*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

Who Offers HELOC on Investment Property?

If you're a real estate investor looking to tap into your property's equity, you've probably wondered: "Who actually offers HELOCs for investment properties?" The answer might surprise you—finding these lenders takes more work than you'd think.

Here's the reality: most traditional banks and credit unions focus their Home Equity Line of Credit (HELOC) products on primary residences. Investment properties? They're seen as riskier bets, which means fewer lenders are willing to play ball. But don't worry—options do exist, and we're going to walk you through exactly how to find them.

In this comprehensive guide, we'll cover:

- Which financial institutions actually offer HELOCs for investment properties

- The key requirements and qualifications you'll need to meet

- Why many successful investors choose alternatives like Home Equity Loans (HELOANs) instead

- How to navigate the application process and secure the best terms

Whether you're looking to renovate a rental property, purchase additional real estate, or access capital for other investment opportunities, understanding your financing options is crucial. Let's dive in and explore who offers HELOCs on investment properties and whether this financing tool is right for your investment strategy.

![**Task:** Create a professional hero image that visually represents the concept of investment property financing through HELOCs, showing the relationship between property equity and accessible credit.

**Visual Structure:** A split-screen composition with a modern investment property (multi-unit building) on the left side and a stylized credit line visualization on the right, connected by flowing lines representing equity conversion to available credit.

**ASCII Layout Reference:**

```

+--------------------------------------------------+

| |

| [Investment Property Image] → [Credit Line] |

| (Left 50%) (Right 50%) |

| |

|](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771279827360_d5e05y.jpg?alt=media&token=e744d9b7-cb04-4612-9e37-da7893795529)

How to Find Providers That Offer HELOC for Investment Properties

Let's be real—tracking down lenders who offer Home Equity Lines of Credit (HELOCs) for investment properties takes some legwork. Most financial institutions reserve these products for primary residences only. But don't worry—with the right strategy, you can find the financing you need for your investment property. Here's your roadmap to making it happen:

Step-by-Step Guide to Finding HELOC Providers

Explore online lenders

Digital lenders are shaking things up with specialized investor products that traditional banks simply don't offer. It's worth checking out what's available online.Start with national banks and credit unions

Big-name financial institutions are your best bet for investment property HELOCs. Look for established banks with dedicated real estate lending teams who understand investor needs.Contact local community banks

Don't overlook the smaller players. Community banks often have more wiggle room in their lending policies and genuinely want to help local investment property owners succeed.Consult with mortgage brokers

A good broker is like having an insider on your team. They've built relationships with multiple lenders and know exactly who's offering investment property HELOCs right now.Check with credit unions

Credit unions often surprise investors with competitive rates and member-friendly requirements that make qualifying easier.

Known Providers of Investment Property HELOCs

Good news—several financial institutions do offer HELOCs for investment properties. Keep in mind that availability depends on your location and property type:

- TD Bank - Offers investment property HELOCs with competitive rates

- BMO Harris Bank - Provides financing options for investment properties

- AmeriSave - Offers HELOC products for investors

- Wells Fargo - Has investment property HELOC options

- Bank of America - Offers various equity products for investors

- US Bank - Provides HELOCs for qualified investment property owners

- Flagstar - Offers investment property financing options

- PenFed Credit Union - Known for investor-friendly products

- Alliant Credit Union - Offers HELOCs on investment properties

- Fifth Third Bank - Provides various equity options for investors

According to Point, "Wells Fargo, Bank of America, US Bank, Flagstar, PenFed Credit Union, Alliant Credit Union, and Fifth Third Bank" are among the institutions that offer HELOCs on investment properties.

Better Mortgage also notes they are "one of the few lenders that offers HELOC on primary, secondary, and investment properties."

![**Task:** Create an infographic displaying the major financial institutions that offer HELOCs for investment properties, organized as a visual directory with bank logos represented as placeholder boxes and key information.

**Visual Structure:** A grid-style infographic with 10 institutional entries arranged in two columns, each entry containing institution name, a placeholder for logo, and a brief descriptor of their investment property HELOC offering.

**ASCII Layout Reference:**

```

+--------------------------------------------------------+

| LENDERS OFFERING INVESTMENT PROPERTY HELOCs |

+--------------------------------------------------------+

| [TD Bank] | [BMO Harris Bank] |

| Competitive rates | Investment property options |

| | |

| [AmeriSave] | [Wells Fargo] |

| Investor products | Investment HELOC options |

| | |

| [Bank of America] | [US Bank] |

| Various equity options | Qualified property owners |

| | |

| [Flagstar] | [PenFed Credit Union] |

| Investment financing | Investor-friendly products |

| | |

| [Alliant Credit Union] | [Fifth Third Bank] |

| Investment properties | Various equity options |

+--------------------------------------------------------+

```

**Image Section Breakdown:**

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771280058978_v78ym4.jpg?alt=media&token=f86127ff-44c8-4c1e-abfe-d1f162c76e0a)

Essential Screening Questions to Ask HELOC for Investment Property Lenders

When you're shopping around for lenders, these are the key questions that'll help you find the right HELOC for your investment property:

- Do you specifically offer HELOCs for non-owner-occupied investment properties?

- What is the maximum loan-to-value (LTV) ratio you allow for investment properties?

- What are the minimum credit score and income requirements?

- Do you require rental income documentation or cash reserves?

- What is the draw period and repayment period structure?

- Are there prepayment penalties or inactivity fees?

- What are the current interest rates and how often do they adjust?

- What closing costs and fees should I expect?

- Do you have any property type restrictions (condos, multi-family, etc.)?

- Is there a minimum or maximum loan amount?

What to Look for in Terms and Conditions

Here's where the details matter. Make sure you understand these key parts of your HELOC agreement:

- Interest rate structure - Variable interest rates. How often does it adjust?

- Margin - The percentage points added to the index rate

- Rate caps - Maximum interest rate allowed during the loan term

- Draw period length - Typically 5-10 years

- Repayment period - Usually 10-20 years

- Minimum draw requirements - Some lenders require minimum withdrawals

- Annual fees - Recurring charges to maintain the line of credit

- Conversion options - Ability to convert variable-rate balances to fixed-rate

- Cancellation terms - Circumstances under which the lender can freeze or reduce your credit line

Documentation Requirements

Get ahead of the game by gathering these documents before you apply:

- Proof of ownership of the investment property

- Recent mortgage statements

- Proof of rental income (lease agreements)

- Property tax statements

- Homeowner's insurance policy

- Bank statements (usually 2-3 months)

- Proof of additional income sources

- Property appraisal (will be ordered by the lender)

- Landlord insurance documentation

Landing a HELOC for your investment property takes some legwork, but you've got this. With the right research and preparation, you'll secure this flexible financing tool and be one step closer to growing your real estate portfolio.

What is a HELOC and How Does It Work?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by the equity in your property. Think of it this way: unlike traditional loans that hand you a lump sum upfront, a HELOC works more like a credit card—you draw funds as you need them, up to a set limit.

The Two Phases of a HELOC

HELOCs operate in two distinct phases:

Draw Period: This is your access window, typically lasting 5-10 years. During this time, you tap into your credit line whenever opportunities arise. The best part? You may only need to make interest-only payments on what you've actually borrowed.

Repayment Period: Once the draw period ends, you shift into repayment mode—usually 10-20 years. At this point, the borrowing window closes, and you'll pay back both principal and interest.

According to Cornerstone Bank , a typical HELOC structure includes "10-Year Draw Period, followed by 15-Year Repayment Period" with rates "based on current prime rate plus a margin of 1.00% with a floor rate of 4.25%" for investment properties.

![**Task:** Create an infographic timeline visualization showing the two distinct phases of a HELOC (Draw Period and Repayment Period) with clear visual distinction between the phases and their characteristics.

**Visual Structure:** A horizontal timeline infographic split into two major sections, with the Draw Period on the left and Repayment Period on the right, separated by a vertical divider. Each section contains key information boxes with phase characteristics.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| HOW A HELOC WORKS |

+----------------------------------------------------------+

| |

| DRAW PERIOD | REPAYMENT PERIOD |

| (5-10 Years) | (10-20 Years) |

| | |

| • Access funds | • No more borrowing |

| • Interest-only | • Principal + Interest |

| payments | payments |

| • Revolving credit | • Fixed payment schedule |

| | |

| [Timeline bar =========>|<========== Timeline bar] |

| | |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771279051865_gsxegx.jpg?alt=media&token=091ce410-88da-4580-840a-e04f2ace24b3)

Variable Interest Rate Structure

Here's something important to understand: HELOCs typically come with variable interest rates that move with market conditions. Most are tied to the prime rate plus a margin your lender sets based on your credit profile.

As of February 2026, the national average HELOC interest rate sits at 7.32%, according to Bankrate's survey of the nation's largest home equity lenders. What does this mean for you? Your monthly payments can shift over time, which makes budgeting a bit trickier for your investment planning.

How HELOCs Differ from Traditional Loans

Unlike fixed-rate home equity loans or traditional mortgages, HELOCs bring some unique advantages to the table:

- Flexibility: Borrow only what you need when you need it

- Variable rates: Interest rates that change with market conditions

- Interest-only payments: Often available during the draw period

- Revolving credit: Ability to borrow, repay, and borrow again during the draw period

Accessing Funds Through a HELOC

Once you're approved, getting to your money is straightforward. Most lenders offer multiple access points:

- Special checks

- A dedicated credit card

- Online transfers to your checking account

- Mobile banking apps

This flexibility puts capital at your fingertips for property improvements, new investment opportunities, or unexpected expenses. Just keep in mind the tradeoff: that convenience comes with less predictable interest costs down the road.

Why Most Successful Real Estate Investors Don't Use HELOCs for Investment Properties

When you're building a real estate portfolio, the financing tools you choose can make or break your long-term success. While Home Equity Lines of Credit (HELOCs) offer flexibility, many savvy real estate investors reach for Home Equity Loans (HELOANs) when it's time to scale. Let's break down the key differences so you can make smarter financing decisions.

Understanding HELOCs vs. HELOANs

Think of a HELOC as a revolving line of credit secured by your property's equity. It works in two phases:

- Draw period: Typically 5-10 years, where you borrow what you need and make interest-only payments

- Repayment period: Usually 10-20 years, when borrowing stops and you pay back both principal and interest

A HELOAN? It's straightforward—you get a lump sum with fixed terms from day one. This simple difference creates real challenges for investors ready to grow their portfolios.

The Unpredictability Problem with HELOCs

Here's the thing: variable interest rates are one of the biggest headaches with HELOCs. As Semiretired MD points out, "Most HELOCs have variable interest rates, which means your payments could increase if interest rates rise." That unpredictability makes planning tough, especially when you're juggling multiple properties.

With HELOANs, you get fixed rates and steady monthly payments. That means you can:

- Project cash flow with confidence

- Budget for property improvements without surprises

- Avoid sudden payment spikes that throw off your portfolio math

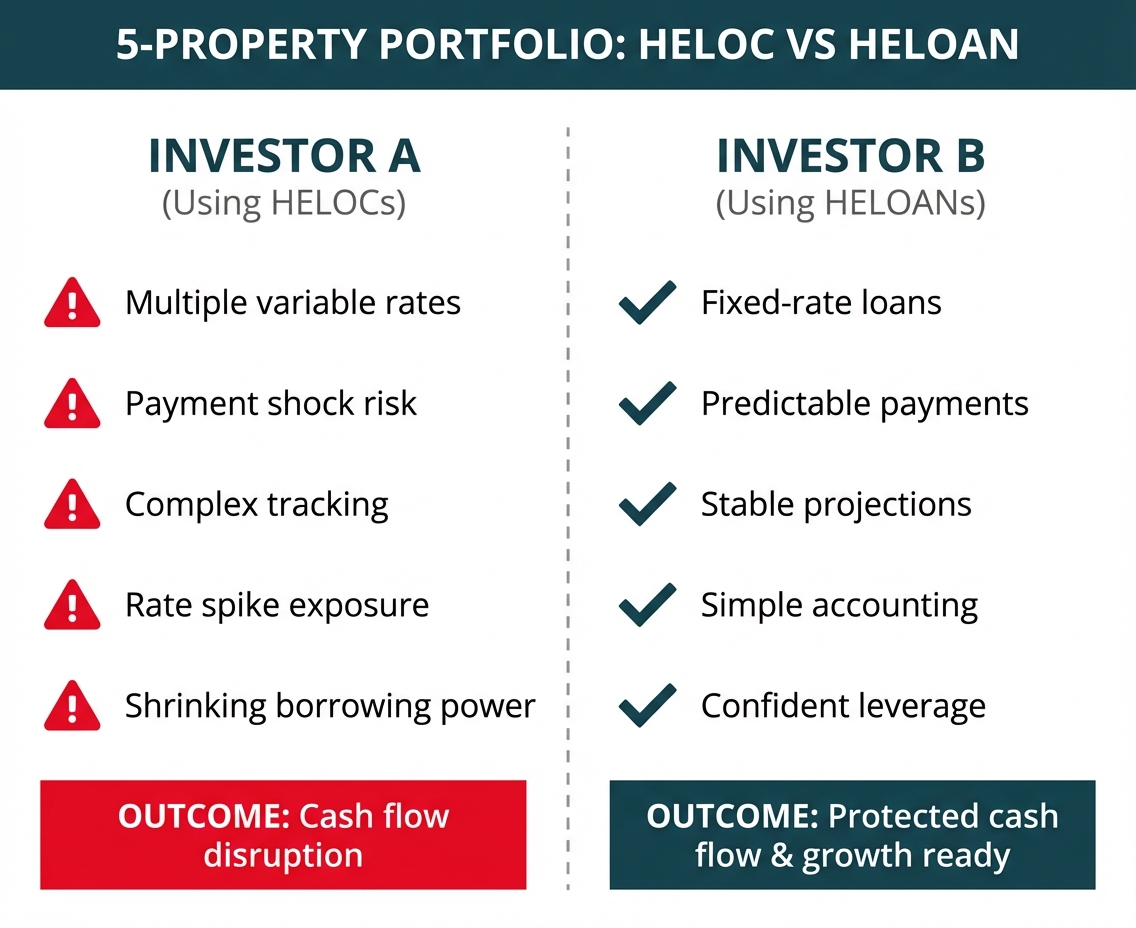

Scaling Challenges: A 5-Unit Portfolio Comparison

Let's look at two investors, each with a 5-unit portfolio:

Investor A (Using HELOCs):

- Taps equity from each property using separate HELOCs

- Juggles multiple variable interest rates that shift independently

- Risks payment shock when rates climb or draw periods end

- Tracks different draw and repayment timelines for each property

- Watches borrowing power shrink as variable rates creep up

Investor B (Using HELOANs):

- Locks in fixed-rate HELOANs on properties

- Enjoys predictable monthly payments across the portfolio

- Builds stable, long-term financial projections

- Keeps accounting simple with consistent payment structures

- Leverages equity confidently, knowing exactly what future payments look like

When interest rates jumped in 2022-2023, Investor A saw monthly payments spike across their entire portfolio. Investor B? Their expenses stayed put, protecting cash flow and keeping them ready to pounce on new acquisitions.

Portfolio Management Considerations

Beyond interest rate concerns, HELOCs present additional challenges for portfolio management:

Foreclosure risk: Using a HELOC puts your property at risk if you can't make payments. According to Investopedia, this risk increases when using HELOCs for investment purposes rather than property improvements.

Collateral limitations: As Chase points out, "HELOCs are backed by the equity you have in a property," meaning your ability to access capital is directly tied to property values—and those values don't always move in your favor.

Lender restrictions: Many lenders set the bar higher for investment property HELOCs compared to primary residences. Expect requirements like stronger credit scores, lower loan-to-value ratios, and steeper interest rates.

Why HELOANs Better Support Portfolio Growth

Smart real estate investors know that predictability is your best friend when building wealth through property. HELOANs give you the stable foundation you need to:

- Make confident acquisition decisions because you know exactly what your financing costs

- Keep your debt-to-income ratios consistent when you're ready to apply for additional financing

- Build accurate pro formas for potential investments

- Shield your portfolio from interest rate swings that could eat into your returns

While HELOCs might work well for short-term needs or one-off projects, investors who are serious about growing their portfolios methodically often find that HELOANs are the better fit for their long-term wealth-building goals.

Requirements for a HELOC on an Investment Property

Getting a Home Equity Line of Credit (HELOC) on an investment property isn't as straightforward as getting one for your primary residence. Lenders see investment properties as riskier bets, so they tighten up their qualification criteria accordingly.

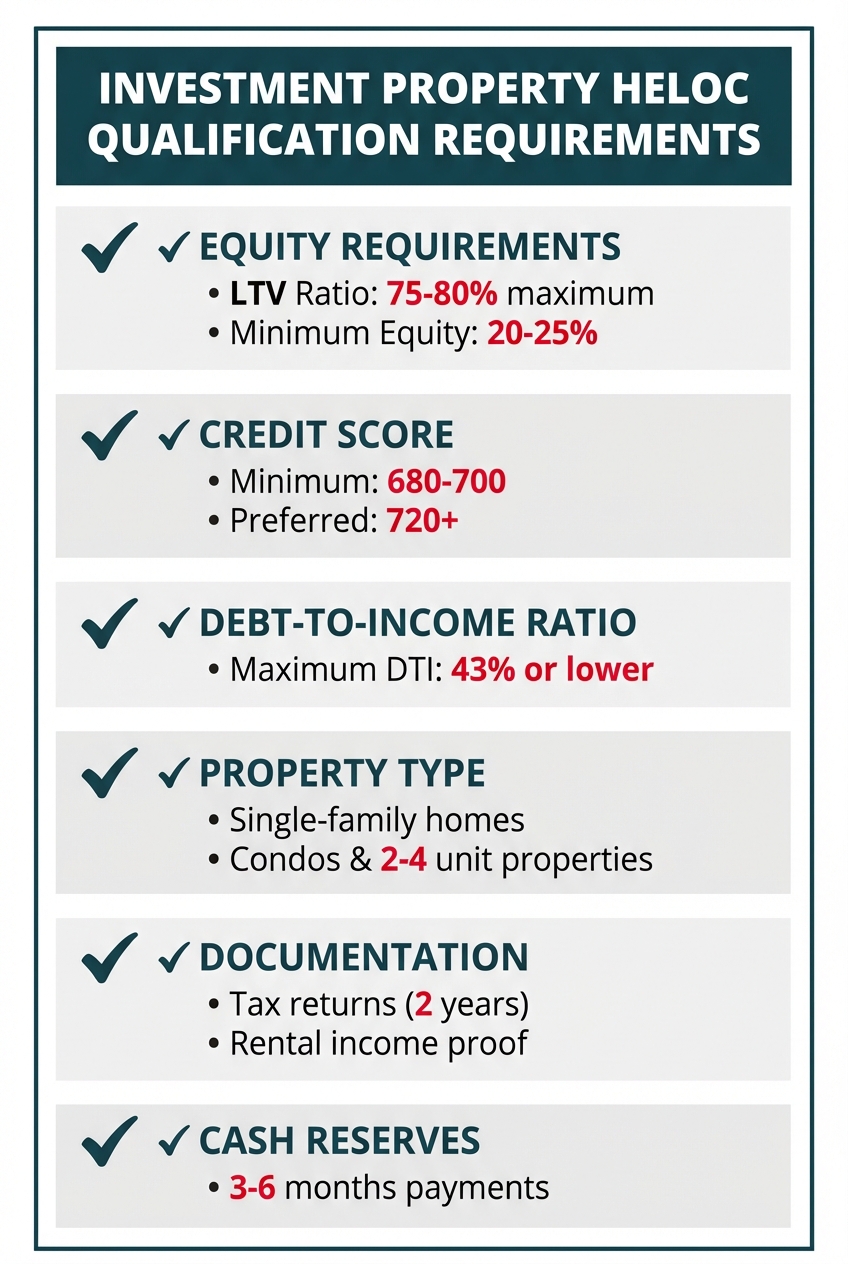

Equity Requirements

Most lenders want to see considerably more equity for investment property HELOCs than they do for primary residences. Typically, you'll need:

- A loan-to-value (LTV) ratio below 75% to 80%

- At least 20-25% equity in your investment property

- Some lenders may require up to 30-40% equity for investment properties

As noted by SoFi, "To qualify for a HELOC on an investment property, a loan-to-value (LTV) ratio below 75% to 80% is typically required." Here's what that looks like in practice: if your property is worth $400,000, your combined loans (including the HELOC) shouldn't exceed $300,000-$320,000.

Credit Score Requirements

When it comes to your credit score, here's what lenders want to see:

- Minimum credit score of 680-700

- Many preferred lenders require 720 or higher

- Excellent credit history with minimal late payments

According to Citizens Bank, "A credit score of 680 or higher" is typically required for investment property HELOCs. That's a higher bar than the 620-640 minimum often accepted for primary residence HELOCs—so make sure your credit is in solid shape before applying.

Debt-to-Income Ratio

Lenders want to know you can comfortably handle more debt:

- Maximum DTI ratio of 43% or lower

- Some lenders may require DTI as low as 36%

- Rental income from the property may be partially counted (typically 75% of rental income)

Property Condition and Type Restrictions

Not every investment property will make the cut:

- Property must be in good condition

- Single-family homes and condos are most commonly approved

- Multi-unit properties (2-4 units) may be eligible with some lenders

- Commercial properties typically don't qualify for traditional HELOCs

Documentation Requirements

Get ready to gather your paperwork—lenders will ask for:

- Rental income verification (lease agreements, rent receipts)

- Property tax statements

- Homeowners insurance

- Mortgage statements

- Bank statements showing reserves

Cash Reserves

Lenders need to see that you're prepared for the unexpected:

- Typically 3-6 months of mortgage payments in reserves

- May include PITI (principal, interest, taxes, and insurance) for all properties you own

Occupancy Considerations

Investment property HELOCs come with specific requirements that differ from primary residence loans:

- Confirmation that the property is not owner-occupied

- Documentation of tenant occupancy

- Proof that the property generates income

Here's the reality: finding lenders who offer investment property HELOCs takes some legwork, since many traditional banks and credit unions focus primarily on primary residences. Working with a mortgage broker who specializes in investment property financing can help you find the right lender for your unique situation.

Drawbacks of Using a HELOC for Investment Properties

Let's be real: investment property HELOCs come with some challenges you need to understand before diving in. The cost structure is steeper than what you'd see with a primary residence, and these extra expenses can eat into your returns if you're not prepared.

Higher Interest Rates and Variable Rate Risk

Here's the deal: investment property HELOCs carry higher interest rates than primary residence options. While a HELOC on your home might start around prime plus 0.5%, expect to pay prime plus 1-2% or more on an investment property. Lenders see more risk here, and they price accordingly.

The variable rate nature of HELOCs adds another layer of uncertainty. When rates climb, so do your monthly payments during repayment. For investors who depend on predictable cash flow to stay profitable, this unpredictability can throw a wrench in your plans.

Substantial Closing Costs and Fees

Getting a HELOC on your investment property isn't free. Here's what you're looking at:

Closing costs: Expect to pay 2% to 5% of your total loan amount according to multiple financial institutions. On a $100,000 HELOC, that's $2,000-$5,000 out of pocket before you access a dime.

Common fees: Budget for application fees ($75-$300), origination fees (0.5-1% of the loan amount), annual maintenance fees ($50-$100), and possible inactivity fees if your line sits unused.

Foreclosure Risk and Equity Reduction

This is the big one. Your investment property is on the line—literally. If you default on your HELOC payments, you could lose the property altogether since it serves as collateral. This is particularly concerning for investors who may experience temporary vacancies or unexpected repair costs that affect their ability to make payments.

Additionally, using a HELOC reduces your equity position in the property, which can limit your options if property values decline or you need to sell quickly. Smart investors often prefer maintaining stronger equity positions in their properties to weather market downturns and keep their options open.

Strict Qualification Requirements

Lenders hold investment property HELOC applicants to a higher standard than primary residence borrowers. Here's what you can typically expect:

- Higher credit score requirements (often 720+ versus 680+ for primary homes)

- Lower loan-to-value ratios (typically maxing out at 70-75% versus 80-90% for primary residences)

- More extensive lower debt-to-income ratio thresholds

- Proof of property performance and rental income history

These tougher requirements can make qualifying challenging, especially if you're managing multiple properties or just getting started on your investment journey.

Limited Accessibility and Availability

Here's the reality: many lenders simply don't offer HELOCs on investment properties, which narrows your choices and makes shopping around tougher. With less competition in the market, lenders who do offer investment property HELOCs can charge premium rates and fees—they know you don't have many alternatives.

For real estate investors focused on building and scaling a portfolio efficiently, these drawbacks often make HELOCs less appealing than alternatives like HELOANs. With fixed rates and predictable payment structures, HELOANs tend to align better with how investment property businesses actually operate.

![**Task:** Create a warning-style infographic highlighting the five major drawbacks of using HELOCs for investment properties, with each drawback presented as a cautionary alert with supporting details.

**Visual Structure:** A vertical layout with five distinct warning boxes, each containing a drawback title, icon, and key details, arranged in descending order of severity with visual emphasis on risk factors.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| ⚠ HELOC DRAWBACKS FOR INVESTMENT PROPERTIES |

+----------------------------------------------------------+

| |

| [!] HIGHER INTEREST RATES & VARIABLE RISK |

| Prime + 1-2% or more • Unpredictable payments |

| |

| [!] SUBSTANTIAL CLOSING COSTS |

| 2-5% of loan amount • $2,000-$5,000 on $100k |

| |

| [!] FORECLOSURE RISK |

| Property used as collateral • Equity reduction |

| |

| [!] STRICT QUALIFICATION REQUIREMENTS |

| 720+ credit score • Lower LTV ratios |

| |

| [!] LIMITED ACCESSIBILITY |

| Fewer lenders • Premium rates & fees |

| |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Header section:](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771279061629_2pmdun.jpg?alt=media&token=c79fa563-2eeb-4075-a495-dc6090548e11)

Variable Interest Rate Exposure

Here's something every investor needs to understand: HELOCs almost always come with variable interest rates, and that can take a real bite out of your returns. As research from Trepp points out, "The primary risk with floating-rate loans is the potential for interest rates to rise, which can lead to significantly higher debt service costs over time" (Trepp). This unpredictability makes it harder to:

- Accurately forecast cash flow

- Plan for future investments

- Maintain consistent debt service coverage ratios

For investors who use leverage strategically, rising rates can squeeze your cash flow tight—sometimes turning a winner into a money pit.

Payment Shock After Draw Period

Here's a transition many investors don't see coming: Most HELOCs offer a draw period (usually 5-10 years) where you're only paying interest. Sounds manageable, right? But when that period ends, you'll need to pay both principal and interest, which can mean significantly higher monthly payments. Smart investors plan ahead for this shift so it doesn't catch them off guard.

Vulnerability During Market Downturns

When the market takes a dip, properties with HELOCs can face a perfect storm of challenges:

- Property values may drop, potentially leaving you underwater

- Rental income might shrink as economic conditions tighten

- Interest rates could climb, pushing your payments higher

As financial expert Bennett Thrasher remind us, "When interest rates rise, borrowing becomes more expensive. For real estate investors and developers, this means higher costs for new loans and refinancing existing debt, potentially squeezing profit margins".

Potential for Negative Cash Flow

Here's the reality: HELOC interest rates can shift on you. A property that's covering its expenses just fine today could slip into negative cash flow territory if rates climb. That's a real concern if you're counting on rental income to handle your financing costs.

Prepayment Penalties and Hidden Fees

Watch out for the fine print. Many HELOCs hit you with prepayment penalties if you close the line within a certain window (typically 3-5 years). You might also run into annual fees, inactivity fees, or minimum withdrawal requirements that chip away at your returns. Take time to understand these costs before you commit.

Bottom line: for investors focused on building a solid, sustainable portfolio, these drawbacks often make HELOCs less appealing than fixed-rate options like HELOANs. With a HELOAN, you get predictable payments and the stability you need for long-term planning.

Why Most Successful Real Estate Investors Don't Use HELOCs for Investment Properties

You might be curious why seasoned investors tend to pass on Home Equity Lines of Credit (HELOCs) for their investment properties. It comes down to how HELOCs are structured compared to Home Equity Loans (HELOANs)—and how those differences affect your ability to grow and manage your portfolio effectively.

Understanding the HELOC Structure

Think of a HELOC as a revolving line of credit that's backed by your property's equity. It works in two phases:

- Draw Period: This is your borrowing window—typically 5-10 years—when you can tap into your credit line as needed

- Repayment Period: The next 10-20 years when you can no longer draw funds and must pay back both principal and interest

While this flexibility might look appealing at first glance, it creates real challenges for investors serious about growing their portfolios.

The Variable Rate Risk Factor

Variable interest rates on HELOCs create one of the trickiest hurdles when you're scaling your portfolio. While HELOANs lock in your rate, HELOCs leave you exposed to rate swings. When you're juggling multiple properties, even modest rate bumps can take a real bite out of your overall returns.

According to Bankrate, "HELOCs have variable interest rates throughout their terms. That means borrowers will likely benefit as rates decline, whereas those with fixed-rate home equity loans will continue to pay the same rate."

Sure, falling rates sound great on paper, but that unpredictability can throw a wrench in any investment strategy that depends on knowing your numbers.

Administrative Complexity at Scale

Managing multiple HELOCs across a growing portfolio can quickly become a juggling act:

- Tracking different draw periods and repayment transitions

- Managing variable payment amounts that shift with market conditions

- Navigating different terms and conditions from various lenders

- Monitoring utilization rates and available credit

For investors focused on scaling their portfolios efficiently, these administrative headaches create unnecessary friction that can slow your momentum.

Long-Term Cost Analysis

Here's the reality: while HELOCs might look attractive with lower initial costs during interest-only periods, the long-term expense often exceeds that of HELOANs—especially when you're utilizing funds for extended periods. Variable rates have a way of compounding over time, and that can significantly increase your total borrowing costs across multiple properties.

The Scaling Challenge

Here's what successful real estate investors know: predictable financing is the backbone of portfolio growth. HELOANs deliver:

- Consistent payment structures that make cash flow management straightforward

- Protection against interest rate increases

- Clear amortization schedules for smarter tax planning

- Easier qualification for additional financing thanks to predictable debt service

These benefits multiply as your portfolio grows from 5 to 10, 20, or more properties.

Bottom line: if you're serious about building a substantial real estate portfolio, the fixed nature of HELOANs typically offers a more stable foundation for sustainable growth than the variable structure of HELOCs.

When Does a HELOC Make Sense for Investment Properties?

Now, let's be fair—HELOCs aren't the right fit for most investors building large portfolios, but there are specific situations where their flexibility really shines:

Short-Term Projects and Fix-and-Flips

HELOCs can be a smart choice for investors focused on property flipping, where quick access to funds is essential. The ability to draw only what you need when you need it means you're not paying interest on the entire approved amount during renovation phases.

"Real estate investors use HELOCs to finance rental properties, flip homes, or make strategic upgrades that boost property value. Since HELOCs typically come with lower interest rates than credit cards or personal loans, they're a cost-effective way to fund improvements".

Bridge Financing Needs

Sometimes timing doesn't line up perfectly between property transactions, and that's where a HELOC shines as bridge financing. Say you spot the perfect investment property but haven't sold another asset yet. The revolving nature of a HELOC lets you cover that down payment gap until your funds free up.

Emergency Fund for Property Investors

Let's face it—investment properties can throw curveballs. Unexpected repairs pop up. Tenants move out suddenly. A HELOC gives you a reliable safety net without tying up large amounts of cash, keeping your liquidity in good shape.

Cash Flow Management During Renovation Periods

Big renovations mean your property isn't bringing in income for a while. A HELOC helps you navigate these cash flow challenges by letting you draw funds as construction costs arise while still covering your other property expenses.

When Flexibility Outweighs Rate Predictability

If payment flexibility matters more to you than locking in a fixed rate, HELOCs deliver. During the draw period, you can make interest-only payments, which can free up cash flow when you need it most.

According to Better, "Property renovations and improvements are the most common way to use a HELOC," but they're also valuable for "expanding your real estate portfolio" and addressing "bridge financing needs."

These scenarios show when a HELOC can be a smart move. That said, always weigh these benefits against the variable rate risk and the potential payment jump when your repayment period kicks in.

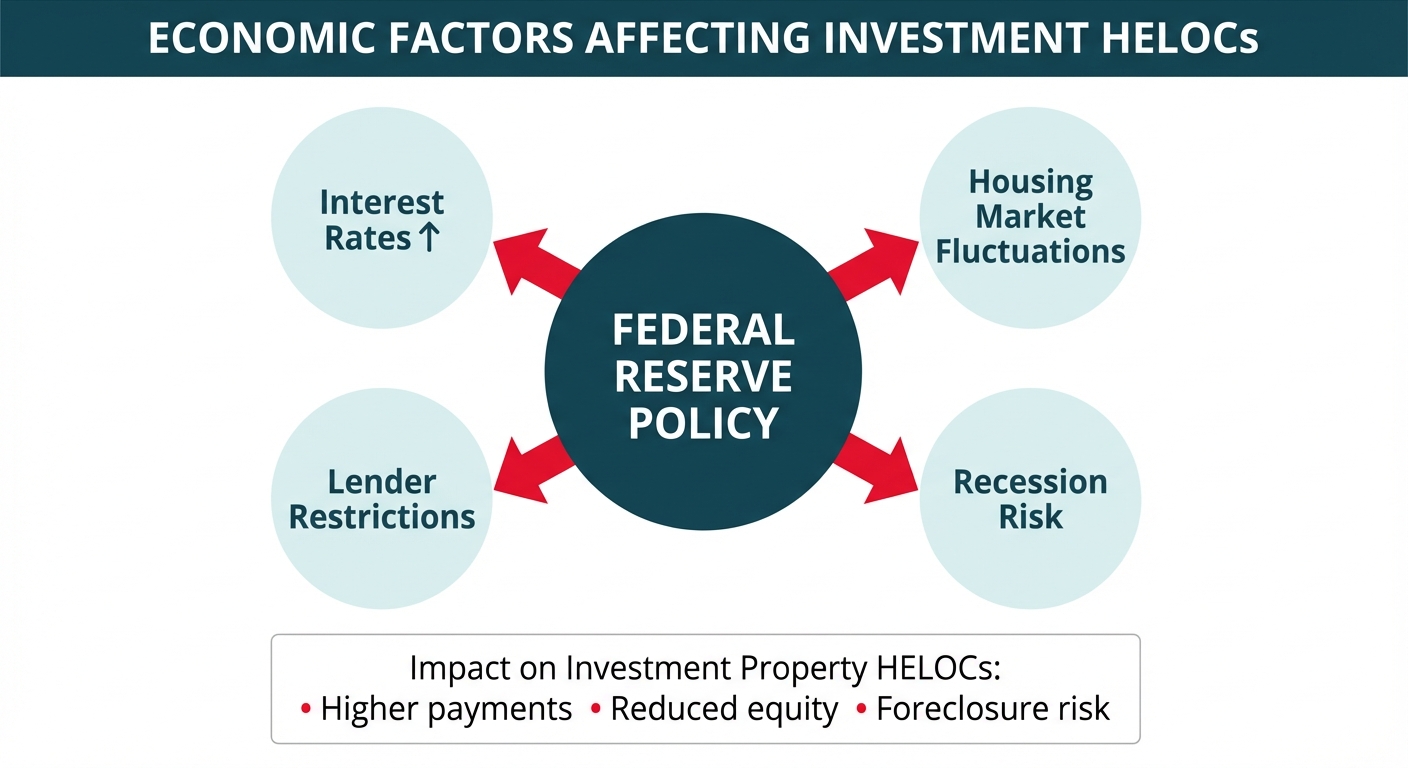

The Impact of Economic Factors on HELOCs for Investment Properties

Before you tap into your investment property's equity with a HELOC, let's talk about the bigger picture. Economic conditions play a major role in shaping your loan terms, costs, and overall financial health. Here's what you need to know to make smart, confident decisions.

Interest Rate Environment

Here's the deal: HELOCs come with variable interest rates tied to benchmark rates like the prime rate, which moves when the Federal Reserve adjusts its policy. When the Fed raises rates, your HELOC interest rate and monthly payments will likely climb too—sometimes within just a month or two. Unlike fixed-rate loans, HELOCs typically don't have caps limiting how high rates can go, so you'll want to plan accordingly.

As the Office of the Comptroller of the Currency notes, "HELOCs generally do not have interest rate caps that limit rate increases," which means rapid rate hikes could catch you off guard with higher payments.

Housing Market Fluctuations

Your investment property's value determines how much equity you can access through a HELOC. When the housing market dips, property values can drop too—potentially shrinking your available equity or even leaving you underwater on your loan. Lenders might also freeze or reduce your credit line if values fall significantly in your area.

For investment property owners, this creates a one-two punch: your borrowing power could shrink right when you need funds most, while rental income might also take a hit if the broader market struggles.

Recession Risk Considerations

Economic downturns bring unique challenges for investment property owners carrying HELOCs. During a recession, you might face:

- Higher rental vacancies as tenants struggle financially

- Flat or declining rental rates

- Dropping property values

- Unpredictable interest rate swings

Because HELOC rates are variable, even Fed rate cuts during a recession might not fully offset your losses from reduced rental income or declining property values. Navy Federal Credit Union notes that "Interest rates directly impact the cost of borrowing against your home equity," making economic timing a critical factor in HELOC decisions.

Foreclosure Vulnerability During Downturns

Here's something every investor needs to understand: investment properties with HELOCs face real foreclosure risk when the economy takes a hit. Think about it—if your rental income drops while your HELOC payments climb, you could find yourself in a tight spot. Remember, a HELOC puts a lien on your property, so falling behind on payments could mean losing your investment.

Investopedia points out that sticking to interest-only payments during the draw period (a common approach) can lead to serious payment shock once repayment kicks in—especially if that timing lines up with tough economic times.

Regulatory Changes Affecting HELOCs

When economic uncertainty hits, banks typically tighten their belts—and that affects both new and existing HELOC borrowers. Here's what you might see lenders do:

- Raise credit score requirements

- Lower maximum LTV ratios

- Require more detailed income verification

- Freeze existing credit lines

These moves help protect the banking system, but they can throw a wrench in your investment plans if you're counting on HELOC financing.

The bottom line? Knowing how economic factors affect HELOCs is crucial for smart investing. Because these loans have variable rates, they respond quickly to market shifts—creating both opportunities and risks based on your timing and overall financial picture.

OfferMarket's HELOAN Products

At OfferMarket, we've built Home Equity Loans (HELOANs) specifically for investors like you. Unlike HELOCs with their unpredictable variable rates, our HELOANs give you fixed rates and clear repayment terms. You'll know exactly what you're paying each month—no surprises. As The Federal Savings Bank notes, qualified borrowers can tap into their home equity through these fixed-rate, lump-sum loans.

We designed our HELOAN products with your investment goals front and center: competitive rates, a straightforward application process, and terms that actually make sense for your strategy. With predictable payments, you can confidently plan your next acquisition or renovation without the guesswork.

As you grow your real estate portfolio, exploring these HELOC alternatives helps you find financing that supports your goals while keeping risk low and returns high.

Tax Implications of HELOC on Investment Properties

Before you tap into a HELOC for your investment property, let's talk taxes. How the IRS treats your HELOC interest can make a real difference in your cash flow and overall returns. Understanding these rules puts you in control.

Interest Deductibility Rules

Understanding when you can deduct HELOC interest comes down to three main factors: which property secures the loan, how you put the funds to work, and which tax rules apply to your specific situation. Here's what you need to know: interest on a HELOC tied to an investment property plays by different rules than one on your primary residence.

For your investment properties, HELOC interest can often be deducted as a business expense—as long as you're using those funds for business purposes connected to your rental. That's different from a HELOC on your personal home, where the IRS only allows interest deductions if you use the money to "buy, build, or substantially improve" that same home.

Business Expense Considerations

When you direct your HELOC funds toward legitimate investment property business activities, you can generally report that interest as a business expense on Schedule E. Here are some qualifying uses:

- Property renovations or improvements

- Repairs and maintenance

- Purchase of additional investment properties

- Other legitimate business expenses tied to your real estate portfolio

One smart move: keep your business and personal funds completely separate. As Stessa, a property management platform, advises, you should "segregate use of funds" and maintain solid documentation to back up your deductions.

Record-Keeping Requirements

Good documentation is your best friend when claiming HELOC interest deductions on investment properties. Make sure you:

- Keep detailed records showing exactly how you used your HELOC funds

- Save every Form 1098 statement your lender sends

- Hold onto all receipts for improvements, repairs, or other business expenses

- Document the connection between the HELOC and your investment property activities

These records are your safety net if the IRS comes knocking, and they'll help you back up every deduction you claim.

Tax Planning Strategies

A little strategy goes a long way when it comes to your HELOC and taxes. Here are some smart moves to consider:

- Time your big property improvements to land in years when your income is higher—that's when deductions pack the biggest punch

- Chat with a tax pro before you take out a HELOC so you can structure the loan in the smartest way possible

- Think about keeping separate accounts for business and personal funds—it makes tracking a whole lot easier

- Take a hard look at how HELOC interest affects your overall tax picture, including any AMT concerns

Keep in mind that tax rules don't stay the same forever. The Tax Cuts and Jobs Act of 2017 shook up HELOC deductibility in a big way, and more changes could be on the horizon.

Comparison with HELOAN Tax Treatment

When it comes to taxes, HELOCs and HELOANs play by similar rules for investment properties, but there are some key differences worth knowing:

- HELOC interest rates move around, which means your deduction amounts can shift over time

- HELOAN interest stays put, making it easier to plan your taxes with confidence

- HELOANs hand you all the cash upfront, which could mean bigger interest expenses and deductions right away

- HELOCs let you deduct interest only on what you've actually borrowed—a smarter choice if you don't need everything at once

Getting clear on these differences helps you pick the financing option that fits your investment game plan and tax situation best.

Always loop in a qualified tax professional for your specific situation—tax laws are tricky and they're always evolving.

The Predictability Factor: Why Fixed Rates Win

When you're juggling multiple properties, knowing your exact expenses makes all the difference for accurate cash flow projections. Here's the bottom line: "The primary benefit of fixed-rate loans is the stability they offer. With a set interest rate, your payments remain consistent" throughout the loan term, so you can plan your finances with confidence. Defease with Ease

OfferMarket's portfolio analysis shows that investors with fixed-rate loans can:

- Project exact cash flow for the entire loan term

- Make confident acquisition decisions based on known expenses

- Avoid the risk of payment increases during market volatility

OfferMarket's Approach

Our platform brings together loans, property listings, and insurance services under one roof—and we've built financing solutions that match how successful investors actually build wealth in real estate. Our HELOAN products give you the stability you need to grow your portfolio confidently, with competitive rates that help maximize your returns.

Timeline Expectations

Here's the reality: securing a HELOC on an investment property typically takes 30-45 days—noticeably longer than for your primary residence. Here's what that journey looks like:

- Initial application and document submission: 1-3 days

- Property appraisal scheduling and completion: 1-2 weeks

- Underwriting review: 1-3 weeks

- Final approval and closing: 1-2 weeks

Keep in mind that investment property financing gets extra attention from lenders, so these timeframes can stretch a bit longer.

By staying organized and having your documentation ready to go, you'll put yourself in the best position to find and secure a HELOC for your investment property.

Conclusion: Take the Next Step with OfferMarket

Here's the bottom line: HELOCs on investment properties deserve careful thought before you commit. Variable interest rates, the potential for payment surprises during repayment, and tougher qualification standards make HELOCs a trickier fit for many investors focused on growing their portfolios.

HELOANs often make more sense for serious real estate investors. Why? Fixed interest rates and steady monthly payments give you the predictability you need for smart, long-term planning. That stability becomes even more valuable as your portfolio grows beyond your first few properties.

Before you decide, here's what we suggest:

- Compare your options head-to-head: Get quotes for both HELOC and HELOAN products to see which one aligns better with your investment goals

- Considering your long-term goals: Think about how your financing choice fits into your bigger picture for portfolio growth

- Consulting with financing experts: Connect with professionals who truly understand the ins and outs of real estate investment financing

At OfferMarket, we're dedicated to helping real estate investors like you find financing solutions built specifically for your needs. Our HELOAN products have empowered countless investors to tap into their property equity while keeping the financial predictability you need for steady, sustainable growth.

Ready to explore your options? Get an instant HELOAN quote from OfferMarket today and discover how our financing solutions stack up against traditional HELOCs. Our simple application process and investor-first approach make it easier than ever to secure the right financing for your goals.

Looking for more insights on real estate investment financing? Dive into our comprehensive guide on real estate financing options or explore the various loan options available for property investors.

You've got the drive to build wealth through real estate. Let OfferMarket be your trusted partner in making it happen with the right financing behind you.

![**Task:** Create a professional call-to-action (CTA) graphic emphasizing OfferMarket's HELOAN products as the superior alternative to HELOCs for investment property financing, with a clear value proposition and action button.

**Visual Structure:** A horizontally-oriented promotional banner with three sections: left side showing key benefits, center featuring the main value proposition, and right side with a prominent call-to-action button.

**ASCII Layout Reference:**

```

+----------------------------------------------------------+

| |

| [Benefits List] WHY CHOOSE OFFERMARKET [CTA] |

| HELOAN FOR YOUR |

| ✓ Fixed Rates INVESTMENT PORTFOLIO? |

| ✓ Predictable [Get] |

| Payments • Competitive Fixed Rates [Your] |

| ✓ Simple • No Payment Surprises [Quote] |

| Process • Investor-Focused Service [Now] |

| |

+----------------------------------------------------------+

```

**Image Section Breakdown:**

- Left section (30% width):

- Three checkmark bullets with key benefits

-](https://firebasestorage.googleapis.com/v0/b/offer-market-us.appspot.com/o/generated_images%2Fgenerated_1771280863802_97m68x.jpg?alt=media&token=a0bee8dc-a1a0-40f0-8ea7-466efe613620)