*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Fix and Flip Loans

Last updated: April 16, 2024

Fix and flip loan investor update

In our effort to focus on serving buy and hold rental property investors, OfferMarket's "Fix and Flip loan" program is being rebranded to "Fix and Rent". We provide short term interest-only financing to buy, rehab, rent and refinance (BRRR method) rental properties.

We're seeing a growing amount of distress among investors currently in fix and flip loans. These investors are struggling to complete their rehab, attempting to extend the loan, and facing a market with lower home prices and softening market rents. We are advising all of our clients to use conservative estimates when evaluating deals, and stress test your consider how a deal and your personal finances will turn out in worst case scenarios. Further, we are urging our clients to protect their credit scores throughout the fix and flip loan term to ensure you can qualify for a DSCR loan if you ultimately decide to rent and refinance the property.

What are Fix and Flip Loans?

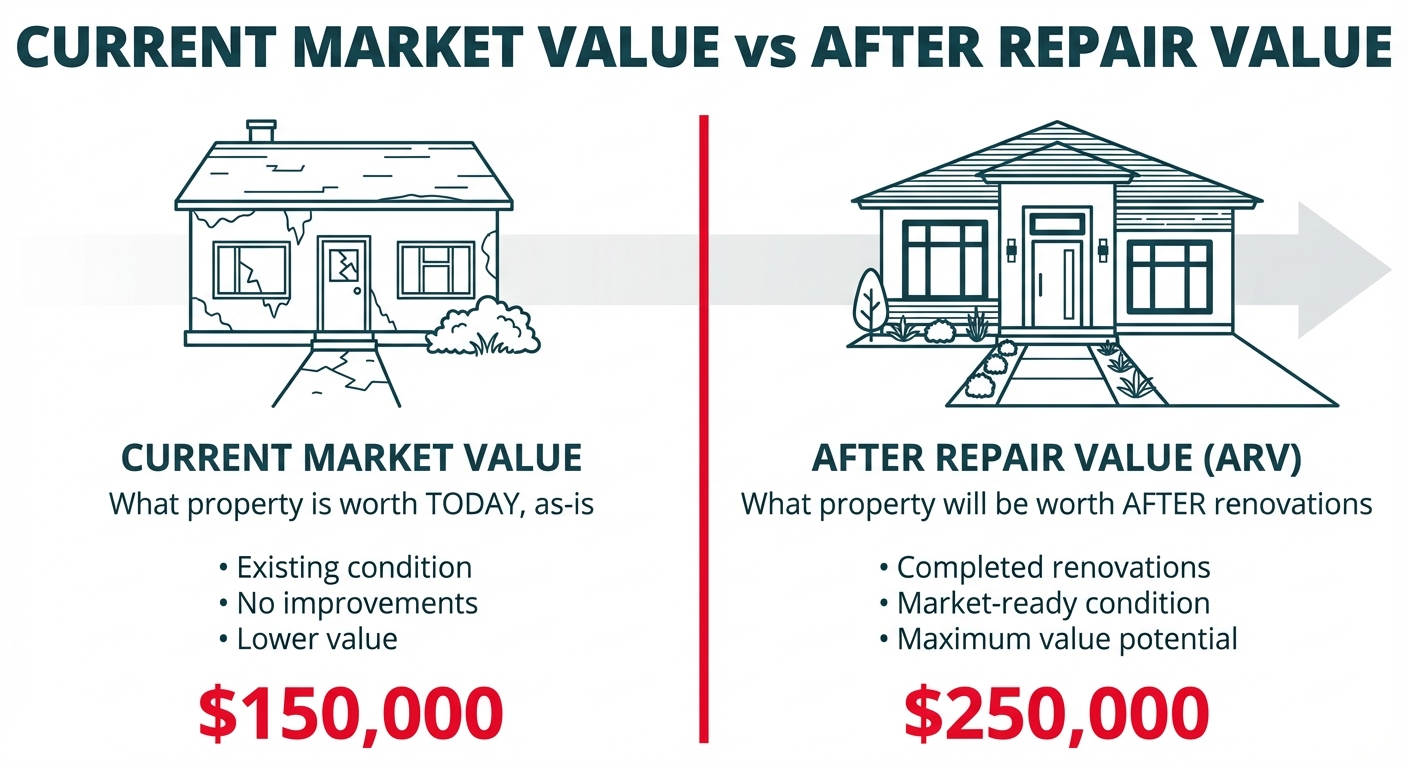

Fix and flip loans from OfferMarket Capital provide you with the capital to purchase and rehab distressed 1 to 4 unit residential properties.

Also known as "hard money" or "RTL" and "rehab loans", these loans are popular among flippers and rental property investors because we provide you up to 90% towards the purchase of the property and 100% of the renovation.

Bridge loan calculator

Try our bridge loan calculator and get an instant fix and flip loan quote and pre-approval in under a minute.

Hard money pre-approval

Did you know that you can get fix and flip loan terms on-demand in under a minute? Visit at offermarket.us/loans

👩💻 Submit your request with no obligation and review your preliminary terms 📄 download your pre-approval letter 🗓️ schedule a call with your dedicated relationship manager to confirm the best possible terms for your transaction ⚡ Process your loan entirely online and close in 15 days or less

To help you save money, we offer the lowest possible interest rate and origination fee on every single quote.

In many cases, we only charge interest on the amount of your loan that has been disbursed. This means you do not pay interest on the total loan amount until it has been disbursed to you.

You can even roll interest payments into your loan and avoid making monthly interest payments.

For clients that have experience with 5 or more verifiable rehab projects, we can even advance your draw funds for each stage of your scope of work.

Whether you are a beginner or a pro, we are committed to providing you with everyday low pricing, industry leading service, and an easy to use online platform to grow your real estate investing business.

By rolling your interest payments into your loan and advancing your draw funds, you will optimize your liquidity and protect your credit score. This means you need less cash to close and you will be positioned to get the best possible terms on your DSCR loan refi.

We hope this overview has been helpful. If you have any questions or concerns, now or during the processing of your loan, we are always happy to assist you.