Table of contents

Table of contents

Loans

*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Table of contents

Table of contents

Multifamily Term Loans

What is a Multifamily Term Loan?

Multifamily term loans are asset-based loans for purchasing and refinancing 5+ unit residential properties. Multifamily term loans have an interest and principal repayment (amortization) component. Investors have a few options when selecting the best multifamily term loan for a specific deal.

Underwriting Criteria for Multifamily Term Loans

Multifamily term loans are based on the following underwriting criteria:

✅ Deal economics (see: DSCR Calculator) ✅ Borrower track record of experience ✅ Borrower credit score

Multifamily Term Loan Interest Rates

Our DSCR Loan Index tracks the prevailing interest rate for DSCR loans. See how OfferMarket's DSCR loan interest rate and terms compare:

Multifamily Bridge Loan Guidelines

| Guidelines: | Multifamily Bridge Loan |

|---|---|

| Interest Rates | see index above |

| Origination Fees | 1 to 2 points (% of loan amount) |

| Property Types | 5+ unit and mixed use |

| Loan Amounts | $500,000 - $25,000,000 |

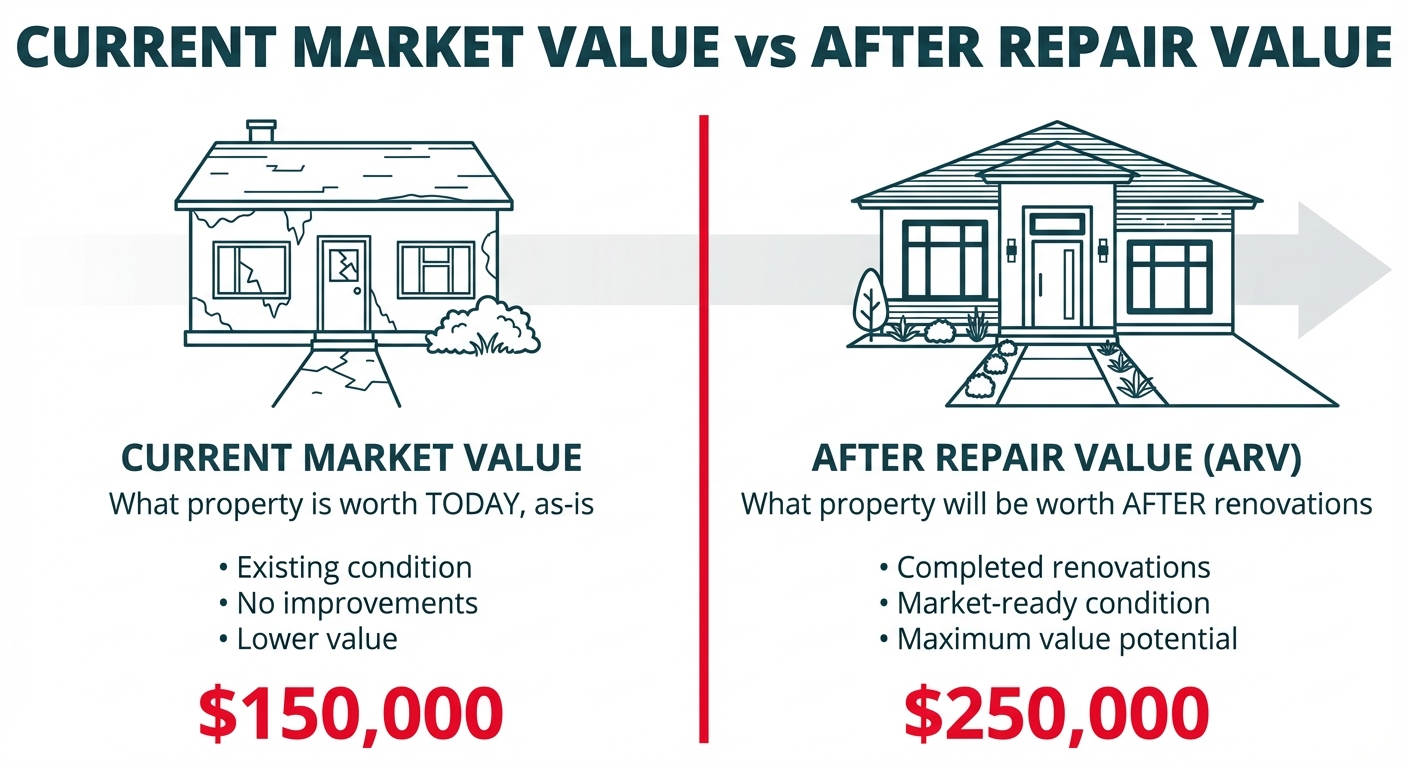

| Maximum LTV, ARV | 75% |

| Maximum Loan To Cost | Purchase: 80% of As-Is Value and 100% of rehab, Refinance: 75% of As-Is Value and 100% of rehab |

| Term Length | up to 24 months -- +0.5% for months 13 - 18, +0.75% for months 19 - 24 |

| Minimum Guarantor FICO | 650 |

| Ownership | LLC or Corporation |

| Recourse | Full recourse, Limited recourse |

What is the process for getting a multifamily term loan?

Timeline: 15 - 30 days

- Get a quote (takes 1 minute)

- Complete processing action items in your My Loans portal

✅ Credit & Background Check ✅ Personal Financial Statement ✅ Schedule Of Real Estate Owned (track record of experience) 📄 Download your pre-approval letter 📄 Download your loan terms ✅ Upload entity docs ✅ Authorize title order ✅ Authorize appraisal order - Schedule closing