analysis by AmeriSave confirms that these agreements typically cost 14% to 22% annually in equivalent interest during the early years.

Why HEAs Are More Expensive Than Alternatives

Here's the deal: HEAs are built for homeowners who have limited financing options—usually due to credit hiccups or income challenges. But if you're a real estate investor with your eye on the prize, there are some solid reasons why HEAs might not be your best bet:

Sharing appreciation: With a fixed-rate loan, your payment stays the same no matter how well your property performs. With an HEA, you're handing over a slice of your property's growth potential—and let's be honest, that upside is probably why you got into real estate in the first place.

No tax benefits: Interest on many investment property loans can be tax-deductible. HEA costs? Typically not.

Limited availability: Finding an HEA provider for investment properties is like finding a needle in a haystack. Traditional investor loan products are far more accessible.

Prepayment considerations: Pay off a traditional loan early, and you save on interest. Pay off an HEA early? You're still on the hook for that appreciation share you agreed to.

Bottom line: If you've got decent credit and steady rental income, DSCR loans, portfolio loans, or cash-out refinances will likely serve you better—keeping more of your future gains in your pocket.

When Home Equity Agreements Might Make Sense for Real Estate Investors

Let's be clear: HEAs aren't typically the go-to for savvy real estate investors. But there are a few situations where they could work in your favor.

For Investors with Credit Challenges

If you're dealing with a temporary credit setback, HEAs might open doors when hard money lenders won't. The key difference? HEAs care more about your property's equity and appreciation potential than your credit history.

According to Investopedia, "Home equity agreements may be more accessible to homeowners with less-than-perfect credit because approval is based more on the value of your home than your credit score or debt-to-income ratio".

When You Need Capital Fast

Sometimes opportunities don't wait. For investors facing time-sensitive situations, HEAs can unlock quick access to funds. Here's when they might come in handy:

- Jumping on a can't-miss investment opportunity

- Handling unexpected repairs across your properties

- Snagging a distressed property that needs immediate action

Reading Your Local Market

In hot markets where values are climbing fast, some savvy investors use HEAs for short-term capital needs while planning to refinance or sell within a few years. Just remember: this strategy calls for careful number-crunching to weigh potential appreciation costs against traditional financing expenses.

Using HEAs as Bridge Financing

Think of HEAs as a bridge to get you where you need to go when:

- You're between investor loan qualifications

- You need to quickly consolidate high-interest debt before refinancing

- You're planning improvements that will boost property value before locking in long-term financing

Here's a real-world example from Offit Kurman: Say you need $25,000 for property improvements but don't qualify for hard money financing. You could tap into an HEA, complete the upgrades, then refinance once your property value increases and your financial picture improves.

A Word of Caution

While these scenarios show HEAs can be useful tools, approach them carefully. The Consumer Financial Protection Bureau points out that HEIs (Home Equity Investments, another term for HEAs) can be risky products with potentially higher costs compared to traditional financing options. Smart investors know to explore every financing option before turning to an HEA for their investment properties.

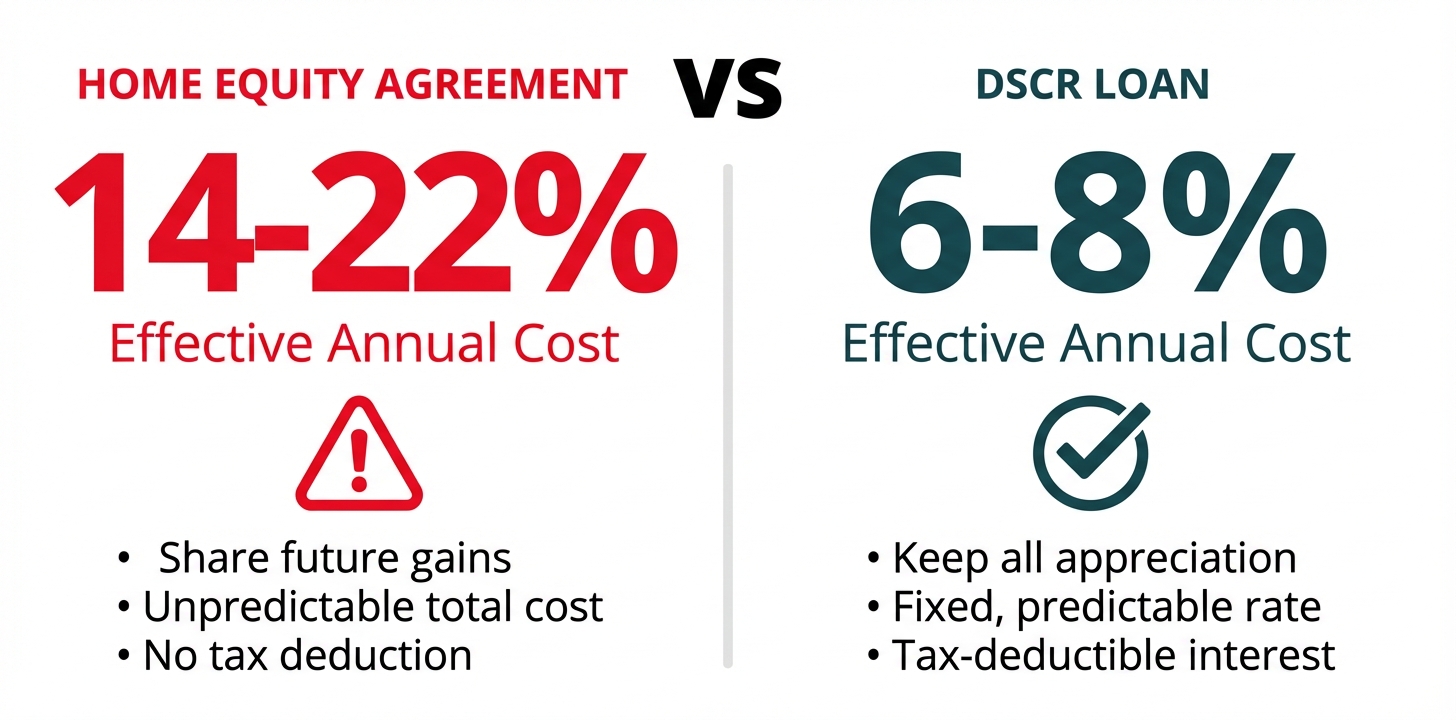

Alternative Financing Options for Real Estate Investors

As a real estate investor, you have plenty of financing tools at your disposal beyond the traditional mortgage. Each one serves a different purpose depending on your strategy. Home Equity Agreements (HEAs) might catch your eye initially, but seasoned investors often find more cost-effective solutions that align better with their wealth-building goals.

![Task: Create a visual infographic showcasing the most popular alternative financing options for real estate investors, arranged in order of preference and usage frequency.

Visual Structure: A pyramid-style hierarchy diagram with five tiers, showing investor financing options from most preferred (top) to least preferred (bottom), with icons and key features for each option.

ASCII Layout Reference:

```

+------------------------------------------------------------------+

| INVESTOR FINANCING OPTIONS: PREFERENCE PYRAMID |

+------------------------------------------------------------------+

| |

| [STAR ICON] |

| DSCR LOANS |

| Most Popular Choice |

| • Qualify on property income |

| • Competitive rates 7-9% |

| |

| +---------------------------------+ |

| | PORTFOLIO LOANS | |

| | • Multiple properties | |

| | • Flexible terms | |

| +---------------------------------+ |

| |

| +------------------------------------------+ |

| | CASH-OUT REFINANCING | |

| | • Tax-deductible interest | |

| | • Predictable costs | |

| +------------------------------------------+ |

| |

| +------------------------------------------------+ |

| | FIX & FLIP LOANS | |

| | • Short-term (6-24 months) | |

| | • Based on ARV | |

| +------------------------------------------------+ |

| |

| +--------------------------------------------------------+ |

| | HOME EQUITY AGREEMENTS | |

| | • Rarely used by savvy investors | |

| | • High long-term costs (14-22%) | |

| | • Give up future appreciation | |

| +--------------------------------------------------------+ |

| |

+------------------------------------------------------------------+

```

Image Section Breakdown:

- Title:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770760308012_agovfh.jpg?alt=media&token=a60da48c-0c17-4163-9c18-8640b8761176)

DSCR Loans: The Investor's Go-To Option

Debt Service Coverage Ratio (DSCR) loans have become a favorite among real estate investors for good reason—they qualify you based on what the property can earn, not your personal income. As RateLeaf puts it, "DSCR loans offer unique advantages for real estate investors. A strong DSCR can lead to more stable financing for investment properties".

DSCR loans feature:

- No personal income verification required

- Qualification based on property's cash flow

- Competitive interest rates for investors with strong portfolios

- Faster approval processes than conventional loans

Portfolio Loans: Flexibility for Multiple Properties

Portfolio loans let you bundle multiple properties under one loan product. If you're looking to grow your real estate holdings efficiently, this option deserves a close look.

Private Lending: Speed and Flexibility

Private lending gets capital in your hands fast, with less red tape than traditional financing. Yes, interest rates run higher, but the flexible terms and approval criteria give you options that banks simply can't offer.

Lines of Credit: Ongoing Access to Capital

Need funds ready to go when the right deal comes along? A line of credit secured against your existing properties gives you that flexibility—no new loan application required each time opportunity knocks.

Blanket Mortgages: Streamlining Multiple Property Management

According to Resideum, "Hard money loans are a popular choice for real estate investors with a strong credit history and a substantial down payment". But here's the thing—if you're juggling multiple properties, a blanket mortgage might be your new best friend. It lets you bundle several properties under one loan with a single payment. That means less paperwork, simpler portfolio management, and potentially lower overall costs.

Why Savvy Investors Prefer These Options Over HEAs

Smart real estate investors tend to steer clear of HEAs, and for good reason:

- You keep all your future appreciation potential

- Your long-term costs stay lower

- You maintain complete ownership control

- Your financial outcomes remain predictable

- Everything stays aligned with your wealth-building goals

OfferMarket's Specialized Investor Loan Products

At OfferMarket, we get it—real estate investors have unique financing needs. That's exactly why we've built our lending solutions with you in mind. Because we operate in both lending and the real estate marketplace, we bring you:

- Streamlined DSCR loan programs with competitive rates

- Fix & Flip financing with flexible terms

- Portfolio loan solutions for growing investors

- Personalized guidance based on your investment strategy

This dual perspective gives us real insight into property values, market trends, and what investors actually need—so we can structure financing solutions that traditional lenders simply can't offer.

Why Choose OfferMarket for Real Estate Investor Loans

Here's what makes OfferMarket different: we combine marketplace expertise, competitive loan products, and a genuine understanding of what investors need. While traditional lenders often treat investment properties like primary residences, we've built our entire approach specifically for real estate investors like you.

Marketplace Expertise Driving Better Lending Decisions

Here's something traditional lenders can't offer: real marketplace knowledge. As a comprehensive real estate marketplace, OfferMarket brings insights that translate directly into more accurate property valuations, deeper understanding of rental markets, and better loan terms for you. When you combine expertise in loans, listings, and insurance under one roof, you get a complete picture of your investment strategy—not just a piece of the puzzle.

Competitive Rates and Flexible Terms

Let's talk numbers. OfferMarket delivers competitive rates on investor-friendly products like DSCR loans, which qualify you based on your property's rental income instead of your personal income. As industry experts note, "DSCR loans give investors flexibility that traditional mortgages can't match". Whether you're planning a long-term hold or a medium-term play, OfferMarket structures loan terms that actually fit your investment goals.

Rapid Funding for Time-Sensitive Opportunities

You know the drill: in real estate, the best deals don't wait around. OfferMarket's streamlined approval process helps you move fast when opportunity knocks. While other lenders might take weeks to close, our efficient systems can cut that timeline significantly—giving you the edge you need in competitive markets.

Superior Property Condition Assessment

OfferMarket's platform experience means we know properties inside and out. This translates to fewer surprises during underwriting and loan terms that accurately reflect your property's true condition. Working with a fixer-upper? Our insight helps you structure financing that makes sense for properties needing improvements.

Geographic Market Knowledge

Every market has its own personality—and its own investment potential. OfferMarket's extensive geographic expertise means lending decisions based on real market-specific factors, not standardized underwriting guidelines that ignore what makes your target market unique. This translates to potentially better terms for properties in areas where other lenders might be overly cautious.

Understanding Landlord-Specific Needs

"DSCR lending allows you to qualify for a loan based on your property's performance", and that's exactly the kind of flexibility real estate investors deserve. At OfferMarket, we get it—the cash flow juggling, the portfolio growth ambitions, the day-to-day realities of being a landlord. Our landlord-first mindset means we craft financing solutions that actually work for your investment strategy, not standardized products that miss the mark.

When you choose OfferMarket for your real estate investment financing, you're working with a team that sees the full picture of your investment journey. We're here to provide solutions that traditional lenders simply aren't equipped to offer.

Steps to Apply for an Investor Loan with OfferMarket

Getting a real estate investment loan shouldn't feel like a maze. At OfferMarket, we've built a process that's faster and smoother than what you'll find at traditional lenders—without sacrificing the personalized approach you need as an investor.

Step-by-Step Application Process

Initial Consultation: Start by chatting with our lending specialists about your investment goals and property details. We speak your language because we understand what real estate investors actually need.

Get an Instant Quote: No waiting games here. Our online platform delivers instant quotes so you can see your financing options right away and move forward with confidence.

Submit Your Application: Fill out our straightforward application with the basics about you and your investment property.

Documentation Submission: Gather the necessary paperwork for your loan type. For DSCR loans, you'll typically need:

- Property details and rental income information

- Purchase agreement (for acquisitions)

- Entity documentation (if purchasing under an LLC)

- Basic personal information

As experts point out, "Complete the lender's application form and provide all required documents" is a key step in the DSCR loan process.

Property Assessment: Our team takes a close look at the property—its condition, location, and income potential. This step matters because it directly shapes your DSCR calculation.

Loan Approval: Get your approval, often much faster than you'd expect with traditional financing.

Closing: Wrap things up with our dedicated support team walking you through every step.

![Task: Create a clean, professional timeline infographic showing OfferMarket's 7-step loan application process with estimated timeframes.

Visual Structure: A horizontal timeline with seven connected nodes, each representing a step in the application process, with icons, step names, and time estimates.

ASCII Layout Reference:

```

+------------------------------------------------------------------+

| OFFERMARKET LOAN APPLICATION PROCESS |

| Fast Track to Funding |

+------------------------------------------------------------------+

| |

| [1]────→[2]────→[3]────→[4]────→[5]────→[6]────→[7] |

| • • • • • • • |

| Consult Quote Submit Docs Assess Approve Close |

| |

| Day 1 Day 1 Day 2 Day 3 Day 7 Day 10 Day 14-21 |

| |

| [Icon] [Icon] [Icon] [Icon] [Icon] [Icon] [Icon] |

| |

| Initial Instant Fill Gather Property Loan Funded |

| Chat Quote Form Papers Review Decision |

| |

| TOTAL TIMELINE: 14-21 DAYS |

| (vs. 30-45 days with traditional lenders) |

+------------------------------------------------------------------+

```

Image Section Breakdown:

- Header:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1770760934568_xi3tuv.jpg?alt=media&token=cdbbf99c-ddd3-4af8-8482-8057ca8eb50a)

Timeline Expectations

Most lenders take 30-45 days to close. At OfferMarket, our streamlined process often gets qualified borrowers to the finish line in just 14-21 days. That means you can jump on investment opportunities without watching them slip away while you wait on financing.

The OfferMarket Difference

Here's what really makes OfferMarket stand out: we bring together loans, listings, and insurance expertise under one roof. This integrated approach delivers real benefits:

- Better Property Insights: Our marketplace experience gives us a sharper eye for property conditions and values across different markets.

- Investor-Focused Solutions: We get what investors need because we work alongside them every day across multiple areas of real estate.

- Streamlined Experience: Handle your financing, property acquisition, and insurance through one trusted partner.

- Dedicated Support: Our real estate investment specialists provide personalized guidance every step of the way.

We're not your typical traditional lender or faceless online platform. OfferMarket brings together user-friendly digital tools and seasoned real estate expertise. You get speed and convenience plus knowledgeable support throughout your investment journey.

Ready to explore your investment property financing options? Get started today with an instant quote and see the OfferMarket advantage for yourself.

Conclusion: Making the Right Financing Choice for Your Real Estate Investments

Home Equity Agreements (HEAs) offer a unique financing option for real estate investors seeking to access equity without monthly payments. However, as we've explored throughout this article, they come with significant trade-offs, particularly in terms of long-term costs and the surrender of future appreciation potential.

Here's the bottom line: for most real estate investors, investor financing options like DSCR loans, Fix & Flip loans, and conventional mortgages deliver more value with greater flexibility and lower overall costs. Yes, skipping monthly payments sounds appealing, but you could be handing over a significant chunk of your property's future gains in return.

When weighing your options, think about your investment timeline, cash flow requirements, and how this decision fits into your bigger wealth-building picture. As investment property financing experts point out, "Choosing the right financing starts with understanding how different loan programs evaluate risk and structure terms. The 'best' loan matches your investment goals and financial situation".

HEAs might make sense in certain situations, but most experienced landlords and property investors protect their equity position and maximize returns by sticking with proven financing products. Keep in mind that "understanding your investment goals, researching potential lenders, and carefully evaluating loan offers" is essential to landing the right financing solution.

Ready to explore financing options that can help grow your real estate portfolio more effectively than HEAs? OfferMarket provides tailored DSCR and Fix & Flip loans designed specifically for investors like you. Get an instant quote today and discover how our marketplace expertise can deliver faster approvals, competitive rates, and financing solutions aligned with your investment strategy.